Where to for the US 10-Year?

Here at TEAM, historical market analogues do not form part of our capital management process or risk framework, but they can often provide great perspective.

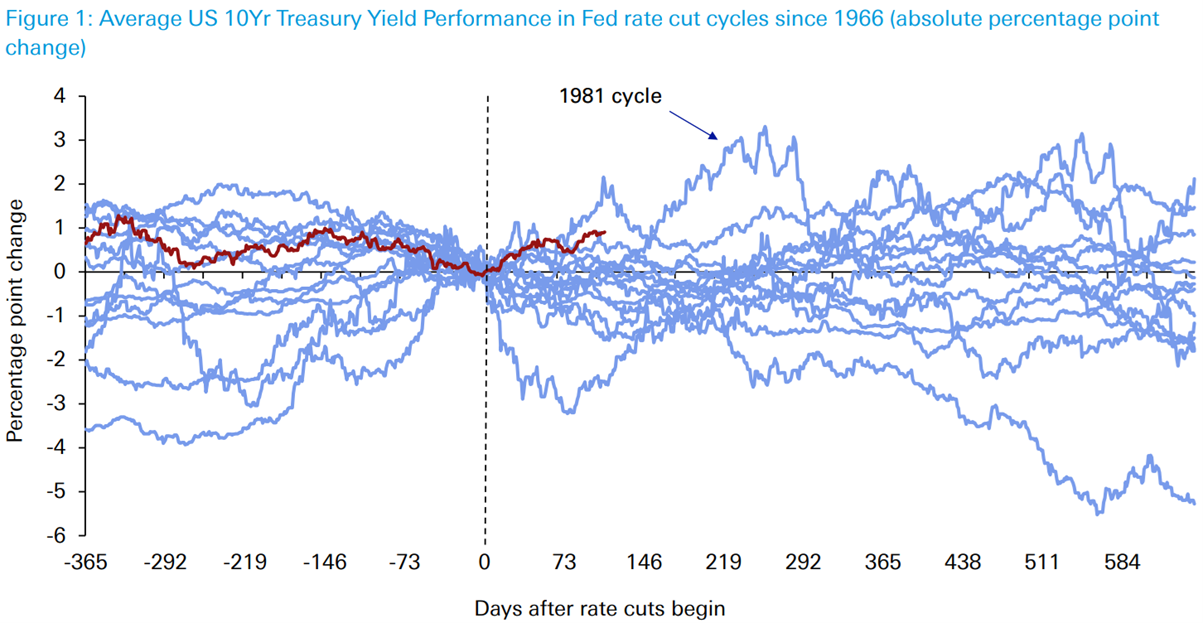

Shown below, a snapshot of 14 prior Fed easing cycles since 1966, showing the absolute percentage point change in the US 10-year Treasury yield, courtesy of Jim Reid and the Deutsche Bank team. The current easing cycle is illustrated by the crimson line:

The only prior easing cycle in this sample with weaker US 10-year Treasury performance was all the way back in 1981, when Paul Volcker was battling to slay the inflation dragon, resulting in acute gyrations in Fed policy.

Since Chairman Powell and Co. began cutting rates in mid-September last year, US 10-year Treasury yields have soared nearly 100 basis points as markets have move quickly to adjust to a higher long-term ‘neutral’ rate.

Current expectations, evidenced by the pricing of the December 2025 contract, point to somewhere in the region of 4% for the 10-year, up from less than 3% only a few months ago.

The bad news is that the spectre of debt issuance looms large with almost $3 trillion of US Treasury bonds and notes (c.12% of total outstanding Treasury issuance) due to be refinanced in 2025.

Forward looking inflationary expectations have also been relatively well contained so far, but surveys including the University of Michigan consumer sentiment study which shows the average inflation forecast in 5 years’ time have ticked sharply higher in recent months.

Arguments against a further move higher in rates might include a ‘howitzer’ from DOGE in delivering genuine efficiency gains across the Federal government complex, and the release of a consumer AI application akin to Apple’s 2007 Smartphone moment which could trigger another disinflationary wave.

Regardless, the performance of the 10-year US Treasury bond, amongst the most closely watched indicators of risk globally, is likely to play a very meaningful impact on the direction of travel for risk assets this year.

HNY to you all. Good luck.

(Cover Image Source: Brandon Day)