Quarterly Investment Review & Outlook

Investment Review & Outlook 3rd Quarter 2022

Major Asset Class Returns for 3rd Quarter 2022, local currency terms

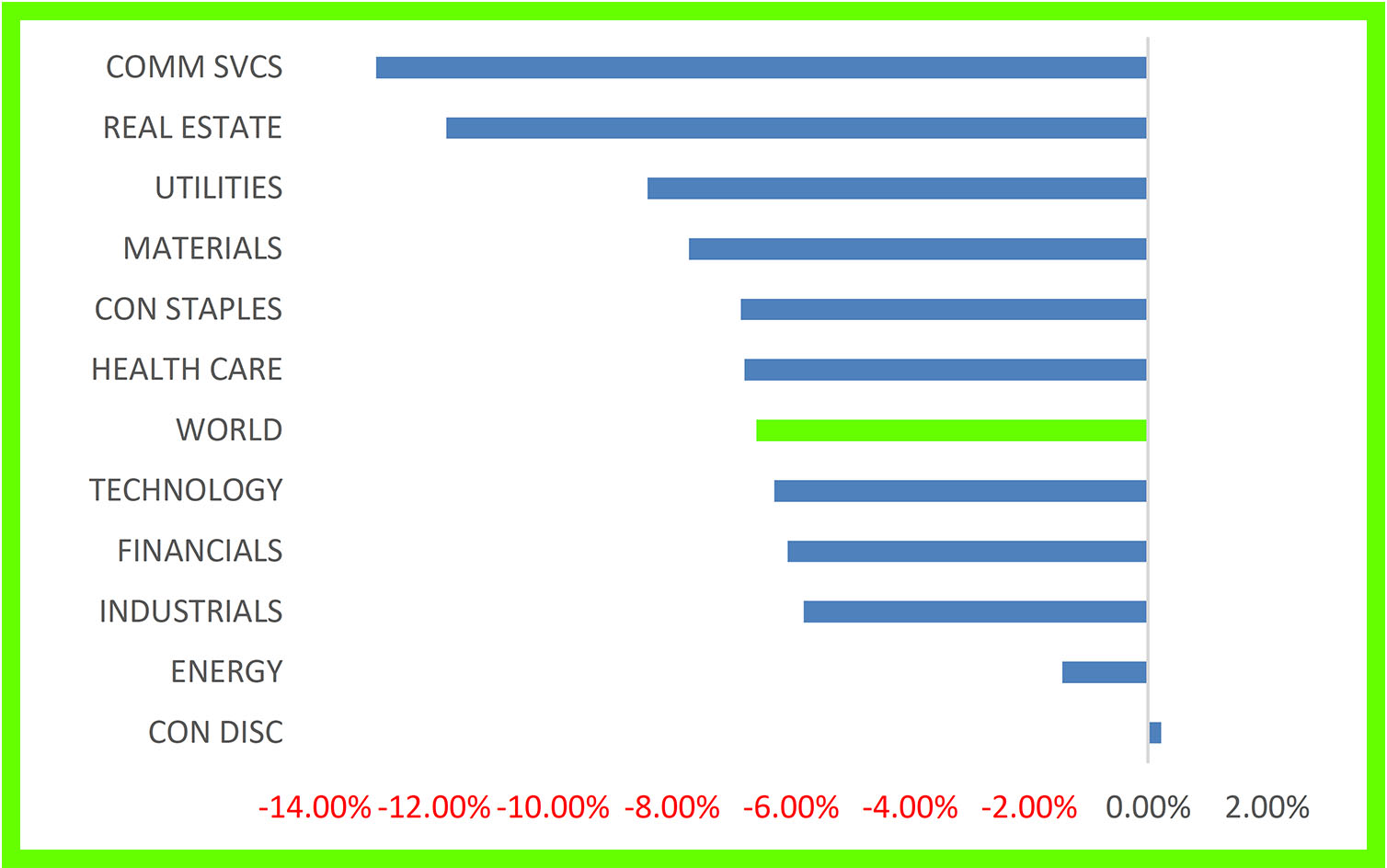

Global Equity Sector Returns for 3rd Quarter 2022, local currency terms.

(Source: Bloomberg)

Market Review: Weathering the Storm

Weather the storm: to deal with a difficult situation without being harmed or damaged too much (Merriam-Webster)

More drama and turbulence for investors to contend with as the third quarter, notably September, provided some of the most chaotic and historic asset price moves in living memory.

Investors continue to grapple with the growing prospect of a G7 recession amid stubbornly high inflation, the biggest downturn in China’s property market in three decades, and the ongoing hot war in Ukraine which presents the biggest risk of nuclear conflict since World War 2.

In addition, a regime shift is now firmly underway following more than two decades of ultra-easy monetary policy, as central banks seek to restore their institutional credibility and bottle the global inflation genie. The impact of these co-ordinated tightening efforts is now becoming clearer to see as markets start to experience withdrawal symptoms in the absence of quantitative easing.

The emergence of cracks in the global financial system during the period was best evidenced by the fallout in the UK government bond market and related ‘run’ on sterling in the wake of the new UK Chancellor’s mini budget, an announcement which even surprised highly placed colleagues within his own party.

The proposed £45 billion of tax cuts, without any offsetting reduction in public spending, was perceived by markets as ripping up the UK fiscal rule book. Against a backdrop of hiking efforts from the Bank of England to tame runaway inflation and a 300-year high current account deficit, Kwarteng’s profligate spending plan triggered one of the greatest bond market implosions in history.

To give some sense of the how poorly the announcement was received, the price moves in gilts dwarfed anything witnessed over the past thirty-five years, including events such as Britain’s ejection from the Exchange Rate Mechanism, 9/11, Brexit or the depths of the COVID pandemic:

(Source: Bank of England, FT)

The debacle prompted Former Treasury Secretary Larry Summers to declare that ‘the UK is behaving a bit like an emerging market turning itself into a submerging market’. Chancellor Kwarteng’s actions provided rich pickings for the media, culminating in the front-page splashes below1:

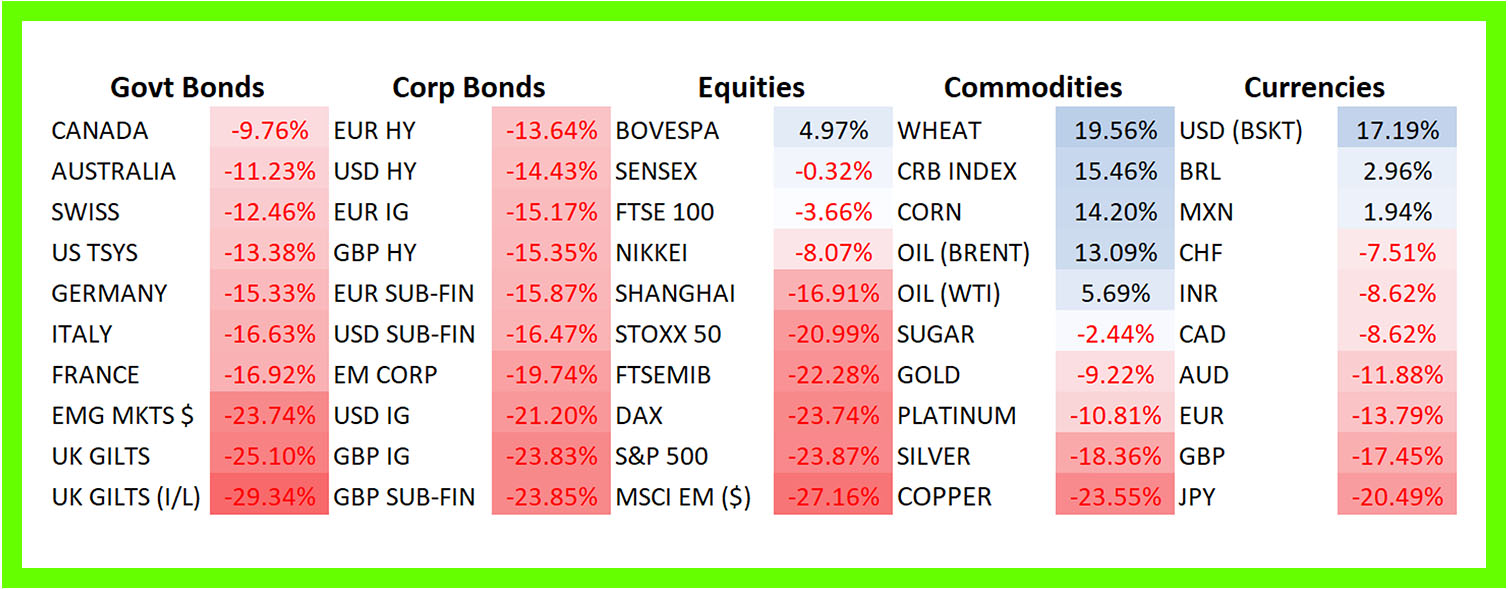

In short, 2022 remains an annus horribilis2 for many investors in terms of the sheer breadth of asset price declines witnessed so far. Whilst we recognise that periods of turbulence can be destabilising and worrying for our clients in the short-term, it is important to recognise that they are part and parcel of investment cycles.

Applying a slight variation to our usual quarterly format, below are several common questions we have been receiving from clients of late. We provide our responses, along with some insights into how TEAM has been navigating markets this year and how we are thinking about positioning portfolios in the months ahead.

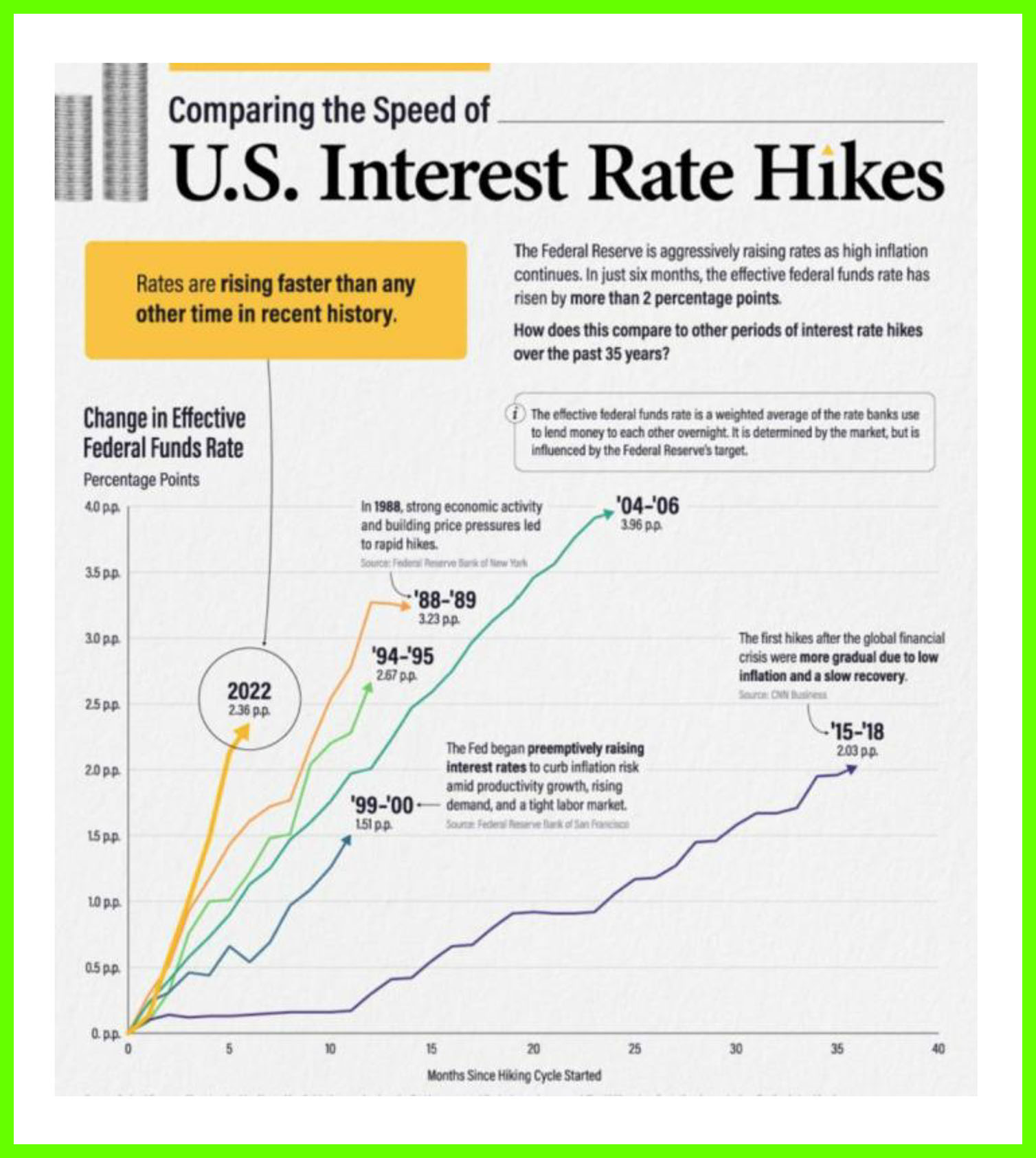

Q: Why has almost every asset class fallen this year?

A: In a nutshell, financial market conditions have changed enormously in a relatively short space of time, from loose monetary conditions and cheap credit to far tighter monetary conditions and more expensive credit. Shown below is the speed and magnitude of the current US interest rate hiking cycle relative to other periods of monetary tightening over the past 35 years:

(Source: Visual Capitalist)

A unique period of history in which inflation and interest rates stayed extremely low for an extended period, boosting asset prices, has been upended by several significant events.

These include, but are not limited to, post-pandemic globally high inflation, sharply rising interest rates, extensive lockdowns in China, the ongoing ‘hot’ war in Ukraine and the rise of a new right-wing political force in Italy. None were on many investors’ radars this time last year; a stark reminder of how quickly economic and geo-political circumstances can change and affect our savings and investments.

The result has been a swift and significant re-pricing of ‘risk’ across the spectrum. This has, in turn, negatively impacted the price of almost every asset class, from traditional havens such as government bonds and gold through to higher risk investments such as property, equities, and private equity:

Major Asset Class Returns for 2022 YTD, local currency terms

Global Equity Sector Returns for 2022 YTD, local currency terms.

(Source: Bloomberg)

From a historical perspective, many asset classes were richly valued entering this cycle, making the adjustment more acute.

Q: What have TEAM done to try and mitigate the effect of the market falls?

A: We are pleased to report that TEAM’s range of multi-asset strategies has managed to side-step a lot of the carnage that we have witnessed across financial markets so far in 2022.

This has been achieved through the strength of our investment process and the ability and courage of conviction to act differently from the crowd. We don’t possess a crystal ball in our investment toolbox and could not have foreseen events unfolding as they have, but we entered the year more cautiously positioned than twelve months prior as price trends in riskier assets were beginning to deteriorate sharply.

Throughout 2022 we have maintained low levels of equity risk, reduced exposure to conventional bonds (government or corporate) and held meaningful exposure to real assets, including energy and agricultural commodities. Absolute return strategies have also delivered on their mandate of providing positive annual returns regardless of market conditions.

Finally, dollar assets have been a mainstay for sterling and euro-based investors.

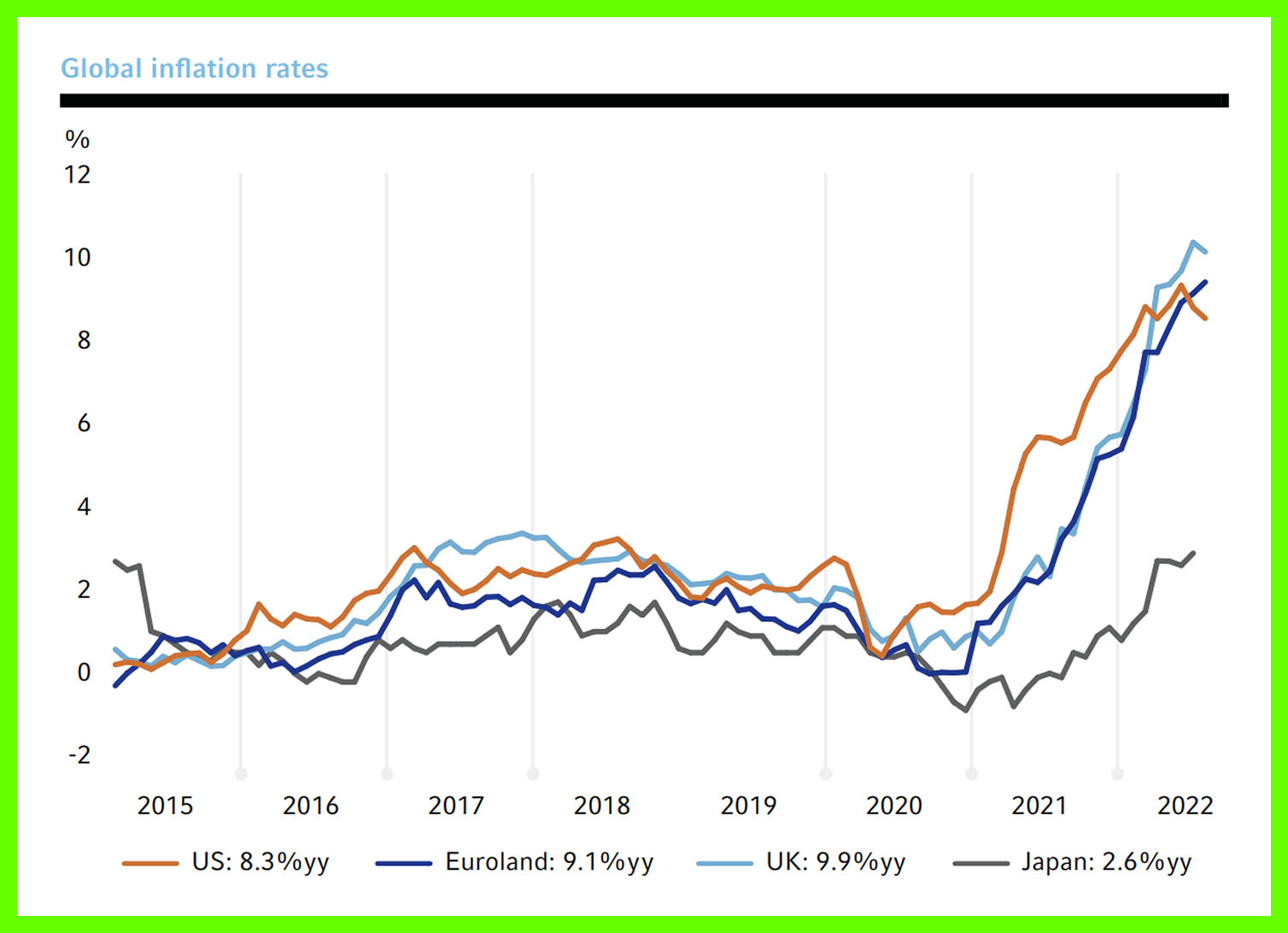

Q: How long will this period of high inflation last?

A: One of our core beliefs is that the financial market landscape over the next 25 years is highly unlikely to resemble the past 25 years. The COVID pandemic has bookended an extraordinary chapter of history (ultra-low, or negative interest rates, little to no inflation), and the seeds have been planted for a structurally higher inflationary cycle:

(Source: DataStream, Refinitiv)

Fast-moving consumer data that we monitor (airplane flights taken and ticket prices, house sale prices and rental yields, used and new vehicle sales, miles driven, fuel costs at the pump, shipping costs, food essentials), is beginning to move down from elevated levels, in some cases sharply in the case of America.

With that said, some of the stickier services inflation components (including wages, salaries and other worker compensation) remain stubbornly high. The key issue for central banks is whether inflation can return to close to a 2% to 2.5% range. This will require a slowdown in employment creation and for wage growth to cool from elevated levels (currently 7% annualised in the United States).

The monetary tightening policies actioned so far should ease labour demand over the coming months, but central banks will want definitive evidence that the jobs market is materially slowing before backing off, or pausing, from rate hikes. Helicopter handouts from UK and European governments, an escalation in the Russia/Ukraine conflict and a full China re-opening in the coming months all carry upside risks.

All told, our view is that investors should be prepared for a longer, higher global inflationary cycle, where the eventual plateau for the general level of price increases might be somewhere closer to 3-4% per annum, (with upside risk to 4-5% per annum) rather than the 1-2% we have experienced over the past two decades.

To prepare for this future, we have significantly expanded our asset allocation menu. The rationale is to give ourselves, and our clients, the ability to access several potential sources of return that should perform well in this new environment.

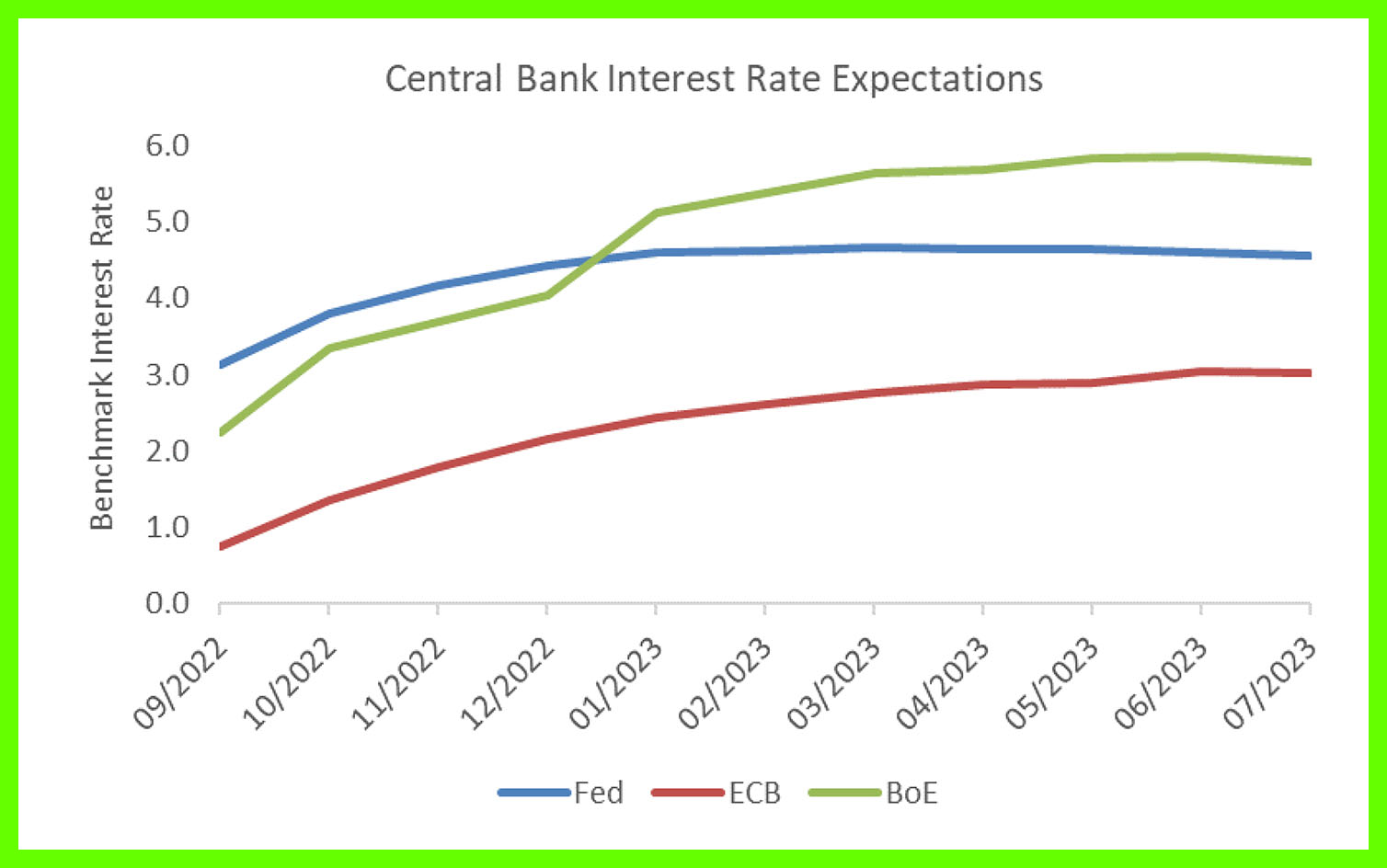

Q: How high will interest rates go?

A: It was not that long ago that 2%+ interest rates in the western world seemed highly unlikely, yet expectations have moved up very quickly of late, prompted by inflation readings and the actions of central banks, not to mention a certain UK tax cut announcement that was not well received!

The most useful metric in forecasting ‘terminal’ interest rates tends to be from the market itself, which reflects the collective knowledge and wisdom of all participants, many of whom are positioning significant capital and managing portfolio risk on the expected outcome. At the time of writing, the market expects central bank ‘peak benchmark interest rate’ levels of 3.04%, 5.85% and 4.66% in the Eurozone, UK and the US respectively:

(Source: Bloomberg, TEAM)

Central banks are still talking the talk (tough rhetoric) and walking the walk (policy action through rate rises), so we are likely to see continued hikes for the next several meetings, including the prospect of ‘jumbo’ (large) raises. Beyond that, the fast-moving data we described above should be feeding through to aggregate prices, and we would expect to see signs of stress in the employment and housing sectors.

A very important market development would be language or action from central banks that points to a ‘pause’ or even reversal of the existing policy. We will continue to monitor developments closely.

Q: What is the outlook for next year?

A: TEAM’s investment framework remains cautiously positioned as we stand here today. It is difficult to find strong positive trends across asset classes now, so the key to weathering the storm is to pursue genuine diversification through interesting, unrelated return streams, whilst ensuring we hold extremely liquid assets within our portfolios.

Our overarching objective during difficult market episodes such as the one we are currently experiencing is to focus on playing good defence and keep strategy drawdowns to an acceptable tolerance level. Like a prize fighter in the ring, a moderate degree of punishment can be absorbed, but it is the knock-out blow we want to avoid.

The reason is the asymmetrical nature of investing. Simply put, a 50% loss is not the opposite of a 50% gain! Illustrated in the table below are hypothetical portfolio drawdowns along with the percentage recovery required to get back to breakeven, and the length of time in years it would take the investor to recoup his or her investment at different growth rates:

(Source: TEAM)

Continued turbulence is likely in the short term on account of geopolitics (as an example, recent developments in the Russia/Ukraine conflict may trigger an escalation of war) and the US mid-term elections. In addition, the quarterly corporate earnings results season will indicate how companies are coping with this very testing environment. The prospect of earnings downgrades over the coming twelve months looms large.

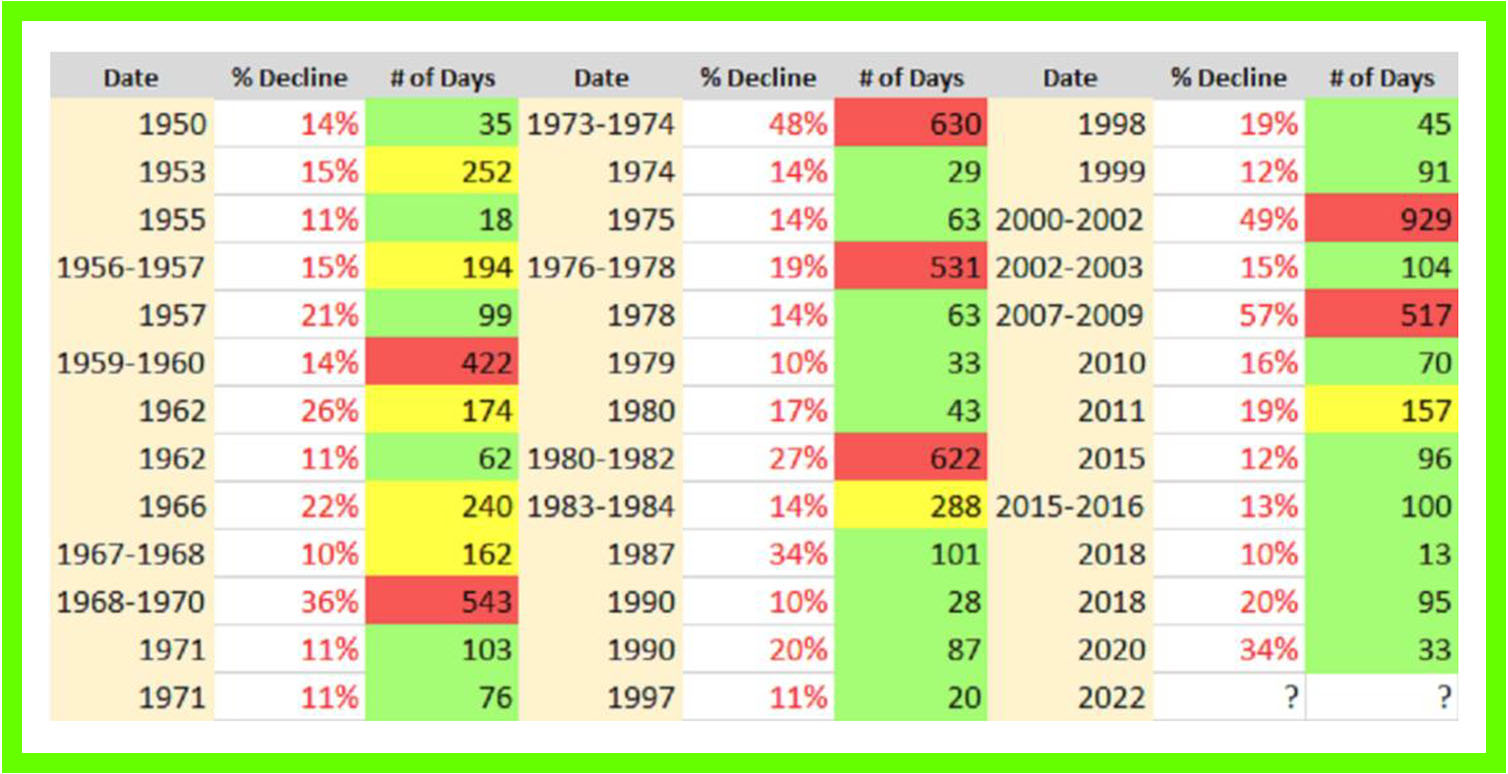

With that said, we are now firmly into stock market correction territory. In this regard, the following research from Ed Yardeni can act as a useful guide. It shows the number of -10% (+) corrections in the bellwether US S&P large-cap index. Since 1950, there have been 39, or an average of 1 correction every 1.87 years:

The table illustrates the peak-to-trough decline for all corrections, as well as how many calendar days it took for those declines to find their ultimate ‘bottoms’.

What is particularly noteworthy is the length of most corrections. As you will observe from the colour coding above, only 7 of the previous 38 corrections (we don’t know precisely how long the current correction will last) since the beginning of 1950 have taken more than a year to find their bottom.

The S&P Index spent 7,168 days ‘correcting’ from peak to trough in the 72-year period from Jan 1, 1950, to Dec 31, 2021. This works out to an average correction length of 189 days, or approximately 6 months. We are now beyond the average cycle correction, which tells us the odds are strong that we are closer to end than the beginning of this painful reset in asset prices.

Conclusion

In closing, when stocks, and broader assets, experience a correction, investors should ‘avoid overcorrecting’. Impulsive action driven by emotional responses including fear, desperation, panic and despondency, typically serve to crystalise portfolio losses and forfeit future gains. Calm, rational thinking is essential.

As the axiom goes, ‘It is always darkest before dawn’. Market corrections of this nature, whilst uncomfortable, are welcome developments. They serve to cleanse speculative excesses and greed from the system, whilst sowing the seeds for the next bull market. It is vitally important to be invested when that time comes.

TEAM portfolios are managed by a dedicated and experienced group of investment professionals with a strong track record of navigating market cycles. We have the perspective to understand that markets are dynamic, and that how we invest should be equally responsive.