Quarterly Investment Review & Outlook

Investment Review 4th Quarter 2025 - Bulletproof

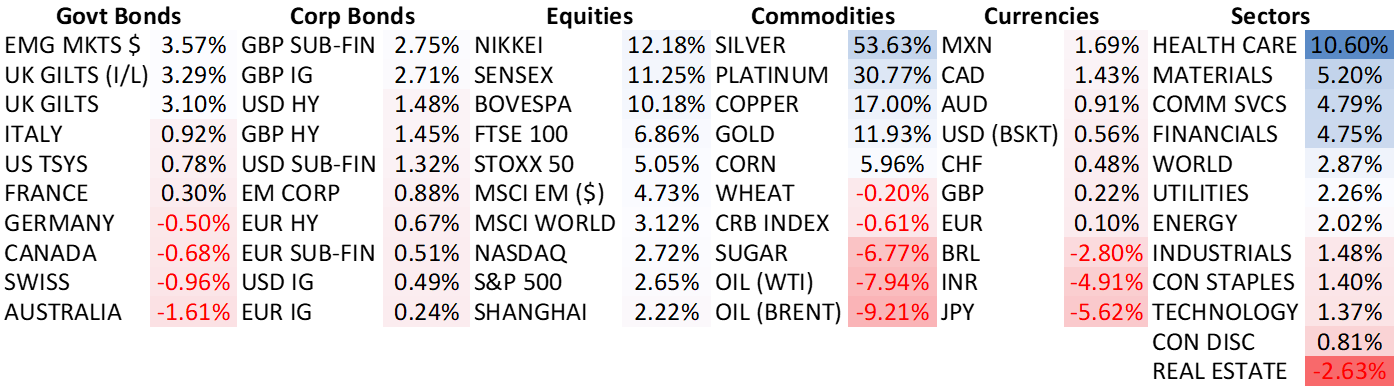

Major Asset Class Returns for 4th Quarter 2025, GBP (£) terms

The fourth quarter concluded a year characterised by remarkable stock market resilience in the face of significant macroeconomic fog. Investors already struggling with visibility amidst global tariff policy gyrations found themselves mired in a proverbial ‘pea souper’ as October commenced with an enforced US federal government shutdown.

The shutdown, involving most non-essential departments, impacting approximately 1.5 million workers, and involving the temporary suspension of key economic data releases including unemployment, inflation, and consumer spending trends, would last 43 days, the longest in American history. According to the Congressional Budget Office, the impact was an 11-billion-dollar permanent loss to the economy.

A glance at asset class price returns for the quarter would make the above scarcely believable. Such is the prevailing ebullient mood amongst investors that the shutdown was almost completely ignored.

Instead, America’s large cap bellwether S&P 500 index and the technology-laden Nasdaq index powered to fresh records, with each index posting more than 35 confirmed new all-time highs in 2025. Insatiable investor appetite for the Artificial Intelligence theme, a strong corporate earnings season, and optimism over breakthroughs relating to global trade all buoyed sentiment.

Don’t Fight the Fed

Markets are embracing the mantra ‘Don’t Fight the Fed’, a term purportedly coined by the late, great, investor Marty Zweig, in the 1970’s. The logic is that continued action taken by the Federal Reserve to lower interest rates and borrowing costs for government, consumers, and businesses, should stimulate economic activity and create a favourable investment climate for risk assets.

Risk assets wobbled briefly during early November as investors expressed concern that an economic data vacuum on account of the extended US federal government shutdown might push the Federal Reserve (‘The Fed’) to defer rate cuts despite signs of labour market cooling. At one point during the sell-off, the odds of a December rate cut had dropped to as low as 30%.

However, dovish comments from Federal Reserve Governor Christopher Waller and New York Fed President John Williams late in the month pointed to an open endorsement of further US interest rate cuts, reviving animal spirits. By the time of the Federal Open Market Committee meeting, betting markets had raised the prospect of a 25-basis point cut to 90%, and, at the meeting, the Fed duly obliged.

Growing AI Scepticism

An interesting development during the later part of the year has been evidence of growing selectivity regarding the US technology sector. Specifically, the market darlings of this post pandemic cycle, the Magnificent 7 (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, Tesla) began to show signs of fatigue in terms of share price performance relative to other US domestic sectors and international competitors.

Lofty valuations combined with increasing scepticism over the scale of planned AI-related capital expenditure (close to $500 billion in 2026 alone), how these AI capex plans are being financed (not just through operational cash flow anymore, but via debt financing and off-balance sheet accounting structures), and whether meaningful profits can ultimately be achieved for shareholders, all weighed on sentiment.

Conversely, international ex-US markets (developed and emerging) outperformed their US counterparts during the quarter, delivering positive absolute returns to cap a fine year. Relative valuation attractiveness continues to be a primary factor, whilst UK and European stocks were buoyed by improving earnings expectations and a perceived stabilisation in trade relations.

Equities: Scores on the Doors (all returns in sterling terms)

Developed market equities (represented by the MSCI World Equity Index) delivered a +3.1% total return over the 4th quarter. The S&P 500 large cap index and technology-laden Nasdaq Index, powered by mega cap growth stocks and all things AI, both delivered a +2.7% total return.

Japan’s Nikkei 225 Index finished the quarter ‘top of the pops’ with a return of +12.2%, fuelled by optimism over new Prime Minister Sanae Takaichi’s expansionary, pro-growth, policies. Alongside the ongoing corporate governance reform agenda which should be continued good news for international investors by way of shareholder buybacks and special dividends, domestic GDP growth is now running at an almost 4% growth rate over the past 5 years.

The MSCI Emerging Markets Index returned +4.7% over the quarter. An ‘AI second wave’ engulfed Asia in 2025, particularly South Korea and Taiwan, as investors pivoted away from the Magnificent 7 to international infrastructure and hardware providers.

China’s Shanghai Index finished the quarter with a +2.2% return, with the latest economic data serving as a reminder that the country remains firmly in deflation and that there is no sign yet of a recovery in consumption.

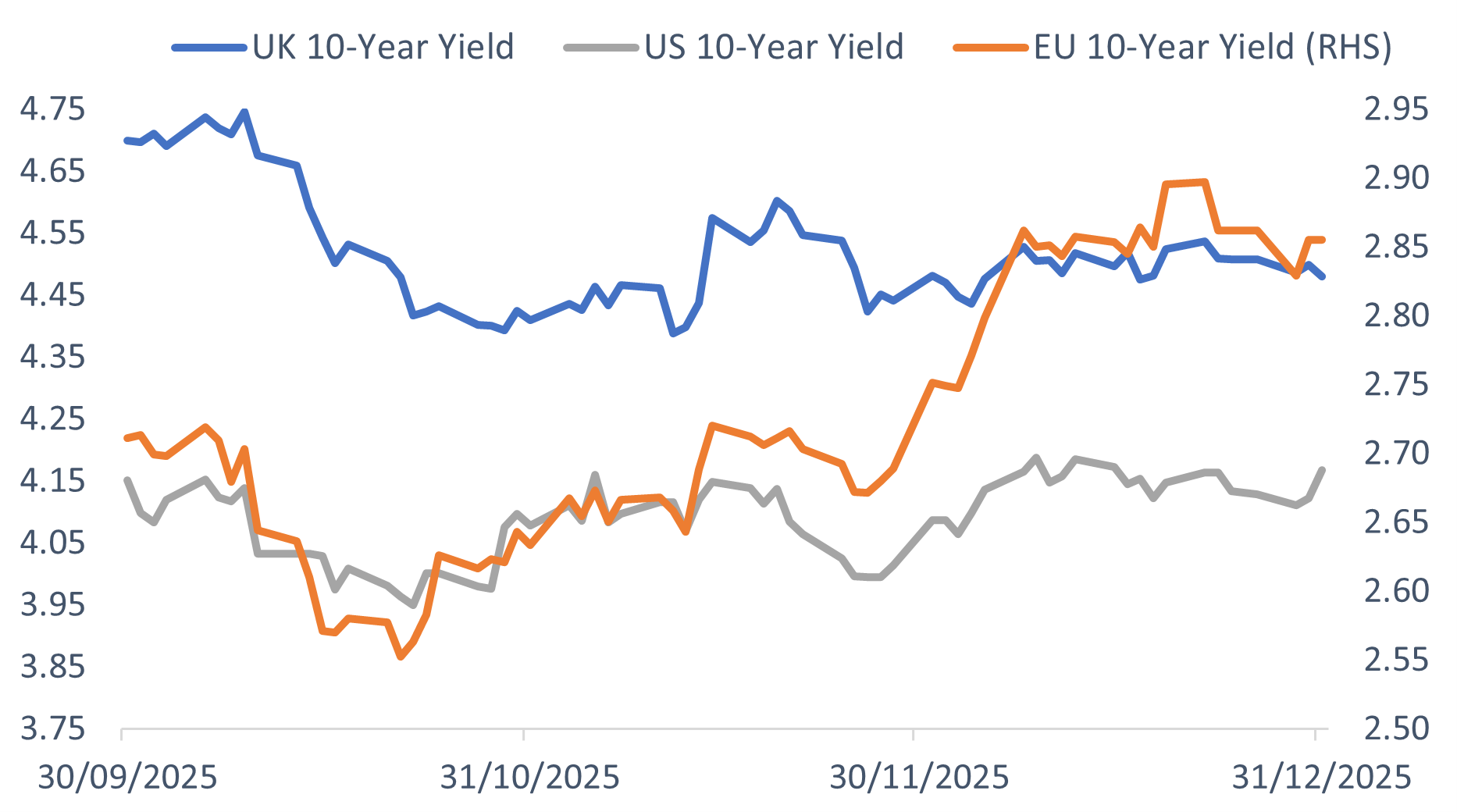

Fixed Interest

Government bonds ended a tumultuous year on the back foot with concerns over debt sustainability and upcoming bond supply under the spotlight. Support from central banks faded as the European Central Bank gave further signals that its rate cutting cycle is over, deep divisions at the Federal Reserve clouded its policy outlook, and a surge in Japanese bond yields triggered a global bond re-pricing.

Corporate bonds fared better, posting modestly positive returns with broadly stable credit spreads acting and more disciplined balance sheets acting as shock absorbers against the volatility in government debt markets.

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

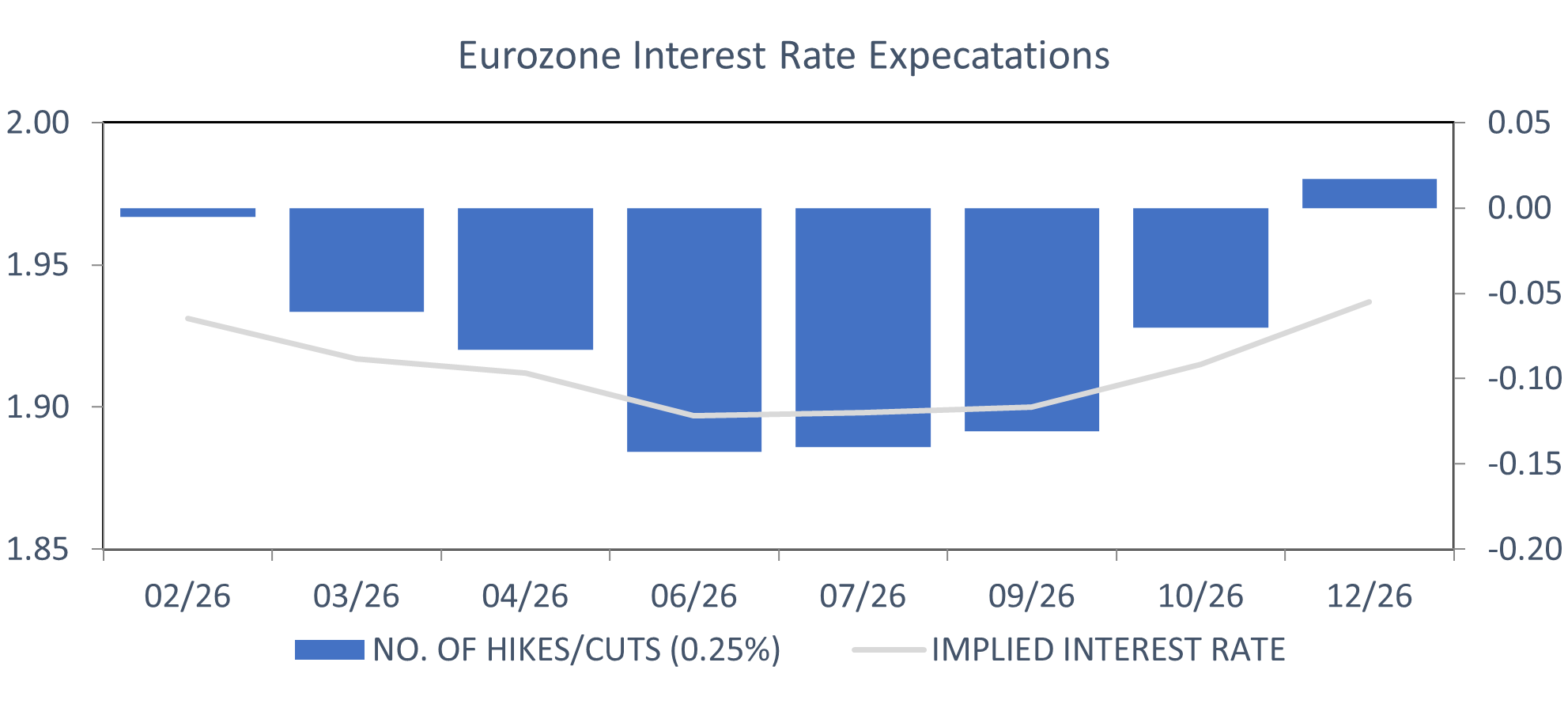

ECB

As expected, the European Central Bank left its deposit rate unchanged at 2% for the fourth consecutive meeting in December. Upbeat rhetoric from President Christine Lagarde, and other board members, suggest that the rate cutting cycle is now complete. Money market futures are pricing in little more than a 10% chance of any further cuts this year:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

In the press conference following the decision, Mme Lagarde highlighted the resilience of the Eurozone economy to external forces, particularly the tariffs blitz from the US, the greatest disruption of the international trade order since the second world war. Confident that domestic demand will be the ‘main engine of growth in the years ahead’, the bank upgraded its growth forecasts for the second time this year. It now expects the Eurozone economy to expand 1.4% this year, 1.2% next year, and 1.4% in 2027 and 2028.

Prior to the meeting, executive board member Isabel Schnabel had already given some hints to the brighter outlook amongst policymakers, describing risks to the economy and inflation as titled to the upside and against this backdrop, she is comfortable with market expectations that the next move by the ECB will ultimately be a rate hike.

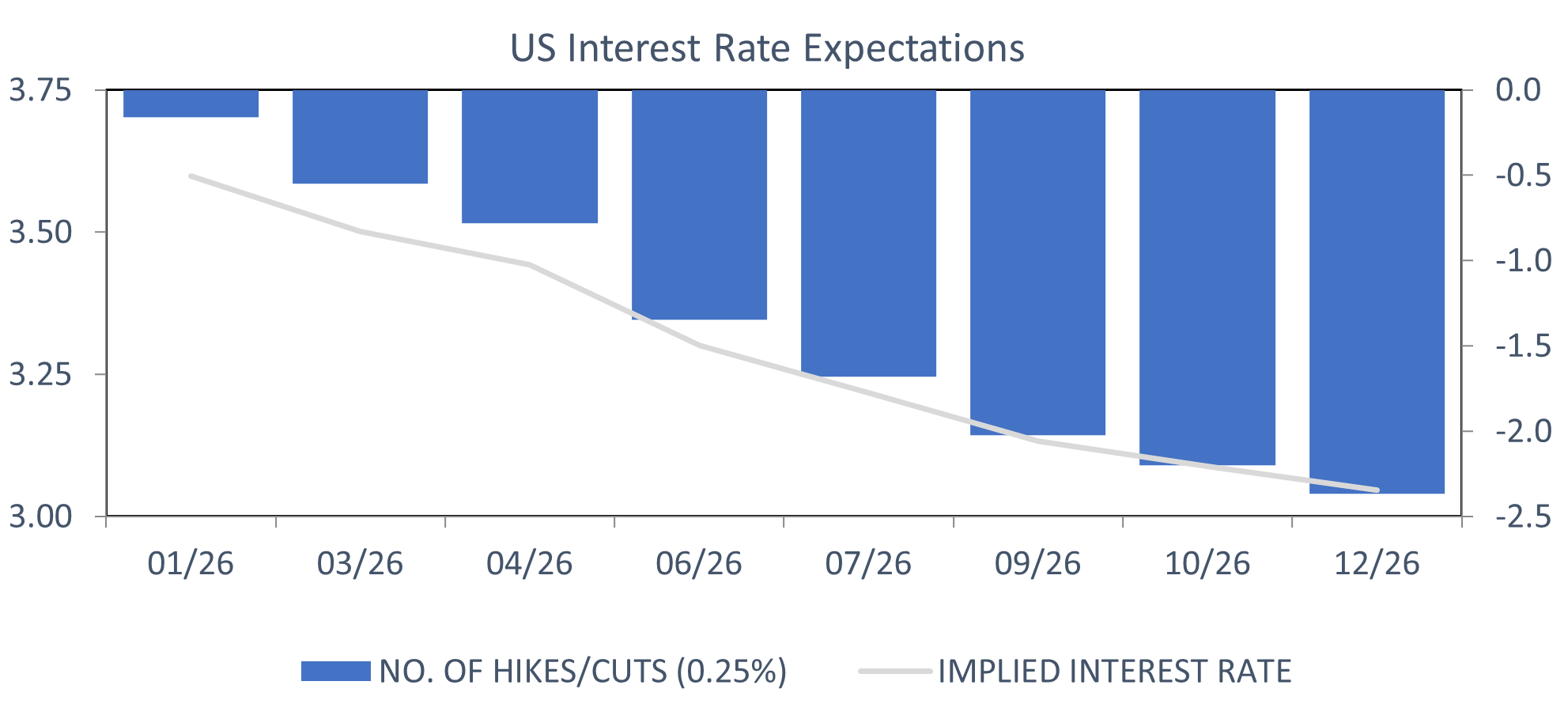

Federal Reserve

While there is clear visibility over the direction of monetary policy in Europe, across the Atlantic the outlook is murkier. The Federal Reserve cut interest rates by a quarter of a percentage point to a three-year low, but the meeting exposed deep fractures in the central bank over whether to prioritise a weakening jobs market or high inflation.

The internal views of voting members diverged sharply, with Trump ally Stephen Miran calling for a half point cut, and Austan Goolsbee (Chicago Fed) and Jeffrey Schmid (Kansas City) adamant on ‘no change’. The Donald weighed in following the decision, labelling Chairman Powell ‘a stiff’, whilst insisting the cut should have been ‘at least double’.

In addition to the split on the FOMC, the prospect of a new Fed chairman to replace the incumbent Jerome Powell when his term ends in May adds further uncertainty. Kevin Hassett, the director of the National Economic Council, is thought to be the preferred candidate of the president due to their close relationship, but he would likely be the most controversial and disruptive selection in the eyes of investors fearing further erosion of the Fed’s independence.

Following the acrimonious December meeting, money markets have pared back expectations of further rate cuts next year to just two, but it could change quickly depending on who succeeds Powell. The appointment is expected to be announced in the coming weeks:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

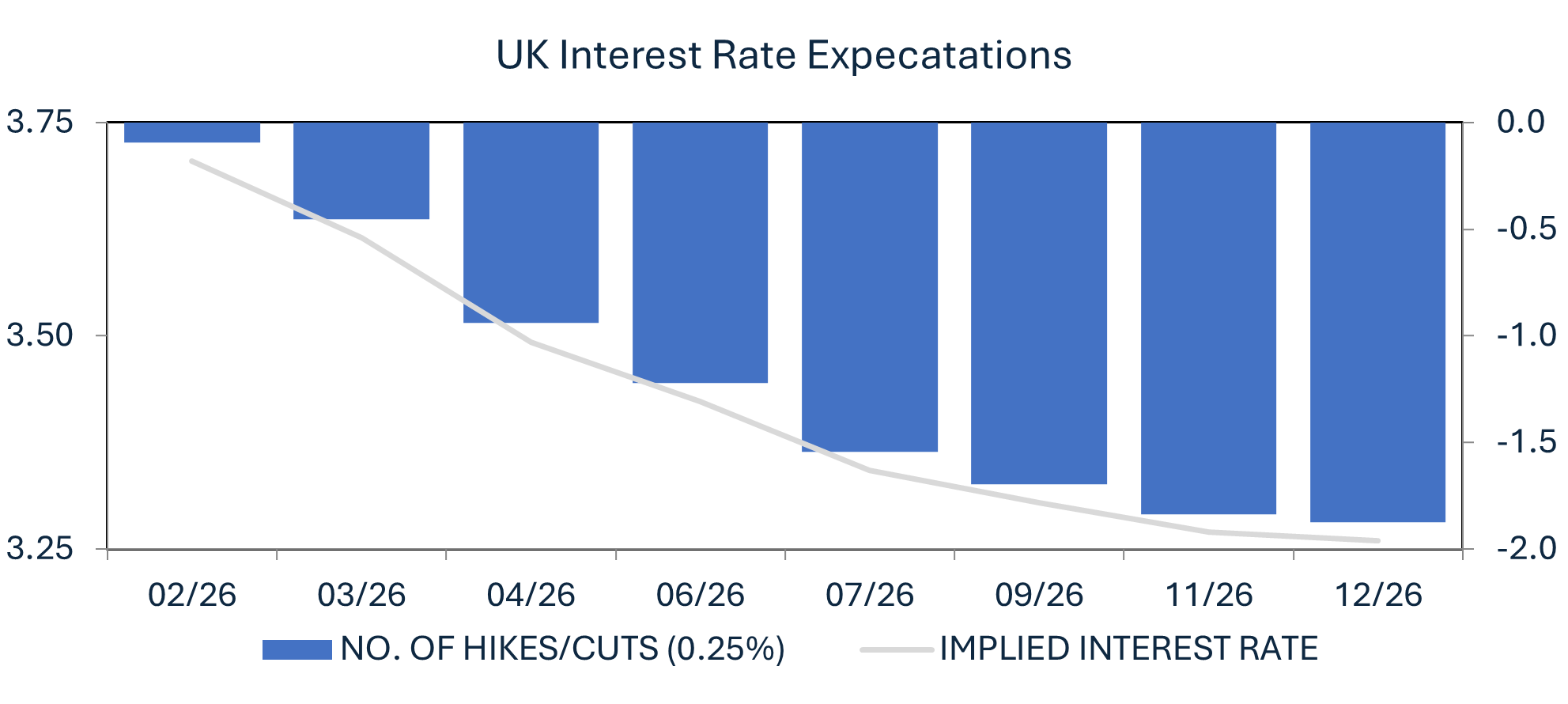

BOE

Closer to home, the Bank of England also cut its benchmark interest rate by a quarter point to 3.75% at the December Monetary Policy Meeting following a close 5-4 vote. The majority, including Governor Andrew Bailey who cast the deciding vote, argued that with peak inflation behind us, unemployment at a four year high, and a sluggish economy providing little to get excited about, further easing was necessary. The dissenters placed more emphasis on the possibility of ‘prolonged inflation persistence’, which may rear its ugly head over the coming twelve months:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

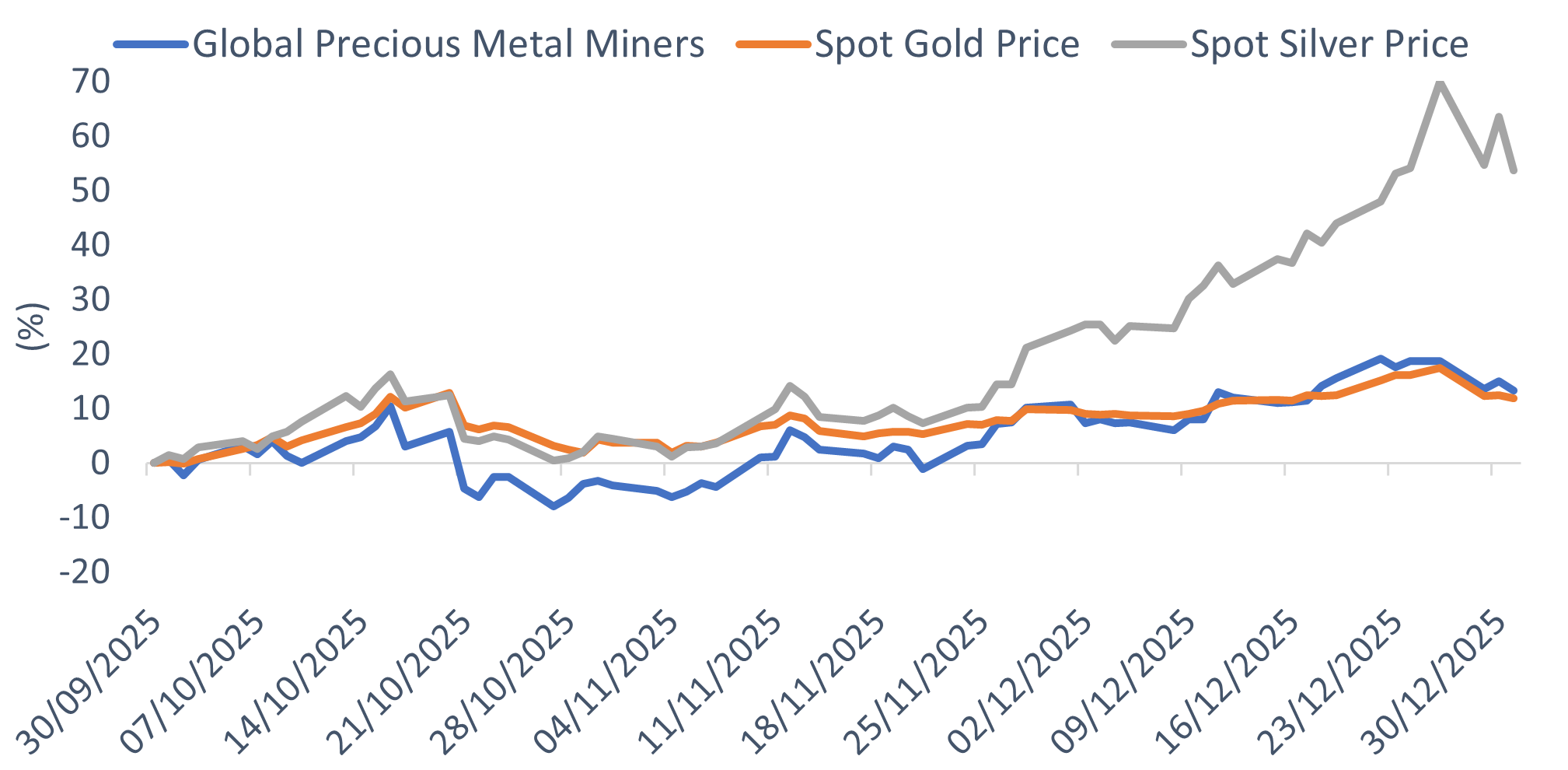

Commodities

Commodities once again stole the show, with physical gold and silver recording new all-time highs throughout the quarter as ongoing factors of geopolitical instability, currency debasement, and physical supply shortages kept a strong bid under prices. Silver returned 54%, gold returned 12%, and a basket of global mining sector stocks returning close to 13% over the three-month period:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

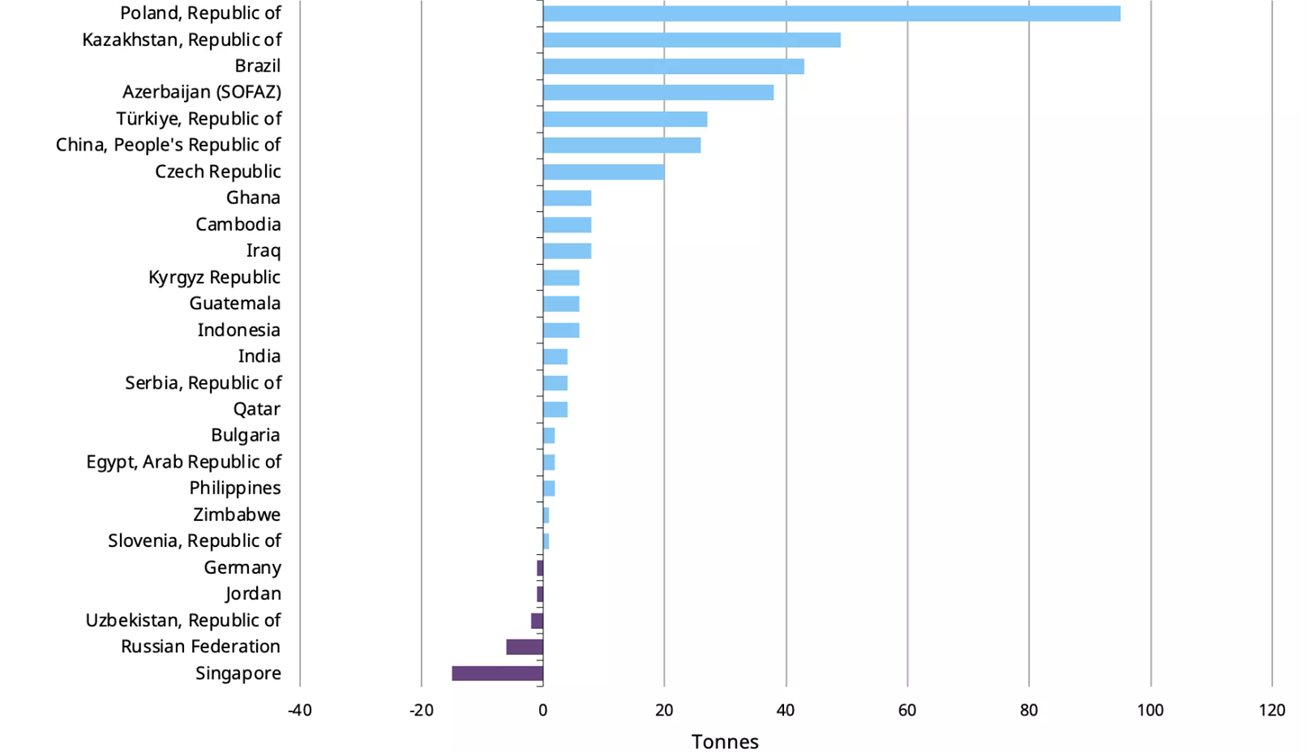

Global central banks have acted as the ‘marginal buyer’ for gold in this cycle, relentlessly accumulating the yellow metal, triggered seemingly by a reaction to America’s decision in late February 2022 to freeze Russia’s foreign exchange reserves. Collectively they bought a record net 1,080 tonnes of gold in 2022, 1,051 tonnes in 2023, 1,089 tonnes in 2024 and 634 tonnes in the first three quarters of 2025 (led by the Central Bank of Poland). Shown below are year-to-date central bank net purchases and sales in tonnes to the end of November:

(Source: IMF, respective central banks, World Gold Council)

(Source: IMF, respective central banks, World Gold Council)

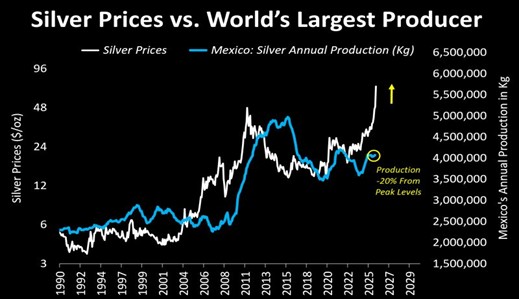

However, it was the surging price of silver that captured the attention of investors in 2025, driven by a deepening structural deficit. Exhaustion of above-the-ground inventories, an absence of new, meaningful, production, and silver’s transition to a strategic industrial asset to service AI data centres, solar panels, and battery-electric vehicles created a perfect supply/demand mismatch.

The icing on the cake for commodity bulls was news that the United States has officially added silver to its ‘Critical Minerals List’. This designation acknowledged silver’s vital role in national security and the energy transition, prompting increased interest from institutional funds and government-backed strategic stockpiling.

Turning to ‘black gold’, oil closed lower on the quarter as the lens of the market remained focussed on a global supply surplus, which offset any geopolitical flare-ups. Record-breaking production from the U.S. and Brazil flooded the market, while OPEC+ strategically unwound previous production cuts in a bid to reclaim market share. This new supply glut hit the market at the same time as tensions in major producing regions showed signs of de-escalation, vaporising any ‘geopolitical risk premium’ that had been built into prices.

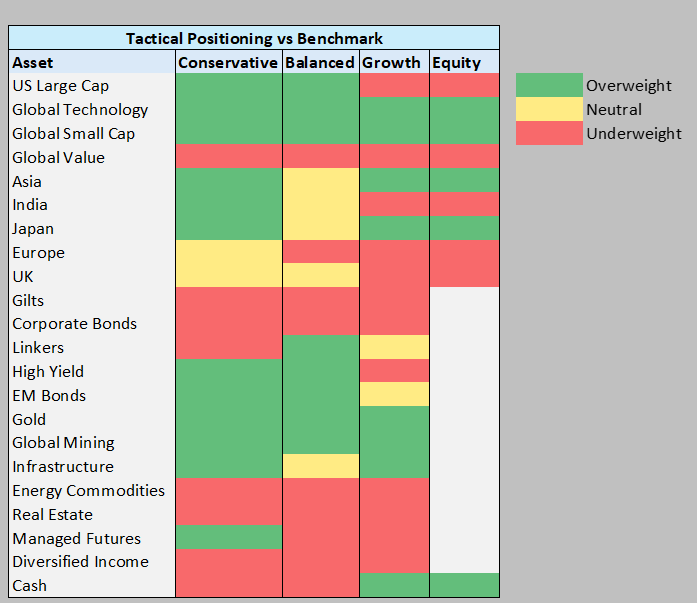

TEAM Positioning & 1st Quarter 2026 Outlook

What worked during Q4 2025:Precious metals (physical silver, physical gold), precious metal mining equities, emerging market (ex-China) equities, investment grade corporate bonds, UK equities.

What did not work during Q4 2025: Energy sector equities, owning cash, developed market property related equities, China equities.

As we enter Q1 2026, our asset allocation for the core TEAM MPS multi asset range and equity strategy is shown relative to neutral weightings in the table below:

Equities

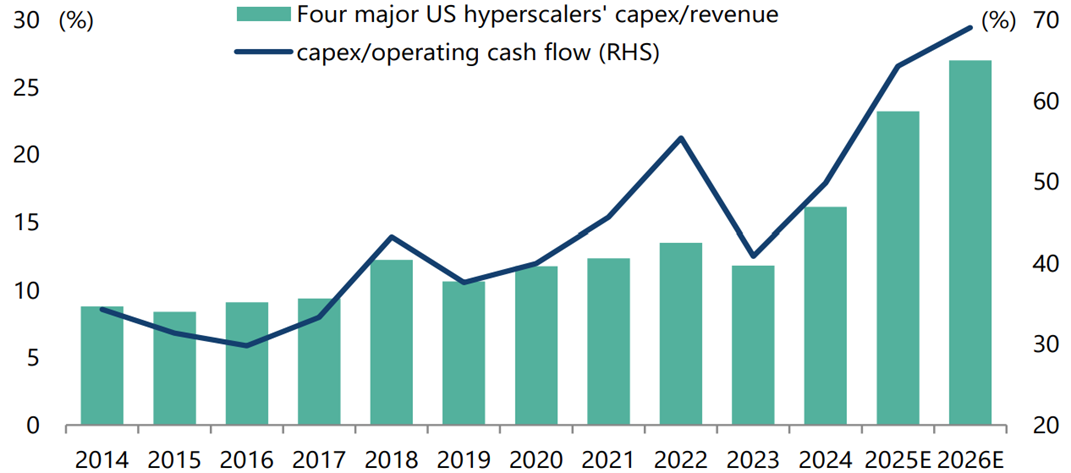

A key issue is whether the US can recapture its leadership status relative to the rest of the world. Much will depend on whether investors will continue to give the benefit of the doubt to the so-called Hyperscalers that include Amazon, Google, Meta, and Microsoft. For reference, hyperscalers can be thought of as industrial scale ‘landlords’ of the internet who own and operate massive networks of data centres around the world.

Instead of companies building their own computer rooms, they rent vast amounts of processing power and storage from the hyperscalers to run everything from smartphone apps to advanced Artificial Intelligence. This year, the combined AI capex spending plans of the hyperscalers is forecast to be close to 500 billion dollars. More alarmingly, the capex spend is consuming an increasing proportion of operational cash flow:

(Source: Bloomberg, consensus estimates, Jefferies Global Research, TEAM)

(Source: Bloomberg, consensus estimates, Jefferies Global Research, TEAM)

The obvious question is whether these companies will be able to convert this gargantuan spending plan, one that carries the strong whiff of FOMO, into meaningful profits for shareholders. Bain and Company Consultancy projects that the planned AI capex spend over the next four years by the four hyperscalers alone will require a staggering two trillion dollars in annual revenue to earn an adequate return.

Our best read on the situation is to closely monitor live prices in the AI chip rental market. In short, each successive generation of AI chips released by the likes of Nvidia can be rented by the hour from hyperscalers, such as Amazon, with the cost for one ‘AI chip’, or GPU (graphics processing unit) approximately $2-$6. Rental pricing is set by the laws of supply and demand. Throughout 2025, the marketplace for renting AI chips remained competitive, keeping prices sticky, and profitable, even for chips released several years ago.

For this reason, we don’t yet sense that the AI bubble is about to burst, particularly when viewing recent survey responses of large American companies (250 employees or more) who reported a substantial increase in AI use over the past twelve months. Furthermore, close to 40% of large businesses expect additional AI use across business lines in 2026. Our take is that the ‘AI factor’ is one of the explanations behind the US economy’s robust growth in the face of a sharply deteriorating employment picture.

We retain a blend between US technology companies and alternative sectors including energy sector equities in anticipation of a more favourable environment for oil in 2026, and infrastructure equities, major beneficiaries of the ongoing upgrade to America’s creaking physical infrastructure.

With critical US midterm election looming in November, the issue of American ‘affordability’, or lack of it, is growing increasingly louder amongst the Donald’s core voting power base. Against this backdrop, we also expect smaller companies to flourish as team Trump and team go ‘all in’ on deregulation and further monetary stimulus, including rate cuts and potential tariff rebates, as well as more unconventional policies.

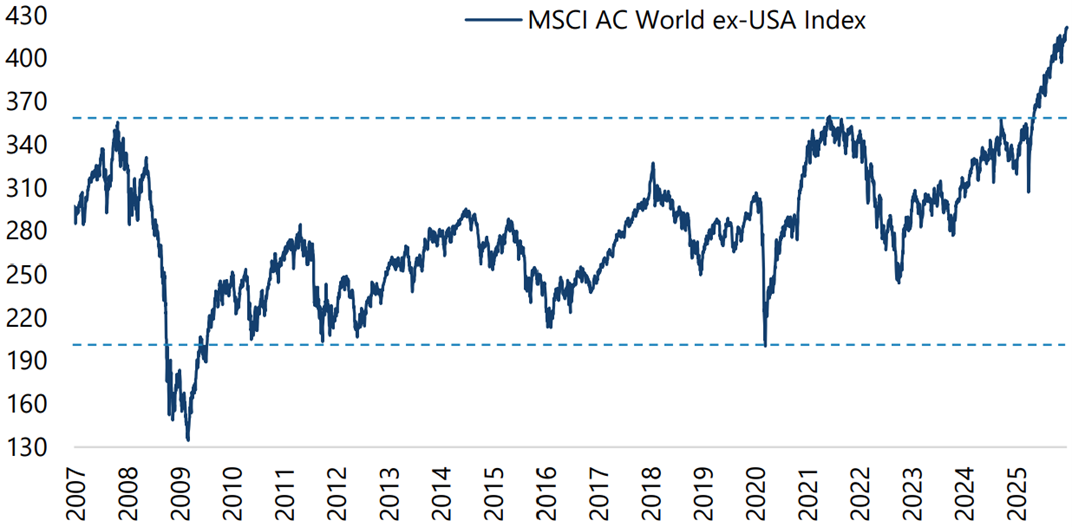

Ex-US exposure

Our US equity exposure is complemented by healthy international ex-US exposure. The upside breakout in 2025 of the MSCI All Country World ex-USA Index from an 18-year trading range has been followed by further strong absolute and relative performance into year-end:

(Source: Bloomberg, Jefferies Global Markets, TEAM)

(Source: Bloomberg, Jefferies Global Markets, TEAM)

Europe ex-UK continues to offer relative valuation merit, fiscal largesse catalysts (notably Germany), well-capitalised banking and insurance sectors, whilst the composition of the UK FTSE market (less domestic, more global value companies listed in London), complements the heavy technology weighting in America.

Asian equity markets have quietly taken off, with Chinese equities breaking out to decade-plus highs in price terms, and South Korea, Taiwan and Japan also breaking out to all-time highs. Many of the respective index constituents across these markets are intrinsically linked to the AI supply chain and trade at steep valuation discounts to their American counterparts.

Within China, the DeepSeek AI model announcement that rattled markets this time last year has seemingly been forgotten, but our sense is that AI progress by the Chinese tech heavyweights using open-source language models continues in earnest. What is also underappreciated by the market in our humble view is China’s growing competitiveness across a range of high-tech sectors. This is not just EVs or battery storage technology but also robots and automation. Furthermore, China’s formidable edge regarding cheap and (almost) limitless access to energy power is likely to become a major talking point in the years ahead.

Fixed interest

We continue to remain sceptical about the pricing of longer-term interest rates in the UK, Europe, and the US. Do 10-year Bund (2.9%), Treasury, and Gilt (4-5%) yields offer investors adequate compensation for the risks that inflation becomes more structural due to competition for scarcer resources, political risk, and/or for the supply of bonds needed to fund budget deficits? We don’t think so.

Events this past quarter have further crystalised our view of a bias towards steeper yield curves in the year ahead. Close to home, months of flip-flopping and U-turns preceded a (leaked) Budget from Chancellor Rachel Reeves that offered more of the same: a pro-spending, pro taxation plan, that is likely to sound the death knell for small businesses and entrepreneurial activity. Once again, the hard choices to plug the ‘black hole’ were avoided, and Britain’s spreadsheet quangos seem hopelessly out of touch with reality.

However, the debt problem is not confined to the United Kingdom. Across the channel, Francis Bayrou’s no-confidence vote in September triggered the appointment of the sixth different French Prime Minister’s in five years. The latest to take the helm, Sébastien Lecornu, failed in his quest to deliver a state budget before the end of the year. To avoid a US-style government shutdown, parliament passed a emergency stopgap legislation, or Loi Speciale, just before Christmas for the state to continue to collect taxes and pay civil servants based on the 2025 budget for the time being.

The current impasse puts President Macron’s proposal to increase defence spending by EUR 6.5 billion over the next two years on hold until an elusive deal is reached. The longer the delay, the lower the already slim chances of the government hitting its targets to bring its annual deficit down to 5% of GDP in 2026 and to less than 3% by 2029.

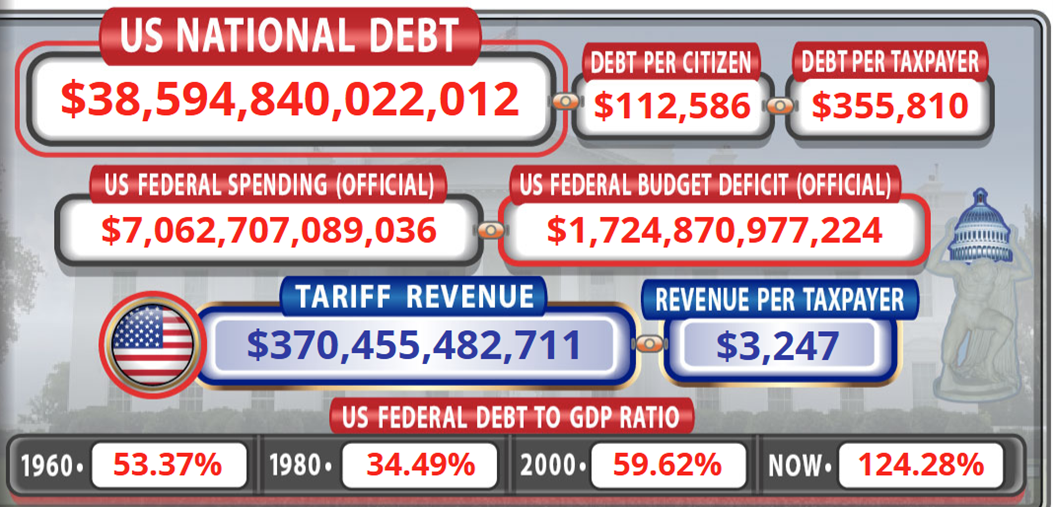

Across the Atlantic, President Trump’s second American presidency has also been characterised by ballooning deficits. During the fourth quarter, the US recorded a negative $601 billion fiscal deficit. Nearly a quarter of every US tax dollar raised is currently spent on interest payments, or about $100 billion per month. Moreover, the impending Federal Reserve Chairman appointment carries additional risk that the Federal Reserve will become a policy tool of the White House, further eroding its perceived independence.

Finally, events further afield have also had a significant impact on European debt markets, especially in Japan. Sanae Takaichi, the country’s newly appointed first female prime minister, is a firm believer in fiscal stimulus and has been more aggressive than advertised, asserting that 2026 will be a major turning point for Japan. The fiscal spend includes a major arms build up to a record proportion of GDP to deter an emboldened China.

The stance forced the Bank of Japan into taking a more hawkish position, raising rates to a 30-year high, with Governor Kazuo Ueda indicating they will go higher. In turn, 10-year JGB yields have risen above 2% for the first time this century, triggering a re-pricing across global markets.

Within fixed income, we continue to focus our investments on short and intermediate dated bonds, known as the ‘belly’ of the curve (typically between 3 and 8 years in duration), which we think offer the most attractive risk-reward profile. Our preference in the space remains high quality investment grade corporate credits and financial hybrid bonds issued by well capitalised European banks and insurance companies.

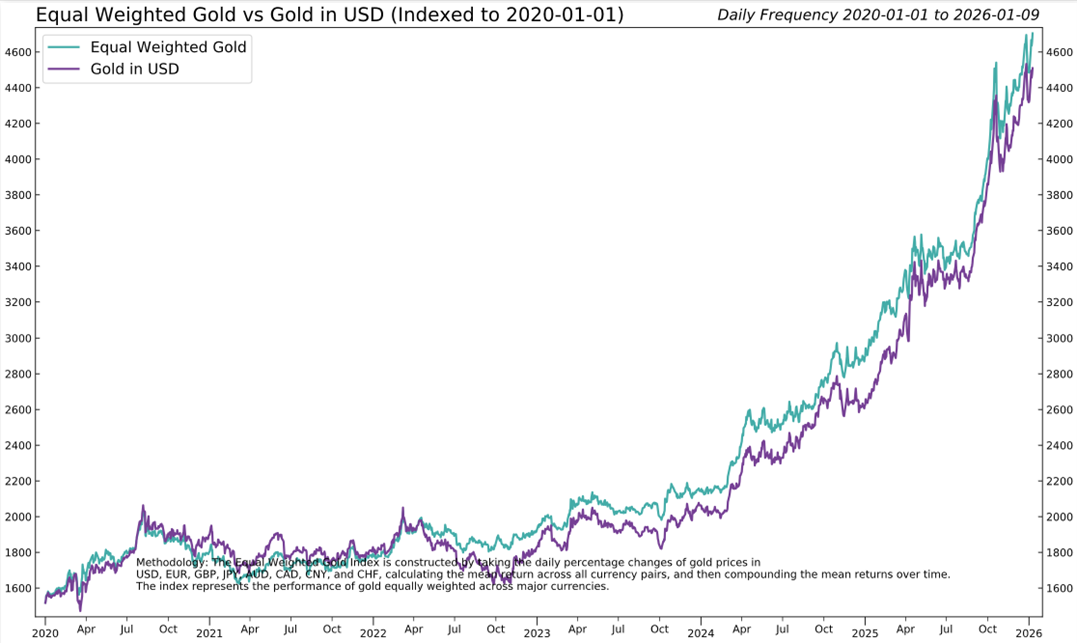

Alternatives and Cash

Physical gold, physical silver, and global precious metal mining stocks, remain essential portfolio insurance in the context of ongoing factors of geopolitical instability, currency debasement, and physical supply shortages. Gold and silver ended 2025 with gains of 65% and 148% respectively, their best calendar year in decades.

The brutal reality facing the US government is that approximately 92% of existing US interest payments are directed to Medicare, Medicaid, and Social Security, which are essentially ‘untouchable’. The fact that the enormous US debt mountain continues to grow despite record US tariff revenue collection this year and federal government tax collection running at almost a 10% annualised rate speaks to the enormity of the challenge. Almost another 750 billion dollars has been added to the national debt over the prior quarter:

(Source: USdebtclock.org)

(Source: USdebtclock.org)

Gold continues to shine, with the price touching new all-time highs during the quarter across many major currencies. Shown below, gold in dollars (purple line) being led by an equal-weighted basket (teal line) which prices gold across eight major currencies including the Swiss Franc, Japanese Yen, Euro and Pounds Sterling:

(Source: 3Fourteen Research, TEAM)

(Source: 3Fourteen Research, TEAM)

We introduced physical silver alongside our physical gold exposure in the summer of 2025 on account of a forecasted chronic silver supply deficit for the next 5 years. Increasing industrial use (demand) from data centres for AI application, EV’s and solar sectors is outstripping industry expectations, elevating silver’s utility to a strategic asset. The recent US government decision to add silver to its ‘Critical Minerals List’ adds to this growing weight of evidence.

Meanwhile, on the supply side, the green agenda that dominated the political and economic narrative for a decade ensured that any plans for new mining capacity were refused, or mothballed. Depending on geological complexities, successfully establishing new silver mine production is a lengthy process, typically taking 7 to 12 years from discovery to full operation. This becomes even more of a problem when the world’s largest producer of silver, Mexico, has seen annual production fall over 20% from its peak a decade ago:

(Source: Bloomberg, Tavi Costa, TEAM)

(Source: Bloomberg, Tavi Costa, TEAM)

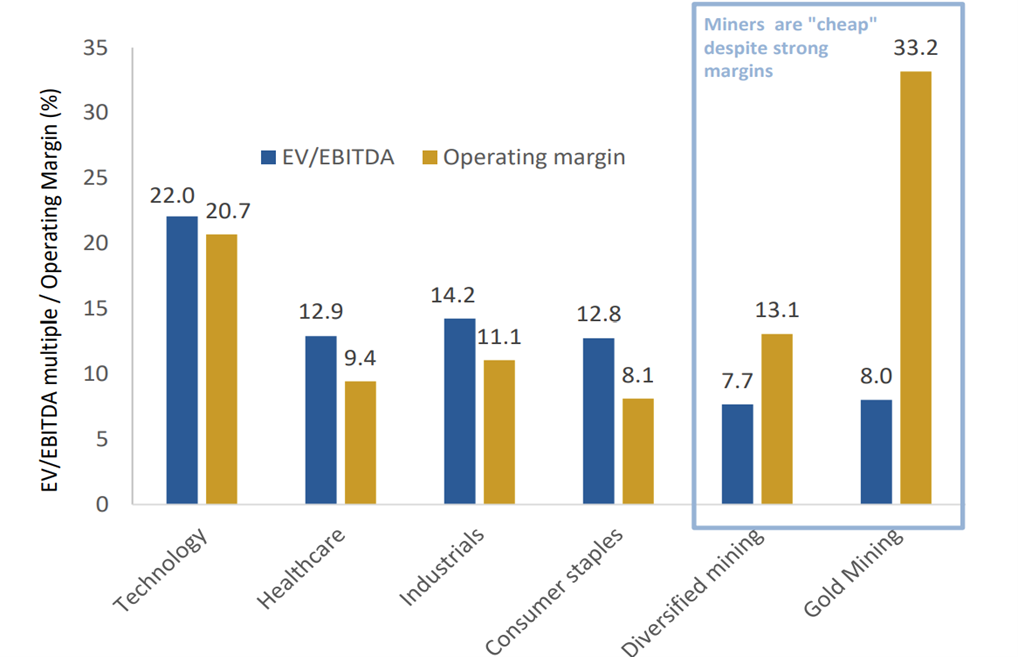

Turning to the precious metal mining stocks, we appreciate the sector has enjoyed a ‘home run’ year, but we reiterate our view that this remains the early-to-mid innings of a secular bull market cycle. Given the positive move we have seen in the spot prices of physical gold and silver it is worth noting that valuations are cheaper today than the beginning of the 2025, whilst operating margins have exploded:

(Source: Baker Steel Partners, Bloomberg, TEAM)

(Source: Baker Steel Partners, Bloomberg, TEAM)

As always, rather than attempt to look around corners and predict outcomes, we rely steadfastly on our systematic investment process, which has successfully navigated an array of market conditions during this post-pandemic cycle and delivered respectable risk-adjusted returns for our investors.

Thank you for your continued support and interest in TEAM.

(Cover Image Source: m.)