Whistling Past the Graveyard

The terms ‘’transitory’’ and ‘’structural’’ have made their way seamlessly into the financial lexicon during 2021 to describe the prevailing inflationary environment. Few market participants or observers are sitting on the fence on this issue. First, because each side can put forward compelling arguments to substantiate their position. Second, because the path that inflation ultimately takes is likely to shape the road ahead for asset prices.

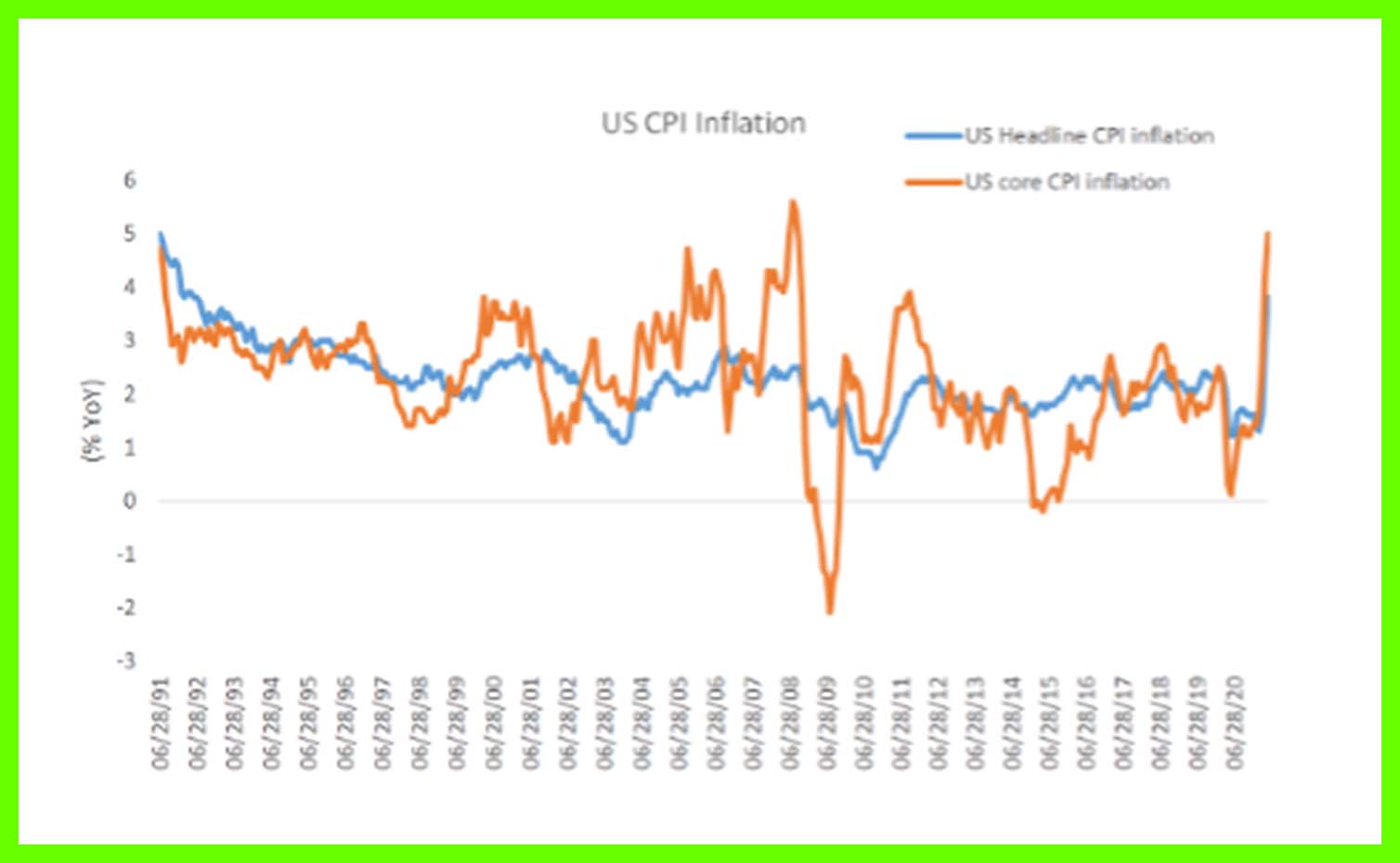

Against that background, a brief review of where we stand. Last week’s Consumer Price Index (CPI) reading in the US was a doozy. Headline CPI inflation rose from +2.6% YoY in March to +5.0% in May, while core CPI inflation (the change in price of goods and services excluding food and energy) rose from +1.6% YoY to 3.8% YoY over the same period. For context, these are the highest readings since August 2008 and June 1992 according to the US Bureau of Labor Statistics (see chart 1 below):

Chart 1

(Source: FactSet)

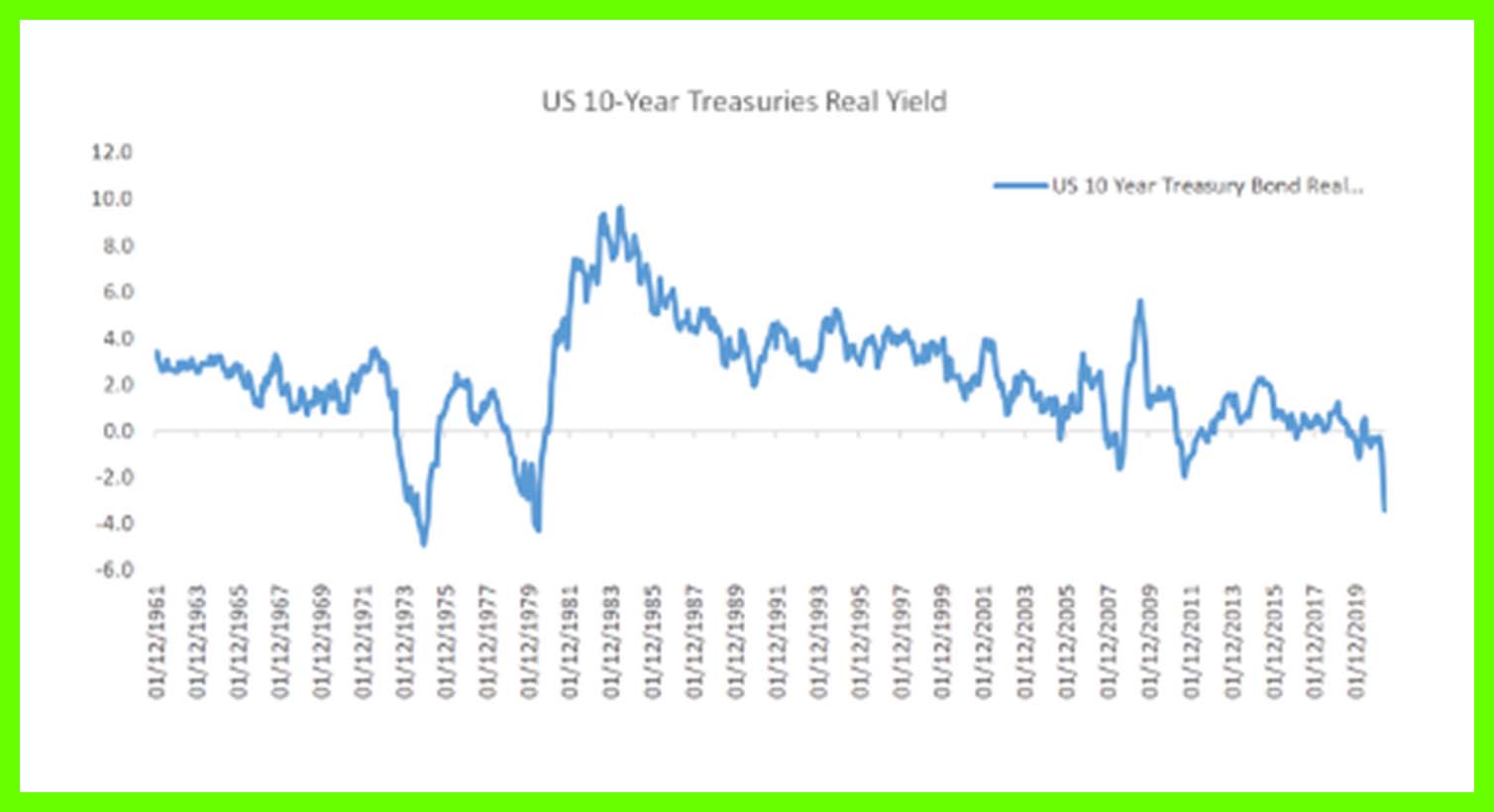

The immediate impact on real long-term US interest rates, which we can define as the 10-year Treasury yield minus the headline inflation rate, was even more dramatic (Chart 2 below). We included this chart several months back in a commodities-focused piece and update it now to include last week’s price action. At readings of approximately minus 3.5% over the past few trading days, real yields have never been lower since 1950, save for the Great Inflation period of the 1970’s and early 1980’s:

Chart 2

(Source: Bloomberg)

Whilst the inflation figures surprised to the upside, the bigger surprise was the calm, almost nonchalant reaction from asset prices. Equity markets, broadly speaking, tend to view inflation a lot like porridge: not too hot, not too cold, but somewhere in the middle is preferred. For much of the past 40 years, that wish has been granted. The three D’s, namely debt, deflation and demographics have combined powerfully to supress inflation, handing the baton to growth as the main factor in determining the relative price movements of stocks and bonds.

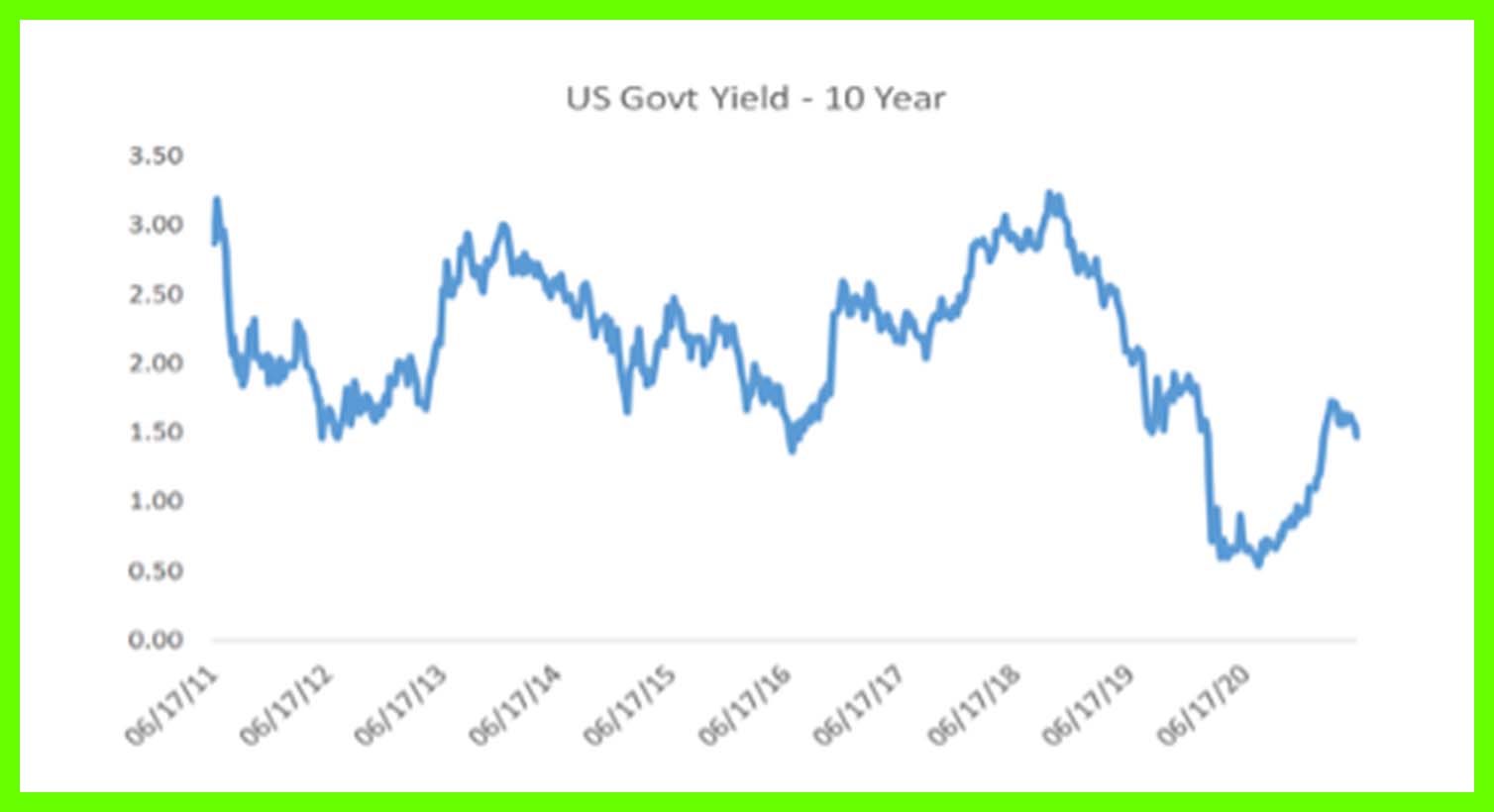

In that context, the latest June 9 headline CPI print might have been expected to be a significantly negative event, reinforcing the case for ‘structural’ inflation. In absolute and relative terms, and, more importantly, relative to expectations, the print exceeded aggregate forecasts. And yet, despite CPI touching 5% for the first time since the oil spike of 2008, the S&P Index rose to a fresh all-time high, whilst the Nasdaq reconquered 14,000 again. Moreover, the 10-year US Treasury yield, after initially spiking to 1.52%, reversed sharply to close at 1.44%, some 30 basis points lower than the March 2021 cycle high (chart 3 below):

Chart 3

(Source: FactSet)

In the context of our internal debates this year, TEAM have broadly been aligned with this outcome. At the beginning of 2021 we were under no illusion that, with pockets of the world reopening against a backdrop of chronic global supply chain shortages, sharp price rises were imminent – and to be expected. Semiconductor chips, lumber, oil, the car rental market, beef and tomato ketchup are examples of selective goods and services that have occupied headlines after witnessing explosive price rises during the first half of the year.

What dissuaded us from moving meaningfully to the ‘structural’ side at the time was the nature of CPI composition, which was playing havoc with CPI readings. Second, at the time, we were yet to observe a material shift in inflation expectations.

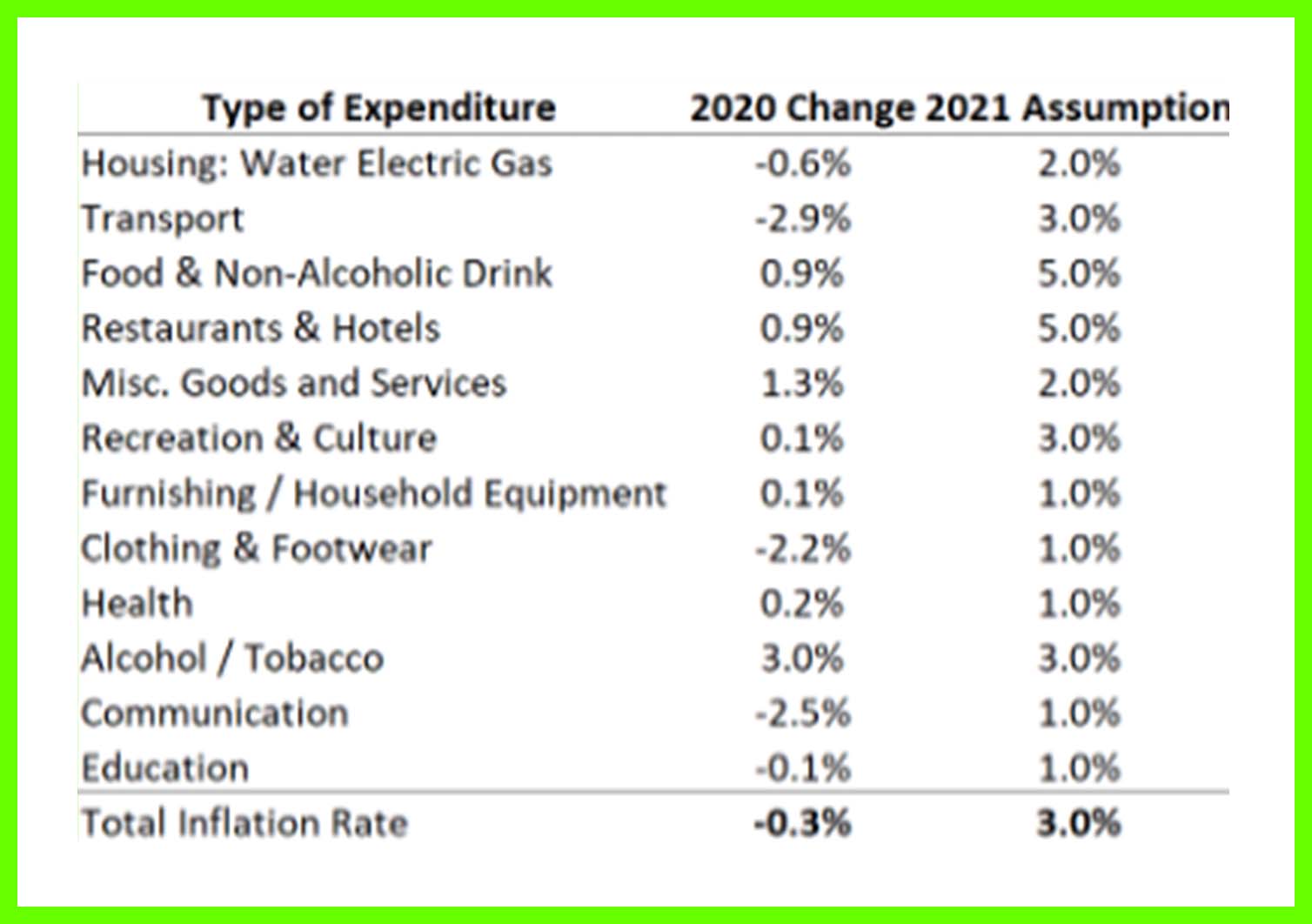

TEAM conducted a granular analysis of the underlying constituents of CPI in both the Eurozone and the U.S back in January, focusing on constituent weightings, inflation readings at the time and the potential delta of each component part to re-opening effects. Even back in December 2020, the dispersion across sub-components of the inflation index was striking. In Europe, Housing, Water, Electric & Gas, the largest individual sector component at 16.1% weighting, was experiencing deflation (a reading of -0.60%), whilst Alcohol & Tobacco, representing 4% of the index, was running at +3% (source: Eurostat).

Plugging in a host of aggressive individual component assumptions, particularly for sectors with acute sensitivity to economic re-opening such as Hotels, Restaurant and Leisure (HRL) for 2021, we arrived at a full year forecast of 3.0% for Eurozone CPI (see Table 1 below). The same exercise was undertaken for the U.S, with similar outcomes. Caveat: the figures are an average estimate, and, as one might expect, were produced with a wide confidence interval.

Table 1

(Source: TEAM Asset Management)

The bottom line is that whilst we felt there was scope for an inflation scare during 2021, our sense was that a global inflationary panic was unlikely. The latest Eurozone May CPI reading came in at 2.0% YoY, with Core CPI running at 0.9% YoY.

Turning to the topic of inflation expectations, we agree with Warren Pies at 3Fourteen Research that ‘’inflation is always and everywhere a psychological phenomenon.” Data crunching can take us so far, but true inflation episodes have invariably been accompanied by a shift in group psychology. On this point, Federal Reserve Vice Chairman Richard Clarida has indicated that the Fed will be guided by market-driven inflation expectations and by surveys of inflation expectations which should be monitored carefully.

The dilemma that we see today is that both sets of data are pointing to sharper and more persistent inflationary pressures.

Shown below in chart 4 is the Federal Reserve’s preferred longer term inflation metric, the 5-year, 5-year forward inflation expectations rate, which measures the expected inflation rate over the five-year period that begins five years from now. Forward looking inflation expectations have risen sharply from the covid-induced low of 0.86% on March 19 2020 to touch 2.38% on May 11 2021, the highest level since October 2014. The measure currently sits at 2.28%, some 10 basis points below the current cycle high:

Chart 4

(Source: FactSet)

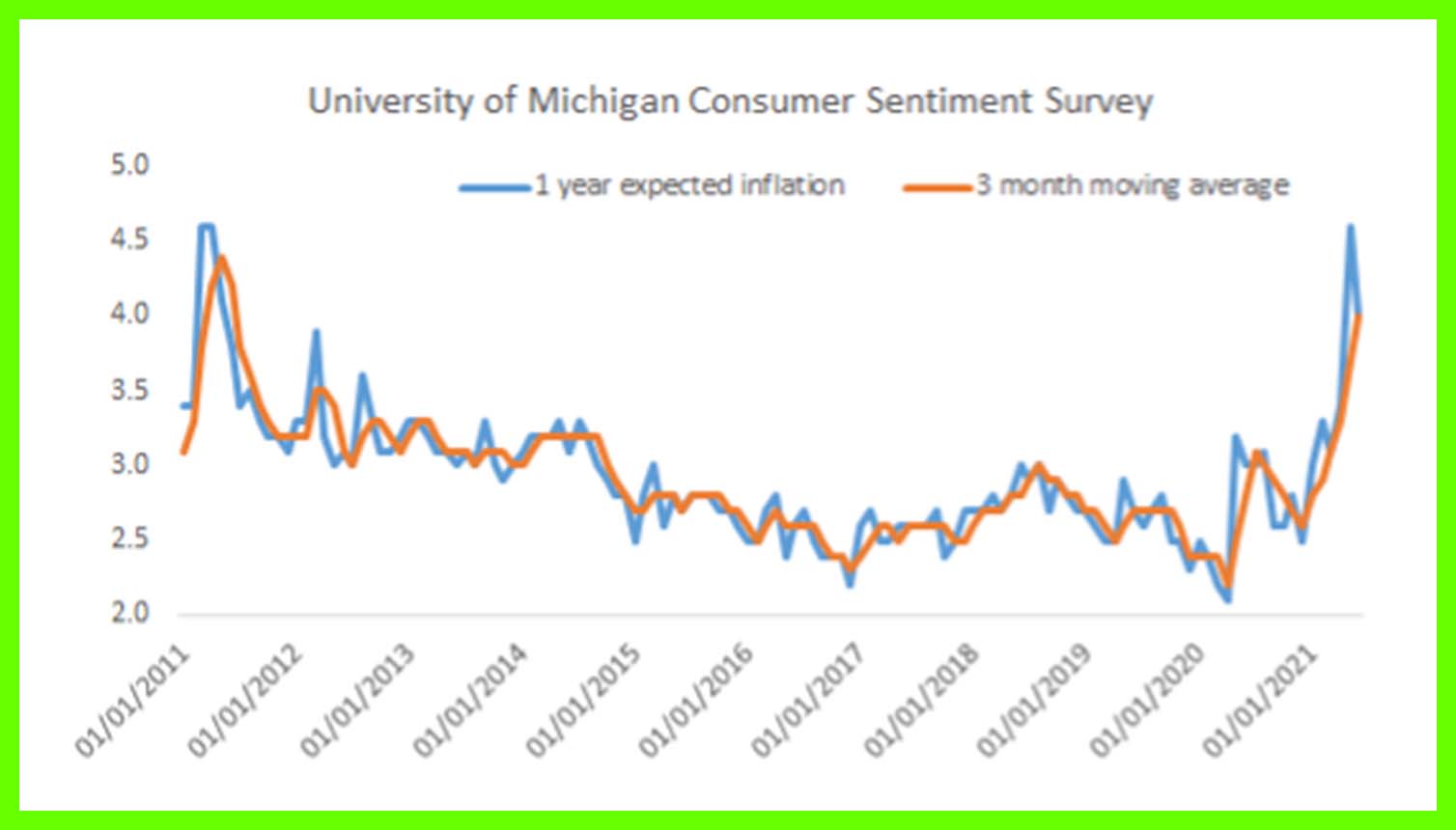

Non-market driven surveys of inflation expectations are also sending the same signal of rising inflation concerns. Consider, for example, the University of Michigan’s consumer sentiment survey.

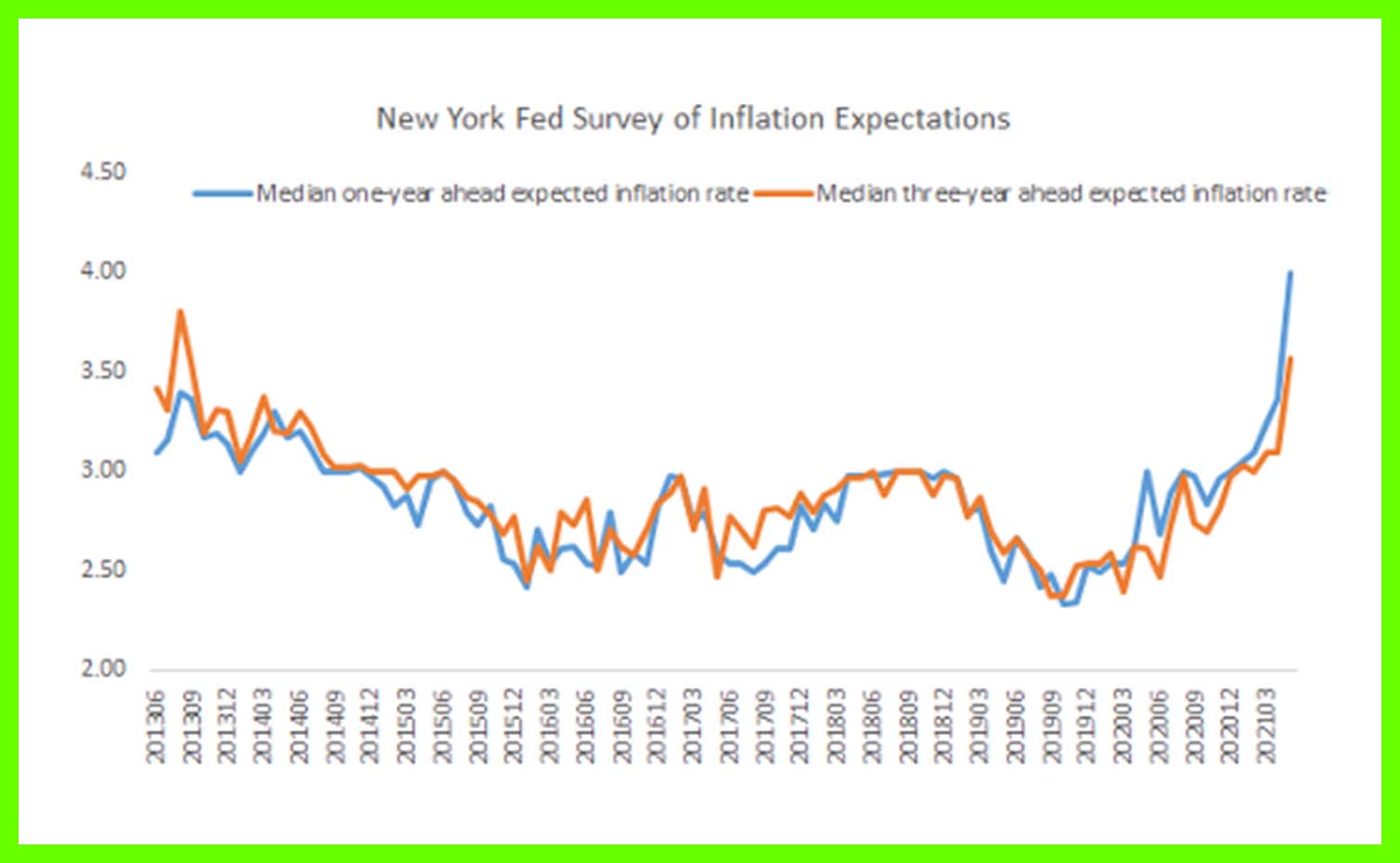

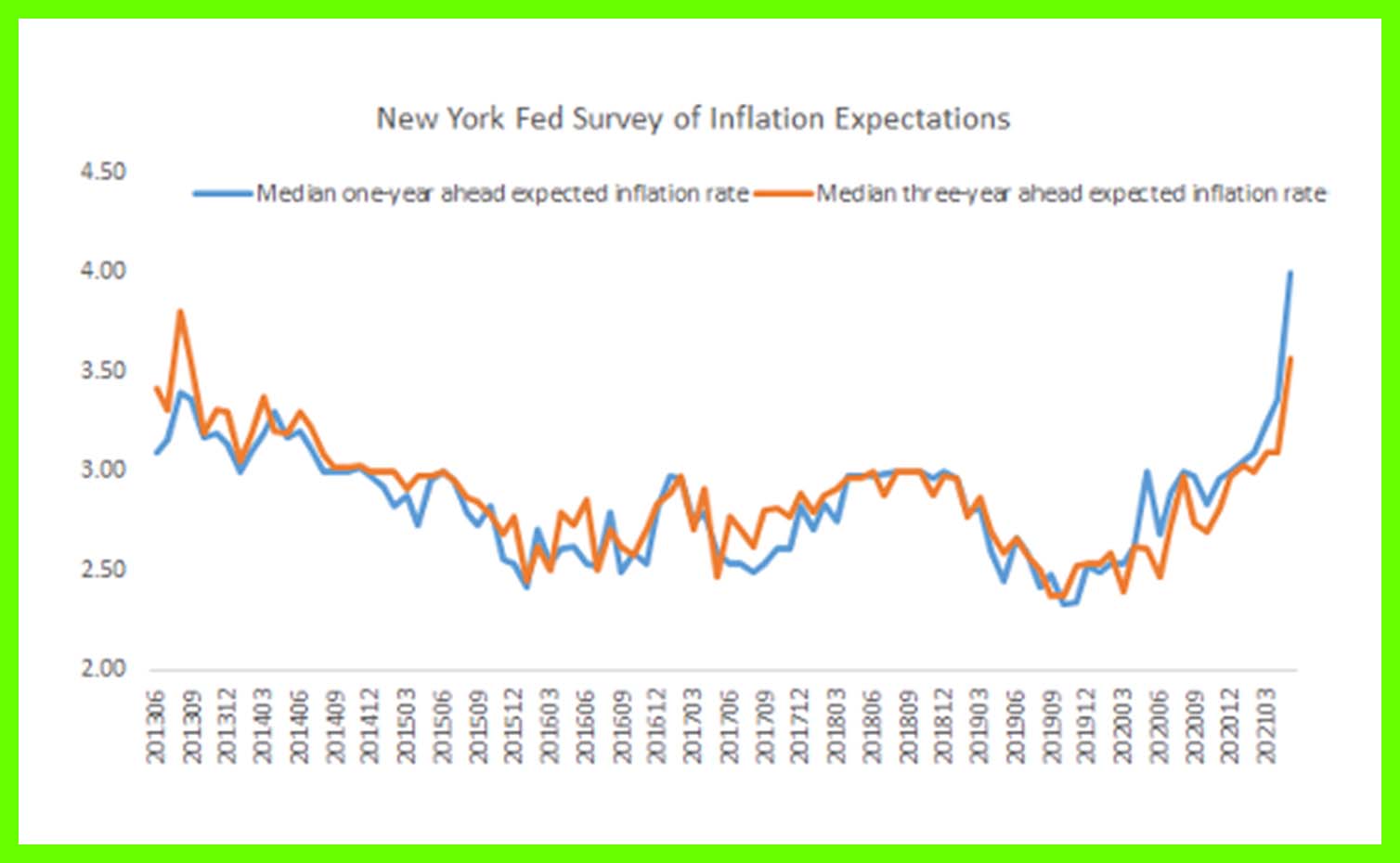

The latest June 2021 survey shows that one-year mean inflation expectations are currently 4%, whilst the three-month moving average (included to filter out short-term noise) also rose to 4%, the highest level since June 2011 (chart 5). Similarly, the New York Fed’s latest Survey of Consumer Expectations showed median year-ahead inflation expectations surging from 3.4% in May to 4.0% in June, breaking through levels last seen in September 2013 (chart 6).

Chart 5

(Source: www.sca.isr.umich.edu/charts)

Chart 6

(Source: Bloomberg, www.newyorkfed.org)

So, where do we stand? On the face of it, bond and equity markets appear relaxed about short-term inflation pressures, interpreting the Fed’s recent pivot towards employment data, notably the targeting of ‘full and inclusive’ employment, as a signal that we need not worry; consistent rhetoric from Fed members suggested an inflation overshoot is expected and, moreover, can be accommodated. On the topic of employment, the US labour participation rate declined marginally from 61.7% in April to 61.6% in May. This remains 1.8% below the pre-Covid high of 63.4% reached in January 2020 (chart 7 below), suggesting that considerable slack remains:

Chart 7

(Source: FactSet)

It is highly probable that the continuing success of the vaccine rollout paves a route towards full economic re-opening across the US over the coming weeks and months. This coincides with the expiration of supplementary weekly benefits of US$ 300 a week, with some 4 million Americans scheduled to lose enhanced federal unemployment coverage before mid-July. Last weekend, Alaska, Iowa, Mississippi and Missouri terminated the US$ 300-a-week benefit program, and several more states, including Idaho and New Hampshire, are slated to pull out of pandemic-related unemployment programs on June 19.

Whilst we do not possess the ability to look around corners, we are hazarding a guess that, sufficiently incentivised to return to gainful employment, that outcome is precisely what will happen. Logically, job growth should accelerate, which is presumably the reason we witnessed a sharp acceleration in the job growth numbers from 278,000 to 559,000 between April and May. This will spill-over into a labour market that is already struggling with a profound mismatch between job vacancies and unemployment. Under these conditions, upside wage pressure is more than a likely outcome.

Against this backdrop, Americans will now be able to (re)purchase a whole range of consumer goods and services in addition to experiencing social activities and events for the first time in over a year. And, broadly speaking, households are a lot wealthier now than when they entered the pandemic. Based on data from the Economic Bureau of Research, US households have now received $US 1.9 trillion more in transfer payments than pre-covid levels, set against US$366 billion lost in personal income in the 14 months since the arrival of Covid and related lockdowns. The US personal savings level currently stands at a little over US$ 2.8 trillion (chart 8):

Chart 8

(Source: FactSet)

That is a huge amount of aggregate demand waiting to be unleashed, particularly into pockets of the economy that are already facing chronic supply bottlenecks.

The bottom line is that, despite continued reassurances from the Federal Reserve over the ‘transitory’ nature of inflation, a growing body of evidence continues to point towards an economic overheating in the latter half of 2021. On the topic of inflation, we at TEAM are whistling past the graveyard. Mr. Powell, are you?