The pound plunges to a record low

We have become accustomed to some dramatic market moves throughout this year but some of last week’s events were chaotic and historic, not least the fallout in the UK’s government bonds and currency in the wake of the new chancellor’s mini-budget.

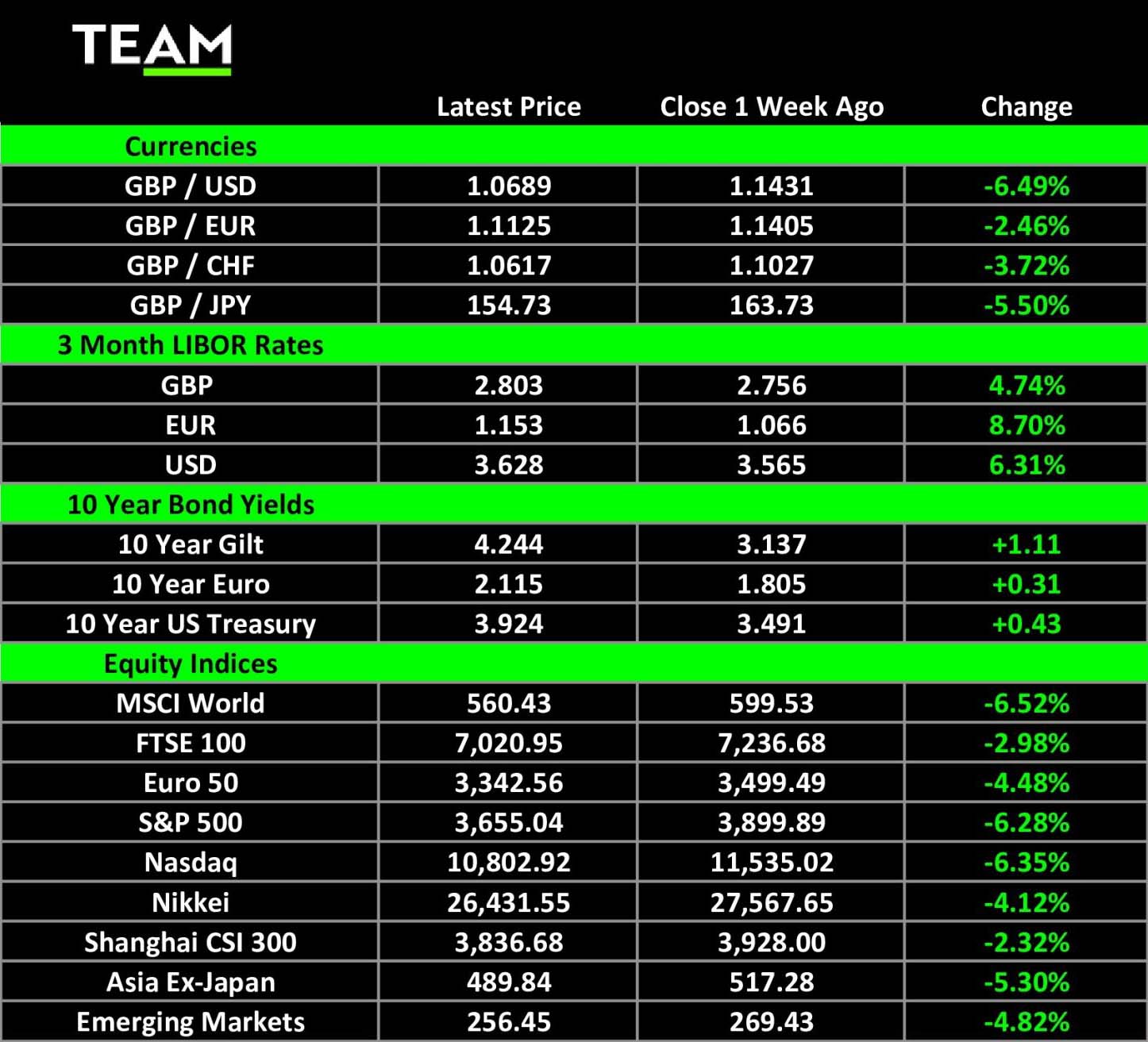

Stock markets were also edge for most of the week as central banks around the world raised interest rates in a bid to curb inflation and the blue-chip S&P 500 index fell 6.3%. FTSE 100 companies, which generate more than 70% of earnings overseas, saw some benefit from the weaker pound and the index fell just 3.0%.

The focus leading into the week was the US Federal Reserve’s interest rate decision on Wednesday with investors looking for clues on how far, and for how long, rates will rise. The third successive 0.75% rate hike was already priced in but those hoping for a softer stance on future policy were left disappointed as Chair Jay Powell re-iterated the Fed “will keep at it” until it has got to grips with inflation, even if it means pushing the economy into recession.

Markets interpreted that to mean the most aggressive interest rate hiking cycle since the early 1980s will continue well into next year. The Fed were not alone and central banks in Norway, South Africa, Sweden, Switzerland and the UK all moved to tighten monetary policy. Notably, the Swiss National Bank ended a near 8-year period of negative interest rates.

On Thursday, the Bank of England hiked its benchmark rate by 0.5% to 2.25%, although there were differences of opinion amongst nine members of the Monetary Policy Committee. Three members voted for a 0.75% increase whilst the committee’s newest member Swati Dhingra favoured a more modest increase, arguing that there are clear signs economic activity is weakening.

The pound edged lower ahead of the BoE meeting, reflecting both the more assertive moves by other central banks and general risk aversion. However, the new chancellor’s mini-budget on Friday morning triggered a much more severe reaction across markets as investors gave it a damning verdict. Kwasi Kwarteng can only hope voters will be more kind.

Chief concerns amongst investors’ concerns are the resulting surge in government borrowing and upwards inflationary pressures. Tax cuts, and the reversal of the national insurance increase, will hit fiscal revenues at a time government spending is also on the rise, most notably the cap on household energy bills for the next two years which is expected to cost up to £150 billion.

The subsequent moves in UK government bonds and the pound were historic. Government bond yields, which move inversely to prices, shot up and the pound fell 3.6% versus the dollar on Friday to a 37-year low. The sell-off extended early on Monday morning when the pound hit an all-time low of 1.0350 versus the dollar, before recovering to 1.0689. Had the intraday fall held, it would have eclipsed Black Wednesday in 1992 as the pound’s second worst daily fall versus the dollar in four decades.

A weaker currency and £45 billion of tax cuts are inflationary and money markets now expect UK interest rates to climb to 6% by next summer. There was some speculation on Monday that the Bank of England push through an emergency interest rate hike to stem the rout but thus far it has resisted the pressure to act ahead of the next scheduled monetary policy meeting on 3 November.

The pound is not the only currency suffering. The Japanese yen fell to its lowest level versus the dollar in 24 years, prompting the Bank of Japan to intervene in the currency markets for the first time since then by selling dollars. The yen immediately strengthened from 146 to 140 versus the dollar but the initial jolt was short-lived and it has since moved back above 144. Commodities, which are closely linked to the health of the global economy, also lost ground last week.

Brent crude fell back to $84 a barrel, its lowest level since January, on expectations the strong dollar and recession will curtail fuel demand. China, the world’s largest energy consumer, also continues to pursue its strict zero-Covid policy through lockdowns which has pushed demand down further.