MODS (GROWTH) and ROCKERS (VALUE)

As a late teenager towards the end of the 1970’s, I was drawn into the “Mod revival”.

I loved the music and the bands such as The Jam, The Lambrettas, Nine Below Zero and The Merton Parkas, to name four. This “New Wave” music, whilst influenced by the “Punk” movement, lent heavily on the sounds of the original 1960’s Mod bands such as, The Who, Small Faces, the Kinks, The Spencer Davis Group and The Beatles, all of whom I had discovered in the earlier part of the 70’s. My hero David Bowie had started his career as a Mod.

Check out Spencer Davis Group – Keep on Running (1965)

and

Check out Nine Below Zero – Three Times Enough (1981)

This Mod sub culture appealed to me because of the variety of elements within it. It had multi-cultural influences coming from African American soul and R&B to Caribbean Ska to Beatnik and modern jazz. It was experimental and forward-looking, if not Avant Garde.

The Mods wanted to stand out above the crowd.

The original 60’s movement began to permeate art, through “Pop Art” and psychedelia. It was the catalyst that pushed London and the UK into being the global leaders in art, fashion and music, a period that became known as“The Swinging Sixties”.

I believe this Mod movement fostered a freedom of thought and invention. This period of history delivered inventions such as DRAM, the memory chip, Telstar, the First Commercial Satellite, the BASIC programming language, LED’s, and, you could argue, indirectly to the birth of the Internet.

Britain had become a hub of creation. Here are a few “Made in Britain” of the time:

1961: First electronic calculator 1963: First woven high strength carbon fibre 1965: The first Touchscreen 1966: The first cash machine with personal identification number 1970: The first hand held television

In the Sixties, there was another sub culture in conflict with the Mods. These were the “Rockers”.

The “Rockers” harked back from the 1950’s and were associated with motorcycles, and in particular with the larger, heavy and powerful Triumph motorcycles of the late 1950s. The 50’s British motorbike had not evolved technically and was about to be put out of business by the emerging and technologically superior Japanese manufacturers.

They favored black leather, much like American motorcycle gang members of the 50’s. Think of “On the Waterfront” (1954) and “The Wild One” (1953) both starring the late, great Marlon Brando.

Their musical tastes ran to white American rock and rollers such as Elvis Presley, Gene Vincent, and Eddie Cochran, encapsulating a genre of music that had progressed very little since the 50’s.

Rockers were exclusively white, working-class youths.

In large part due to the African American and Caribbean musical influences, the Mod movement was devoid of racism. Let me be clear: that is not to accuse the Rockers of being racist.

The 70’s Mod revival I embraced also led me into the allied Two-Tone movement of the early 1980’s when I arrived in London to go to university.

Two-tone was a genre of British popular music of the late 1970s and early 1980s that fused traditional Jamaican ska music with elements of punk rock and new wave music. The Specials, The Selector, The Beat, defined this sound, and each band had multi-culturally diverse band members and audiences.

Check out The Beat – Mirror in the Bathroom (1980)

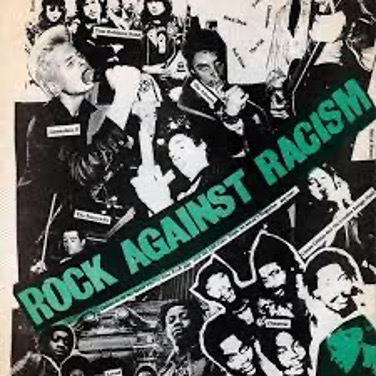

The result was that I became an avid supporter of Rock Against Racism and the Anti-Nazi League. During this period, there was a growing ultra-right-wing faction within British politics and society.

The term “Mod” originated from “Modernists”. I was a “Modernist”, deeply committed to the Mod ideal and I like to think I remain so.

Why is this important to how I invest my own and my clients hard earned money?

I think investment is very much about you. How you invest reflects your beliefs, values and philosophies for life.

Within investing there are two sub cultures much like the Mods and Rockers. These are “Value” and “Growth”.

Investors have debated for a century whether growth investing or value investing is the better strategy, with each having strong support within the investing community. Mods against Rockers, but no Brighton beach front (The Battle of Brighton Beach, May 1964).

Value investors focus on whether a share price is above or below the intrinsic value of the company. They seek out companies trading at a (significant) discount to intrinsic value.

A value investor is not necessarily concerned as to the type of business they're investing in or what its future prospects are. The genesis of the strategy is that the share price doesn't reflect the company's actual value.

A value investor’s exit or sell strategy is simple: when, and if, enough investors recognize the company's true value (it could be a takeover approach), the company’s stock price will rise to, and occasionally above, intrinsic value. At that point, the shares are sold with the proceeds being recycled or reinvested into other shares that offer more attractive “cheap” valuations.

In my way of thinking, what value investors are actually hoping for, is to be short-term investors.

However, what often happens is it takes longer for the market or corporate bidder to recognize the intrinsic value, and therefore there are fewer times when the value investor can repeat the process of finding new value shares and build wealth.

Further, the longer you hold a value share, the greater the chance that it will turn out to be a value trap leading to a lowering of the intrinsic value resulting in the share price falling further rather than rising to hit intrinsic value.

Value investing is “rinse and repeat”.

Much like the Rockers, value investing harks back to the past. It relies on historical data and historical performance. The discipline was founded in the post Great Depression 1930’s by Benjamin Graham and David Dodd at Columbia Business School where Warren Buffett was a student (1951). He enrolled after learning Graham was a lecturer there.

A value investor typically takes a conservative view of companies, placing more weight on their assets, cashflows and record, and less on their investment plans or sales/revenue growth opportunities. Much like the Rockers and their 50’s technology-based motorbikes and culture.

In contrast, growth investing can take decades for an investment’s growth prospect to fully mature. You can hold onto its shares all along the way and share in the success of the company over time. You benefit from compounding returns.

“The strongest force in the universe is Compound Interest” (Albert Einstein).

“The Compound Effect is the principle of reaping huge rewards from a series of small, smart choices” Darren Hardy.

Just a few successful picks can make all the difference in building wealth.

For me, value shares are riskier because the companies have to have done something wrong or are more sensitive to the economic cycle or are carrying too much debt.

So, what is “value” to a value investor?

Valuation can be measured in multiple ways, including price-to-book, debt-to-equity, free cash flow and price-to-earnings or P/E. In contrast, growth investing aims to invest in companies that are rapidly growing revenue or sales, earnings and cash flow.

The P/E is the initial “go to” for a value investor. You buy shares on cheap or low P/E ratios, typically something around less than 12 times. S&P500 is currently on 26 with a long-term average of about 16. 25 times is way too expensive.

Now I am all for bargains.

In my normal life I am a “bargain hunter”. I’m always looking for deals when it comes to things like cars and property. However, decades of investing, observing and experiencing some of the greatest stock market winners in history (Microsoft, Amazon, Shopify, Salesforce, Intuit etc.) have taught me that a slavish devotion to low P/E shares will cause you to miss out on pretty much every massive winner of the future.

Over the long term a devotion to low P/E’s will result in a life of underperformance.

Why?

Basically, I have learnt you have to pay up to own the best, in both the stock market and in life. There’s a reason why Ferraris cost more than Fords. By the way I don’t have anything against Hondas and think the shares are actually a good growth investment.

There is a reason my Lacoste polo shirts cost more than a Next version. I would rather save up to buy my Crocket and Jones loafers than buy a cheaper brand. (In receive no product placement fees ).

Incidentally, choosing quality over price is almost always the sustainable choice because it generally lasts longer helping eliminate waste, is always stylish rather than “fast fashion”, and ends up saving you money since it will need to be replaced less frequently.

This Mod rule works in the stock market as well. Shares in companies with superior products, superior services, superior sales growth, and superior prospects outperform the shares of lower-quality businesses. So, I am willing to pay the higher market valuations of the best businesses.

If you go back over the past 100 years you will find that most of the enormous winners’ shares trade for more than 25 times earnings during their huge runs.

If you aren’t willing to pay more than 30 times earnings, you’ll automatically eliminate yourself from owning the world’s best growth stocks.

It’s not uncommon to see these winners trade for 30, 40, and 50 times earnings during their stock market histories. Winners like Salesforce, Amazon and Google, now Alphabet.

As these winners soared hundreds of percent, value investors sat on the sidelines because they felt these stocks were too expensive given their P/E ratio.

Now this doesn’t mean you should rush out and buy any and every expensive stock. It’s important to keep in mind that a company with a fad product or service can blow up.

Discipline is required to avoid getting swept up in the hype.

The cast iron rule though is that earnings and sales growth are the major drivers of share prices. The more a company grows its earnings, the more its shares will be worth.

Check out www.teamassetmanagement.com

Valuing a company’s assets in an industry or market sector that is going through rapid technological advancements and disruption is not easy. Sometimes, the production power of an asset (the company) can be significantly superseded by a new technology as is happening across the board today.

The value-finding process removes far more stocks than it uncovers, and it can be a highly frustrating way to invest during a bull market.

This targeting of shares with “low prices” draws value investors to principally mature, established businesses that lack obvious growth catalysts, or operate in a commoditized industry.

Currently, these typically include the telecommunications, mining, utilities, energy, and financials sectors.

To a degree, the value investor is saying they are right and the market is wrong. They think of themselves as “contrarians”. They may be, but beating the market is difficult. In the end the Rockers abandoned their old British bikes and bought the new superior Japanese Honda’s and Yamaha’s.

Value investors have to be resilient as well. The old 50’s Triumph motorbike can keep breaking down.

In the meantime, we have a new COVID variant christened Omicron, which is causing some mild panic in the markets. I expect that to continue. The issue being there’s a shortage of real-world data. Personally, I think the authorities and governments of the world have reacted and handled this development well and in a very timely manner.

Maybe, this is our “new normal” and we have to get used to periodic new outbreaks of further mutants of the virus.

The best we can do as individuals is to maintain caution regarding hygiene and gatherings.

I would also encourage being vaccinated with the boosters. I understand the individual rights perspective but I for one believe in the science.

Maybe I am an “Illuminati”.

As above, I do expect further volatility in particularly equity markets and who knows the underlying economic disruption. No crystal ball I am afraid.

However, what we do know is the U.S. Infrastructure Bill will result in some major economic stimulus in America.

- $110 billion for roads, bridges, and major projects

- $73 billion to update and expand the power grid

- $66 billion for rail maintenance, modernization, and expansion – most of this money will go to Amtrak

- $65 billion to broadband infrastructure and development

- $55 billion to clean drinking water

- $50 billion to bolster the U.S.’s infrastructure against climate change and cyberattacks

- $42 billion for ports and airports

- $39 billion to modernize public transport and make it more accessible (seniors, disabled)

- $21 billion for removing pollution from soil and groundwater

- $11 billion for highway safety and pedestrian programs

- $7.5 billion for a network of electric charging stations

- $7.5 billion on zero-emission or low-emission buses and ferries

In terms of economic impact, $1 trillion is approximately 5% of GDP. Not insignificant!

At TEAM, we will continue to adhere to the investment principles that have guided successful risk-adjusted returns for our clients for many years. The typical company in our equity portfolio garners strong brand value amongst consumers of its product or service, boasts an exceptional track record of execution, is innovative, embraces technology and can maintain pricing power through cycles.

These characteristics place our international equity fund on a firm footing as we enter 2022 and the potential range of challenges that lie ahead.

Mark