Surfing the Red Wave

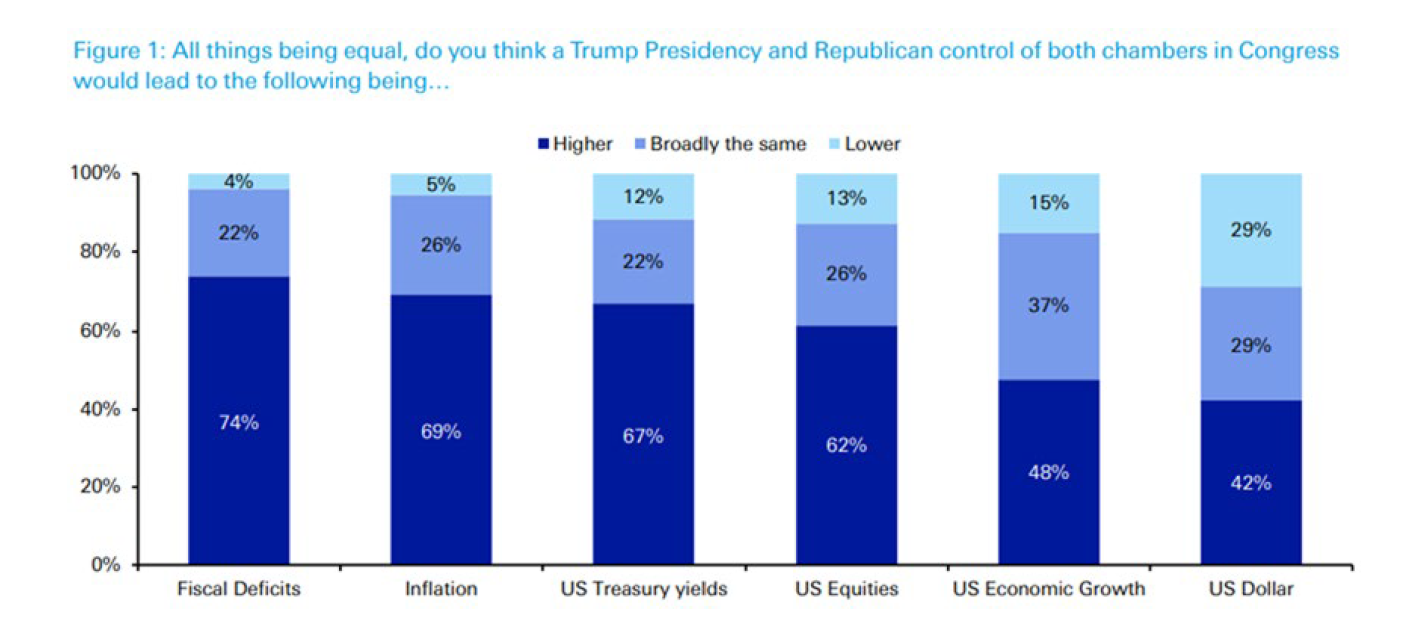

Results from a recent Deutsche Bank summer survey looking at what fund managers expect will happen to various US market and economic variables in the event of a Trump ‘clean sweep’, meaning Republican victory in the race for the White House and control of BOTH houses of Congress (the Senate + House of Representatives):

Highest conviction views:

• Deficits,

• Inflation,

• Yields, and

• Equities all expected to be higher under a ‘red wave’.

Only 4% and 5% of respondents think deficits and inflation will be lower under this scenario.

The outlook for the US dollar is the biggest bone of contention, with 42% thinking higher and 29% thinking lower. This possibly reflects the perceived juxtaposition between the Republican rhetoric of talking up the benefits of a weak dollar, and the practical realities of implementing Trump’s economic agenda (high tariffs and tax cuts).

The results infer interesting insights from a positioning and sentiment perspective, which may be challenged as we head towards election day.

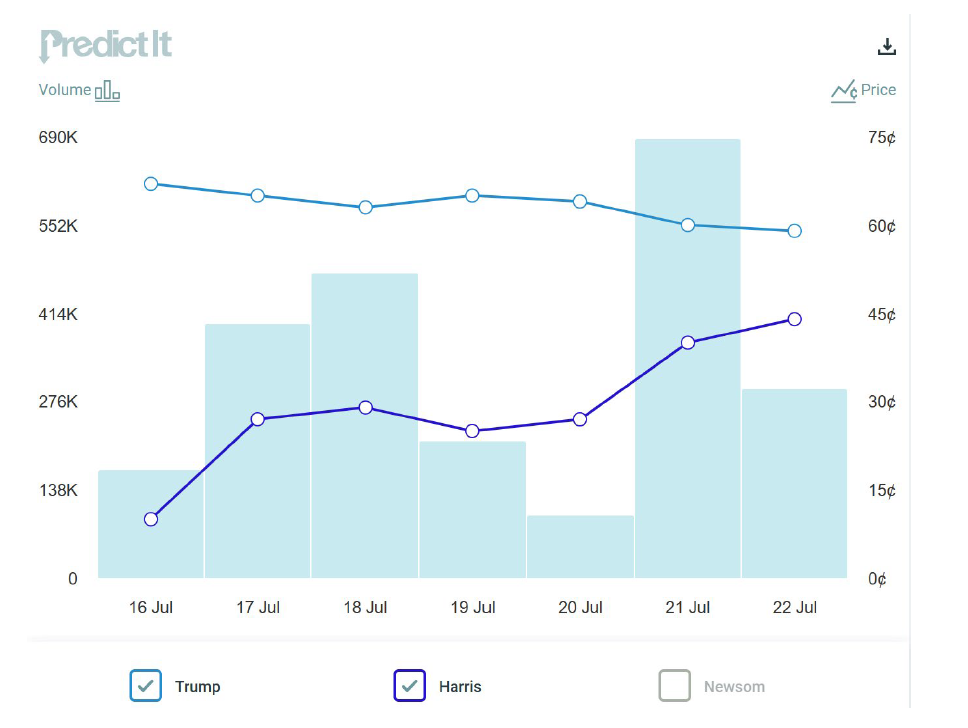

At the time of writing, Kamala Harris has secured the necessary delegate votes for the Democratic party nomination, and is making inroads into closing what had seemed an insurmountable gap a week ago:

The odds of a Republican red wave have also been reduced relative to where they were a week ago, in what appears to have quickly become a more dynamic election.

One thing is certain: events so far in this election race suggest that the path from A to B is unlikely to be straight one.

(Cover Image Source: Bill Fairs)