Quarterly Investment Review & Outlook

Investment Review & Outlook – Fourth Quarter 2021

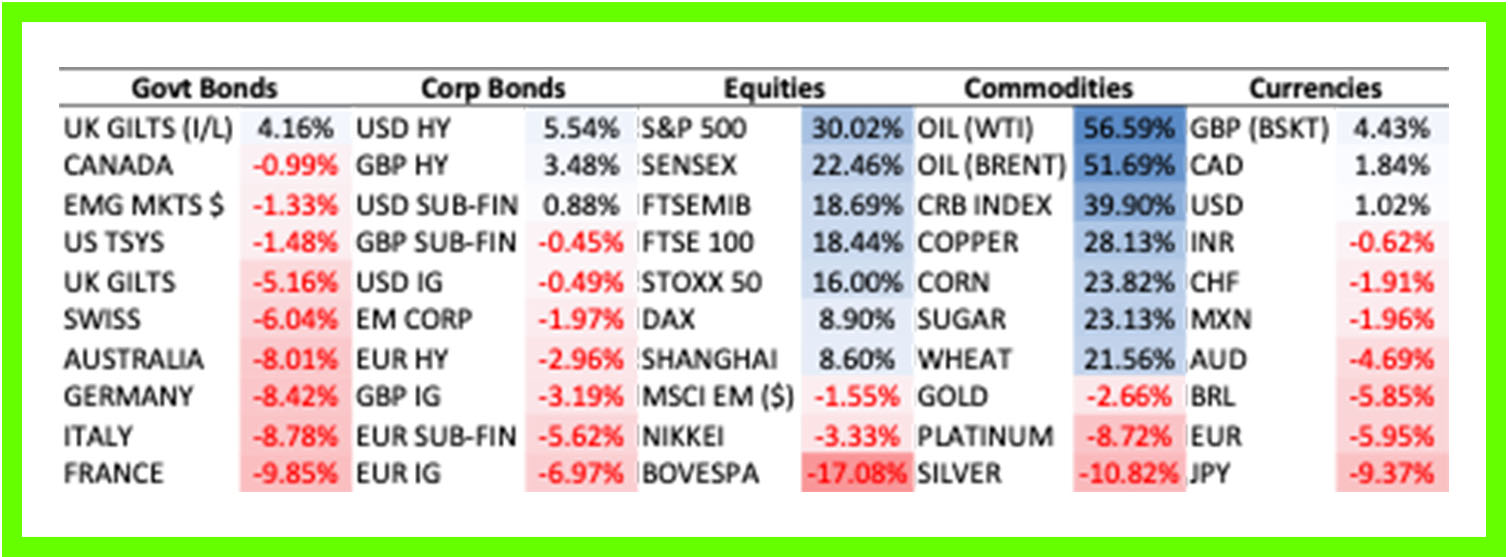

Major Asset Class Returns for 2021 in GBP Terms.

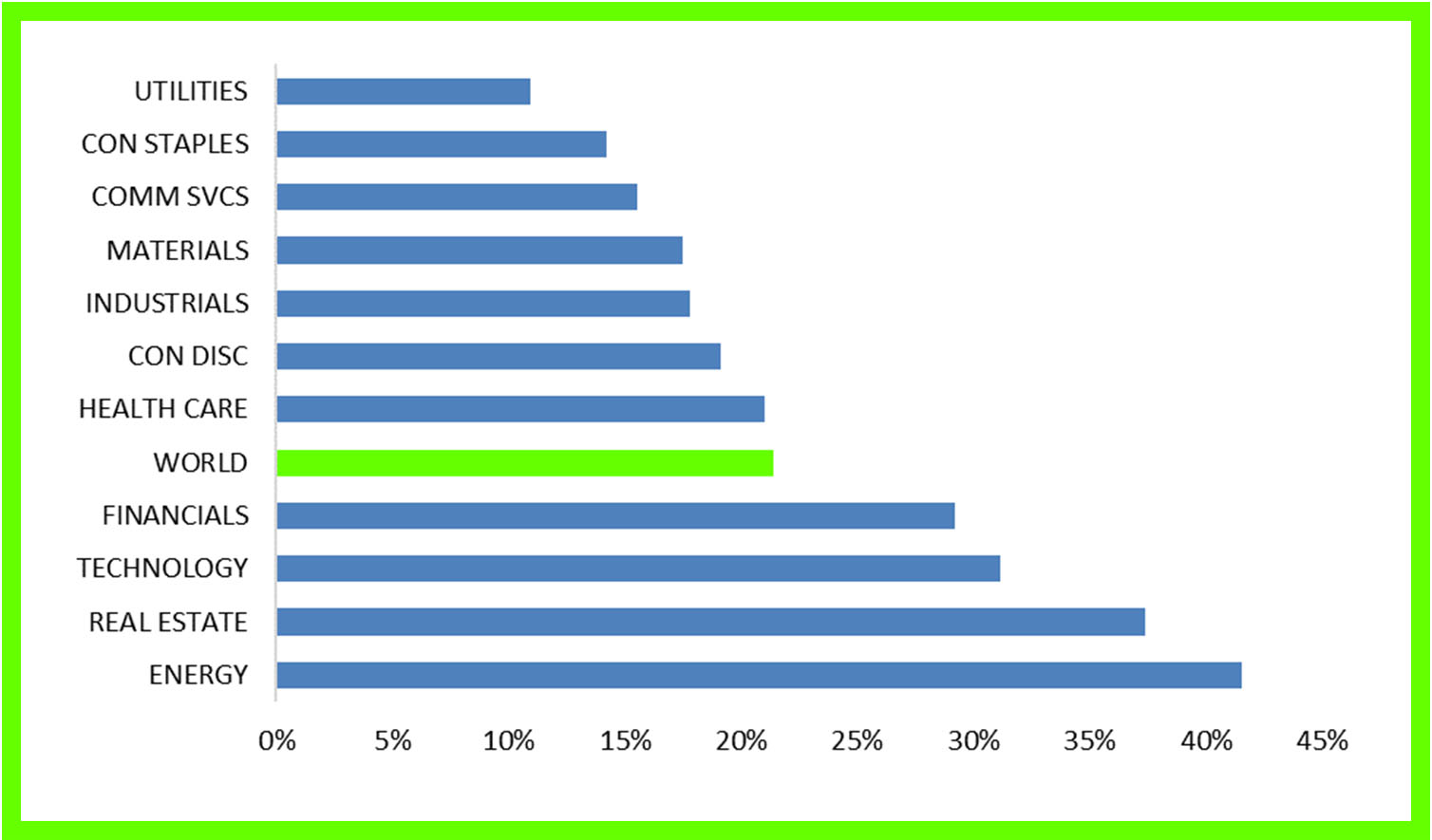

Global Equity Sector Returns for 2021 in GBP Terms.

(Source: Bloomberg)

Market Review: Bull Stampede

Global equity markets powered higher through the fourth quarter to cap a great year for risk assets. A strong economic recovery, negative real bonds yields and stellar aggregate corporate earnings results, all underpinned by ultra-easy G7 central bank positioning, buoyed investor sentiment, ensuring that repeated alarms over the uncertain direction of COVID, soaring inflation and the prospect of quicker-than-expected US central bank tapering were temporary events.

A glance at returns for 2021 illustrates the strength of developed market equities, led by the United States. The flagship S&P 500 index finished the year +30% in sterling terms for its seventh annual double-digit gain in the past decade, whilst the Italian MIB Index (+18.7%), FTSE 100 (+18.4%) and Euro Stoxx 50 (+16%) also posted strong gains. Emerging market economies, however, broadly struggled against a backdrop of stop-start COVID policies and monetary tightening as central banks began to take more progressive action against the threat of elevated, and sustained, inflation. The MSCI Emerging Market Equity Index finished the year down -1.6%.

Commodities were the best-performing traditional asset class, with the Commodity Research Bureau (CRB) Index, an aggregated index comprising 19 separate commodities, returning 40% on the back of strong energy prices (WTI +57%, Brent +52%). Copper (+28%) continued to benefit from a global structural deficit of the metal estimated at around 380,000 tonnes in 2021 and exploding demand in the generation of electricity from ‘renewable’ sources. Corn (+24%), sugar (+23%) and wheat (22%) were well-bid as global supply chain disruptions exacerbated production shortfalls caused by unique and volatile weather systems that disrupted crop yields.

Fixed income was a major underperformer, with bond markets suffering their worst year in more than two decades as inflation surged against a backdrop of disrupted supply chains, massive fiscal and monetary stimulus, and economies re-opening from COVID lockdowns. The US bond market finished 2021 down -1.5%, the first negative year since 2013 and only the 4th negative year since the inception of the Barclays Aggregate Index in 1976. UK gilts declined -5.2%, whilst European sovereign debt markets were all down by high single-digit percentages. The UK inflation-linked gilts sector was the only segment to generate a positive return (+4.2%).

Separately, 2021 may be remembered as the year cryptocurrencies and digital assets achieved mainstream status in the investment world, with the emergence of DeFi (Decentralised Finance), NFT’s (Non-Fungible Tokens) and the Metaverse entering popular vernacular. Bitcoin hit a record high of $68,000 in November shortly after the SEC approved the first US listed Bitcoin-linked ETF, returning 66% for 2021. Cryptocurrencies as an asset class moved towards US$ 2.5 trillion in aggregate market capitalisation 2021. A number of hedge funds, investment banks and asset managers have invested substantial amounts over the year to recruit specialist cryptocurrency expertise and trading capabilities, whilst large global banks began offering cryptocurrency custody.

Investment Outlook

Perhaps unsurprisingly, we enter 2022 with a more cautious stance in terms of outlook and positioning than 12 months ago. The crystal ball has certainly become murkier: can this bull market continue for another year? Will there be a major policy misstep? Does geo-political risk flare into something sinister? Our modus operandi is to mitigate our behavioural and cognitive biases to the greatest extent possible, by allowing our core models and indicators to guide us through the year. We stand ready to change our minds and move in the direction of the evidence as it unfolds.

Backdrop

After years of ultra-accommodative fiscal and monetary measures, US policymakers appear resolved to taking away the proverbial party punchbowl. Markets are staring down the barrel of a potential acceleration of tapering (the process by which the Fed throttles back economic stimulus by slowing the pace of asset purchases), a rising Fed Funds Rate and a relatively problematic US Congressional Mid-Term election year. Strongly countering these negative issues, the US$ 5 trillion+ dollars that the Federal Government injected into the economy between March 2020 and March 2021 continues to reverberate: the US economy is humming, and consumer demand remains very robust.

Inflation

Whether inflation subsides or remains firmly entrenched at a higher natural plateau during 2022 remains immensely important. The outcome will continue to have far-reaching consequences for the direction and path of global asset prices this year.

To recap, after inexplicably sticking to the ‘inflation is transitory’ script throughout much of 2021 in the face of overwhelming contrary evidence, Federal Reserve Chairman Jerome Powell finally conceded defeat on 30 November in testimony before Congress. Since this admission, the Fed has brought forward the end of tapering from June 2022 to March 2022, while money markets are now projecting three rate hikes totalling 75bp in 2022 whereas, as recently as September 2021, half of the FOMC participants were projecting no rate hikes at all in 2022:

(Source: US Federal Reserve (reflects mid-point of US Fed Fund Rate target range))

The catalyst for the change in posture was the November Consumer Price Index (CPI) report which showed the highest US inflation rate since 1982, at +6.8% YoY (chart 2 below). The subsequent U-turn and signal to the market that the Fed is now engaged in ‘inflation-fighting mode’ has been announced at the very time COVID mutation risks have resurfaced in a meaningful way.

(Source: US Bureau of Labor Statistics)

We are now almost two years into the pandemic, but the passing of 2021 ended with a surge in cases and related threats of renewed lockdowns. Markets have taken the view, for now, that the latest Omicron variant represents a ‘successful virus’ in that the most recent variant is considerably more transmissible than predecessors but less lethal. That said, the surge in the 7-day average of new cases across the world is unsettling (chart 3 below). It should also be noted that the global vaccination rate remains far short of the number required to instil confidence that the virus has been vanquished. As it stands, only 49% of the world population has been fully vaccinated.

(Source: Johns Hopkins)

We are keeping a close eye on a range of indicators to assess the US Federal Reserve’s appetite and willingness to stay the current course. Among them is the central bank’s preferred longer term inflation metric, the 5-year, 5-year forward inflation expectations rate, which measures the expected inflation rate over the five-year period that begins five years from now (chart 4 below). The measure currently sits at 2.3% which, for now, is comfortably below the threshold of what we would consider the Fed’s ‘worry point’:

Source: Factset

Finally, to further illustrate the broad-based inflationary pressures in the system, shown below in chart 5 is the Cleveland Fed’s range of inflationary measures including the so-called ‘trimmed-mean CPI’ (blue line). This excludes the inflation components each month which have shown the most extreme moves in either upward or downward direction. The gauge rose by 4.55% YoY in November, the highest level since May 1991, offering clear evidence that the headline numbers are not being disproportionately skewed by one or two individual components:

(Source: Bureau of Labor Statistics, Federal Reserve Bank of Cleveland, Haver Analytics)

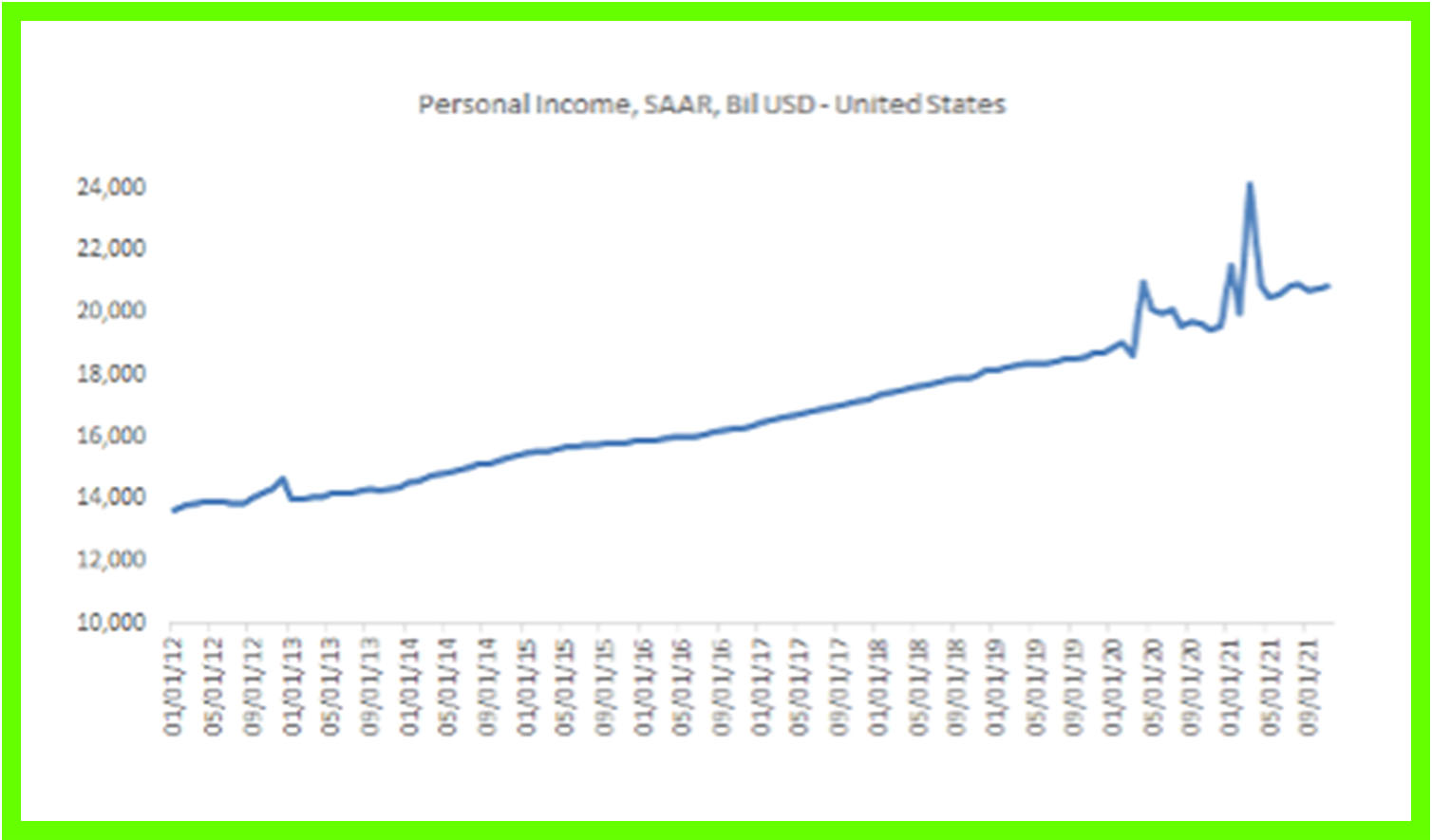

Improving supply chain bottlenecks and base rate comparisons in the first half of 2022 from high levels may create a narrative that the inflation genie has been bottled. However, our view is that prevailing inflation pressures are demand rather than supply driven, led by the extraordinary actions of the Federal Reserve and other G7 central banks through the pandemic via embracing ‘helicopter money’ via direct payments to households. This has created an enormous wealth transfer to US consumers of c.US$ 2 trillion, and is likely to keep the American economy resilient through this year (chart 7 below):

(Source: Factset)

Policy and Political Tightening

History suggests that US Congressional Mid Term elections and a Central Bank in tightening mode are not ‘market-friendly’. Historically, market turbulence has followed. Shown in chart 6 below, courtesy of our friends at 3Fourteen Research, are the prior six Mid Term election years in which the Federal Reserve also raised interest rates. On average, the S&P 500 Index is flat during these years and suffers through heightened volatility. Of note, the results are even worse during the years where the party in the White House lost at least one house of Congress (1994, 2006, and 2018):

(Source: 3Fourteen Research)

Given the fact that so much of the most recent rally has been stimulus induced, this tendency could be pronounced in 2022. And, with President Biden’s approval rating plunging in recent months, the odds of a Republican Congressional takeover are high.

This potential outcome is set against the backdrop of a US stock market which can be considered ‘over-valued’ using a range of indicators. Arguably, this is best gauged by utilising the price-to-sales ratio, which remains well above the previous peak recorded in 2000. The S&P 500 price-to-sales ratio rose to a record 3.2x in late December, compared with the previous peak of 2.4x reached in March 2000:

Source: Bloomberg, Jefferies Research)

Optimism

On the flipside, there are reasons to remain cautiously optimistic for the year ahead. Chart 6 demonstrates that on 4 out 6 previous occasions when markets have experienced a combination of Mid Term election years and a Fed in tightening mode, the S&P Index finished the year higher. In addition, the American economy and corporate America are entering 2022 in excellent shape.

The Economy

The US economy concluded 2021 strongly, based on a range of high frequency indicators. The Atlanta Fed’s GDPNow model shows real US GDP tracking at an annualised rate of +7.6% during the 4th quarter, while real gross domestic investment growth is tracking at an incredible +16.9% YoY rate. Separately, the Conference Board Consumer Confidence Index increased again in December, following an upward revision in November. The index now stands at 115.8, up from 111.9 in November. Finally, Mastercard’s SpendingPulse measures in-store and online retail sales across all forms of payment, and estimates holiday retail sales excluding automotive increasing +8.5% YoY from November 1 through to Christmas Eve, whilst online sales grew +11.0%.

Corporate America

Despite the highly reported cost pressures, S&P 500 operating margins have surged to a multi-decade high above 14% (see chart 7 below). It is very possible that that corporate spending will accelerate next year. Mapped against inventories that have been depleted on account of supply chain disruption in 2021, we could see a new capex cycle. Increasing capital spending throughout 2022 will provide an additional tailwind to the economy.

Source: www.yardeni.com

In our view, a positive surprise from the US consumer is potentially the biggest upside risk to markets in 2022. Whilst the list of reasons to be bearish this year is extensive, a much stronger-than-anticipated surge in demand could take place if COVID fears prove unfounded. Households have plenty of savings, there is abundant evidence of pent-up demand, surveys point to strong business intentions and current real borrowing rates are negative.

Other Regional Snapshots

The Eurozone enters 2022 with healthy growth momentum. Business surveys highlight broad-based gains across countries and sectors, and fiscal policy looks set to provide sustained support to growth as the EU fund disbursements accelerate. The European Central Bank remains incredibly dovish in its policy outlook and is not anticipating any rate hikes until 2024. A key risk to growth is the renewed COVID outbreak that has triggered further restrictions in northern Europe, particularly Austria, Germany, and the Netherlands.

The UK looks poised for another year of above-trend growth in 2022. A very successful vaccine and booster shot rollout places it in good standing to manage further COVID outbreaks better than European counterparts. With that said, Brexit has left England exposed to upward pressure on wages and inflation. The Bank of England surprised markets in mid-December with a 15 basis-point rate rise.

Inflation indicators are likely to determine the course of action through the next several quarters. Japan’s economic recovery remains relatively meek, with aggregate consumption still trailing pre-COVID levels. A cyclical recovery is anticipated, driven by mobility and the spending of excess consumer savings as vaccination rates continue to pick up. Prime Minister Fumio Kishida has announced a supplementary fiscal package of c.5.5% of GDP, which should stimulate economic activity.

Finally, China continues to grapple with periodic COVID outbreaks, and her borders will likely remain closed for all of 2022 on account of a zero-COVID policy. Regulation on large technology companies remains an uncertainty, and there are understandable fears over which sector might be targeted next. Fiscal and monetary easing will likely be the course of action, but this is likely to take the form of a targeted approach and unlikely to offset the drag from property and a lack of FDI.

Asset Allocation & Positioning Summary

TEAM enters the 1st quarter of 2022 advocating a more conservative posture than 12 months ago, with a focus on high quality. Our key positioning calls heading into January:

- Underweight equity risk. Global Large-Cap, Global Value and Japanese equities are preferred areas of exposure.

- Underweight real assets. US Infrastructure Equity and Global Real Estate are preferred. Modest position in Physical Gold. Zero Cryptocurrency exposure. Separately, Volatility looks attractive as an ‘asset’ here.

- Overweight Fixed Interest. This exposure come with a large caveat: in the bond space, our preference is Emerging Market Sovereign Bonds, Inflation Protected Government Bonds and Selective High Yield Corporate Credits. We view conventional bond exposure at this juncture as ‘return-free risk’ and maintain zero percent exposure.

- Overweight Alternative Income Streams. These are securities that exhibit conventional bond characteristics, namely an attractive and sustainable yield and less-than-equity market volatility. Examples include Infrastructure Assets and Music Royalty Streams.

Volatility fosters opportunity. TEAM’s flexible investment framework, underpinned by a diverse asset allocation menu and the ability to tactically allocate, should stand us in good stead for what is likely to be a very interesting year ahead.

We wish you a healthy, peaceful, and prosperous 2022.