Running Hot

Hot on the heels of this week’s ‘surprise’ inflation prints in France, Spain, and Germany, aggregate Euro-area inflation remains elevated at +8.5%.

The drivers were broad-based, with food, alcohol & tobacco, and energy prices still (un)comfortably above double-digit levels:

Most worryingly for policymakers, core inflation (ex food and energy) rose to a record +5.6% from January.

Markets are looking past the next ECB meeting in a fortnight’s time, where a 50-basis point interest rate hike is all but guaranteed, and towards the prospect of a higher-for-longer rate scenario. In assessing the potential outlook for inflation for G20 economies, we came across the following study last summer.

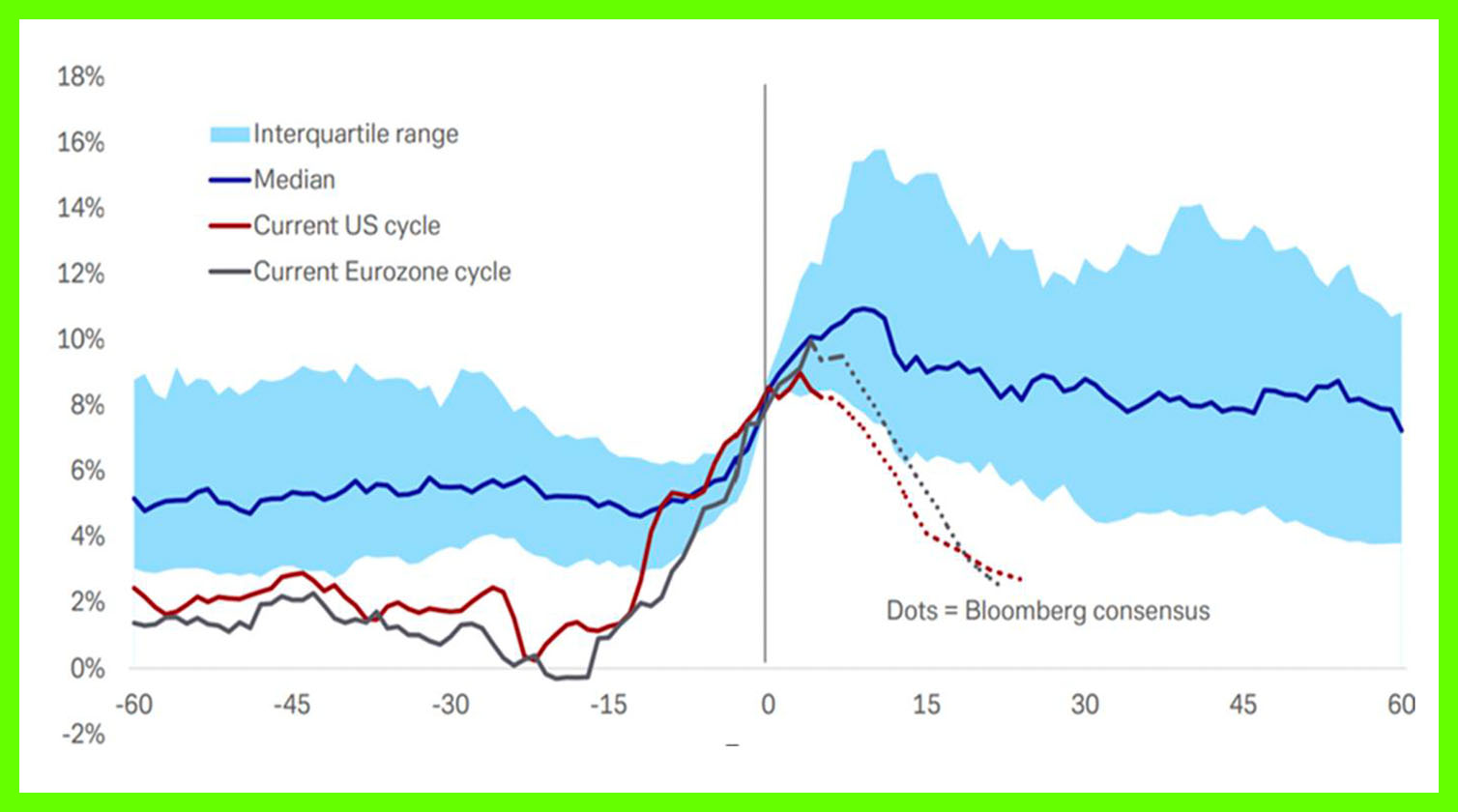

The research team at Deutsche Bank looked at what normally transpires when inflation in an economy hits 8%. The study utilised 50 developed and developing market countries, comprising 126 unique observations, and covering over 50 years of data (post the 1970 break with Bretton Woods):

Their conclusion was that contrary to current consensus expectations at the time, which were amongst the most optimistic over this period, it would be unusual (caveat: not impossible) to see inflation fall back quickly to previous levels.

This week’s inflation prints lend credence to that view, suggesting that the glidepath back to ‘normalised levels’ is likely to be bumpy rather than smooth. Expect more thermals in 2023.