The View from Asia: Covid Catapult

(Cover Photo Source: Hưng Nguyễn Việt)

For many, the passing of 2020 will have evoked a sense of welcome relief, less ‘adieu’ and more ‘goodbye and good riddance’. It would not be an understatement to say that last year ranks amongst the most extraordinary in living memory, with countries around the world still grappling with the humanitarian and economic devastation inflicted by COVID-19 and its various mutations. We welcome the new year with a renewed sense of optimism but recognise that many big picture issues remain unresolved.

At TEAM Asset Management, we are global investors. Our six megatrends encapsulate the secular, structural forces that influence the present, and, more importantly in our view, will shape tomorrow’s economic landscape. Identifying these trends, and then positioning our investment portfolios to capitalise on the investment opportunities they create, forms the core of our investment process.

The shift in balance of global economic power from West to East is one of TEAM’s megatrends. Asia’s re-emergence as the world’s dominant economic and financial region has been accelerated by a global health pandemic that has spread to 218 countries and territories around the world, infecting almost 89 million people at the time of writing.

With large pockets of the West grappling with desynchronized reopening-and-closing strategies and political polarisation, Asia has benefited from both a strong and effective response to contain Covid-19 early in its ascendancy.

The strength, speed and magnitude of the regional recovery can be observed in the composite leading indicators (CLI) for Asia and the Chinese export picture (charts 1 and 2 below). Each illustrates the extent to which factories and merchants open for business and operating under normal conditions have been able to successfully accommodate global goods and services demand. Since bottoming in early 2020, these metrics are now running comfortably above pre-COVID levels:

Underpinning regional economic developments has been a range of extraordinary policy measures deployed by government and central banks across the G7, including several liquidity bazookas to thaw freezing fixed income and credit markets at the height of the pandemic in March 2020, in addition to derivatives of helicopter money in the form of direct payments to households and struggling businesses. The net effect of this unparalleled liquidity surge has been soaring prices across the asset class spectrum, from corn to crypto currencies.

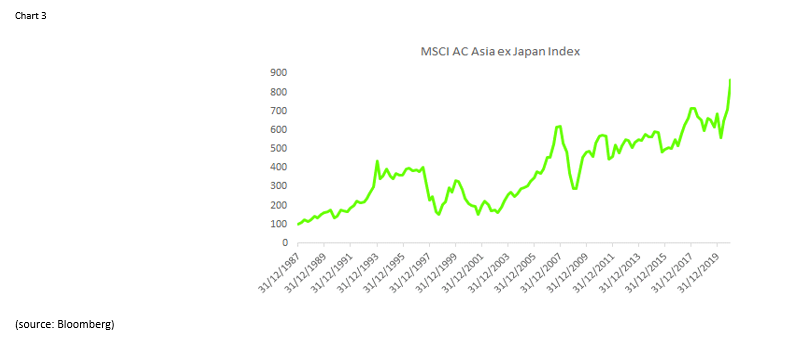

It will not come as surprise that the above conditions fed through to Asia Inc. with the region and broader emerging markets recording the best quarterly performance since the 4th quarter of 2018, aided by a structurally weaker US dollar. The MSCI AC Asia Pacific ex-Japan Index (longer term chart shown below) rose by 18.8% in US dollar terms last quarter (compared with a 12.7% gain in the MSCI USA Index and a 14.4% gain in the MSCI All Country World Index) and posted a 20% total return for 2020 in both market-weighted and equal-weighted terms.

So, where to from here? If history is any guide, a synchronised recovery taking place in the context of a structurally weakening dollar, and with the whiff of global inflation becoming progressively stronger, should be an unequivocally bullish scenario for Asian equity markets. Applying the standard issue ceteris paribus caveat, we are likely to observe a significant uplift in nominal GDP growth relative to real GDP growth, which would be good news for aggregate corporate profits.

In addition, with the spectre of deflation still looming large from the impact of further enforced lockdowns across the globe, unorthodox policy implementation of the fiscal and monetary variety is likely to be the de facto stance adopted by central bankers, adding yet more grease to the wheels of capital markets. As it stands today, price action across asset classes points to investors looking through second-wave spikes in the America, Europe and the UK towards a successful vaccine rollout by the middle of this year.

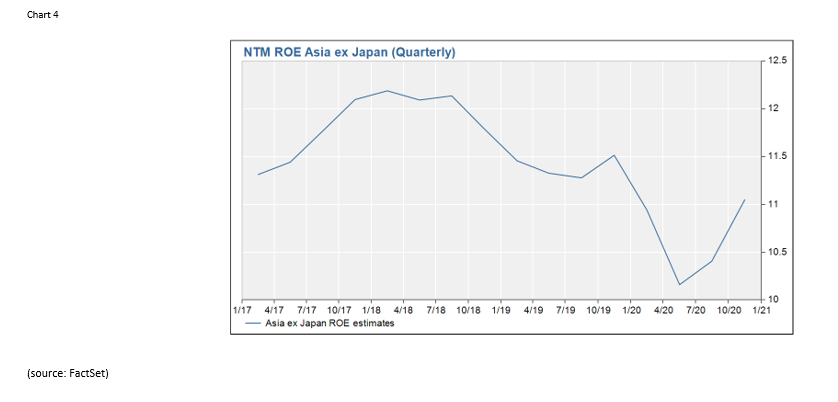

Taken together, the above should precipitate a healthy and sustained rebound in corporate profitability across Asia (as measured by both return on equity and earnings per share growth estimates) following almost a decade of structural decline. A low base reference point sets up the potential for a dramatic rebound. Consensus MSCI Asia AC Asia ex-Japan return on equity has declined from 14% in 2011 to 9% in 2020 and is forecast to rise to 11.1% in 2021 (chart 4), whilst aggregate corporate earnings expectations across the region for 2021 currently range from 10% to 50% (chart 5):

So far, so good. Yet against this backdrop, we must also be cognizant of the shorter-term risks. The rise of Asian equity prices has resulted in the MSCI Asia Pacific ex-Japan region trading at a little over 18 times earnings on a forward basis. This is almost 3 standard deviations above 10-year average levels, and the benchmark has only been more expensive twice in the past thirty years (1994 and 1999). One can therefore conclude that the region is not screamingly cheap on an aggregate basis.

Other warning lights that are flashing and have our attention include a range of high-frequency sentiment, positioning and fund flow data that we follow, recent US IPO and SPAC-related price performance as well as the monumental challenges presented by a successful vaccine roll-out. Our sense is that the prospects of a market correction are growing daily. Should this scenario unfold, we have our pencils sharpened to deploy additional capital to a growing list of Asian corporates that align with our megatrends and investment implications.

Turning to the companies themselves, at TEAM we allocate capital with the wind on our backs, which is to say we like to keep things simple. Each company that we consider typically holds a dominant position in their local market, demonstrating a history of strong business execution and, crucially, a sustainable model to drive returns going forward. Our investment compass generally leads us towards growth-orientated companies, but we also consider robust business models that can deliver healthy levels of earnings growth in addition to sustainable and growing dividends, preferably above the level of inflation.

In this context, Asia continues to stand out. We look forward to sharing further insights in the coming months.