Out of the Abyss: Where Next?

Two months is a long time in financial markets. It seems barely conceivable that only weeks ago Wall Street was setting a plethora of unenviable records for the first half of the calendar year, the worst in performance terms since 1970.

Soaring global inflation was the chief protagonist, wrongfooting central banks whose forecasts of a brief ‘transitory’ episode have been exposed as almost comically inaccurate.

Meanwhile, China’s zero-tolerance covid approach led to repeated stop-start lockdowns of her major cities, crippling global supply chains that have become intertwined with just-in-time delivery of goods and services. Finally, Russia’s invasion of Ukraine plunged Europe into the greatest conflict since the end of World War Two, fanning extreme price moves up (and down) across commodity and energy markets.

Domino Effect

Against this backdrop, risk appetite amongst investors evaporated, triggering a domino effect of sharp declines across capital markets, from cryptocurrencies and profitless technology companies to sovereign government bonds and gold, traditionally considered haven investments during times of market dislocation and stress.

As we entered July, there seemed little reason for cheer considering economic releases that pointed to further evidence of a slowing world economy. Inflation records continued to be set in America, the UK and the Eurozone, whilst flash consumer and business survey indicators showed faster-moving barometers of activity losing momentum.

In addition, measures of investor sentiment from several credible sources (including Bank of America Merrill Lynch) were at historically depressed levels, fund managers controlling hundreds of billions of dollars were holding very high levels of cash, and chorus chants of a global recession were growing increasingly louder by the day.

Rule Number Nine

With seemingly nowhere to go but lower still, markets duly embraced investor pioneer Bob Farrell’s Rule Number Nine, ‘when all the experts and forecasts agree – something else is going to happen.’ Much like a spring at full tension, the backdrop and, by extension, investor sentiment, only had to move from awful to slightly-less-awful to trigger a snap back in the opposite direction.

The move was led by credit markets, and quickly extended to equity markets, that began repricing assets to reflect a potential policy pivot by the US Federal Reserve, effectively calling Chairman Powell out that interest rates would continue to be raised aggressively through 2023 and beyond.

Fed Retreat

In a nutshell, the prospect of an impending and deep global recession, ‘peak inflation’ readings that should see price pressures ease (albeit from very elevated levels) into year-end and abating global supply chain issues will likely force the Fed to reflect and at least pause, or retreat entirely, from its prevailing position.

Given the magnitude of the sharp price declines witnessed in 1H 2022, the return of risk appetite at a seasonally quiet time of year, and with many participants positioned very defensively, created the conditions for a spectacular rally, led by heavily beaten-up growth stocks.

At the time of writing, the bellwether large cap S&P 500 Index, the tech-laden Nasdaq Composite Index and the Russell 2000 index (comprising mid and small-cap US stocks) have risen +18%, +23% and +22% respectively from their June 16th lows, whilst the High Yield Bond Index is currently +7%.

Plagued by an array of domestic economic and political issues, the Emerging Markets indices (led by China that is undergoing a severe, covid policy-induced weakening of growth) and the UK FTSE Index (index constituents are more heavily skewed to sectors such as materials, industrials and financials) have rallied, albeit far more modestly, by +5% and +3% respectively.

Simple Not Easy

Warren Buffett observed that ‘investing is simple, but not easy’. During June, with financial asset prices falling precipitously and investors extrapolating the recent past to the road ahead, an urge amongst investors to act impulsively and cut risk, and/or liquidate all investments, will have been considerable.

The problem in many cases is that market stress and dislocation can suddenly shorten time horizons. In taking action to relive the pain of accumulating further paper losses, the investor has diverged from the original plan of protecting and growing wealth over the long-term (often 10 years or more). This most recent episode serves as a good example.

Our Approach

At TEAM Asset Management, our multi-asset investment framework has been designed to keep us in harmony with strong asset class trends whilst seeking out appropriate diversification through market cycles. A diverse allocation menu and the flexibility to be nimble and move tactically to take advantage of shortterm opportunities underpins our approach.

Our preference in adopting an objective, data-driven approach to allocating capital and managing risk rests on two key principles. First, mitigating (not eliminating) the plethora of behavioural and cognitive biases that can harm optimal decision-making outcomes. Second, endeavouring to avoid the big loss.

(Not) Forecasting

Appreciating the ethereal pleasure and comfort that the exercise can bring, our preference is to shy away from forecasting the future, particularly during volatile and uncertain periods. Any form of forecasting, particularly regarding the economy or the direction of security prices, inherently introduces several biases into the decision-making process. These can include, but are not limited to:

- Confirmation bias: the natural human tendency to seek out, or emphasise, information that confirms and existing view or belief

- Information bias: the tendency to incorporate information even if irrelevant in understanding a problem or issue

- Hindsight bias: the tendency to see beneficial past events as predictable and bad events as unpredictable, rather than blame errors of judgement

(Avoiding) The Big Loss

Associated with the above is the concept of loss aversion, which is the tendency for people (individually and collectively as a group) to strongly prefer avoiding losses than generating gains.

Introduced to the investment nomenclature by behavioural finance gurus Daniel Kahneman and Amos Tversky, the premise is that investors refuse to sell loss-making investments in the hope of recapturing their initial capital outlay (and more). To recap, the percentage gain required to get back to breakeven from a - 40%, -60% and -90% drawdown is +67%, +150% and +900% respectively.

TEAM’s investment framework pays careful attention to price and price structure (the movement of price across timeframes). Focusing on price trends across assets keeps us on the right side of the market, in addition to acting as a natural risk control mechanism.

We employ a proprietary trend breadth measure as a key input into our framework, that is designed to scale in, and out, of positions in a timely fashion as price action materially improves or deteriorates. The premise is to accept when we may be wrong about the prospects of an asset, or security, and accept an initial loss, rather than holding out on hopes of a turnaround. Mr. Market is always right.

Portfolio Positioning

We entered 2022 adopting a cautious tone for our core multi asset range. Blockbuster returns had been recorded for risk assets in both 2020 and 2021, and US mid-term election years have historically created difficult market conditions, particularly in the first half of the year.

Most importantly, our investment framework had begun dialling back risk, primarily from our equity sleeve, in favour of playing ‘good defence’ via alternative income streams (securities demonstrating traditional bondlike characteristics of moderately low volatility and a sustainable, attractive yield), complementary absolute return strategies, and healthy allocations to gold and commodities.

The net effect was to position equity allocations at historically low levels, and hold zero exposure to conventional bonds, either sovereign or corporate. This stance was held (with modest tweaks) through most of the first half of this year.

However, on account of a material improvement in our internal models, we began to steadily build the risk allocation to higher growth areas across TEAM’s multi-asset range in June and again in July to ‘modestly above market cycle average’ for the first time in 2022.

Key beneficiaries included large cap equities, global technology equities and global small cap equities, in addition to US infrastructure equities as direct beneficiaries of a desperately needed national upgrade. The principal source of funds was our real asset sleeve, as we substantially reduced commodities, gold, and volatility.

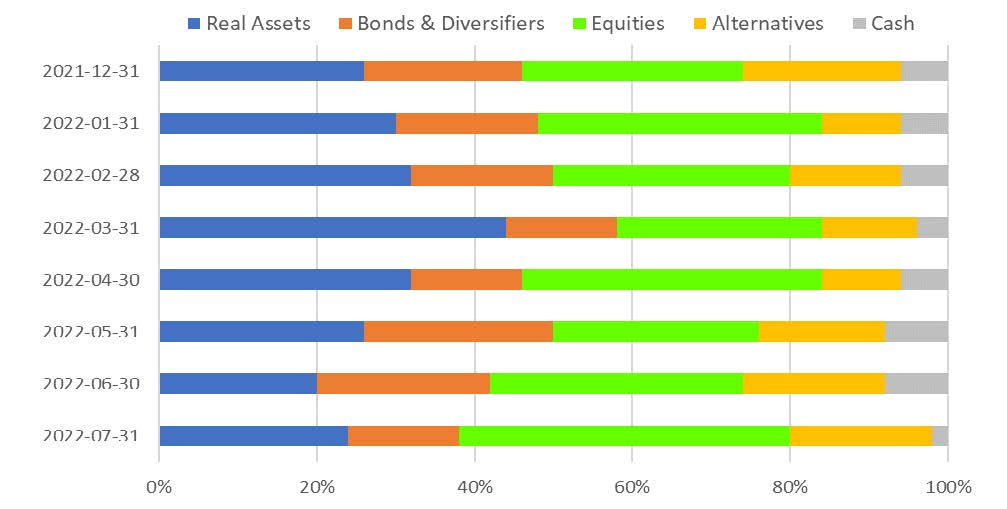

The TEAM Multi Asset Balanced portfolio asset allocation during 2022 is illustrated below:

What Next?

It is fair to say that markets have delivered a ‘robust’ stress-test so far in 2022, both in terms of financial and emotional turmoil and impact. We are pleased to report that TEAM’s core range of multi asset portfolios sidestepped much of the carnage witnessed in the first two quarters and participated meaningfully in the risk rally since the June 16th bottom.

As it stands today, prices have moved a very long way in a short space of time. Whilst the magnitude and breadth of the rally have impressed, a pause for breath, or something more acute, would not be a surprise. A multitude of economic and geopolitical issues continue to plague the global economy, and we would be remiss to confidently predict the worst is behind us.

Two areas of the market we are paying close attention to are crypto currencies and bond yields. The former as a yardstick for broad risk appetite in this cycle, the latter for signs that central banks will have to keep the pedal to the metal in maintaining aggressive rate hikes. It is worth noting that yields are already sharply higher than where they began August, and recent hot inflation data is undermining the ‘peak inflation’ bull case.

Rather than blindly chase pockets of risk, our investment framework continues to stress diversification, retaining healthy exposure to several assets that should provide ballast were fragile conditions to re-emerge anytime soon.

As always, our models will continue to act and serve as our investment compass. If the evidence changes, so shall our view. We anticipate taking advantage of further opportunities for our clients over the coming quarters.

(Cover Image Source: Bend Project)