An Introduction Into the World of Crypto

(Cover Image Source: Executium)

What is Cryptocurrency?

Simply put, cryptocurrencies (or ‘crypto’) are digital forms of currencies that do not exist in a physical form. They are used similarly to government-issued currencies (fiat currency) to buy and sell assets or as a medium of exchange between two or more parties. To better understand cryptocurrency, you first must understand what Bitcoin is because Bitcoin was the first cryptocurrency created. In short, Bitcoin is a decentralised digital currency, decentralised meaning without central control, with a maximum supply of 21 million bitcoins. This currency records transactions in a distributed ledger technology called blockchain. In its simplest form blockchain is a database of information. To add more detail a blockchain is a growing list of records, called blocks, that are linked using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Here, modification of data is not allowed by design. This allows decentralised control and eliminates the risks of modification of data by other parties. Cryptocurrency is without doubt complex, but it doesn’t need to be fully understood to get involved, in the same way you don’t need to understand how to program a computer to use a computer.

What are the use cases for Crypto?

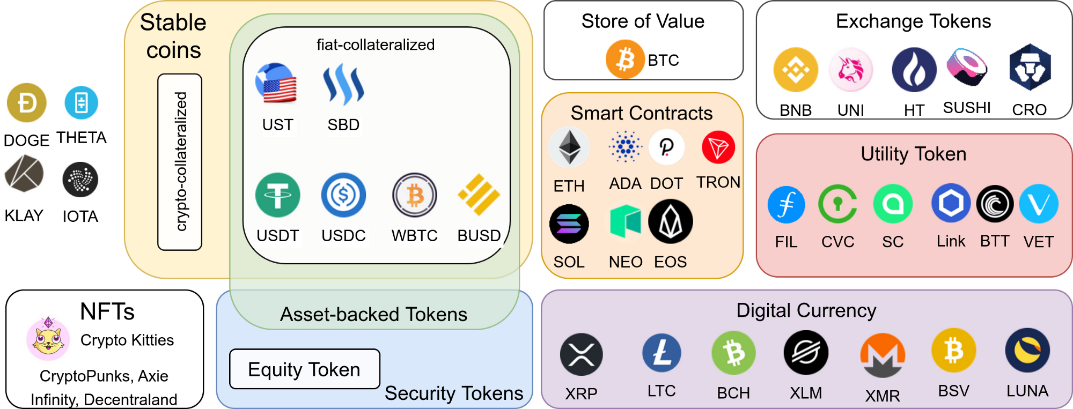

The crypto ecosystem has grown rapidly in the past few years to expand utility beyond just digital currency but to a wide-reaching range of use cases. These include but are not limited to:

- Utility tokens

- Stores of value

- Exchange tokens

- Digital currencies

- Asset-backed tokens

- Stablecoins

- NFTs

Utility tokens

In simple terms, a utility token is a blockchain-based asset people buy with the intention to use for something in the future. These can be used to raise funds for investments and then those tokens can be used as payment for that service. For example, if you invested in a fictional Uber utility token, those tokens could be exchanged for Uber rides once the company was operational.

Stores of value

The only current store of value token is Bitcoin. The use of Bitcoin as a digital currency is still possible, however, in recent times other coins/tokens can do this task faster and at a fraction of a cost. Therefore, Bitcoin’s utility has changed and is now more commonly considered as digital gold.

Exchange tokens

A crypto exchange token is a digital asset that is native to a cryptocurrency exchange. A crypto exchange is where you can buy and sell digital currencies/assets in exchange for fiat currency.

Digital currencies

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. These are often transacted peer to peer without the need of a middleman service.

Asset-backed tokens

Asset-backed tokens are digital claims on a physical asset and so are backed by that asset. Gold, crude oil, real estate, equity, or just about anything else can be tokenised. An asset-backed token’s value is directly affected by the worth of its underlying asset. Asset-backed tokens are generally classified as securities by financial regulators. Ownership of the token represents a right of ownership over the asset (or at least the part represented by the token).

Stablecoins

Stablecoins are cryptocurrencies that attempt to peg their market value to some external reference. For example, USDT is pegged to the value of the US dollar. This gives holders the benefit of digital currency without the volatility of crypto.

NFTs

NFTs (non-fungible tokens) are digital assets that represents real-world objects like art, music, in-game items, videos etc. These assets are stored on a blockchain, this certifies a digital asset to be unique and therefore not interchangeable. Often NFTs can be considered as a digital certificate of authenticity.

The NFT market is one of the fastest growing markets with value tripling in 2020, reaching more than $250 million but that was soon eclipsed with NFT sales exceeding $2 billion during the first quarter of 2021. This is an area we at Team will look to dive deeper into in the coming months.