We’re Going on a Growth Hunt*

(Source: Grok, TEAM)

UK bond markets have, once again, been thrust into the limelight.

Investors are calling ‘bluff’ on the Chancellor’s recently announced ‘tax and spend’ budget, remaining highly sceptical that faster economic growth can fund the huge, planned increases in borrowing, especially in the absence of meaningful, exciting policies to stimulate business activity and investment. The UK 30-year Gilt yield is currently trading at c. 5.5%, touching three-decade highs.

Fear not. With Britain’s industrial base in seemingly perpetual decline, Labour’s latest cunning plan in delivering the political Holy Grail of achieving ‘more with less’ is to hang its hat on the future potential of Artificial Intelligence.

In short, the UK is to become a global cutting-edge global technology hub, ushering in sweeping efficiency gains across the government complex whilst simultaneously harnessing the power of AI to unleash rapid productivity gains.

One potential wrinkle (amongst many) is the simple economics of powering the AI revolution, namely a requirement to provide cheap, reliable, power to data centres that house the semiconductor chips that, in turn, fuel the large language models that make the magic happen. In stark contrast to America, the core strands of the UK’s strategic energy policy over the past twenty years have been to simultaneously ban fracking, strangle North Sea oil and gas operators with a tax noose, and dramatically ramp up offshore wind capacity, which is weather dependent, eye-wateringly expensive to store, and highly unreliable.

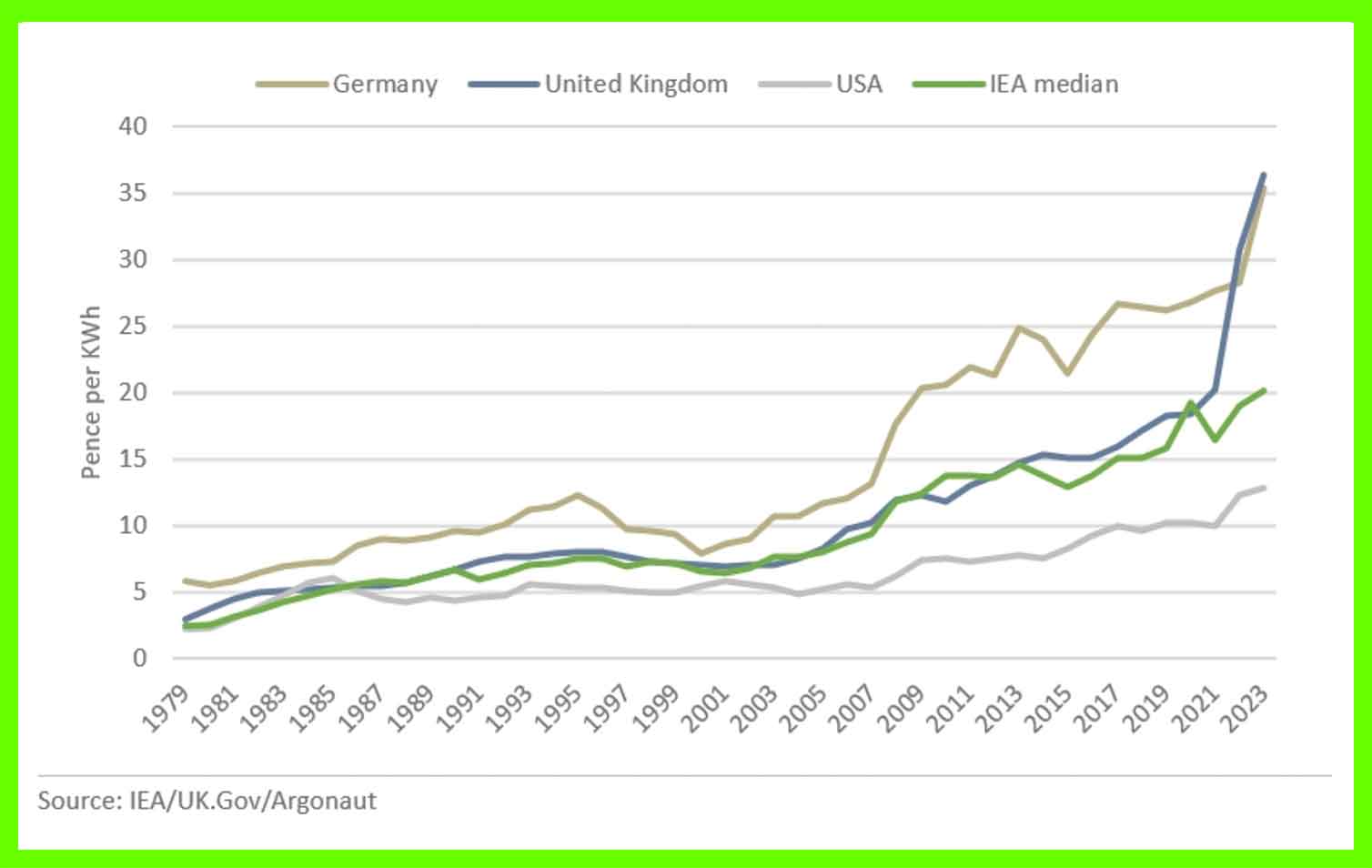

The net result: courtesy of Barry Norris at Argonaut Capital Partners, Britain currently has the highest electricity prices in the world, some three to four times those experienced in the US:

The good news: latent demand for power looks set to accelerate. The energy intensity required to fuel increasingly sophisticated semiconductor chips has prompted leaders at the cutting edge of the AI sector to call for a vast network of 5-Gigawatt (GW) data centres.

The bad news: as it stands today, if Britain flexed its energy muscles and channelled all electricity capacity exclusively to power 5GW datacentres, just six1 would be fully operational. With UK industrial electricity prices running 400% higher than the US, the idea of Britain wrestling control of the world’s technology hub from America would seem to be wishful thinking at best.

Over to you, Rachel.

*Title inspired by Chris Mason, BBC political editor, on this morning’s Today Programme

1 Barry Norris, Argonaut Capital, Atlas should shrug and invest in America instead, 13 January 2025