Treading Softly: Back into Bonds

Executive Summary

- The UK government bond market has been thrust into the limelight of late, with almost constant (and constantly negative) media coverage.

- Uncertainties abound, fuelled by speculation over the likely path of government policy, and seemingly contradictory action from the Bank of England.

- Declines in the UK Gilt market have been swift and substantial

- TEAM have held no conventional bond exposure across our core GBP multi-asset strategies for an extended period, as it had become apparent that most bonds represented return free risk.

- Whilst timing the bottom in any asset class is nearly impossible, at these significantly lower levels, bonds are starting to look more attractive on a risk / reward basis. We have consequently re-introduced government, and selective investment grade, bonds to our models.

TEAM Strategy Update

Treading Softly: Back into Bonds

The UK government bond market has become the poster child for the latest bout of anxiety gripping financial markets, dominating discussion and debate. Cracks are appearing as markets experience withdrawal symptoms of easy money from an extended period of quantitative easing.

Uncertainties abound, driven primarily by Chancellor Kwarteng’s profligate mini budget a fortnight ago, which seemed to fly in the face of the Bank of England’s efforts to tighten monetary policy to fight inflation.

Speculation has been rife in recent days over the potential reversal of government plans. A closed-door meeting at Number 10 to discuss whether to scale-back, or scrap, parts of the mini-budget, along with aggressive posturing by the Governor of the Bank of England, Andrew Bailey, regarding the shelf life of financial assistance to bond markets, have poured fuel on the fire.

Levels of uncertainty certainly remain high. The impact of market declines on the Liability Driven Investment (LDI) schemes of UK pension funds, the ultimate level at which UK interest rates will peak, Britain’s inflation trajectory, and how the proposed tax cuts are to be funded are the most prominent, however the repricing of gilts has been sharp and significant.

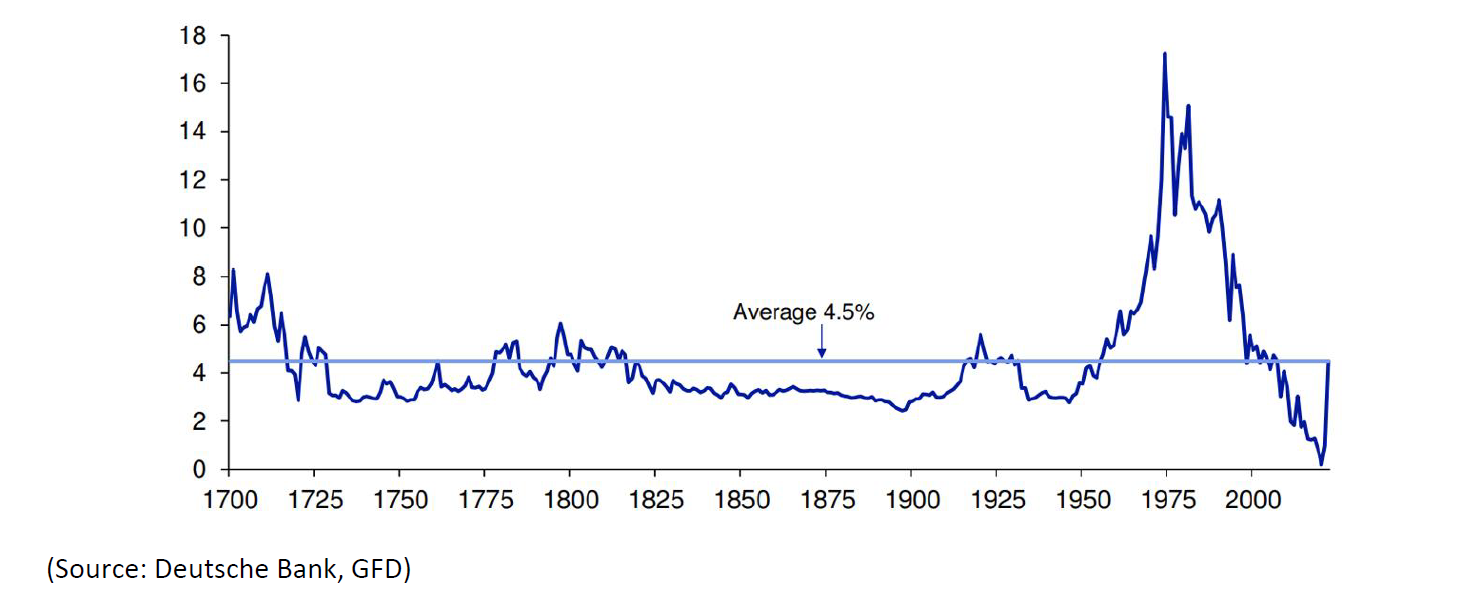

Below is the ultra-long-term chart (1) of the UK 10-year gilt market yield going back to 1700. The yield level serves as the benchmark reference rate for interest rates, and, by extension, mortgage rates for the bulk of UK homeowners:

Barely two years ago, 10-year gilts were effectively trading at 0%, a level which, according to research by Jim Reid at Deutsche Bank, ranks as the lowest in the 322 years of data which exists for UK borrowing costs. Yields at the start of this year were far below 1%, before a seismic shift in monetary policy from many of the world’s central banks to contain inflation triggered a swift and significant re-pricing of ‘risk’ across the spectrum.

Fast forward to the time of writing, and 10-year gilt yields of 4.35% are now, remarkably, trading at close to their long-term average. Whilst the forces driving this move cannot be considered positive from an economic standpoint, yields across developed many markets have started to approach, or exceed, long term averages.

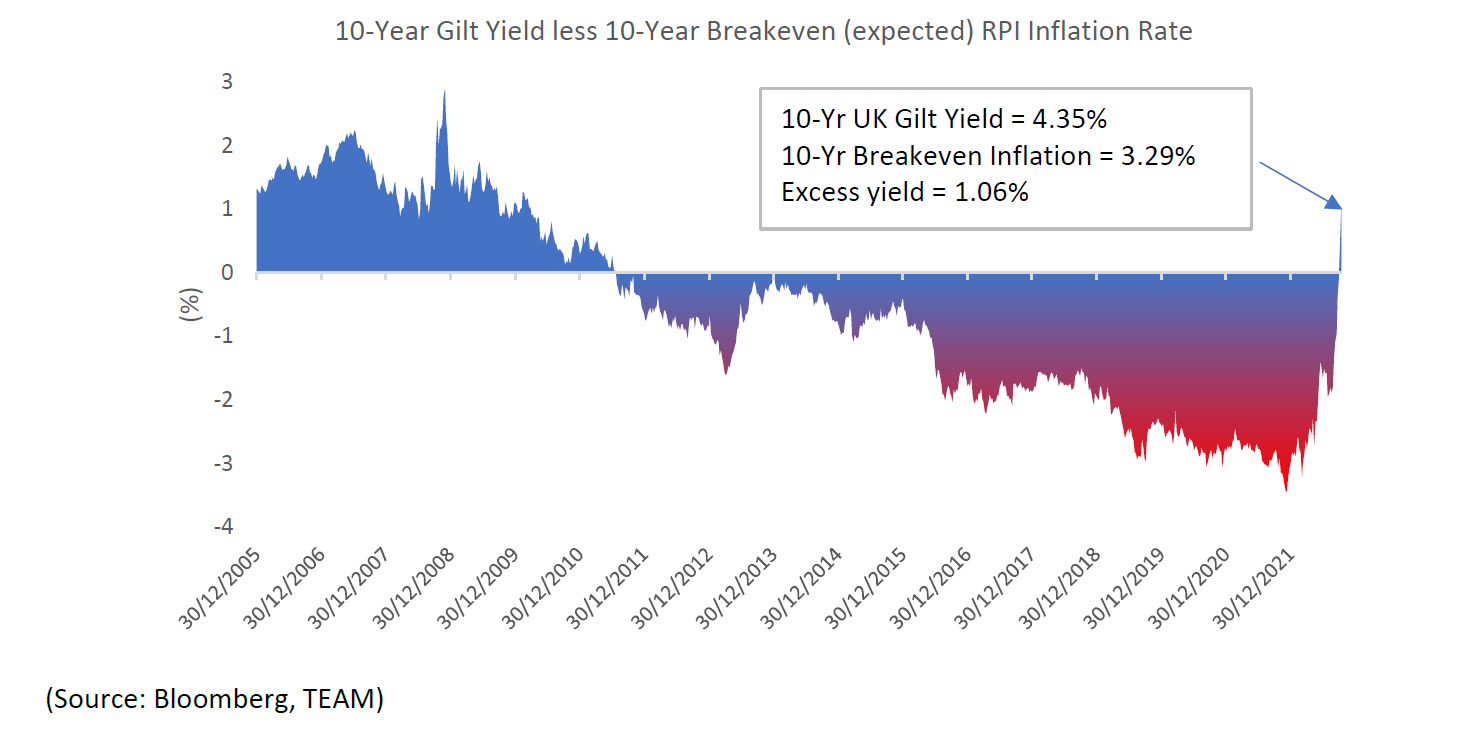

Furthermore, for the first time in more than a decade, UK 10-year government bonds also now provide a yield over and above expected future rates of inflation. Previously, during the era of ‘QE’ which artificially supressed yields, investors were buying UK government bonds at negative real yields:

The obvious question to ask ourselves is whether yields have moved up high enough to adequately compensate investors for the potential risk assumed. In essence, is this asset class now considered ‘cheap’? Whilst our call might appear a little early given current news flow, our sense is that we are now much closer to the end of this price adjustment than the beginning.

Looking across the risk spectrum, bonds have become far more attractive on a risk-to-reward basis from a mediumterm perspective. We have, in recent days, finally re-introduced a modest exposure to government and selective investment grade bonds across our range of multi asset strategies.

(Cover Image Source: YIFU WU)