Dog Days

(Cover Image Source: Priscilla Du Preez)

The period of late summer (attributed to variations of days when mad dogs and Englishmen venture out in the noon day sun, but actually named for the sun’s position in Sirius in the northern hemisphere) is traditionally a quiet period for markets. Anybody with any sense, especially in more temperate climes, exchanges suits and brogues for over-priced pastel polo shirts and flip flops.

Be it because remnants of the latest COVID variant was still kicking around, or that prices of flights have risen to levels taking them out of the reach of mere mortal fund managers, but August 2021 proved, for many to be unseasonably profitable.

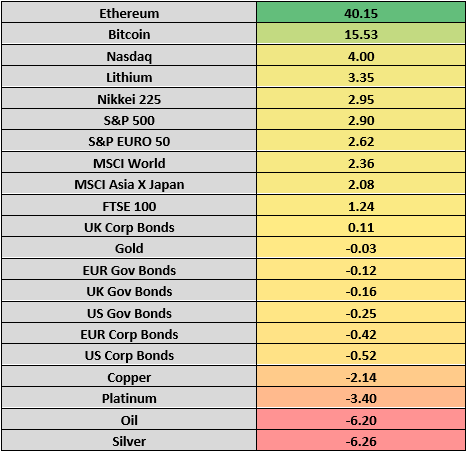

Ranked Asset Class Returns for August

Equity market gains were once again led by the technology-heavy US Nasdaq Index, with this month’s Value Vs Growth conundrum lighting upon the latter. Other markets (including the previously unfavoured Asia) registered gains of between 2% and 3%.

Bond markets, having seen a most unexpected recovery in July on worsening Asian COVID numbers, reverted to 2021’s prior script, with talk of tapering of Central Bank largesse on both sides of the Atlantic surfacing once again to see both Government and Corporate markets down.

Commodities were generally weaker, albeit that the darling of the Electric Vehicle industry, Lithium, continued its 2021 gains, rising a further 3.5%.

Like most institutions, we continue to grapple with the ‘investability’ of the resurgent Crypto asset class. The two heavyweights, Ethereum (Total Market Cap. of $ 320 Bln) and Bitcoin (Market Cap. of $ 675 Bln) were up 40% and 15% respectively in August, admittedly still off their April / May highs, but showing the sort of momentum that suggests there’s more to come as we enter the 4th Quarter.

With one of the largest Exchanges, the newly listed Coinbase (2021 Revenue forecast to be USD$ 6.9 Billion, not bad for a company founded in 2012) looking to list products for at least another 30 individual cryptos in the near future, this is starting to look frighteningly mainstream for a market still largely dominated by retail investors.

This month we have been learning about NFT’s. Look up CryptoPunks and tell me whether your next generation of clients are going to be interested in assets which‘only’ move 3% per month, only trade 5 days a week, and which you ignore when you’re on holiday.