The Law of small numbers, GDP & happiness

The Law of Small numbers is the incorrect belief that small samples resemble the population of data they are drawn from.

It is also “The Gambler’s Fallacy” or “Monte Carlo fallacy”. The mathematical study of games of chance and gambling only started to develop in the 17th century (Fermat and Pascal). This was the beginnings or foundations of modern theories of probability and statistics.

Let’s explain. One of the simplest mathematical simulations is tossing a coin.

Theoretically, each time you toss, the outcome, heads or tails, is 50/50. Now what about the number of times you toss it? Under identical conditions this too should be 50/50. No! Only after 100 tosses do you get close to 50/50 (Borel’s Law or Law of Large Numbers).

The point is that random events only converge to their average in the long run. In the short run, anything can happen.

So, think about heads (H) and tails (T). We have the following run; H H H T H H H

What’s next? The temptation is to go T because T looks like it has a higher chance, but statistically it is still 50/50. We have somehow made T “independent” yet it is still 50/50. We bet on T. “Gamblers Fallacy”.

We also need to consider mathematical bias or hidden bias. The tendency for a statistic to overestimate or underestimate.

Go back to the coin. We toss the coin 4 times we expect 2 H and 2 T. We get 4 T’s. So, we toss again 4 times, T T T H. Clearly after 3 T’s we can’t get 2 H. Our expectation and the empirical probability changes because our “unit” of measurement is not a single toss but independent short sequences of tosses (4). Thus, no matter how many runs of 4 tosses we run into this bias. Somehow, we need to string together the outcomes (H or T). This takes you into all manner of statistical theory including Bayesian and Binomial distribution.

My point is that we tend to update our expectations based on a limited number of observations. We can fix this by observing for longer. But we are very limited in terms of attention span and memory. Even knowing this we can often be misled into an incorrect line of thinking. “Gamblers Fallacy”.

Daniel Kahneman is a winner of the Nobel Prize in Economics. His book, “Thinking, Fast and” is a must read. In it he covers this “Law of Small Numbers” and the “Bias of Confidence over Doubt”. His conclusions resonate; insufficient attention is paid to sample size (too small), the make-up of samples or populations are erroneously based on intuition and judgement (normally flawed) built up from historical observations (relevance) and we exaggerate the consistency and coherence of what we see. This exaggeration is closely related to “the halo” effect, the cognitive bias towards a positive impression.

Gross Domestic Product or GDP conforms to the “Law of Small Numbers”, the “Gamblers Fallacy”.

GDP is the total monetary value of all the finished goods and services produced within a country’s borders in a specific time period, typically annually. This includes all private and public consumption, government spending, investments, stock in hand (inventory), construction and the balance of trade (exports plus, imports minus). This gives Nominal GDP. Real GDP takes into account inflation or deflation.

It is used as a scorecard or comprehensive measure of a country’s or the world’s economic health. It is the "world's most powerful statistical indicator of national development and progress" (Lepenies, “The Power of a Single Number: A Political History of GDP” 2016). It is often used as a measure of a country/world standard of living, GDP per Population

The Stock Markets of the world are fixated with this small number. Individual country GDP and Global GDP. Investors worship at the altar of GDP. The assumption being that GDP growth and Stock Market returns are broadly matched. The underlying economy of a country or the world translates into company profits. Well that’s not happening currently and hasn’t for some time. For example, Microsoft’s profits are very different to US GDP or the world’s GDP. What about, Amazon, L’Oréal, Shopify, Google (Alphabet)? We have seen a “dislocation”?

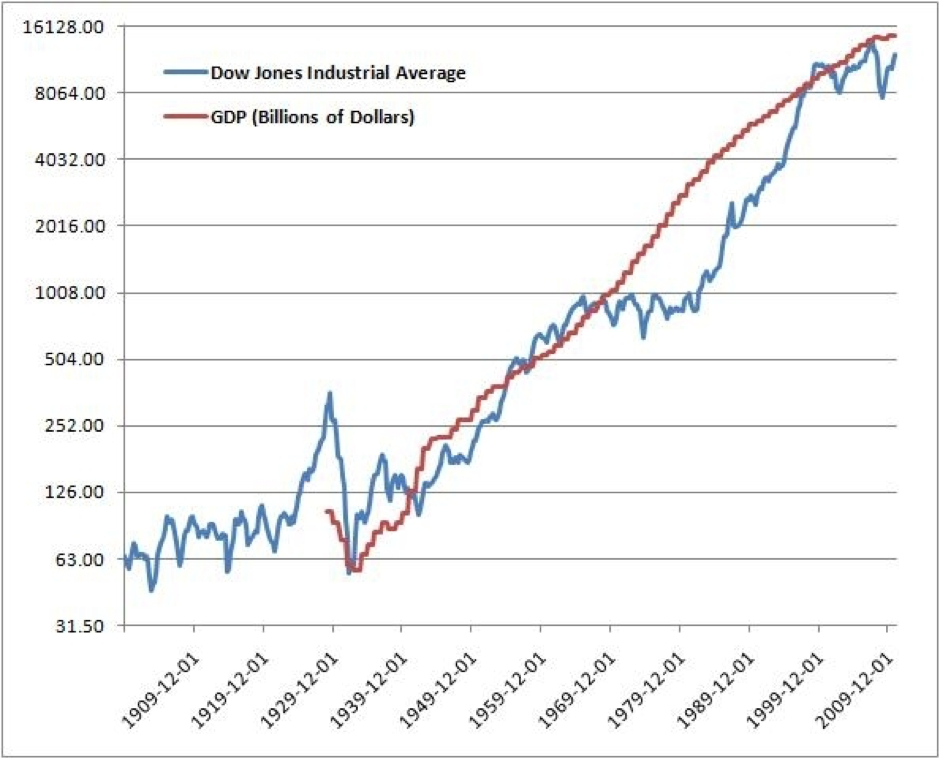

The above Seeking Alpha chart was compiled with Federal Reserve Economic Data, and shows the nominal performance of the Dow Jones Industrial Average and U.S. Gross Domestic Product since 1900 and 1929 respectively. At first sight, both the Dow and GDP seem to move in tandem. Between January 1933 and January 2011, the Dow generated a cumulative return of 7.0%, with U.S. GDP growing at 7.3%.

The above Seeking Alpha chart was compiled with Federal Reserve Economic Data, and shows the nominal performance of the Dow Jones Industrial Average and U.S. Gross Domestic Product since 1900 and 1929 respectively. At first sight, both the Dow and GDP seem to move in tandem. Between January 1933 and January 2011, the Dow generated a cumulative return of 7.0%, with U.S. GDP growing at 7.3%.

Despite two world wars, and the odd pandemic that killed towards 50 millions worldwide and 675,000 at home, not the odd 275,000 (Covid-19 at today’s count) the Dow still began the 20th Century at 68.13 and finished at 11497.12 – seemingly a triumph for capitalism and market forces.

There have been significant periods where the Dow and GDP have parted company. The 16 years between 1966 and 1982 saw the Dow fall 18% and yet the economy grew by 450%. Conversely, the 18 years to 2000 the Dow rose circa 1300% whilst GDP only grew 280%.

This again demonstrates the “Law of Small Numbers”. Today, commentators, experts, some economists, and investment managers alike are warning of the unsustainability of the apparent current GDP to Stock Market “dislocation”! They may be right, but think on this; the crash precipitated by the Great Depression lasted 2 years and then for 10 years markedly out performed US GDP. In 1929 US GDP was $1.109 trillion. 1939 was $1.222 trillion. So plus, just over 10%. By July 1932, the depths of the Depression, the Dow was crawling at 41.22. It ended 1939 at 150.24. By the way US National debt jumped 150% during those 10 years, hitting a then record 44% of GDP in 1934. Today it is 106% and rising. The all time high was 119% in 1946.

However, is this debt to GDP number a true reflection of debt to total wealth of the US? I would argue not and I cover that later. But for example, what is the real value of Silicon Valley for example?

Politicians, Policy Makers, Opposition Parties, Commentators, the Media, all anchor themselves to GDP. Governments use GDP as a political and societal tool. If GDP per capita is increasing then the whole population is benefiting. GDP is the key tool used by policy makers, governments and investors in decision making.

Politicians, etc., manipulate and misuse GDP. National debt is no longer important, today it is about Debt to GDP ratio. Increased government spending enhances GDP but is it increasing a country’s true wealth? Are its people better off? We still broadly conform to good old Pareto, who in 1906 observed that 80% of the wealth in Italy belonged to about 20% of the population.

Want to increase GDP? Make it look like you are growing faster? Engineer the inflation number down. For example, the UK where we all know that the inflation in certain essential items such as food is far higher than the published Consumer Price Index. How about manage your currency down thereby overstating you output? What about inventories or stock even if these have not been sold. All these and more are known as the “Pollyanna Creep” (John Williams, 2004). Pollyanna is the girl in the same titled novel. She plays the “glad game”, trying to find something to be glad about in every situation. Now a psychological principle which portrays the positive bias people have when thinking of the past.

By the way, opposition party politicians can reverse too, displaying the incompetence of the ruling party or politician.

GDP considerations stop long term policy and investment decisions. The issue is the constant revisions to GDP means it is impossible for a government to forecast the downturns and changes in GDP. Infrastructure is a very long run investment initiative. Want to boost demand and consequently GDP, cut taxes not spend on infrastructure (see UK).

GDP tells us zero about sustainability. It does not measure the degradation of a country’s or the world’s natural, human, physical or social capital. It does not recognize the costs of inequality.

GDP does not measure or account for inherent and unsustainable economic activity financed by debt.

This obsession with GDP has manifested itself in the destruction of natural resources and eco systems both human and natural.

In many ways the GDP number is like the number 42 in Douglas Adams “Hitchhiker’s Guide to the Galaxy”. 42 is the number calculated by the supercomputer “Deep Thought” over a period of 7.5 million years. The problem is no one knows what the question is.

GDP is an outdated conceptual number with its origins from an out-date world, the 17th century. Even then it was used for manipulative purposes.

William Petty (1623 – 1687) was tasked by Oliver Cromwell to develop an efficient way to survey and value land, initially in Ireland. This would then allow Cromwell to tax and confiscate and give to his loyal senior soldiers. Later published in “Verbum Sapienti” (1662). Tax contributions were of prime concern in the 17th century, for the wise country would not spend above its revenues. England was engaged in war with Holland, and Petty sought to establish the principles of taxation and public expenditure, to which the Crown could then adhere, when deciding how to raise money for the war. This theme developed.

Between 1760 and 1820 Britain was at war with France for 36 years. It coincided with the Industrial Revolution and the measure of that growth was used to tax for the war effort. Tax became 20% of National Income.

Fast forward to the aftermath of the Second World War. Now emerges the grand master of GDP doctrine, Simon Kuznets. The grandfather of quantitative economics and fuel for Keynesianism, broadly the economic theory that government spending and lower taxes stimulated demand and pulled an economy out of recession/depression. Keynes believed in active government policy to manage demand thereby smoothing out changes in the economy over the short term. The current Quantitative Easing has its intellectual roots in Keynesianism.

The modern concept of GDP was Kuznets’s brainchild, sponsored by the US Congress and then used at the Bretton Woods conference in 1944.

A key factor in the outbreak of the Second World War was economic instability in a number of countries caused by unstable currency exchange rates and trade practices that discouraged international trade. In 1944, in order to avoid a recurrence, a process for international cooperation on trade and currency exchange was created. The intent of the meeting was to “speed economic progress everywhere, aid political stability and foster peace”. Growing the economy was seen as the path to economic well-being and long term peace. That needed to be measured.

The IMF and World Bank were born out of Bretton Woods and still today, the changes in a country’s GDP guide policies and determine how and which projects are funded around the world.

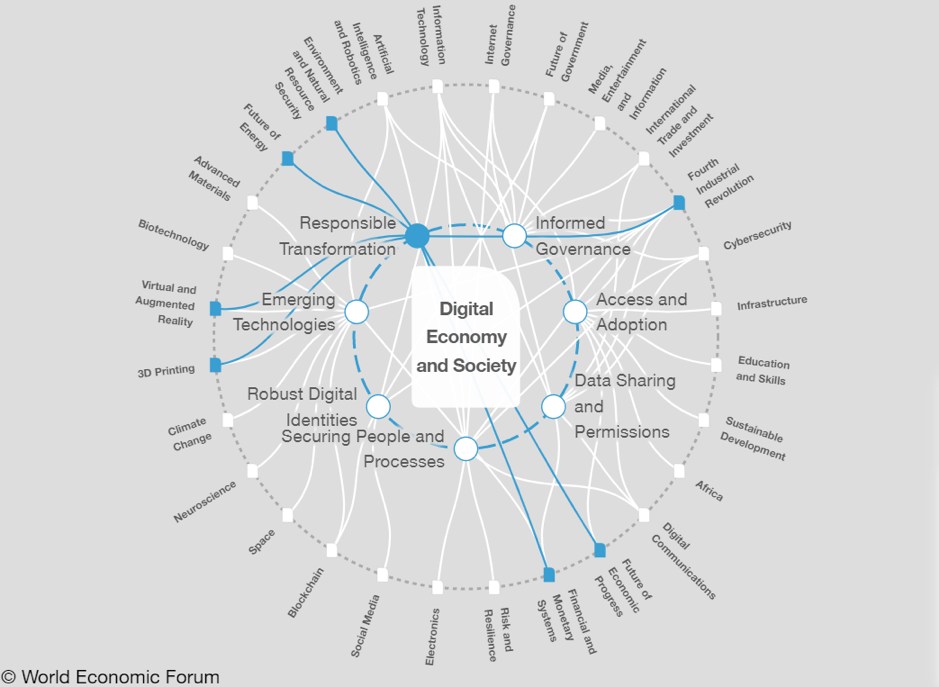

We live at the beginnings of a Fourth Industrial Revolution.

This is fundamentally changing the way we live, work and interact. GDP is biased towards tangibles, good for the accounting of the manufacture of brick, steel and cars etc. It struggles with intangible assets such as software, branding, design, operational processes and their intellectual property, which are most often unpriced and thereby not measured. The exception being when a company makes an intellectual property charge. But these intangibles are highly valuable. The years of R&D that go into developing software, medical devices and smartphones for example. The years of marketing initiatives and expenses that have gone into brand building for the likes of Nike, Nestle and L’Oréal.

We live in a world where the cross-border traffic in information knows no bounds and mostly it is free; email, social media, real time mapping, video conferencing etc. How about this - Wikipedia, for example encompasses 40 million free articles in 300 languages. Every day, more than a billion hours of YouTube’s video is watched for free, and billions of people use Facebook and WeChat every month. Multinationals send intangibles around the world, such as software, design, brands and IP on a daily basis. Services such as R&D, finance and sales and marketing are all part of the economic value of todays traded goods. These services undoubtedly create value, even without a monetary price. McKinsey Global Institute estimate that these three aspects collectively produce up to $8.3 trillion in value annually—a figure that would increase overall trade flows by $4.0 trillion (or 20 percent) and reallocate another $4.3 trillion currently counted as part of the flow of goods to services. This perspective would substantially shift the trade balance and consequently, GDP for some countries, most notably the United States.

GDP misses out huge chunks of value in today’s economies. Free online apps like Google maps or Wikipedia have no impact on GDP despite the clear value to consumers. Anything with a zero price has a zero weight in GDP. Yes, there are new modifications to the old GDP. GDP-B where B stands for benefits. But how do you value B.

Much of this, “you can’t manage what you can’t measure” conundrum is extremely well covered in “Capitalism without Capital” (Haskel and Westlake).

There are intangible and unmeasurable qualities that contribute to the health of an economy. How about happiness and knowledge or learning?

Finland is consistently top of the Happiest Countries according to the annual United Nations World Happiness Report. Yet its GDP growth has apart from 2008/9 (Crisis) consistently been below 2% per annum. Its long-term GDP per capita is 2.45%. New Zealand is consistently high up in this Report. In May, 2019, so before Covid-19, NZ’s Prime Minister announced her Budget, which was acclaimed to be the first by a Western country to put well being ahead of economic pressures.

“Today we have laid the foundation for not just one well-being budget, but a different approach for government decision-making altogether,” Ardern (PM) said while unveiling her budget. Her goal is to downplay the importance of GDP, normally seen as a key indicator of success.

I think it is time to abandon this redundant measure as the corner stone of our economic thinking. Politicians, policy makers, society and investors need to think more deeply. We need to be far more relevant to our world and that of future generations. Not the world of the past. We are in the midst of a Fourth Industrial Revolution (digital) using a First Industrial Revolution (capital) doctrine. I am not alone. Check out Joseph Stiglitz (Nobel prize), Sir Partha Dasgupta, Karl Goran Maler, Professor Erik Brynjolfsson (“We need a new model for growth. Just as we’re reinventing business, we need to reinvent the way we measure the economy”), Daniel Kahneman (Nobel prize), Jonathan Haskel and Stian Westlake (Capitalism without Capital) and many other eminent thinkers.

GPD is not a good measure of economic preforamnce, it's not a good measure of well-being

So, what’s the alternative? There are many.

In 1972, King Jigme Singye Wangchuck of the Buddhist kingdom of Bhutan publicly declared he would no longer seek to grow GDP. Instead, he said, his country would pour its energy into growing their Gross National Happiness (GNH), guided by Buddhism and mindfulness principles. The survey contains 148 questions examining how residents are doing on every level – from the number of televisions in a home to whether wild animals have impacted their lives.

Maybe a little over the top as very focused on spirituality with questions like “Do you meditate?” or “How frequently do you pray?”

On the environment then the Green GDP attempts to monetize the environmental damage factors to help countries better understand exactly where they stand environmentally. It was actually developed by the Chinese government in an attempt to understand the consequences of their carbon emissions and account for the losses they experience from climate change. Problem is how do you put a value on the loss of biodiversity? CO2 you can. The accuracy is debatable.

The US have the Genuine Progress Indicator (GPI) which as well as normal GDP takes other factors such as the cost of crime, ozone depletion and even lost leisure time. The problem with it is that it is not international and not even states wide. Only a handful of states have adopted it.

Then the OECD have the Better Life Index (BLI). It has 11 components; housing, income, jobs, community, education, environment, civic engagement, health, life satisfaction, safety, and work-life-balance. The BLI site lets users navigate based on which factors they value most, allowing them to create their own opinions based on the data for each 11 facets. You can see which regions around the world align with your own values without a value system pre-imposed.

I think BLI is a thoughtful, comprehensive, and promising alternative to GDP.

The UN has the Inclusive Wealth Index (IWI) and publishes a bi-annual “Inclusive Wealth Report”, starting in 2012, the last being in 2018 and covers 140 countries. It covers 56% of the world’s population and 72% of world GDP.

The UN IWI takes many factors into account and is best summarized as below:

Interestingly, the 2018 Report identified that the IWI was higher in 135 countries in 2014 versus 1990 and the global growth rate of IWI was 44% over that period, or an average of 1.8% per year. Over the same period, global GDP grew on average 3.4% per year.

The other broad conclusion is most countries, both developed and developing are running down natural capital and increasing produced and, to a lesser extent, human capital. Over the last 25 years globally aggregated produced and human capital per capita increased 94% and 28%, respectively, while natural capital per capita declined by 34%.

For me this is the closest alternative to GDP. It provides important insights into long-term economic growth and human well-being. It measures all assets which human well-being is based upon, in particular, produced, human and natural capital to create and maintain human well-being over time.

I can’t do much about the politicians, policy makers, society or investors in general, but I am an investor and so I can for the last. GDP is meaningless. Companies I invest in are the meaning. They need to coincide with my economic and behavioral requirements. They do!

During a Brexit debate pro Europe expert, Anand Menon warned of the likely plunge in the UK’s GDP resulting from leaving the EU. A woman yelled back...

That’s your bloody GDP. Not ours.

Lastly

It measures everything, in short, except that which makes life worthwhile.