Quarterly Investment Review & Outlook

TEAM Investment Review & Outlook 4th Quarter 2022

Major Asset Class Returns for 2022, local currency terms

Global Equity Sector Returns for 2022, local currency terms.

(Source: Bloomberg)

Investment Review & Outlook 4th Quarter 2022

Whipsaw

‘Whipsaw’ describes the movement of a security when, at a particular time, the security’s price is moving in one direction but then quickly pivots to move in the opposite direction. The origin of the term ‘whipsaw’ is derived from the push and pull action of lumberjacks when cutting wood with a saw of the same name (Investopedia).

The fourth quarter largely mirrored price action witnessed throughout the year. Rallies in asset price triggered by expectations of a pause, or potential reversal, in the path of interest rate rises, proved short-lived, as central bankers poured water on the fire by adopting more aggressive rhetoric regarding monetary tightening. The result was extremely choppy price action, with a downside bias.

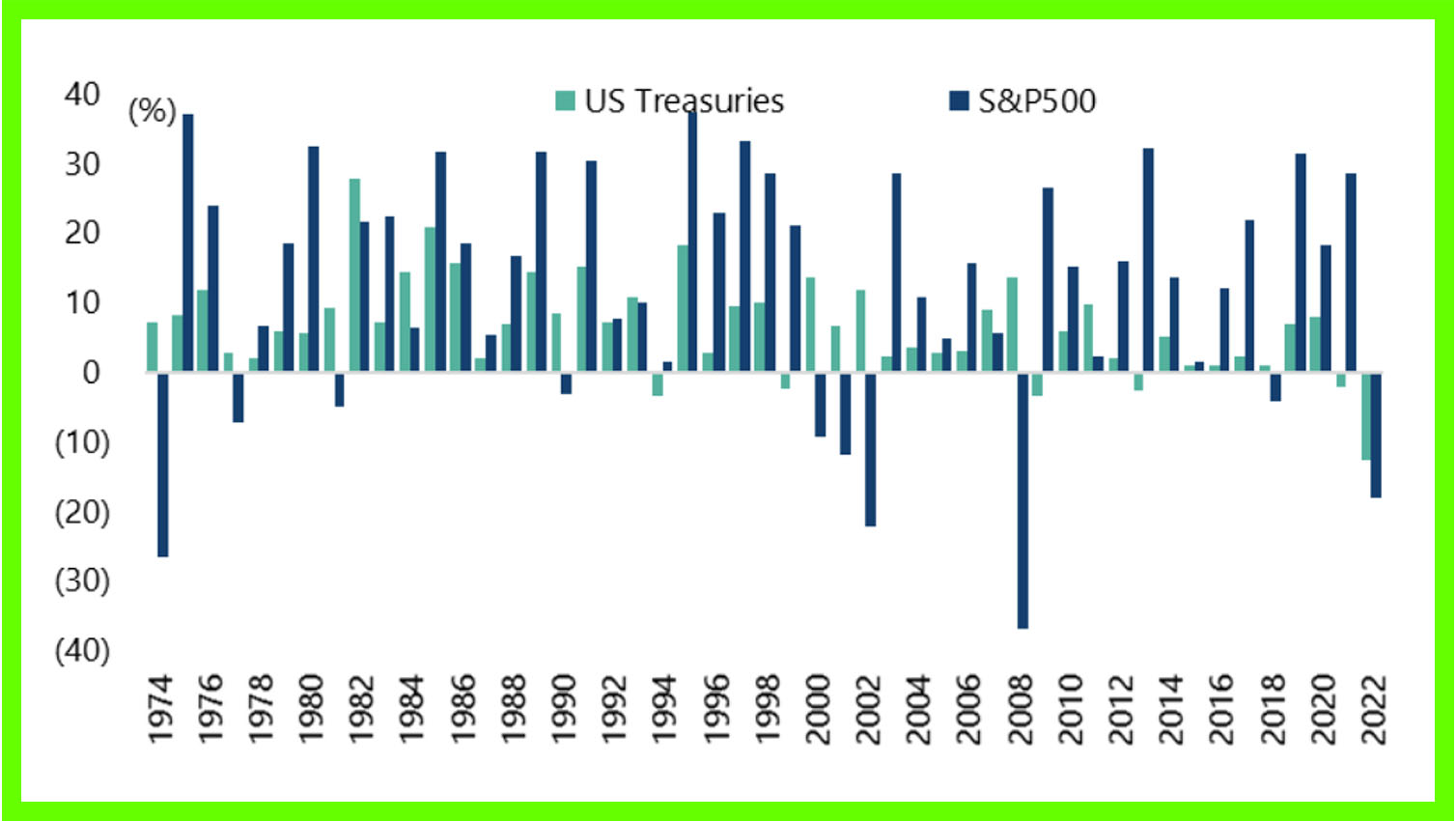

December capped a miserable year for most investors, with equities and government bonds both declining in price on an annual basis for the first time in over 50 years:

(Source: Bloomberg, Jefferies)

2022 was characterised by three key themes:

- escalating geopolitical risk, led by Russia’s invasion of Ukraine, and a ratcheting up of tensions between China and Taiwan.

- aggressive interest rate rises by central banks in their battle to tame runaway inflation, as labour markets tightened sharply (the US, for example, created an estimated 4.5 million jobs in 2022) and global supply chain constraints proved to be a more permanent fixture than anticipated, and

- China’s extraordinary zero-COVID policy approach, which effectively locked down large parts of the economy for most of the year.

Clear & Present Danger

Heading into 2023, themes 1 and 2 remain a concern for investors.

Geopolitical Risks

There are no imminent signs of a ceasefire in Ukraine, with Putin clear that he is prepared for a long confrontation despite grievous human casualties and the loss of vast amounts of Russian modern military equipment and stockpiles. Flush with cash from rising energy prices, and with fresh rounds of mobilizations likely in the first half of this year, renewed efforts from the Kremlin will likely be countered by more of the same: a resilient and professional Ukraine army, and the continuation of Western aid to Ukraine. A swift resolution is difficult to envisage.

Meanwhile, rumblings in the Taiwan Straits continued following U.S House Speaker Nancy Pelosi’s decision to explicitly defy China’s warnings during her visit to Taiwan in August, triggering ‘war games’ shortly after her departure. China’s military fired missiles over the island, sailed warships across the Taiwan Strait and surrounded the island escalating tensions to their most fractious in thirty years. Taiwan has continued to bolster its defences, whilst extending compulsory military service. With anti-China sentiment continuing to build in the United States, along with pledged support for Taiwan, renewed sabre-rattling is a realistic prospect this year.

Hawkish Fed

Having steadfastly adopted a ludicrous ‘transitory’ position on inflation throughout 2021 in the face of mounting evidence from its own models to the contrary, central banks have been scurrying to restore their institutional credibility. Alarmed by the breadth and magnitude of inflationary pressures, the Federal Reserve (the ‘Fed’), European Central Bank (‘ECB’) and Bank of England (‘BoE’) have raised rates much more aggressively than expected, with the Fed raising rates by 425 basis points across seven meetings.

Against this backdrop, the economic outlook for the year ahead currently appears bleak. Interest rate hikes act with a lag, and the full force of a shift towards monetary tightening is likely to be felt throughout this year. Futures markets are currently pricing in the BoE increasing the benchmark interest rate to 4.5% by the summer, the ECB to increase to 3.4% and for the Fed to get to 5% earlier in the year:

(Source: Bloomberg, TEAM)

Recessions in the UK and Eurozone seem inevitable, and the US economy is also likely to contract in 2023.

The US government bond yield curve has already inverted, with the 10-year Treasury bond yield declining below the federal funds rate. Investors typically expect to be rewarded with higher yields for investing their money for longer periods of time. When the curve ‘inverts’, i.e., when interest paid on shorter term US government bonds exceeds the interest on longer-term bonds, it suggests that the market is becoming more pessimistic about near-term economic prospects. Such events have served as a relatively reliable recession indicator in the modern era.

China’s U-Turn

Key news arrived from China in the fourth quarter, where President Xi Jinping’s COVID suppression policy was dismantled by the highly contagious Omicron variant. A loss of control over the spread of the virus at source by authorities, combined with collateral damage sustained to the Chinese economy since the outset of the pandemic, were enough to trigger a dramatic, albeit relatively low-key, U-turn from Beijing.

The National Health Commission (NHC) made two key announcements in December. The first was the relaxation of mandatory mass testing via a scrapping of the national Covid-tracking app. The second was a renaming of the Chinese term for COVID-19 from ‘novel coronavirus pneumonia’ to ‘novel coronavirus infection’, official acknowledgement that the disease has been downgraded. Commencing 8 January 2023, China will not impose quarantine or other disease control measures on inbound travellers and/or imported goods.

The timing of these measures followed the largest and most widespread demonstration of public anger towards the Chinese Communist Party (‘CCP’) since the Tiananmen Protests in 1989. It was accompanied by an extensive central government policy package to support China’s fragile property sector and should enable market participants to focus on the positive development that a carefully managed ‘COVID easing’ will, in time, trigger a de facto full reopening of the economy.

Outlook: A Glimmer of Hope?

Looking forward, three interlinked risks, and potential catalysts, are likely to determine the future path of asset prices in 2023:

- A Fed pause, or pivot

- The depth of a US recession

- Prospects for a sharp decline in corporate earnings

Recessions portend job losses. Companies including Amazon, Goldman Sachs and Twitter have already revealed plans to lay off thousands of workers. Those gainfully employed are also feeling the pinch from inflation and a surge in borrowing costs. Savings built up during the COVID lockdowns have been exhausted, and spending on discretionary consumer goods and services, including holidays and travel, eating out, entertainment and big-ticket items will be lower in aggregate.

This will negatively impact corporate earnings. Many companies will have less flexibility and pricing power to pass on higher input costs, putting downside pressure on margins. With January upon us, publicly listed companies are about to commence the publication of earnings that will include both the fourth quarter and full-year 2022 results. Forward guidance for the remainder of 2023, and the associated demand and supply trends that companies are experiencing, will be very closely watched.

Scepticism regarding aggregate earnings estimates is prevalent, with many sell-side strategists forecasting a full-year earnings contraction of between -10% and -20%. With that said, we must acknowledge that markets are forward-looking, and the level of wealth destruction experienced last year should already reflect prospects of a recessionary outcome. The blue-chip S&P 500 large-cap index fell -19% in 2022, bringing down its price-to-earnings ratio from 26x at the beginning of 2022 to 18x.

US valuations are certainly cheaper than they have been, albeit not screamingly cheap from a historical perspective.

At the same time, it is difficult to foresee a meaningful recovery in risk appetite and a sustained rally in asset prices until there is more visibility on when central banks will cease hiking rates. Peering back at history, the Federal Reserve’s mid-December 2022 50 basis-point hike should be the last of this cycle. In every previous case where the 2-year US Treasury yield crosses below the Federal Funds Rate (the current scenario), the Fed has paused, or cut, rates in the year following.

However, the issue for investors regarding this current cycle is an emboldened Fed Chairman Powell, who has signalled his desire to keep the pedal to the metal and maintain course in efforts to achieve broad price stability. In addition, the current macro backdrop does not resemble the typical ‘pause’ environment.

Excluding 1978, the headline US Consumer Price Index (CPI) and American average hourly earnings are growing faster than at the time of any other pause, whilst unemployment remains at historical lows.

Conversely, economic data including manufacturing data, leading economic indicators, consumer confidence surveys and the yield curve are all at trough levels consistent with a pause. Simply put, the economic data is screaming for a pivot, but the inflation data is not there yet.

Expect the Fed to remain outright hawkish through the first few months of 2023.

Forecasting

Whilst we prefer to shy away from predictions and forecasts for the most part, instead channelling our resources towards delivering resilient investment portfolios for our clients, we are prepared to venture that the sharp dislocation between equity and bond markets in 2022 might be suggestive of a more ominous, tectonic shift in the underlying financial market regime.

Globalisation, open trade, just-in-time supply chains and dependence on one supplier, combined with China’s entry to the WTO and major technological advances, created hugely disinflationary forces over the past thirty years. This was fantastic for bonds, and even better for equities. It is plausible that the COVID pandemic, and the extraordinary government response to it, has bookended this unique period in financial market history.

Balkanization, autocracy, the sourcing and hoarding of commodities amid efforts to secure energy supplies, duplication of supply chains, and a surge in military spending look set to gather pace in the coming months and years ahead.

The consequence is likely to be a more unstable, volatile world, with inflation moving up to a higher plateau, which could translate to a more difficult environment for equities and a need to access alternative revenue streams.

At TEAM, we feel that we are positioned for this new world.

Asset Allocation & Positioning Summary

TEAM enters the 1st quarter of 2023 with much the same message as we welcomed 2022; central bank activity, a critically important earnings season and geopolitical risks all have the capacity to destabilise markets, particularly in the first half of this year.

We continue to advocate a relatively conservative posture in terms of equity risk, with a focus on playing ‘good defence’ rather than blindly chasing riskier pockets of the market.

Equities

With central bank activity likely to keep asset prices rangebound, our preference is to invest in quality companies with strong balance sheets and superior pricing power in their sector that generate consistent, dependable cash flow. Many of these companies are found in traditionally lower beta sectors, such as healthcare and consumer staples. Activity by the Fed that points to a pause or pivot in hikes in due course should provide a rotation opportunity into longer duration, higher growth stocks.

Emerging market (EM) equities have underperformed developed markets for two straight years on the back of the surging US dollar, China’s zero-COVID policy and risk aversion across asset classes. However, the recent depreciation, of the dollar, China’s move towards a full re-opening, and a widening growth and earnings expectations gap over developed markets should provide tailwinds for a better year for EM.

From a regional perspective, we also have healthy exposure to both Japan and the UK which stand out in a valuation context, whilst also providing attractive yields. Shown below are the 12-month forward P/E ratios, with averages based on the prior 20 years:

(Source: FactSet, Goldman Sachs)

Fixed Interest

TARA (There Are Reasonable Alternatives) finally replaced TINA (There Is No Alternative) in 2022.

Having held close to zero conventional bond exposure for 16 months, we stepped in and bought high-quality sovereign and investment grade debt early in the fourth quarter of 2022 given the significant and swift repricing witnessed across the asset class.

We anticipate a rebound in bond markets as economic activity and inflation slow in 2023. Typically, slowing inflation and corporate earnings fuel strong bond returns, particularly at the shorter duration end of the spectrum. Government and investment grade corporate bond yields are the highest they have been in more than a decade and can regain their status as a haven asset in portfolios.

Our preference is to own selective, good quality investment grade corporate bonds which provide an attractive yield above government bonds. The average GBP investment grade corporate bond now yields 5.75% compared to just 2% at the start of last year.

Cash has returned as a viable strategic allocation, offering low-to-mid single digit, risk-free returns that have been unavailable to investors for years. We anticipate holding modest levels of cash throughout the year and get paid as we patiently sit and take advantage of attractive entry points in other assets.

Alternative assets

After years in the wilderness, macro is back, evidenced by selective hedge fund returns in 2022.

Absolute-return strategies that offer uncorrelated return streams, have an established market edge, and act as an effective equity hedge/bond proxy during downdrafts for risk assets are a sensible investment vis-à-vis bonds and equities in our view.

We also like ultra-short term cash funds that can assist in dampening portfolio volatility during periods of heightened stress in markets.

Real assets

Gold, gold miners and energy commodities were mainstays of TEAM’s real asset sleeve in 2023. We enter 2023 positioned for a repeat.

Top of the list of asset classes we will avoid is property. Higher borrowing costs and the squeeze on incomes will have a big impact on affordability and we expect to see a correction in house prices. The outlook for commercial property looks even more challenging. In addition to the headwinds of higher interest rates, a recession will claim many casualties, especially in cyclical sectors such as retail and hospitality, leaving more premises vacant.

TEAM’s flexible investment framework, underpinned by a diverse asset allocation universe and the ability to tactically allocate, has continued to serve our clients well. Our approach has delivered respectable risk-adjusted returns during what can be described as a ‘robust’ stress-test of our portfolios in 2022. We anticipate taking advantage of further opportunities over the coming quarters.