Mexican Standoff

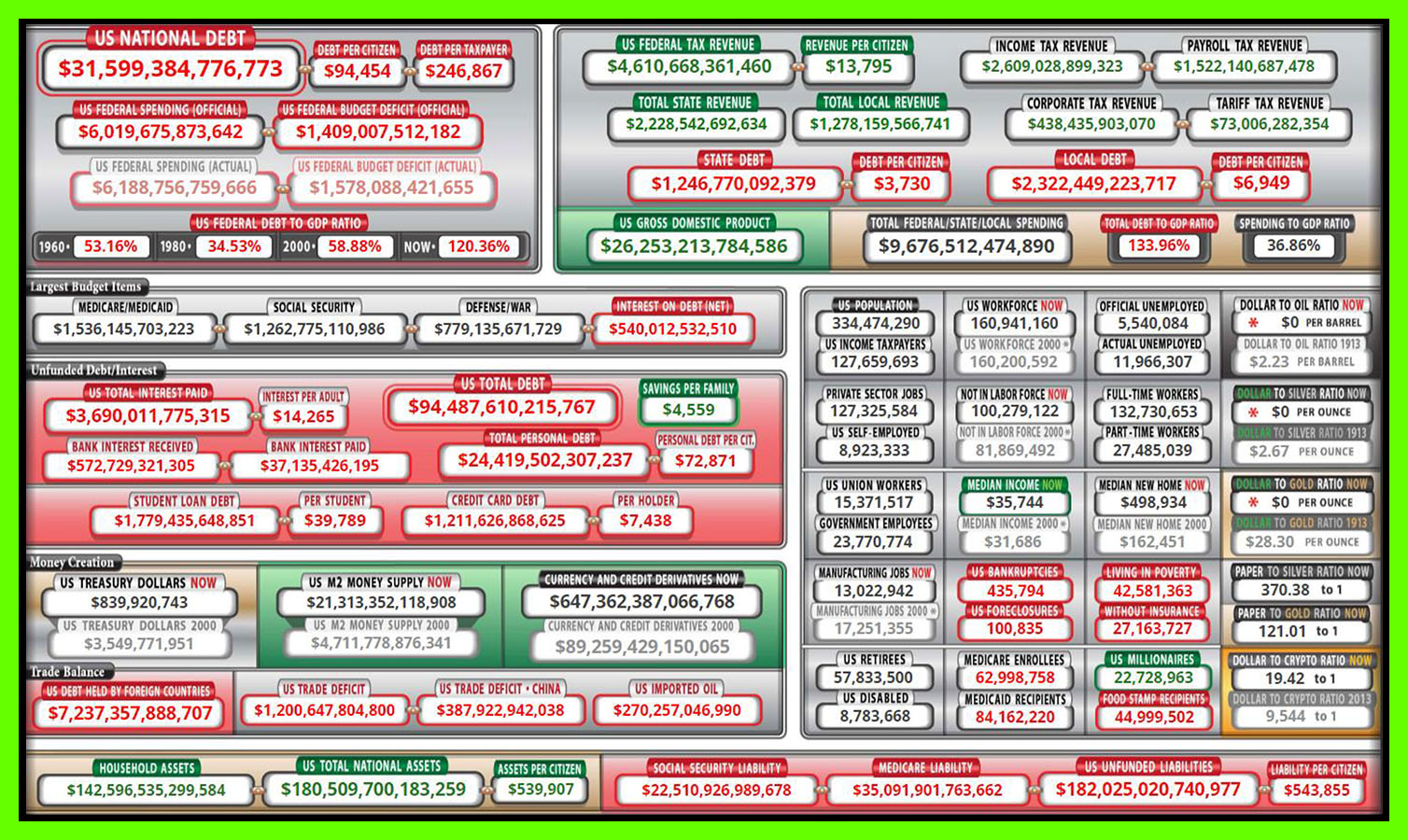

$31.6 Trillion and counting. This figure represents the current level of US National Debt, shown below in the top LHS of this visual (source: www.usdebtclock.org):

To recap, the debt limit, often referred to as the ‘debt ceiling’ (a term we are going to be hearing a lot more of in the coming months), is the maximum amount of debt that the Department of the Treasury can issue to the public or to other federal agencies.

On December 16, 2021, lawmakers raised the US debt limit by $2.25 trillion to a total of $31.4 trillion. That limit was reached on January 19, 2023, triggering an announcement by the Treasury of a ‘debt issuance suspension period’, during which it can take ‘extraordinary measures’ to borrow additional funds without breaching the debt ceiling.

Put another way, the Treasury has engaged in accounting gymnastics to remain a going concern and avoid a devastating federal payments default that would have far-reaching repercussions for the global economy and financial markets.

The problem: these extraordinary measures are a temporary rather than structural fix. Timing their lapse is close to impossible given the complexities and variables involved, but most credible estimates are pointing to sometime in the 3rd quarter of 2023. That feels close.

A delicate balancing act will be required to achieve an outcome that manages to placate both sides: determined, hard-line, Republicans insisting on spending cuts in return for lifting the debt ceiling, and Democrats that feel an erratic and unpredictable GOP is engaged in a game of Russian roulette with the nation’s creditworthiness.

Prevailing sentiment and positioning around this issue suggests a high degree of complacency. Essentially, the broad view is that the consequences of not renegotiating a deal would be too great to bear, and therefore a compromise is inevitable.

However, the complex dynamics and acrimony underpinning this round of negotiations may result in a bumpier road to the finish line. In Rumsfeld speak, this ongoing issue falls firmly into the list of ‘known unknowns’ in 2023 and represents a wildcard with the ability to significantly destabilise markets this year.