Quarterly Investment Review & Outlook

Investment Review 3rd Quarter 2025

Pivot Powell Delivers Again

Major Asset Class Returns for 3rd Quarter 2025, GBP (£) terms

The Tariff Tantrum Lay-up

The history books were ripped up again as a traditionally slow summer period was anything but for global stock markets. America’s large cap bellwether S&P 500 index and the technology-laden Nasdaq index both powered to fresh records as insatiable investor appetite for the artificial intelligence (AI) theme and another classic pivot from Federal Reserve Chairman Jerome Powell in deciding to cut US interest rates buoyed sentiment.

Importantly for bulls, the completion of second quarter US corporate results revealed that aggregate earnings expectations were comfortably exceeded. This should not have come as surprise. The tariff tantrum triggered by President Trump back in early April on the Rose Garden lawn gave blue chip company CFO’s the perfect excuse to materially lower investor expectations for the remainder of 2025. With many of the reciprocal tariffs subsequently softened or reversed, the bar for earnings ‘beats’ this quarter was low.

AI Fever

Nowhere has the ‘wow factor’ been more fully embraced than in the technology sector. A resurgent Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) plus Oracle and Broadcom) basket of stocks has recaptured market leadership and the imagination of investors following a swoon earlier this year. AI fever has gripped markets to such an extent that seemingly disruptive developments in US domestic affairs and further afield in the G7 are being largely ignored.

Market darling Nvidia, the picks and shovels play of the AI story and fully 8% of the S&P500 index, delivered 47 billion dollars of revenue in the quarter, representing +56% growth, and earnings per share of $1.05 representing +54% growth on a year-on-year basis. The numbers were accompanied by soothing tones from CEO Jensen Huang. He described AI infrastructure as entering ‘a new industrial revolution’, and demand for the company’s latest Blackwell chip as ‘extraordinary’.

Nvidia (the leading artificial intelligence chip maker globally) also shocked the market by announcing a 5-billion-dollar investment into Intel which saw the latter shares jump more than 20% on the news. A few days later, Nvidia told us that they will also be investing up to 100 billion dollars in a partnership with Open AI to accelerate infrastructure and the build out of data centres for artificial intelligence. Later in the quarter, Oracle posted results that left Wall St. analysts ‘slack-jawed’. Backlog revenue order growth rose +359% year-on-year to $455 billion, whilst the ‘cloud infrastructure’ unit expects to grow revenue 14-fold by 2030 after the business signed several multi-billion-dollar contracts with customers.

The announcements give further impetus to an ongoing AI narrative which is convincing the street that the extraordinary sums of money being invested into AI-related infrastructure will, eventually, be very profitable investments for America’s mega cap technology companies.

Jay Pivot

One potential curve ball to prevailing positive sentiment was Chairman Jerome Powell’s speech at the Federal Reserve’s annual economic summit for central bankers in Jackson Hole, Wyoming. Powell, and several staunch colleagues at the Fed, have resisted intensifying pressure from President Trump and his inner circle to cut interest rates (‘NOW!!!’) due to concerns that tariffs will feed through to higher consumer price inflation in the US. In the end, a modern-day version of General Custer’s Last Stand was not to be.

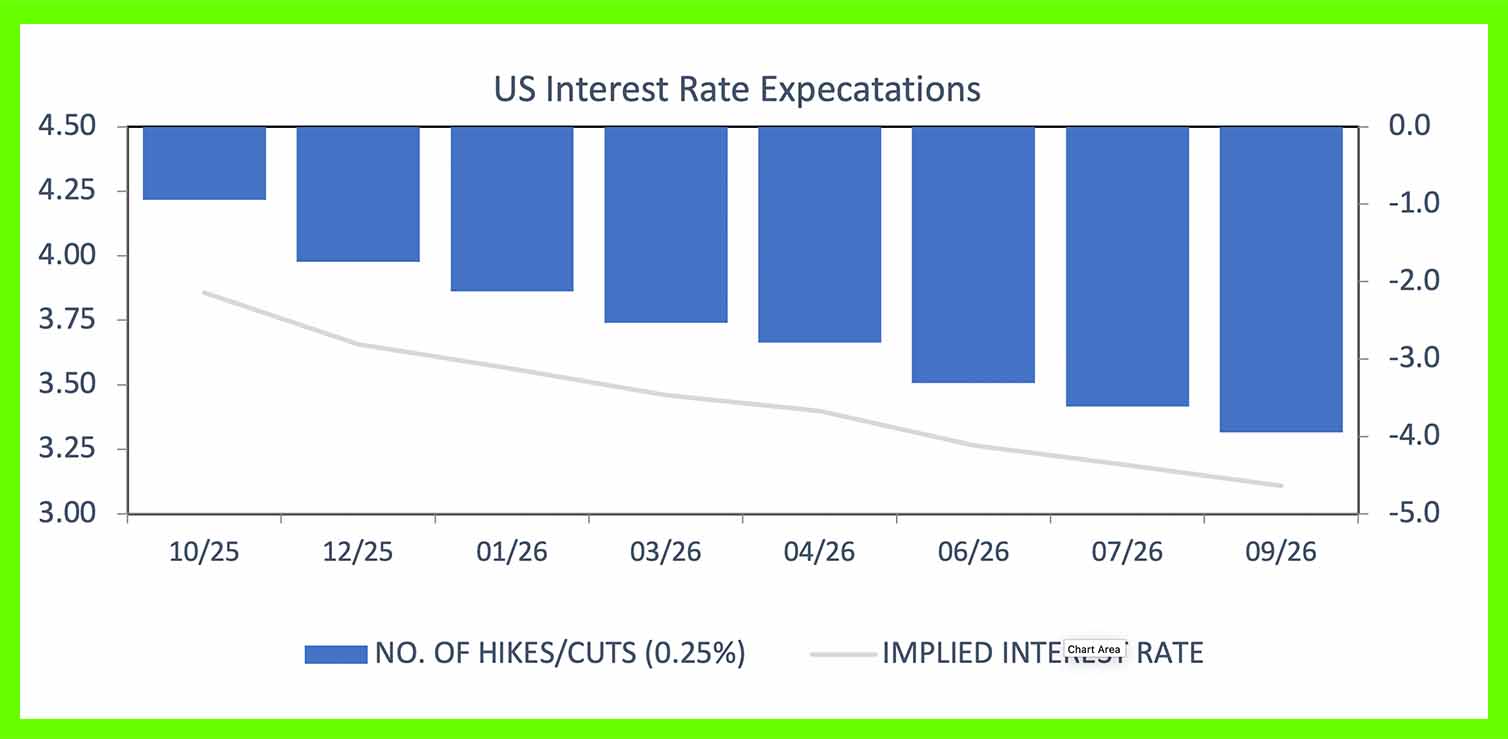

An alarming deterioration in US job creation in recent months, including a Bureau of Labor Statistics report which revealed 911,000 fewer jobs were added than first estimated in the year to March 2025, and little obvious impact from global tariffs yet on inflation, were enough to give Powell and the Federal Reserve Committee the cover they needed to shift towards a more accommodative monetary stance via a 25 basis point rate cut. At the end of September, money markets were pricing an additional two interest rate cuts before the end of this year.

The Donald ‘Fires’ Cook

With rate cut(s) now seemingly in the bag, another extraordinary development from the White House, fuelling ongoing concerns over an erosion of Federal Reserve independence. Having already personally attacked ‘too late’ Powell’s credibility and credentials in the public domain on several occasions, the Donald officially announced via Truth Social that he would be firing Fed Governor Lisa Cook ‘effective immediately’, citing accusations of mortgage fraud.

At the time of writing, Cook remains in office following a decision from the Supreme Court to decline to allow her immediate dismissal. Trump vs. Cook will be argued before the Supreme Court in January 2026 to decide whether the president has legal authority to ‘fire’ the Fed governor. Extraordinary.

Equities: Scores on the Doors (all returns in sterling terms)

Developed market equities (represented by the MSCI World Equity Index) delivered a +9.6% total return over the 3rd quarter. The S&P 500 large cap index delivered a +10.4% total return, whilst the technology-laden Nasdaq Index, powered by mega cap growth stocks and all things AI, delivered +13.8%.

Japan’s Nikkei 225 Index returned +11.2% over the quarter to a new record high, despite the departure of yet another Prime Minister, Shigeru Ishiba, in September. The stock market continues to benefit from an effective corporate governance reform agenda, evidenced by over 10 trillion yen in share buybacks since the start of the fiscal year in April, whilst nominal GDP growth has now been running over 4% annualised for the past five years.

The MSCI Emerging Markets Index returned +13.0% over the quarter. A weaker dollar reduces the servicing costs of any dollar-denominated debt held by governments and businesses, whilst the TACO trade gave a boost to companies entrenched in the AI (Artificial Intelligence) supply chain, primarily semiconductor chipmakers in Taiwan and South Korea.

China’s Shanghai Index finished the quarter ‘top of the pops’ with a +15.7% return, as the country’s own mega cap technology companies delivered excellent earnings results. From a broader macro perspective recently announced ‘anti-involution’ initiative, aimed at curbing excessive price competition in both legacy (steel, cement, chemicals, coal) and growth (solar, lithium batteries, EV’s) sectors is being well received.

Fixed Interest

It was a quarter of very contrasting fortunes for corporate and government bonds with politics and geopolitics remaining centre stage.

Government bond returns were in the red as yield curves steepened, reflecting rising concerns about fiscal sustainability, whilst tighter credit spreads underpinned positive returns for corporate bonds with fears of a global trade war subsiding as we moved from Taco (‘Trump Always Chickens Out’) to Waco (the ‘World Always Chickens Out’) as few countries dared retaliate against the reciprocal tariffs, including the EU which stepped back from imposing €93 billion of retaliatory tariffs:

(Source: Bloomberg, TEAM)

ECB

As expected, the European Central Bank has left its deposit rate unchanged at 2% since June, moving from a ‘wait-and-watch’ mode during the trade negotiations between the EU and US to a more confident stance. This reflects the resilience of the Eurozone economy, including the labour market, and benign outlook for inflation. It has also carefully avoided being drawn into any of the political flashpoints on the continent, stressing that markets have continued to function in an orderly manner.

At its September meeting, the ECB nudged up its annual inflation forecast to 1.7% (previously 1.6%) for next year and expects the Eurozone economy to grow 1.2% (previously 0.9%), the first upward revision since March 2024. Money markets are now just pricing in a one-in-three chance of any further interest rates cuts in the current cycle:

(Source: Bloomberg, TEAM)

Federal Reserve

Coming into the Federal Open Market Committee (FOMC) meeting, prospects of a jumbo 50 basis point cut gained traction following very public comments about the immediate need for lower interest rates by the Donald, Treasury Secretary Scott Bessent, and Steven Miran, recently appointed to the Board of Governors of the Fed.

As discussed, the FOMC ultimately opted to cut the federal funds target range by a quarter of a percentage point which Chair Powell described as a ‘risk management cut’ to forestall the prospect of further labour market weakness. The decision was also almost unanimous with only new appointed Stephen Miran, an ally of President Trump, dissenting in favour of a half-point cut.

The Fed’s updated ‘dot plot’ chart, showing each member of the FOMC’s forecast for the federal funds rate over the new few years, also highlighted a wide dispersion of views on the committee, reflecting the unusual situation of a weak labour market but with upside risks to inflation. The median forecasts point to two more quarter point rate cuts this year, and another two by the end of next summer:

(Source: Bloomberg, TEAM)

The fly in the ointment to that view could be any near-term upside surprises to inflation from the 10% blanket tariffs which remain in place, or a (re)imposition of more aggressive, targeted tariffs by an emboldened Trump. The inflation report for May pointed to only a modest impact on consumer prices, but it can take up to three months before companies pass on their higher costs, especially with much uncertainty over which countries will reach trade deals with the US and what the rate of tariffs will be in the coming months.

BoE

Closer to home, Britain and France are seemingly at loggerheads for the title of most dysfunctional government in the West. The UK Monetary Policy Committee (MPC) decided to keep interest rates unchanged in a 7-2 vote, rejecting a quarter point cut. They also announced that balance sheet holdings (government gilts that they bought in the covid crisis), would shrink by £70 billion in the year to October 2026. This compares with a previous rate of £100 billion. Who the marginal buyer for this paper will ultimately remain to be seen.

Markets had discounted these actions and are pricing ‘no UK rate cuts’ until the first quarter of 2026. The high inflation rate and the (extremely late) key Autumn statement from the Chancellor in late November is keeping the Committee on a hold basis. The decision to delay so extensively is very unlikely to mean good news.

(Source: Bloomberg, TEAM)

Commodities

A phenomenal quarter for the precious metals space, with silver returning over 30%, gold returning over 19%, and a basket of global mining sector stocks returning close to 50%:

(Source: Bloomberg, TEAM)

Global central banks have acted as the ‘marginal buyer’ in this cycle, steadily accumulating the yellow metal, triggered seemingly by a reaction to America’s decision in late February 2022 to freeze Russia’s foreign exchange reserves. As a result, global central banks bought a record net 1,080 tonnes of gold in 2022, 1,051 tonnes in 2023, 1,089 tonnes in 2024, and 415 tonnes in the first half of 2025:

(Source: Jefferies Global Research, World Gold Council)

With that said, the pace has slowed in recent quarters. The slack has been picked up by strong investment and a surge in ETF inflows, signalling that institutional money is, finally, joining the party. Total gold ETF purchases (shown below) amounted to 420 tonnes in the first nine months of 2025, equivalent to 560 tonnes annualised. This is in stark contrast to 2023 and 2024, when net flows were negative:

(Source: Lucas Meric, TEAM)

Potential drivers of this increased demand might include expectations of Fed easing and falling real interest rates, which reduce the opportunity cost of holding non-yielding assets like gold, rising global uncertainty (trade policy concerns, worries about G7 fiscal and monetary stability), and growing recognition of a structural supply/demand mismatch for silver driven by solar, EV, and AI-related demand.

Turning to ‘black gold’, oil was essentially flat on the quarter, largely because rising supply pressures offset bullish geopolitical and demand impulses. OPEC+ (the Organisation of the Petroleum Exporting Countries plus non-OPEC partners including Russia, Mexico, and Oman) began unwinding voluntary cuts, announcing incremental output increases that weighed on prices, whilst non-OPEC+ production, notably from US shale sources) remained robust.

TEAM Positioning & 3rd Quarter 2025 Outlook

What worked during Q3 2025: China, EM ex China, Nasdaq technology and American large cap growth stocks, high yield bonds, and precious metals exposure.

What did not work during Q3 2025: Energy sector equities, owning cash, global small cap equities.

As we enter Q3 2025, our asset allocation for the core TEAM MPS multi asset range and equity strategy is shown relative to neutral weightings in the table below:

Equities

To give a sense of the AI capex mania gripping Wall Street, the bellwether S&P 500 index has added an astonishing 15 trillion dollars of market capitalisation since the lows in early April this year. The recommencement of US Federal Reserve easing in September, has, against the backdrop of a still-hot American economy, (re)ignited confidence amongst investors.

For perspective of the dominance of the theme, fully 35% of the S&P 500 index is now the Magnificent 7 (comprising Apple, Alphabet, Google, Meta, Microsoft, Nvidia, and Tesla). And, since the Chat GPT launch in November 2022, AI-related companies have driven 75% of total index returns, almost 80% of the earnings growth, and fully 90% of capex growth. Can you spot the difference below between the top eight stocks in both the S&P 500 index and the Nasdaq technology index?

(Source: Jim Bianco Research, October 2025)

History has also been kind to the current backdrop. Of 23 cases since 1980 when the Federal Reserve has cut interest rates whilst the S&P 500 index is within 2% of its all-time high, the index has returned 13.9%, on average (+9.8% median average) over the next 12 months with a 100% success rate of positive returns. That is a very good batting average.

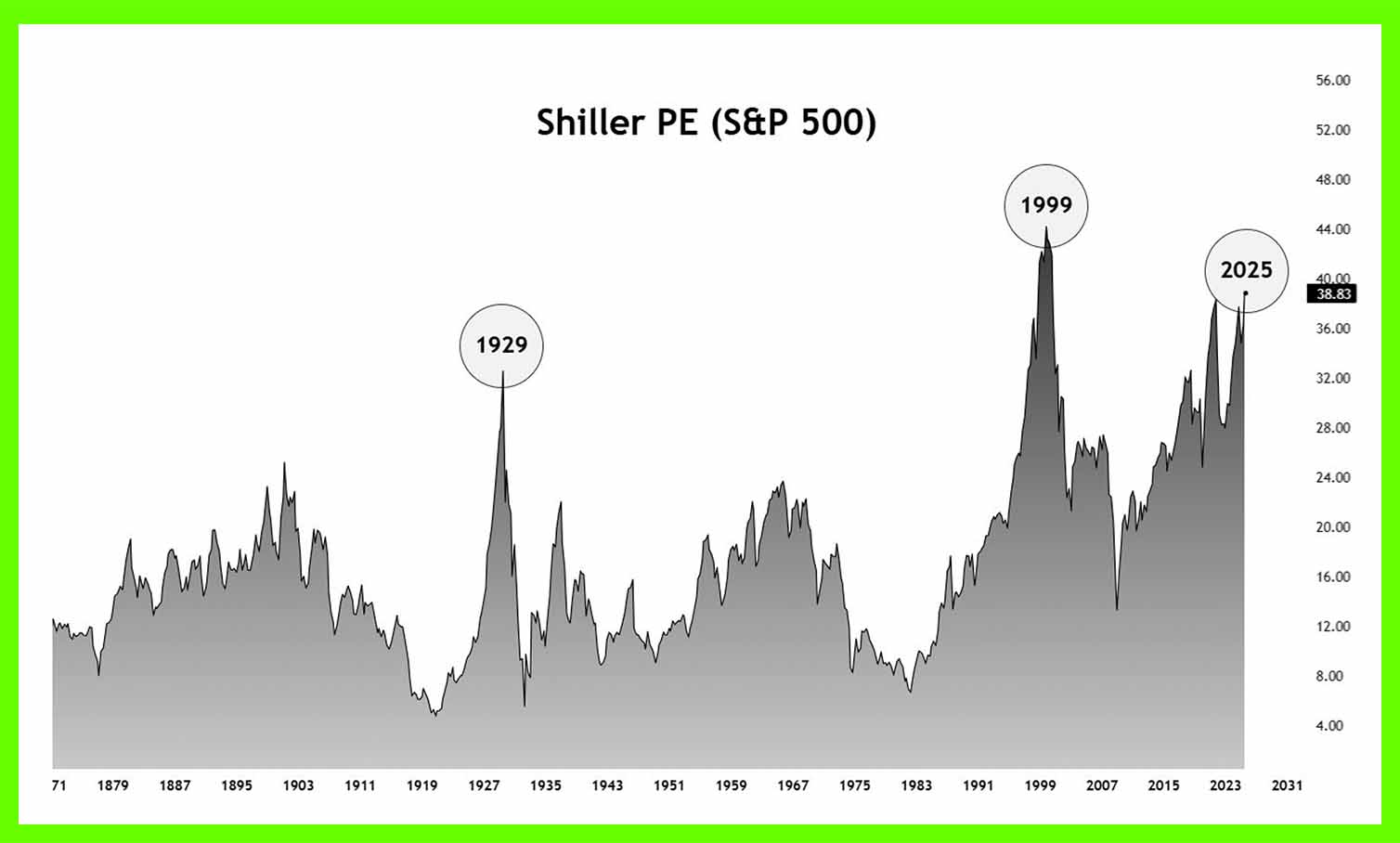

With that said, starting valuations are important. In that context, the Shiller P/E ratio (a widely followed and respected long-term valuation metric for the S&P 500 index) has breached 40X for the first time since the Dot-Com bubble (we all know what happened next):

(Source: Rasmus Ulveman, TEAM)

In the long-term, the answer to the question of whether these companies can effectively monetise their capex investment programme is likely to determine the winners and losers of the next market cycle. To recap, an estimated 350 billion dollars this year, and 400 billion dollars next year, is due to be spent on AI related equipment by the major US technology companies.

For now, extraordinary sector operational performance has, thus far, justified the hype. We have a healthy position to US technology across our strategy range but remain ready to act swiftly should the tide turn.

Ex-US exposure

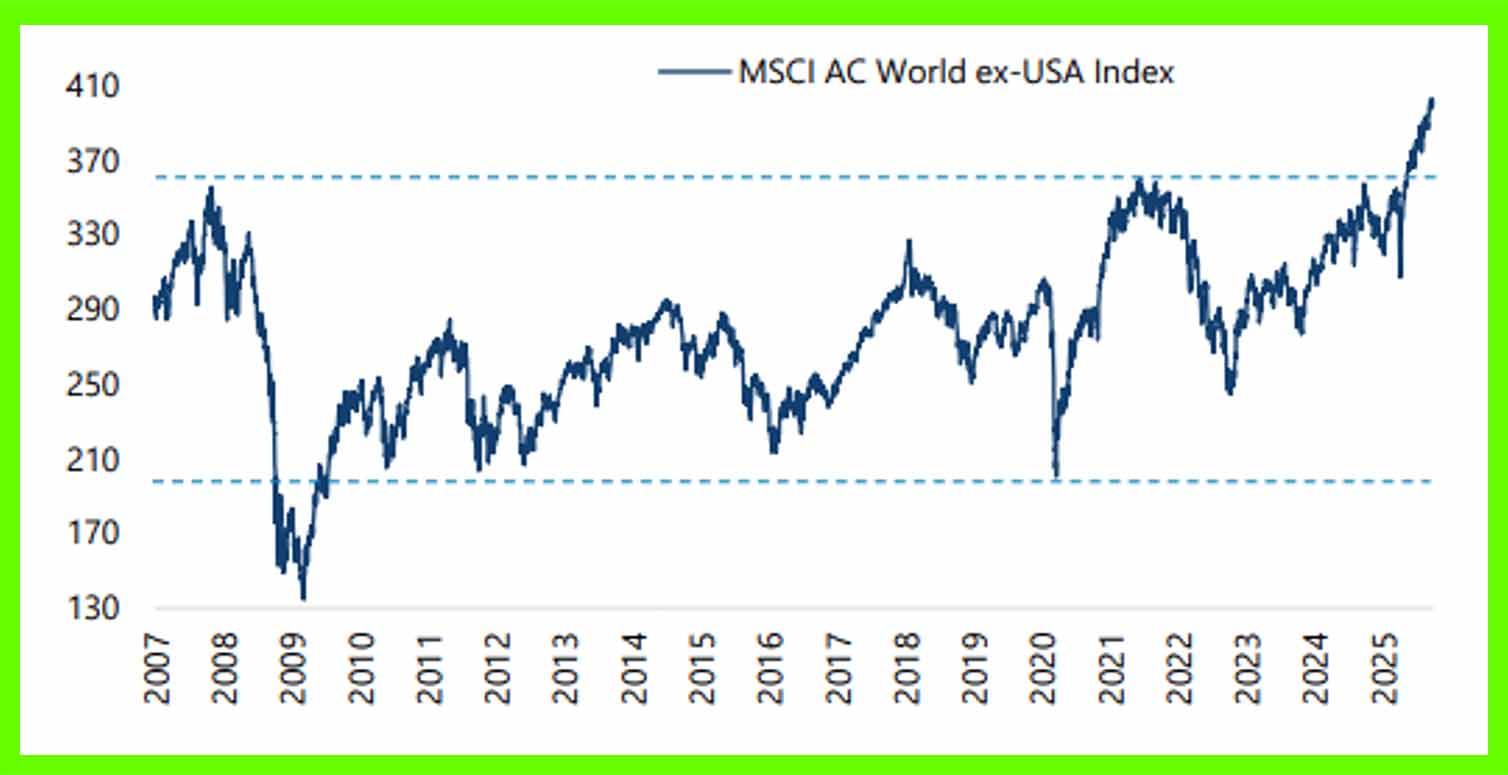

We see more attractive opportunities outside of the US, evidenced by the recent upside breakout of the MSCI All Country World ex-USA Index from an 18-year trading range:

(Source: Bloomberg, Jefferies Global Markets, TEAM)

Europe ex-UK continues to offer relative valuation merit, fiscal largesse catalysts, well-capitalised banking and insurance sectors, whilst the composition of the UK FTSE market (less domestic, more global value companies listed in London), complements the heavy technology weighting in America.

Asian equity markets have quietly taken off, with Chinese equities breaking out to decade-plus highs in price terms, and South Korea, Taiwan and Japan also breaking out to all-time highs. Many of the respective index constituents across these markets are intrinsically linked to the AI supply chain and trade at steep valuation discounts to their American counterparts.

Within China, our preferred method of exposure remains the Chinese internet space that, considering the resurgent Nasdaq last quarter, trades at a substantial discount (approximately 65% to the Magnificent 7) to American counterparts, whilst corporate earnings in China are continuing to inflect upwards, a promising signal. What is underappreciated by the market in our humble view is China’s growing competitiveness in high-tech sectors. This is not just EVs or batteries but also robots and automation.

Fixed interest

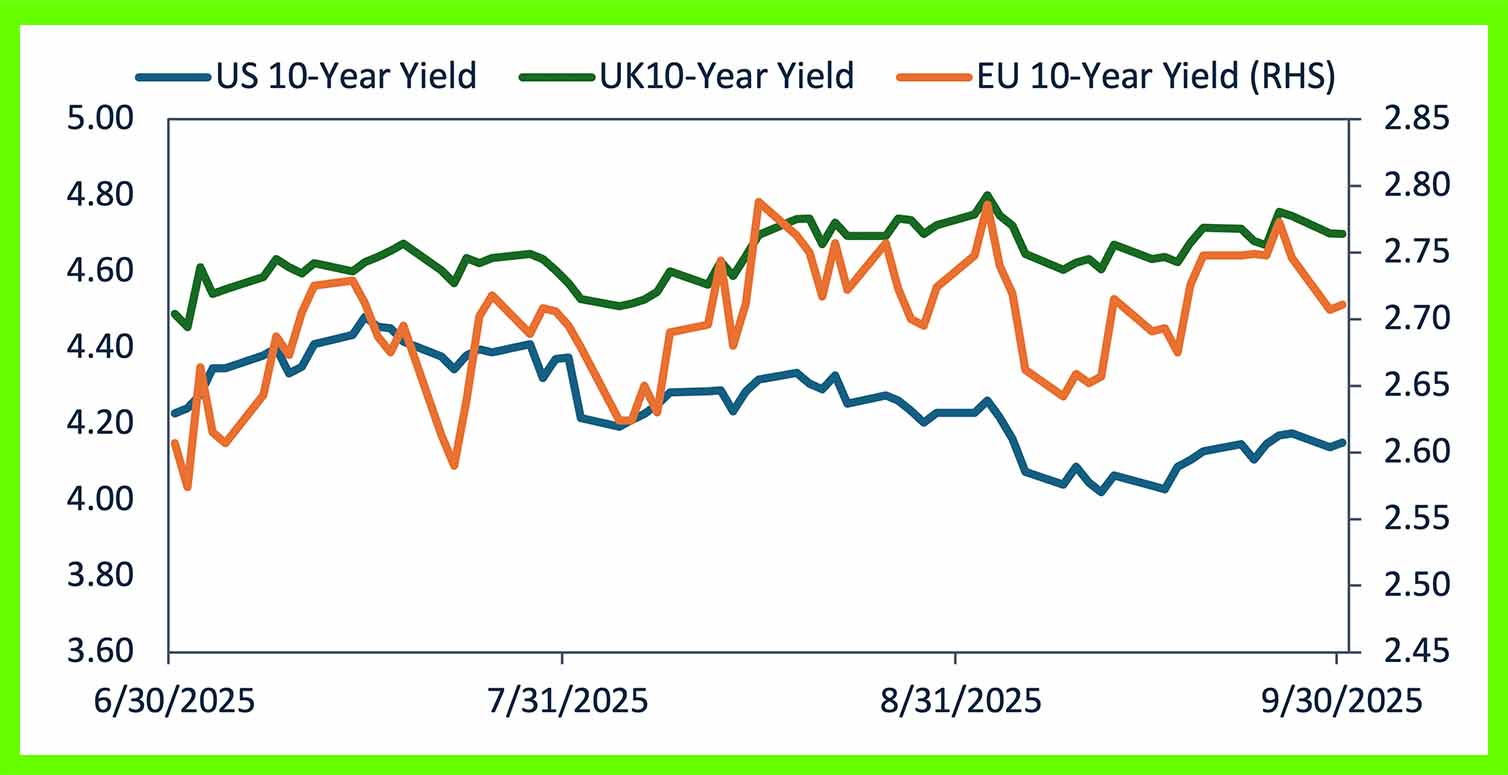

We continue to remain sceptical about the pricing of longer-term interest rates in the UK, Europe, and the US. Do 10-year Bund (2.7%), Treasury and Gilt (4-5%) yields offer investors adequate compensation for the risks that inflation becomes more structural due to competition for scarcer resources, political risk, and/or for the supply of bonds needed to fund budget deficits? We don’t think so.

The reluctance, or inability, of governments across the G7 to make difficult choices on tax and spending to get back on to a path of fiscal sustainability will leave government debt curves vulnerable to further steepening (upward pressure on yields). Although headlines suggesting that countries such as the UK and France are heading towards an IMF bailout are hyperbole, the message is clear that investors will want to be paid more to lend long-term to governments pursuing irresponsible fiscal policies.

Governments, and debt management offices across G7 have sought to limit the upward pressure on long-dated bond yields by reducing the average maturity of new debt issuance dramatically, but it’s a short-term fix which leaves borrowing costs more vulnerable to short-term market movements.

It’s not just a buyers strike to be blamed for steeper yield curves. Structural demand for traditional buyers of long-dated debt will also decline further going forward. In the UK, pension funds’ price-insensitive demand for long-dated bonds to match long-term liabilities underpinned the Gilt market for decades, enabling the UK to benefit from the longest average duration debt (14-years) in the G7.

However, as Bob Dylan penned, ‘The Times They Are a-Changin’’ as defined benefit pension schemes are set to shrink rapidly over the next twenty or so years as members pass away. The Office for Budget Responsibility (OBR) forecasts that the UK pension fund ownership of gilts will fall from almost 30% of GDP in 2025 to 11% by 2074.

Dutch pension funds, which are by far the largest in Europe, are also set to sell-off EUR 125 billion of long-dated bonds between 2025 and 2028 due to a substantial reform of its retirement sector – a transition from guaranteed final payouts to pensioners to a defined contribution framework. Rabobank estimates that Dutch pension funds own EUR 457 billion of government bonds with the heaviest sales expected in German, French and Dutch sovereign debt.

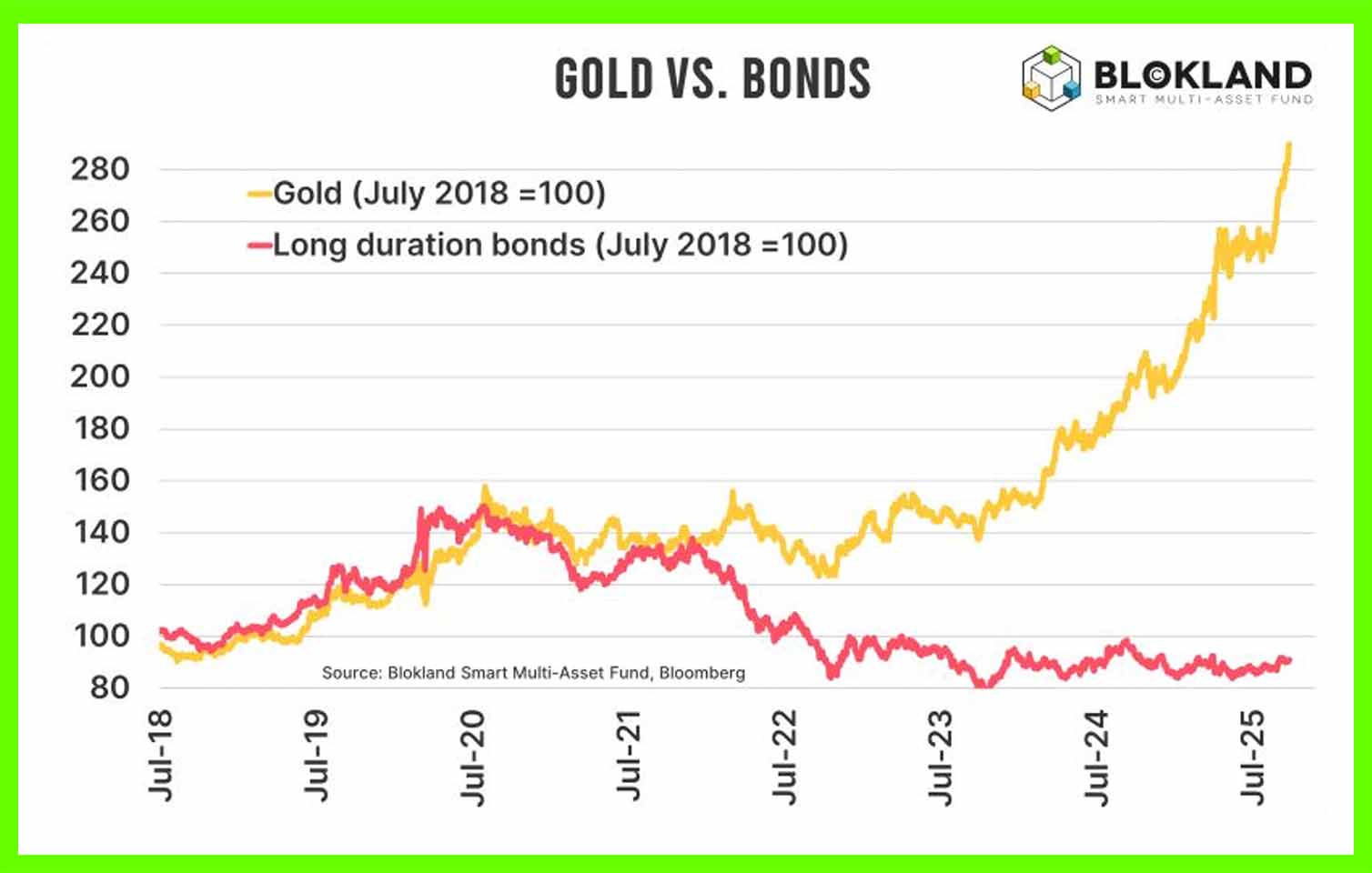

Against this backdrop, we disposed of all G7 ‘risk-free’ government bonds across our strategy range several quarters back in favour of owning physical gold. The rationale is the backdrop of mounting government deficits and a wall of new supply over this cycle that could create refinancing problems for weaker companies.

So far, the thesis has been working better than anticipated in price terms:

(Blokland Smart Multi Asset Fund, Bloomberg, TEAM)

Within fixed income, we will continue to focus our investments on intermediate dated bonds, or the ‘belly’ of the curve (typically between 3 and 8 years in duration), which we think offer the most attractive risk-reward profile. Our preference in the space remains high quality investment grade corporate credits and financial hybrid bonds issued by well capitalised European banks and insurance companies.

However, tight credit spreads will also mean there is less room for error and remaining agile, and selective, across sectors, geographies and maturities will be critical.

Alternatives and Cash

Physical gold and global miners remain essential portfolio insurance in the context of long-term dollar debasement (the loss of purchasing power). The simple case for ownership is that gold has outlasted every stock market in history, and 10kg of the yellow metal will still buy an average family size home, just as it did nearly 100 years ago.

The brutal reality facing the US government is that approximately 96% of existing US interest payments are directed to Medicare, Medicaid, and Social Security, which are essentially ‘untouchable’. The fact that the enormous US debt mountain continues to grow despite record US tariff revenue collection this year and federal government tax collection running at almost a 10% annualised rate speaks to the enormity of the challenge. Almost $750 billion has been added to the national debt over the prior quarter:

(Source: USdebtclock.org)

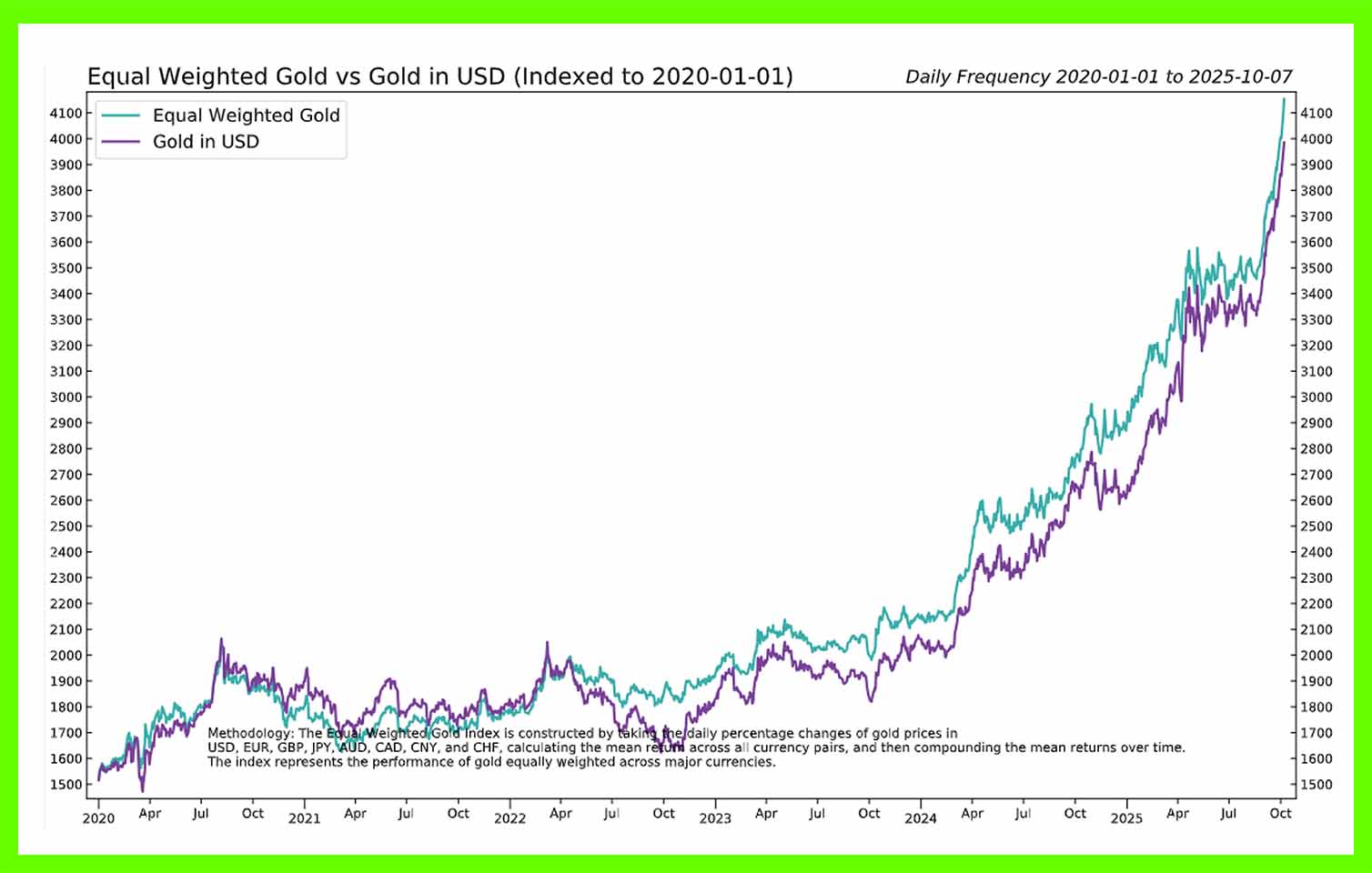

Gold continues to shine, with the price touching new all-time highs during the quarter across many major currencies. Shown below, gold in dollars (purple line) being led by an equal-weighted basket (teal line) which prices gold across eight major currencies including the Swiss Franc, Japanese Yen, Euro and Pounds Sterling:

(Source: 3Fourteen Research, TEAM)

We introduced physical silver alongside our physical gold exposure at the beginning of the quarter on account of a chronic silver supply deficit for the next 5 years and increasing industrial use (demand) from data centres for AI application, EV’s and solar sectors. In addition, extensive internal research demonstrated that physical silver, appropriately weighted, can sit comfortably alongside gold to deliver long-term benefits for a multi asset portfolio.

From our previous quarterly:

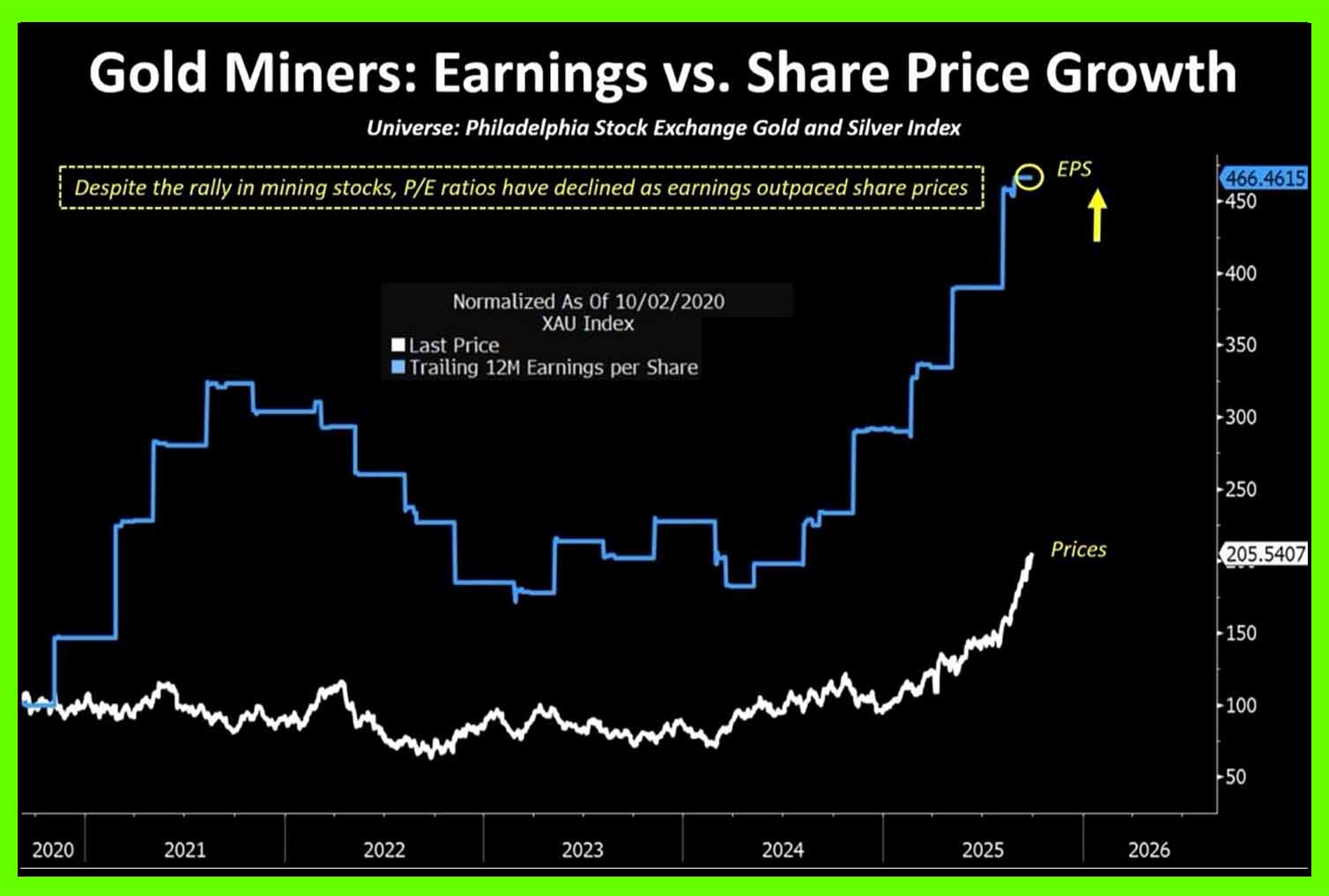

Selective high-quality precious metal mining stocks continue to offer excellent upside potential, with companies delivering a renewed focus on capital efficiency, significant cash flow generation at current spot prices, and scope for meaningful share buybacks and/or special dividends through this bull market cycle. It would not take much in the way of global capital flows to put a bid under the sector. This is now playing out.

We understand that the mining stocks have enjoyed a phenomenal quarter, but we reiterate our view that this remains the early innings of a secular bull market cycle for precious metals. Given the positive move we have seen in spot prices (white line is the gold price below), it is worth noting the commensurate increase in earnings (blue line for gold miners share price growth) for the leading companies.

In aggregate, valuations are cheaper today than last quarter. This reflects the operational gearing inherent in the mining business model and reflects a relatively depressed oil price, one of the key input costs in this sector:

There will be bumps in the road (the line from A to B in markets is rarely a straight one), but we anticipate holding exposure to this sector for several years to come.

As always, rather than attempt to look around corners and predict outcomes, we rely steadfastly on our systematic investment process, which has successfully navigated an array of market conditions during this post-pandemic cycle and delivered respectable risk-adjusted returns for our investors.

Thank you for your continued support and interest in TEAM.