Quarterly Investment Review & Outlook

Investment Review 2nd Quarter 2024

Major Asset Class Returns for 2nd Quarter 2024, GBP (£) terms.

Investment Review 2nd Quarter 2024

Warning: Political Storms Ahead

The momentum trade across global financial markets showed no sign of slowing, with the MSCI World All Country Equity Index rising +2.5% over the period under review. A constant theme in this post-pandemic cycle has been ‘US outperformance versus the rest’, a trend which reaccelerated during the second quarter.

A +4.1% rise in the bellwether large cap S&P 500 index over the past three months propelled arguably the world’s greatest barometer of risk to a stunning +15.3% gain in the first half of 2024, one of the strongest performances for the opening six months of a calendar year since the late-1990’s dotcom bubble.

So far in 2024, the S&P 500 has registered no less than 31 new all-time price highs. It is worth recalling that at the beginning of the year, Wall Street strategists predicted zero percentage gains for the S&P index, as reflected by the average end-of-year price target. A hasty backpedalling is currently underway.

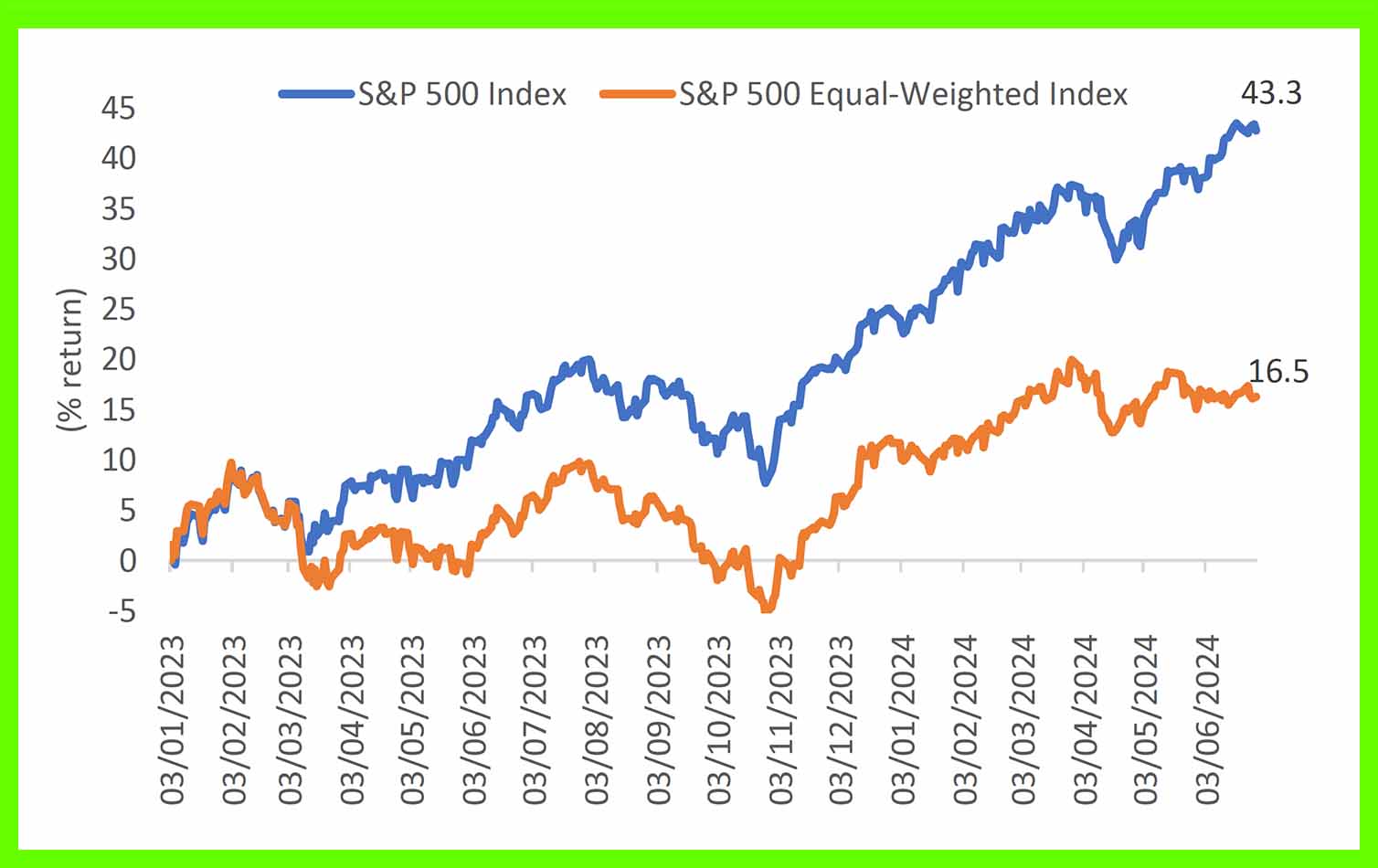

Stock market leadership in America remains highly concentrated, evidenced by the significant underperformance of the equal-weighted S&P 500 (where each stock is assigned the same percentage weighting, as opposed to weightings based on the market capitalization of the company) relative to the headline cap-weighted S&P 500 since January 1, 2023:

(Source: Bloomberg, TEAM)

The start date coincides with the most important development in world stock markets over the past eighteen months. Not a macro or politically driven event, but Microsoft’s high-profile investment in ChatGPT maker OpenAI that triggered an ongoing investor frenzy over the growing potential of generative artificial intelligence (AI) technologies.

The quest to identify first-order winners from the unfolding AI theme can be seen in the increasing influence of the Magnificent 7’s (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, Tesla) weighting within the S&P 500 index, which touched a new cycle high of 32% this quarter, 12% greater than at the beginning of 2023.

The three largest stocks, Apple, Microsoft, and Nvidia, have all officially joined the exclusive three trillion-dollar club, with Nvidia alone responsible for fully one-third of the headline S&P 500 index gains year-to-date. Whilst there is hype over prospects for the artificial chipmaker, so far, the company has surpassed lofty expectations.

In perhaps the most anticipated announcement in corporate earnings history, the chipmaker’s revenue surged 262% from a year earlier to 26 billion dollars in the three months to the end of April 2024, whilst the gross profit margin expanded to an astonishing 78%, up from 65% a year ago.

Moving away from America, price action across UK and European financial markets throughout April and May resembled the first quarter of this year. Namely, tepid relative performance from equities and a continued, albeit orderly, ‘back-up’ (bond market parlance for ‘increase’) in yields as more resilient economic data pushed back expectations on the timing, and pace, of interest rate cuts.

Against this backdrop, markets seemed poised to sail through June in a relatively smooth fashion, before a volley of political missiles caught investors off-guard, triggering a swift repricing of risk and disrupting European credit markets.

In late May, British prime minister Rishi Sunak informed the public, amidst a torrential downpour in Downing Street, that he would call a snap July 4 general election. The move gave the Conservative Party a grand total of six weeks to run their campaign and overturn a more than twenty-percentage point deficit to Labour in the polls.

Across the Channel in France, political upheaval arrived in the shape of Marine Le Pen, as her ‘hard-right’ National Rally dominated the first round of French election voting in June, pulling one third of the overall vote.

That followed President Macron’s own version of political suicide when he took the kneejerk decision to call a snap general election following his party’s abysmal showing in the European parliamentary elections a fortnight prior.

With the all-important second round of voting scheduled for July 7, the left-leaning New Popular Front and Macron’s centralist alliance are engaged in an intense period of horse-trading to avoid dividing the anti-National Rally vote and prevent the National Rally from attaining an outright majority.

Many are now worried that the prospect of dysfunctional politics, flagging growth, and a steadily rising debt burden may dent France’s long-term attractiveness to foreign investors who hold around half the country’s government debt.

Having been remarkably well-behaved in recent years, the spread, or extra yield, of French government 10-year bond yields (‘OATS’) over German 10-year bond yields (‘Bunds’) rocketed higher to over 80 basis points, levels last seen during the euro area’s sovereign debt crisis:

France - Germany 10-Yr Govt Bond Spread

(Source: Bloomberg, TEAM)

Echoes of 2012 are building as a further spike in French yields will undoubtedly shift the lens of the market towards Italy and Spain, where precarious levels of outstanding debt and a spillover effect of rising yields would make for a potent cocktail.

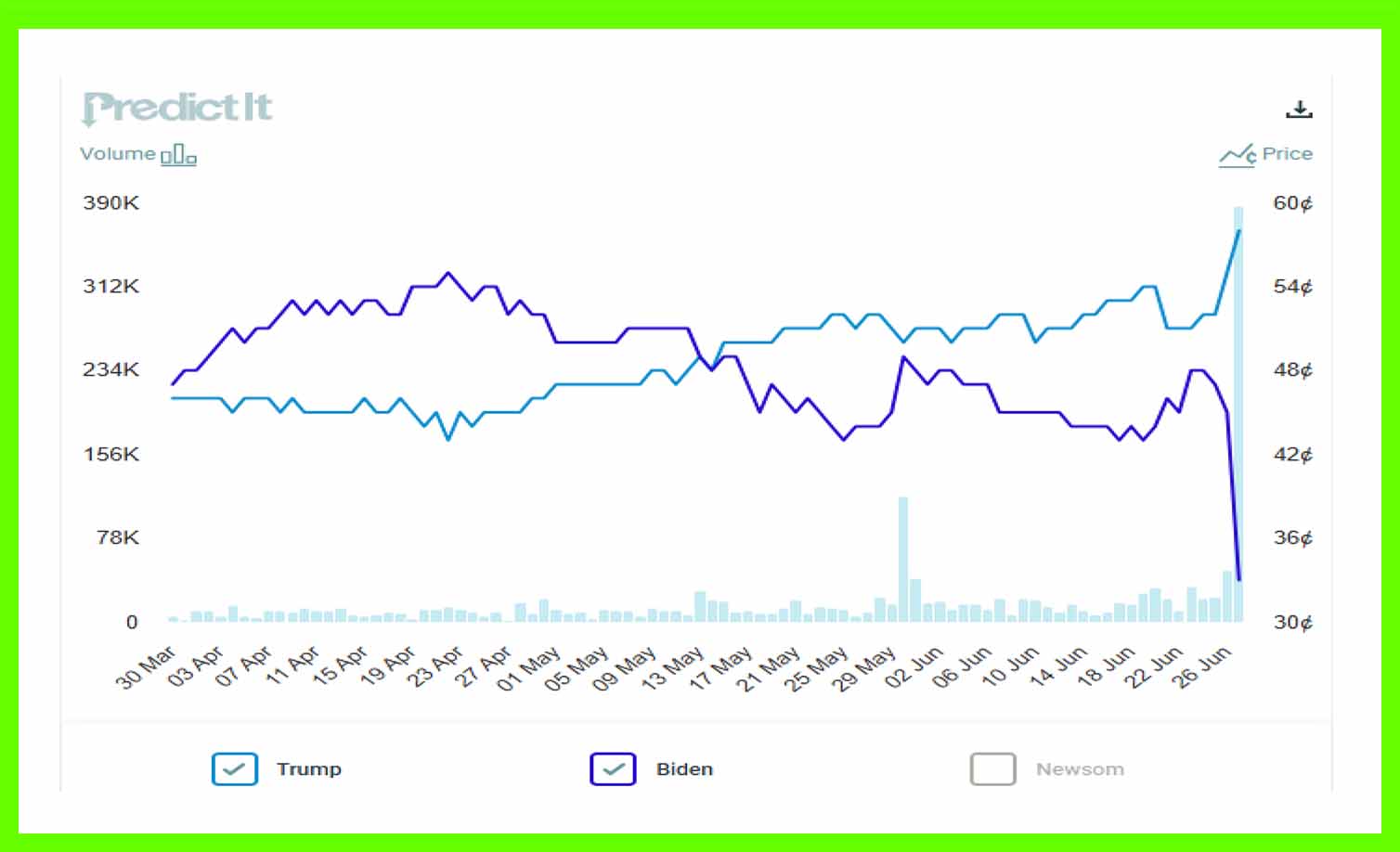

Finally, the rolling 90-day betting odds on who will be the next US President from Predict It is shown below:

(Source: www.predictit.org)

Jaws that had been opening slowing into the June 27 election debate between Donald Trump and the incumbent Joe Biden widened sharply within minutes of their opening remarks. The gap reflects modest progress from Trump but is largely the result of what has been labelled a ‘train-wreck’ of a performance from Biden.

Those within the American population that wanted, and needed, reassurance on Biden’s stamina and mental fitness are more unconvinced now than at any other time during this cycle. In his battle for re-election, the debate has cemented a theme that has remained a constant throughout Biden’s campaign.

Namely that it is not current economic performance or the party’s domestic and foreign policies that most concerns voters, but perceptions of Biden himself, and whether he is up to the task, that is the major swing factor. A growing discord within the Democratic Party and its supporters is palpable as we enter the election home straight.

For investors, global markets, so far, taking the outcome in their stride, but we enter the second half of this year navigating choppier waters.

Equities: Scores on the Doors (all returns in sterling terms)

Developed market equities (represented by the MSCI World Equity Index) delivered a +2.5% total return over the 2nd quarter. The S&P 500 large cap index delivered a +4.1% total return on top of the +11.5% return for the first quarter of 2024.

Japan’s Nikkei 225 Index consolidated over the quarter, returning -7.3%, although -6% of this return is via yen currency weakness. The pressure on Bank of Japan Governor Kazuo Ueda to raise rates continues to mount. Another 21 basis points of hikes in the overnight call rate is currently expected by year-end according to the overnight swaps market.

European developed market equities ex-UK returned -0.3%, weighed heavily by France (-9.7%), whilst the MSCI Emerging Markets Index returned a respectable +4%, driven by companies in Taiwan and South Korea benefiting from the arms race to build AI infrastructure.

China also outperformed global market averages, with MSCI China returning +5.6% on the quarter. Whilst residential property data and credit growth data remain locked in a downtrend, more encouraging news arrived in the form of the most intense level of property easing since the COVID reopening.

The central government officially announced in May a previously floated scheme to encourage local governments to buy unsold properties from developers to convert into affordable housing. Another notable feature of easing was that the national minimum downpayment ratio was reduced for first- and second-time home buyers, whilst the minimum mortgage rate was also effectively scrapped.

India returned +7.5% on the quarter, outperforming global and emerging market benchmarks. The initial reaction to the general election result was a -6% day on June 4, given that the failure of Prime Minister’s BJP Party to secure an outright majority was a genuine shock. The resilience of the market appears to be emanating from confidence in an effective coalition and the implementation of populist policy measures.

Fixed Interest

Bond markets seemingly pressed ‘repeat’ in the second quarter, with price action mirroring activity in the first quarter, albeit in a tighter range. Shown below are the benchmark 10-year yields (bond prices move inversely to yields) for EU, UK, and US government bonds over the quarter (note the right-hand axis for European bond yields):

(Source: Bloomberg, TEAM)

In essence, plenty of huffing and puffing, but yields ended the quarter not far from where they started. This reflects the push-and-pull dynamic between central banks that are seemingly desperate to embark on a sustained rate cutting cycle, and resilient economic and inflation data that is preventing them from doing so.

Hopes that the Bank of England (BoE) might be able to introduce a summer interest rate cut were all but dashed following the publication of April’s inflation data. The core rate, which excludes volatile items such as food and energy, was +3.9%, almost twice as high as the Bank of England’s target rate, and prices in the services sector rose +5.9% from a year earlier.

A high probability ‘no summer cut’ call quickly became a certainty when Rishi called a surprise snap general election for early July. The Monetary Policy Committee voted 7-2 in favour of keeping the benchmark interest rate unchanged at 5.25% at their June meeting. Money market futures are now pointing to a quarter of a percentage point cut in August, followed by one more before the end of the year.

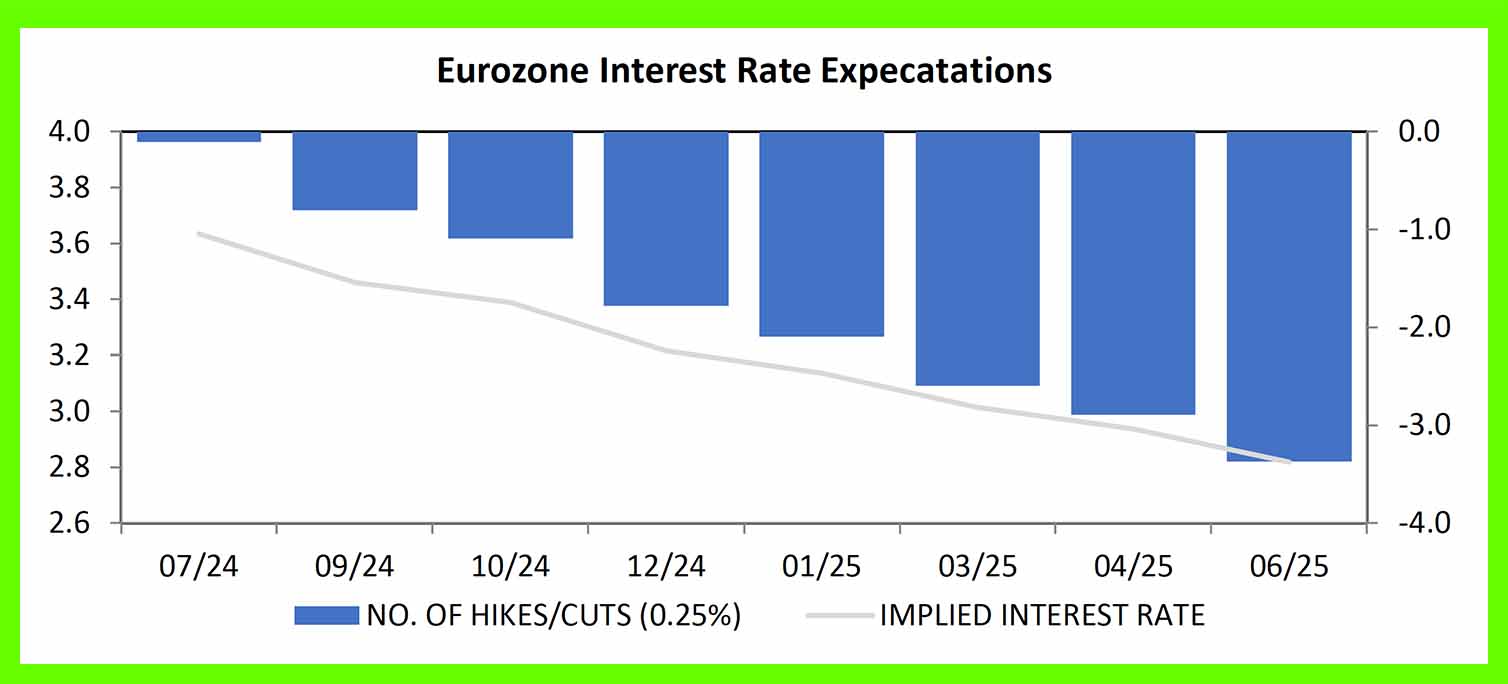

Meanwhile the European Central Bank (ECB) had guided towards a quarter-point interest rate cut in June, the first in five years, and duly delivered. President Lagarde has been offered a little more wiggle room with the Eurozone economy struggling, and inflation coming to heel more quickly than in the UK and US.

However, markets were not expecting such a cautious outlook, with Lagarde acknowledging that while the move represents a ‘strong likelihood’ that it is the start of ‘dialling’ back rates from their all-time high, the pace of cuts would be data dependent and she is ‘not pre-committing to a particular rate path’.

The more hawkish than expected messaging had a small impact on future interest rate expectations. Money market futures continue to price in another quarter-point cut in September, followed by another in December to bring the ECB’s deposit rate down to 3.25% by the end of the year.

(Source: Bloomberg, TEAM)

Perhaps the biggest risk to this outlook is Federal Reserve policy. Expectations of the first rate cut by the Fed have been pushed to November and there will likely be a reluctance from the ECB to diverge its policy too far or risk fuelling more imported inflationary pressures from a weaker Euro.

Commodities

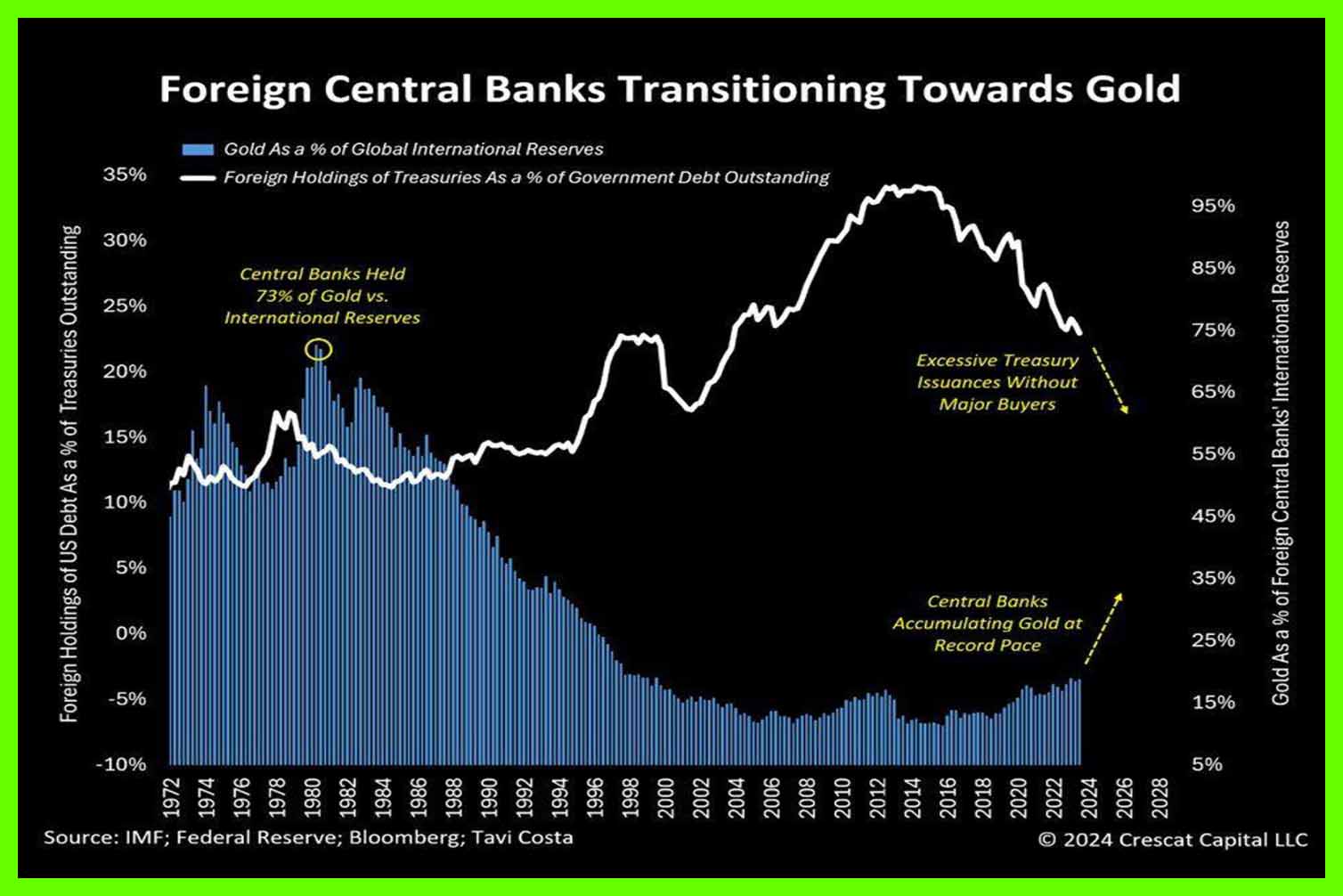

Gold returned +4.2% on the quarter in US dollar terms, and the performance of the yellow metal remains resilient in the context of the US monetary tightening cycle. We have witnessed record central bank gold buying since the third quarter of 2022, potentially triggered by America’s decision earlier that year to freeze Russia’s foreign exchange reserves.

As a result, global central banks bought a record net 1,082 tones of gold in 2022 and a net 1,037 tonnes in 2023, whilst a net 290 tonnes was purchased in the first quarter of 2024 according to the World Gold Council.

To coin a phrase associated with the late England football player turned pundit Jimmy Greaves, energy markets, specifically oil, delivered the proverbial game of two halves during the second quarter.

Positioning and sentiment amongst speculators turned decidedly negative into mid-April on over-supply concerns, before prices rebounded strongly on the back of fears of a wider Middle East war and a strong summer driving season in America. The outcome was a largely flat return over the period under review.

TEAM Positioning & 3rd Quarter 2024 Outlook

We highlight again the critical importance of sticking to one’s investment plan. The second quarter produced a laundry list of reasons to be negative on the short-term outlook for markets and expect a nasty correction.

- Rate cut expectations from central banks were pushed back…again

- Geopolitical risks have ratcheted up, with the situation in Ukraine and Russia in particular ‘bubbling up’

- Election turmoil has unfolded across Western democratic nations

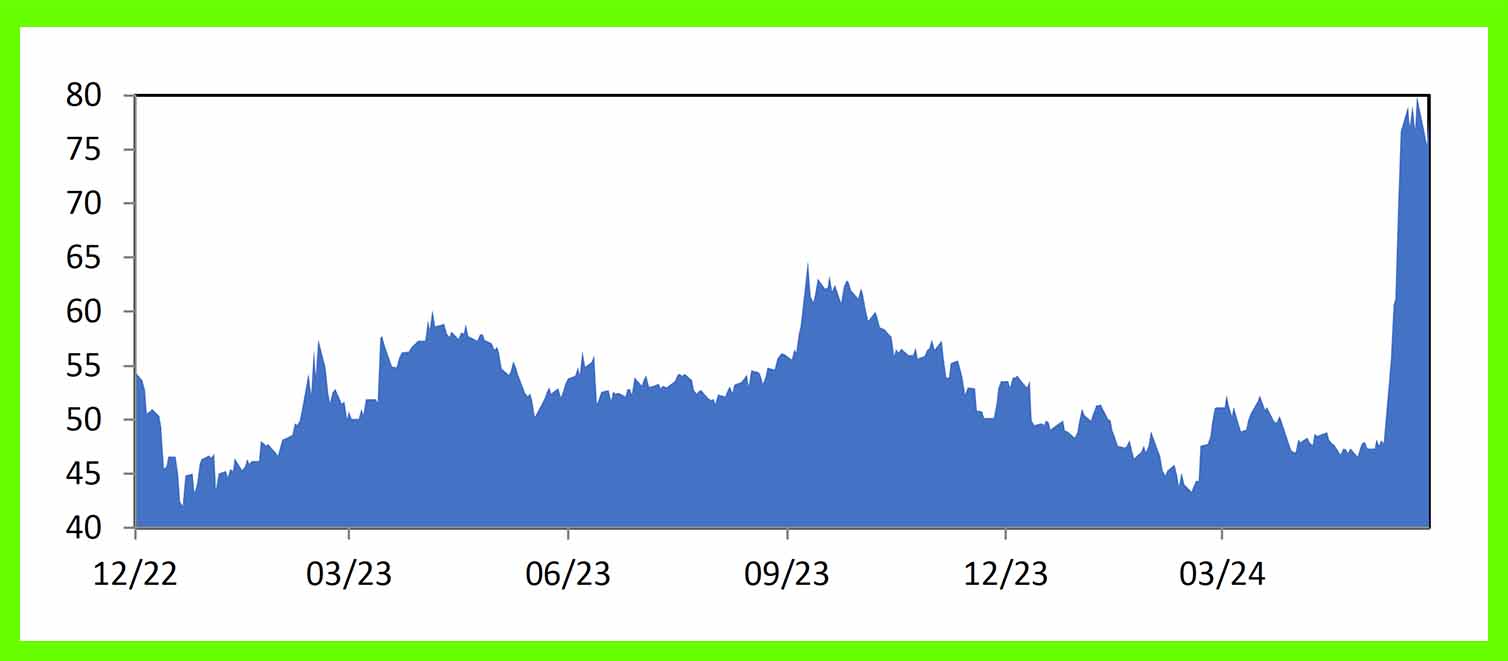

- Very little appetite for portfolio hedging, suggesting a complacent market

Turning to America specifically, starting point valuations are not cheap (particularly with the Magnificent 7 included), concentration risk in major market indexes is very high by historical standards, corporate earnings expectations for the second half of 2024 are elevated, and, at this point, it is not certain who will be leading the Democratic Party into the US election.

We share some of these concerns but reiterate a key point that our philosophy and process does not involve attempting to look around corners and forecast the future, not do we proclaim an edge in trading political risk.

In this regard, we are pleased to report that our systematic framework has continued to keep us in harmony with strong trends and prevent our cognitive and emotional biases from acting impulsively on short-term noise.

Additionally, the mainstays of our liquid alternatives sleeve, such as physical gold, mining stocks, and energy equities, have provided valuable diversification benefits during this cycle, or what we label the ‘zig and zag’ effect. April was a good working example, with liquid alternatives providing strong returns as mainline equity and bond indexes endured a (albeit temporary) sell-off.

Saints and sinners

What worked: Asia ex Japan equities, US large cap and technology exposure, physical gold, mining stocks, and cash, where we are being paid to be patient as we look to deploy into risk assets at more attractive levels.

What didn’t work: long duration bond exposure, although we have a very modest allocation, and a zero allocation to inflation-linked bonds, small cap equities, Japan equities, Us infrastructure equities.

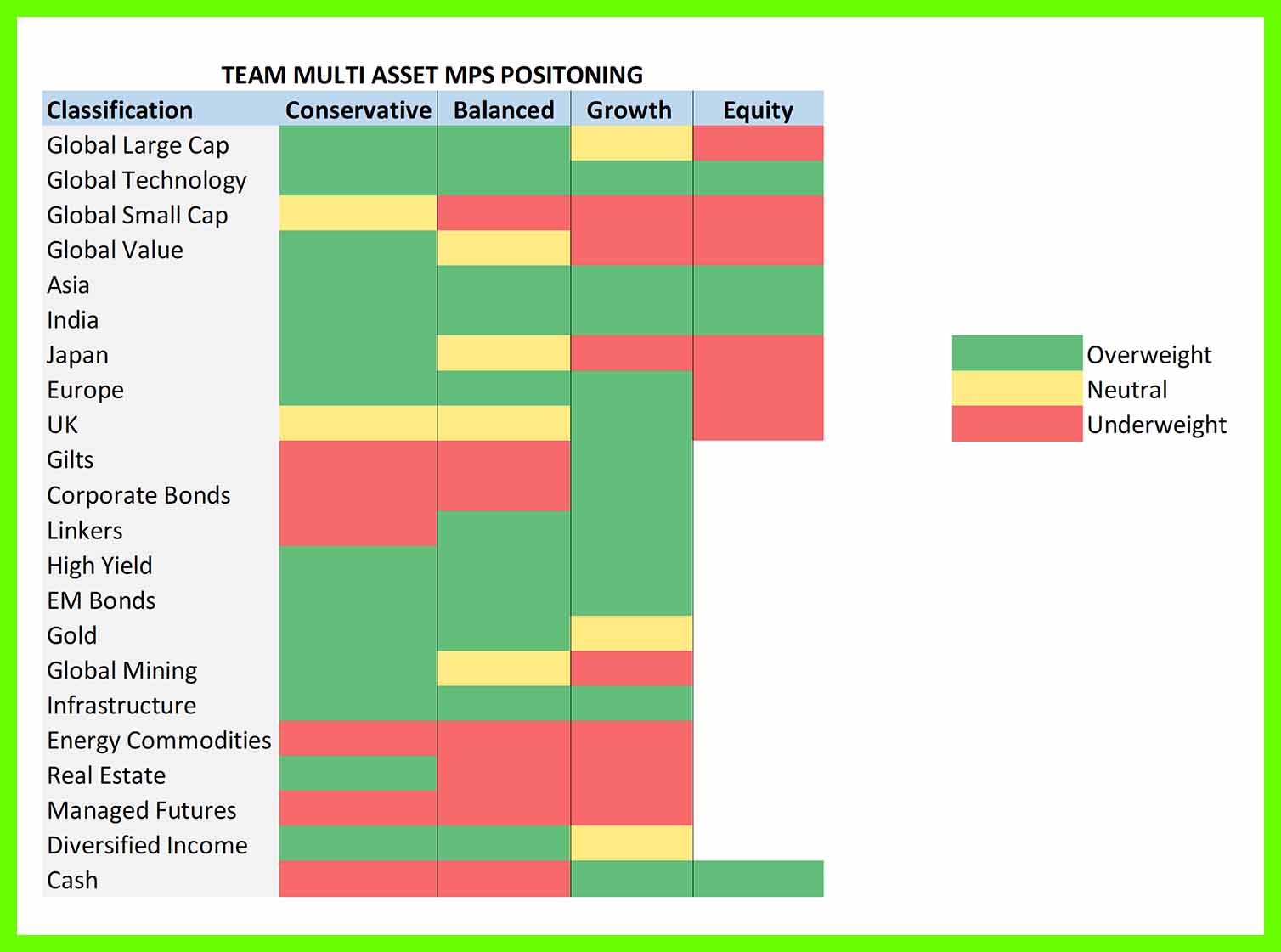

We enter the third quarter of 2024 positively positioned from a risk perspective, with overweight allocations to equities, funded from fixed income, liquid alternatives, and cash.

Our asset allocation for the core TEAM MPS multi asset range is shown relative to neutral weightings in the table below:

Equities

We retain a healthy split between US and non-US equity securities, with a skew to large-cap companies.

In a world where the cost of financing is set to remain disproportionately high (read: ‘painful’) for smaller companies, bigger is better.

Large cash balances are earning meaningful interest income, which is finding its way to bottom line profits. Separately, regarding US technology trends, whilst we claim no edge in picking the eventual winners in the AI space, it is hard to argue against big tech companies winning via organic or inorganic (acquisition) means. We have a modest exposure to small cap and zero to micro-cap companies.

Japan’s corporate governance revolution, driven by the Tokyo Stock Exchange (TSE), is the real deal. The aim is to hold corporate management teams to account over governance and performance issues, with the TSE now maintaining a monthly name and shame list of companies that voluntarily disclose information regarding ‘actions to implement management that is conscious of cost of capital and stock price’.

Whilst we do not expect the line to be a straight one from A to B, investors can look forward to the prospect of enhanced returns driven by rising dividends, share buybacks and improved return on equity as companies look to improve balance sheet efficiency.

Separately, foreign arrivals to Japan, are surging on account of both a very cheap yen and the fact that Japanese prices have essentially flatlined since 1995. For US visitors, prices are the equivalent to where they were in 1969 (!). Unsurprisingly, this is supercharging spending in the country.

India remains one of the world’s most exciting domestic demand driven investment stories. A new capital expenditure boom is underway and anticipated to drive 7% real GDP growth and approximately 12-15% aggregate corporate earnings growth over the next 5 years or more. Given India still miniscule representation in the MSCI World All Country Index of 1.8%, room still exists for a significant re-rating.

Fixed interest

Heading into the second quarter, we expected bond markets to be relatively range bound as it has become increasing clear that central banks are willing to tolerate higher inflation to avoid downside risks to economies.

Whilst we don’t anticipate change to the monetary policy outlook as we move into the third quarter, there is more elevated political risk to contend with that could be disruptive and create some volatility.

Regardless of the timing and pace of interest rates we remain cautious of holding long-term bonds as the increased supply needed to fund deficits, both in the US and Europe, risks upside pressure on long-term yields and steeper yield curves.

In this scenario, we continue to believe that embracing a boring and pragmatic approach is a sensible course of action. Boring is to avoid leaning too hard over our skis and focussing on credits that offer attractive yields and balance sheet strength to withstand periods of market turbulence. Pragmatic is being flexible and nimble, adjusting positioning quickly if the facts change.

Alternatives and Cash

Physical gold and gold miners remain essential portfolio insurance.

As previously discussed, the major change regarding gold demand since 2022 is an increase in central bank accumulation. To recap, following the breakout of Russia’s war in Ukraine, Europe (including historically neutral Switzerland and Austria) joined the US and the rest of the developed world (in sanctioning Russian banks and freezing their overseas assets.

We can glean a fair idea of how much gold the world’s central banks have been buying via data from the Word Gold Council. Purchases are considered ‘monetary gold’ for use as recognised reserve assets by central banks, accepted by credit rating agencies, and international institutions like the International Monetary Fund.

Shown below is a 50-year chart demonstrating a narrowing of the chasm between international holdings of US Treasuries as a percentage of global government debt outstanding (top line, left hand axis) and gold as a percentage of global international reserves (bottom bar graph, right hand axis). Our expectation is for this trend to continue, led by China, which continues to declare its holdings with a significant lag:

(Source: Tavi Costa, Crescat Capital LLC)

As for the energy commodities basket, and oil in particular, we noted during our prior commentary that ‘the outlook is less bullish, but with that said, exogenous shocks, particularly of a geopolitical nature, are not out of the question. Energy equities continue to offer genuine asset and sector diversification.’ Unpleasant as the catalyst may have been, this scenario has played out during the first quarter, catching many off-guard.

We maintain this view, as the prospect of further supply disruption remains a possibility. Indeed, a renewed rally in the oil price in the months ahead remains the key risk for Biden’s Administration, the Federal Reserve, and global markets, given the natural transmission mechanism from oil through to forward-looking inflation expectations. Continued hot economic and jobs data would be another troubling development.

As always, rather than attempt to look around corners and predict outcomes, we rely steadfastly on our systematic investment process, which has successfully navigated an array of market conditions over the prior three years and delivered respectable risk-adjusted returns for our investors.

Thank you for your continued support and interest in TEAM.