Investment Review & Outlook 2nd Quarter 2022

Major Asset Class Returns for 2nd Quarter 2022, local currency terms

Global Equity Sector Returns for 2nd Quarter 2022, local currency terms.

Market Review: Fluctuation

Fluctuation:an irregular shifting back and forth or up and down in the level, strength, or value of something (Merriam-Webster)

The story goes that when approached by a young person and asked, with an undertone of desperation, about the future direction of stock prices, legendary American financier John Pierpont Morgan is alleged to have replied: ‘young man, I believe the market is going to fluctuate’. It’s fair to say Mr. Morgan’s riposte neatly summarises the gyrations witnessed across financial markets so far in 2022.

Investors hoping for a dose of early summer cheer were dealt another sharp blow as asset prices across the risk spectrum plunged lower during the quarter. The old financial market adage, ‘’sell in May, and go away’’, popularised in the Stock Trader’s Almanac with reference to historically weaker performance from equity markets during the six-month period from May to October, is proving itself a reliable axiom once again. 1|Page

Following an extraordinary period of history in which financial assets have benefited from abundant liquidity, disinflation and ultra-low interest rates, a sharp reversal of these conditions is forcing a swift pricing reset. In addition, key macroeconomic risks, namely a hot war in Ukraine, tightening central bank policy, and China’s zero-tolerance covid approach, continue to loom large. Whilst these issues are now well understood by markets, the potential outcome of each remains far from clear.

Fixed Interest

Sovereign and investment grade bonds, traditionally a haven for investors during times of elevated stress and dislocation within equity markets, have seemingly lost their power, buffeted by persistently elevated global inflation readings, hawkish central bank activity and sharply rising interest rate paths.

US, German and UK government bonds returned -4.05%, -6.53% and -7.42% on the quarter respectively, whilst UK inflation-linked bonds were down an eye watering -17.54%. All investment grade and the more speculative pockets of the high yield corporate bond markets that we follow dropped between -5% and -10%, reflecting increased concern from investors over the prevailing economic conditions.

European yields were acutely volatile as the ECB indicated it would finally conclude the mindboggling policy of continuing quantitative easing into the worst inflationary episode for the region in forty years. Asset purchases will be stopped in early Q32022, with interest rates being raised soon afterwards. The decision was still enough to send shockwaves through peripheral Europe, sparking a sharp sell-off in Italian bond prices in June.

The return of Italian debt risk prompted an emergency European Central Bank (ECB) board meeting to emphasise that the central bank would increase purchases of Italian bonds, if required, to counter fragmentation in the transmission of ECB policy across the Eurozone. Unsurprisingly, the nature and scope of the policy, along with crucial implementation details are yet to be revealed, disappointing markets that do not deal with uncertainty well.

A reversal of sorts took place late in the quarter, as credit markets began to take the view that in the wake of sharply deteriorating macroeconomic datapoints and weak forward-looking indicators (including business sentiment and consumer confidence), central banks, and the Fed in particular, would be unable to follow through with their aggressive tightening plans.

Commodities

The Commodities Research Bureau (CRB) Index, a broad basket of 19 commodities (approximately 39% energy, 41% agriculture, 7% precious metals, 13% industrial metals) returned -1.37% on the quarter, although there were significant price variations within the asset class. Energy prices (oil and gas) performed strongly on a combination of still robust aggregate global demand set against supply constraints. These include the ongoing conflict in Ukraine, and the success of the ‘green’ movement and ESG agenda over the past decade, the result of which has been a catastrophic collapse in new refinery construction and related exploration and production infrastructure over the past decade.

Industrial metals were the poorest performing components, with sharp falls in the price of aluminium, nickel, and zinc. Copper and lead prices were also significantly lower, possibly given technical factors on the strength and duration of the rally over the past 18 months, and copper’s utility as a barometer for economy activity, which points to troubling times ahead. Precious metals were, unsurprisingly, lower in the face of rising yields and the dollar’s relative strength over the quarter.

United States

The bellwether U.S. S&P 500 large-cap index fell-16.10% in the second quarter, whilst the technology heavy Nasdaq Composite Index dropped -16.32%, capping the worst start to a year since 1962.

After steadfastly adopting a ‘transitory’ stance on the inflation issue throughout 2021, an emboldened Chairman Powell, fellow Federal Reserve governors, and former Chairs, have embraced a new hawkish rhetoric, pledging to take interest rates beyond ‘neutral’ (a seemingly secretive, arbitrary number unknown to the public) and accept unemployment pain to achieve price stability.

May’s Consumer Price Index (CPI) print published in mid-June ultimately forced the Fed’s hand into announcing a 75-basis point hike five days later. Headline CPI rose to +8.6% YoY, the highest inflation number since December 1981 (chart below). Most worryingly, core services inflation rose from +4.9%YoY in April to +5.2% in May, the highest level since June 1991.

(Source: U.S Bureau of Labour Statistics)

Meanwhile, the closely followed Cleveland Fed’s trimmed mean inflation index, so-called as the measure seeks to remove outlier components comprising the top and bottom contributors to give a clearer view of the broad inflation picture, rose to +6.53% in May, the highest level since data records began in December 1983:

(Source: Federal Reserve Bank of Cleveland)

It is also worth noting that more than 50% of the 36 categories that comprise the US CPI are now rising at more than a 5%+ annualised rate. Just 3 categories are currently down on a year-on-year basis. This has clear implications for politicians hoping for ‘peak inflation’, and a swift return to the 2% target rate.

The Fed is now firmly walking the talk. Interest rates have been raised by 150 basis points in this cycle, with another 190 basis points of tightening by March 2023 being predicted by Fed funds futures. The Fed has also committed to the largest quantitative tightening ever in terms of the proposed schedule to shrink its bloated balance sheet over the next three years. Having peaked at US$8.92 trillion on March 2022, the Fed intends to systematically shrink its portfolio of holdings by approximately US$1 trillion per annum, or US$2.8 trillion (c.30%) by the end of 2024.

Heading into April, the US economy appeared robust, but corporate America was already signalling a more difficult environment (material procurement difficulties, wage inflation, inventory builds as customers’ preferences changed, severe margin pressure) as companies delivered their first quarter earnings results. Several of the largest domestic retailers revised guidance to reflect a gloomier outlook, resulting in some of the sharpest individual one-day share price declines since Black Monday in 1987.

By the end of the quarter, faster-moving economic data indicated that the economy is already experiencing a sharp slowdown. This includes a deterioration in the ‘flash’ US composite manufacturer’s index (PMI), based on survey data from companies in the manufacturing and services sectors, as well as a weakening trend in the interest-rate sensitive housing and auto sectors. U.S new home sales declined by 16% YoY in the three months to May, whilst auto sales were also down -29.6% YoY in May. Markets are moving quickly to price assets for an economy that is slowing.

Eurozone

In the Eurozone, the clouds continue to darken. A breakthrough in the Russia/Ukraine war remains absent, inflation pressures are increasing, the European Central Bank has, tardily, turned hawkish, and peripheral risk is back in focus after a lengthy hiatus as Italian bond spreads began to widen more dramatically, indicating stress in the system. The Stoxx 50, an index comprised of 50 leading blue-chip companies across the Eurozone, fell by -9.88% during the quarter, whilst Germany’s Dax and the Italian MIB indices returned -8.61% and -9.69% respectively.

Alongside the ever-present inflation genie, perhaps the most significant development has been Russia’s response to the European Union’s embargo of Russian energy exports. The EU has outlined plans to cut imports by two-thirds by year-end and to phase out imported Russia gas entirely by 2027. The bloc has already stated that it will cease importing Russian coal commencing this August, and most Russian oil in six months. The explicit goal is to starve Russia of the c.US$850m per day the country was reaping in European oil and gas sales prior to the invasion of Ukraine.

Russian state-owned energy giant Gazprom reacted by reducing supplies through the Nord Stream 1 pipeline running under the Baltic Sea from Russia to Germany, Europe’s major natural gas pipeline, by 60%. Supplies to Italy have been cut by half. Germany relies on Russia for 35% of its gas imports, Italy for 40%. Putin’s decision to weaponize energy has Europe’s leaders deeply concerned about the threat of a complete shut-off that would spell disaster for the continent ahead of winter.

United Kingdom

Closer to home, the UK’s economy is softening, with sharply rising mortgage rates, soaring energy costs and the 1.25% increase in the national insurance levy that took effect in April all dampening growth.

The Consumer Price Index (CPI) rose by 9.1% YoY in May, with the largest contributions to the headline number coming from surging housing and utilities, transport, and food and non-alcoholic beverage prices (see chart below). The Bank of England now anticipates a rate of 11% later this year.

(Source: Office for National Statistics)

UK Chancellor Rishi Sunak finally buckled to public pressure, unveiling details of an emergency multibillion pound package of support (a so-called ‘windfall tax’ on the profits of oil and gas companies) to help ease the burden on Britons facing a record squeeze on living standards. The 25% levy on energy firms will raise approximately £5 billion, which will finance one-off grants of £650 to more than 8 million of the poorest households. The initiative is a bitter pill for Chancellor Sunak to swallow given that the tax is a key policy of the main opposition Labour Party. It also undermines a key Conservative Party pledge as the government of choice for businesses.

On the political front, UK Prime Minister Boris Johnson survived a vote of no-confidence, though the deep discontent within his Conservative Party was laid bare by the 148 votes against him, a bigger rebellion than the one suffered by predecessor Theresa May, who was ousted as premier six months later. The vultures, it seems, would appear to be circling (and this would have profound implications following the end of the quarter). Political machinations add further instability to an already precarious situation as the country’s leadership attempts to delicately balance monetary tightening against the threat of recession.

Japan

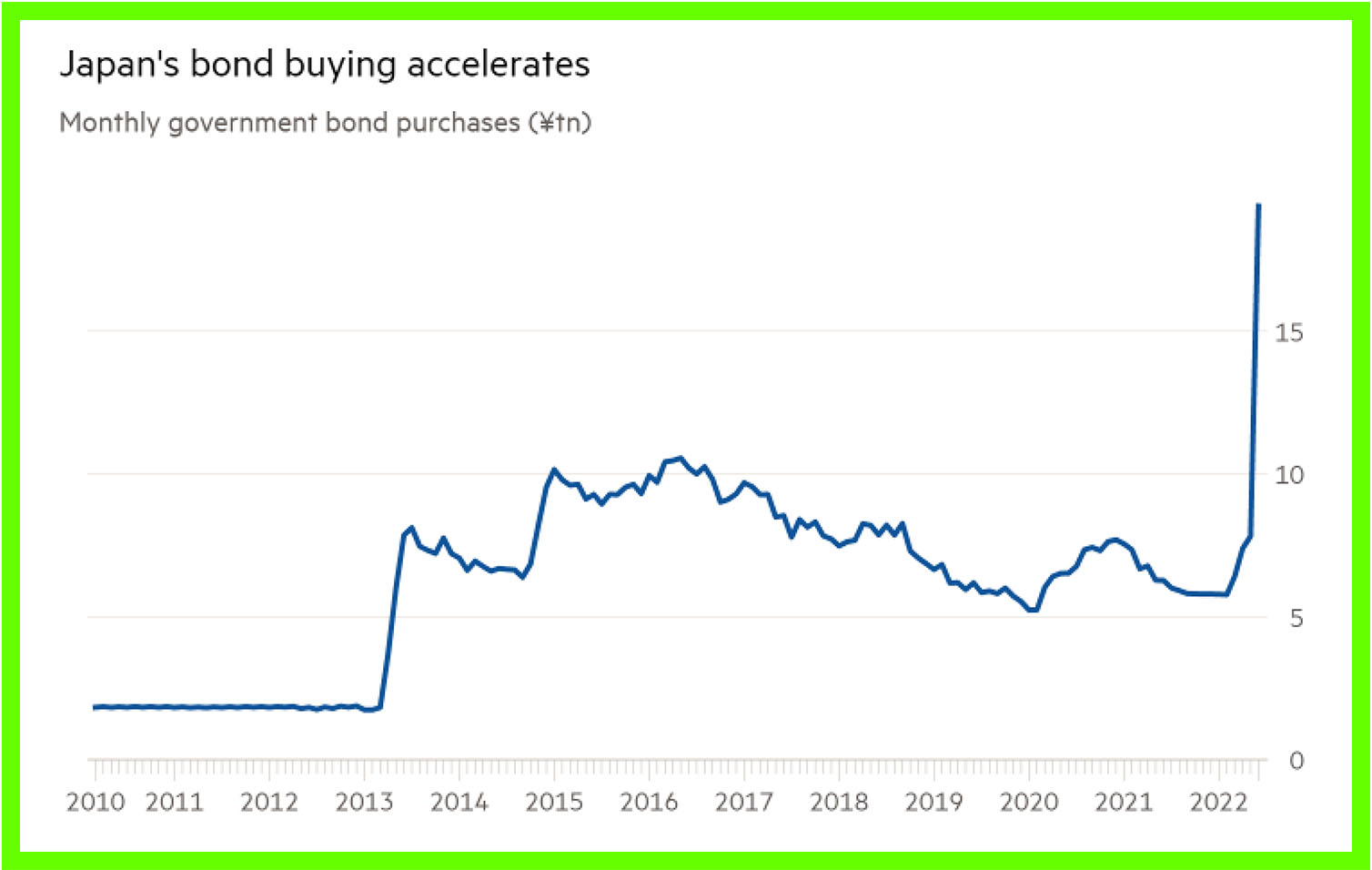

The Japanese economy remains challenged by a combination of higher energy and food prices, which have been exacerbated by a significant depreciation in the Japanese yen. The Bank of Japan (BoJ) Governor Haruhiko Kuroda restated his commitment to a yield curve control policy that attempts to maintain the 10-year yield at, or below, 25 basis points. The purpose of the strategy is to artificially depress interest rates, weighing on savings yields and incentivising spending through keeping borrowing costs low. The hoped-for outcome: higher nominal growth and inflation.

To achieve this, the BoJ has been engaged in a massive buying programme of Japanese government bonds, including record purchases of over Yen 16 billion in June 2022 alone:

(Source: BoJ, FT.com)

With the yen having declined against the US dollar by 24% since the start of 2021 and almost 15% year-to-date, there is growing pushback to the policy from a public that is being significantly impacted by imported inflation pressures (foreign goods become relatively more expensive to buy). Certain market participants are once again heavily engaged in the ‘widow-maker’ trade of shorting (or betting against) Japanese government bonds, so-called because of the frequency with which the bet has failed to pay off over the past two decades.

Separately, Prime Minister Fumio Kishida recently announced his Grand Design economic plan, which will focus on raising wages and financial innovation in the economy. The devil will of course be in the details, which we anticipate post the upper house election in July.

China

Chinese equities delivered the only positive return amongst major indices in the second quarter. This could be in large part due to policy easing, be it monetary easing (lower mortgage rates), fiscal easing (tax cuts and tax rebates for specific industries), or property easing (lower bank fees for home purchases, loosening of home buying restrictions), that stands in stark contrast to the tightening financial conditions being experienced across the globe. The domestic CSI300 Index (a combination of securities represented in Shanghai and Shenzhen) has risen by 19.4% since late April, while the MSCI China Index is up +18.5% since the middle of May.

Indeed, with Beijing also finally relenting on the oppressive regulation and oversight policies that have plagued the property and e-commerce sectors for the past two years, Chinese equities should stand out in a world of Fed tightening. The market’s hesitation is almost certainly because of Xi’s bizarre choice of continuing the zero tolerance Covid policy against a highly contagious Omicron variant, resulting in frequent and extensive lockdowns that have the practical effect of undermining many of the stimulus measures.

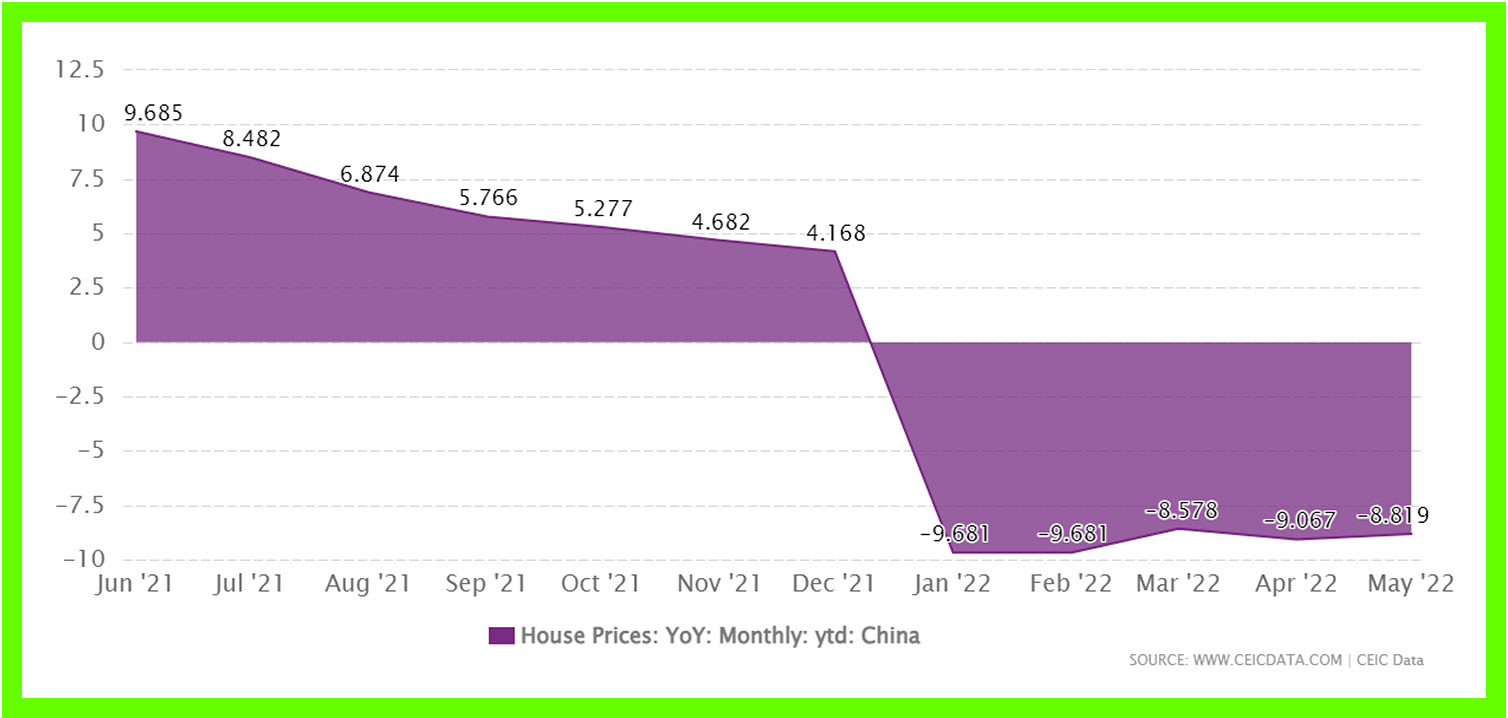

This was arguably reflected most dramatically in the renewed downturn in the residential property sector last quarter. Property sales remain weak despite many cities loosening home buying restrictions and lowering mortgage rates. The continuing caution on the part of buyers is stoked by fear that where lockdowns have not yet happened, local populations will naturally assume that the Omicron variant, and hence localised lockdowns, could come to them soon. The following chart shows house price changes (% YoY), indicting still sluggish demand:

(Source: CEIC Data)

This bear market has offered investors few sanctuaries, with global equities collapsing and bond yields rising, spelling disaster for conventional 60/40 equity/bond portfolio construction. There is little in the way of good news in our market review above. With that said, markets have come a long way (down) in a short space of time.

Continued angst over the inflation picture, increasingly hawkish US Federal Reserve posturing, the prospect of recession in the US and China, concerns over a peak in corporate margins and profitability and the headwinds of a strong US dollar are all now well-flagged and, arguably, reflected in current market prices. Like the proverbial spring that has been compressed to its potential, it is possible that prices have reached a short-term nadir, evidenced by technical measures of market breadth and sentiment.

With many investors positioned very defensively in terms of asset and security selection, high cash positions and/or paying up for portfolio insurance, the news only needs to go from awful to slightly- less-than-awful to release the spring and send risk assets higher.

Whilst we prefer shy away from predictions and forecasts for the most part, instead channelling our resources towards delivering resilient investment portfolios for our clients, we are prepared to venture that the sharp dislocation between equity and bond markets in recent times might be suggestive of a more ominous, tectonic shift in the underlying financial market regime.

Globalisation, open trade, just-in-time supply chains and dependence on one supplier, combined with China’s entry to the WTO and major technological advances, created hugely disinflationary forces over the past thirty years. This was fantastic for bonds, and even better for equities. It is plausible that the COVID pandemic has bookended this unique period in financial market history, with Putin’s recent act of aggression acting as an accelerant.

De-globalisation (or localisation), autocracy, the sourcing and hoarding of commodities, duplication of supply chains, and a surge in military spending look set to gather pace in the coming months and years ahead. The consequence is likely to be a more unstable, volatile world, with inflation moving up to a higher plateau, which could mean bad news for bonds and a more difficult environment for equities. At TEAM, we feel that we are positioned for this new world.

Asset Allocation & Positioning Summary

TEAM enters the 3rd quarter of 2022 with much the same message as we welcomed in the new year; our expectation following a blockbuster return for risk assets in 2020 and 2021 ahead of a US mid- term election year was for more difficult conditions, particularly in the first half. We continue to advocate a relatively conservative posture in terms of equity risk, with a focus on playing ‘good defence’ rather than blindly chasing riskier pockets of the market.

Our key model positioning calls heading into July are;

Strong underweight to fixed interest. We retain a zero (0%) position in conventional bonds, a stance we have held for 18 months on the premise that soaring global inflation would prompt financial tightening from central banks, leading to sharply rising yields and lower prices (bond prices and yields are inversely related).

That has certainly played out, with the US Treasury market posting the weakest start to a year since 1788 (source: Deutsche Bank). Eurozone and UK sovereign bonds also recorded their worst first half year start to a year in several decades. Given the magnitude of the falls, selective pockets of the sovereign and investment grade space are now beginning to look attractive and a policy change is under review.

Underweight equity risk. Global large-cap, global technology, and global small cap equities are our preferred areas of exposure, principally as medium-term price trends have improved. We have also added a little more risk this month (global technology, global small cap equity, Asia equity).

Healthy exposure to real assets. We have scaled back these assets more recently, given the deterioration in medium term price trends and as diversification benefits in certain assets have evaporated. Physical gold and commodities (ex-gold) are our preferred holdings.

Strong overweight to equity hedge/diversifiers and alternative income streams. This includes, a) absolute-return strategies that offer uncorrelated return streams, have an established market edge, and act as an effective equity hedge/bond proxy during downdrafts for risk assets, and b) alternative income streams, securities that exhibit conventional bond characteristics, namely an attractive and sustainable yield and less-than-equity market volatility. Examples include renewables infrastructure assets and music royalty streams.

TEAM’s flexible investment framework, underpinned by a diverse asset allocation universe and the ability to tactically allocate, continues to serve our clients well. Our approach has delivered very respectable risk-adjusted returns during what can be described as a ‘robust’ stress-test of our portfolios so far in 2022. We anticipate taking advantage of further opportunities over the coming quarters.