Thinking the Unthinkable

(Cover Photo Source: S O C I A L . C U T)

Investors put their capital at risk. As portfolio managers, we attempt to manage that risk by investing in a range of asset classes, primarily equities, property, commodities, and bonds, with bonds usually representing the least risky part of a portfolio. Conventional wisdom therefore dictates that the higher the percentage of bonds held in a portfolio, the less risk that we are taking on behalf of that client.

As stewards of capital, we are obliged to constantly consider what our clients are paying us to do. The easiest answer is to continue investing according to conventional wisdom, however we are also obliged to predict what will happen in the future, and to alter our views (and our strategy) accordingly, even if those insights and changes initially feel somewhat uncomfortable. What follows is an insight into our current thinking, bearing in mind that one of our most basic responsibilities is to avoid investing in things that we think are likely to lose money in either nominal or real terms.

As we are all aware, with economic conditions apparently bottoming, and forecasts for a strong bounce-back for the second half of 2021 on an effective outcome to the global vaccination effort, the 30-year bull market in bonds appears to be pushing up against its natural limits. 10 Year Government yields have started to climb in the US from their Summer 2020 lows of 0.51%, and yields are on a similar trajectory, albeit with lower absolute numbers, in Europe and the UK. (10 Year Bunds bottomed at -0.85% mid-crisis in March and have climbed to -0.45% at present).

Despite yields creeping up, bond prices have actually proved surprisingly impervious to the more positive economic outlook, given the magnitude of the recovery which could become apparent from what are presently depressed levels. Under normal conditions, it would be fair to have expected a much larger correction in bond markets on the announcement of the successful Virus trials in November. We believe we can hazard a guess as to why this didn’t happen, which is covered later.

Of course, we are in far from normal conditions. The major disrupting factor we are facing, and which is the cause of so much uncertainty, is that for the foreseeable future, it will be in Governments’ interests to create / allow historically high levels of inflation. Their primary aim in allowing this inflation will be to deflate away the future value of massive debt levels which have been accumulated over the last 10 years since the financial crisis, a situation that has only been compounded by the funding of relief measures they have been forced to put in place because of Covid.

Debt to GDP ratios (a measure of how much is owed relative to an economy’s annual total output) have exploded in both Europe and the US, and whilst some correction can be expected through improving GDP associated with economic recovery in years to come, there are only 2 real ways out of the current debt levels. The first is to run budget surpluses (effectively spending less than one earns to pay off one’s debts) which, to put it politely, is both politically unpopular, and given the current climate, highly unlikely. The second is to create sufficient inflation to reduce the value of one’s future liabilities.

Which creates an interesting quandary for bond markets.

Future inflation is an absolute negative for bonds, because the value of maturity proceeds of a bond are (usually) a fixed sum. Thus, the more inflation one experiences between now and the bond’s maturity, the less the future value, in real terms, of the proceeds one receives when the bond repays its capital value. (The inverse is of course true when one has a liability such as a mortgage, as future inflation erodes the future capital value one has to repay).

Compounding this is that Governments (under normal conditions) will usually seek to combat the rise in inflation by raising interest rates. This has the effect of increasing the attractiveness of floating rate instruments (which most bonds aren’t) which benefit from rising rates, at the expense of fixed rate instruments (which most bonds are). Hence investors generally sell bonds in favour of assets whose returns rise as rates rise, which causes bond prices to fall.

This combination of inflationary and interest rate impacts is, in very broad terms, why economic recoveries are usually bad for bonds. If we are right about the potential for an inflationary surge, then we should be fast approaching the time when these two factors are about to spell trouble for western fixed interest markets.

However:

Government debt levels are not static. In addition to new debt which is issued in isolation for ‘new’ purposes, there is also a constant rolling over process, whereby new bonds are issued to finance the repayment of capital to the holders of maturing issues (as opposed to doing something responsible such as maybe repaying the initial debt). Both these ‘new’ and ‘rolled over’ bonds, are issued at prevailing market yields which are dictated by markets via their current pricing of outstanding bonds.

With interest rates (and thus bond yields) continuing to fall, governments have, since the financial crisis (and realistically since the early 1990’s), been able to afford to keep both rolling old issues, and issuing more ‘new’ debt, knowing that the annual cost (the annual coupons they must pay on all outstanding debt) is manageable when expressed as a percentage of GDP. This is equivalent to an individual paying an interest only mortgage, where as interest rates fall, one’s monthly payments to the bank also fall (or alternatively, as governments have done for 30 years, allowing one to borrow more capital but to pay the same total monthly interest bill).

This is what that looks like in real life:

The following chart shows total UK Government Debt since the financial Crisis (2008 to the end of 2019). 2020 will likely see a sizeable spike because of COVID stimulus funding)

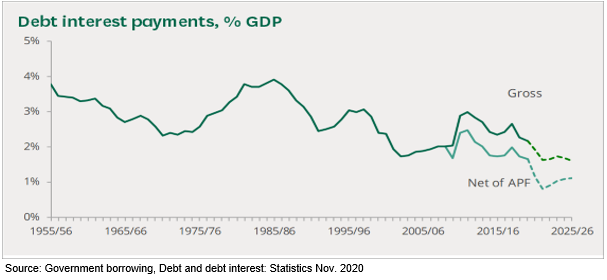

The next chart long term shows the cost of meeting the interest costs of that total debt as a percentage of UK GDP (Concentrate on the period from 2008 to date, and the forecast for 25/26)

So, the percentage of UK GDP (which has been relatively static for the period) spent on paying interest on government debt has fallen over the last 10 years, despite the actual level of debt nearly tripling from GBP 0.8 Trillion to GBP 2.2 Trillion.

Now, with current 10-year Gilt yields at 0.25%, guess what happens to UK (or any governments’) public finances if instead of paying 0.25% on 10-year debt, they are suddenly forced into paying 2%. Or 4%. Or 10% !

This means that governments are stuck in the extremely difficult position of being unable to raise interest rates, for fear of triggering a commensurate rise in bond yields, which would in turn make the annual interest bill unaffordable, because of the absolute size of the debt which has been allowed to accumulate, and the amount of debt which needs to be rolled over every year.

In addition to this, as we have identified previously, with governments’ actively wanting to create lots of inflation as the only (politically palatable) way of reducing the future value of their existing debt levels, they are extremely unlikely to take the very action to counter that inflation, which is to raise interest rates. This, incidentally, is the situation Japan has been in for the last 25 years.

All of this goes to create the fixed interest investor’s quandary. Whilst we would normally actively avoid holding conventional fixed rate bonds in a time of rising inflation, we would usually be happy to do so in a time of static interest rates.

Now, with most conventional bond yields below 1% (and a fair percentage below 0%), it is pretty much a racing certainty, especially in real terms (that is allowing for inflation), that the capital value of bonds we hold today will be lower in 5 years’ time. And on that basis, as any rational investor presented with a guaranteed capital loss would do, we probably shouldn’t hold those assets.

Alternatives to conventional fixed rate bonds do of course exist. Inflation linked issues can help, as their coupon and capital values are usually adjusted for inflation, however they are also ‘bonds’ in the sense that their capital value falls when broad market prices fall. There is also the small matter that most presently trade with negative absolute yields, presenting investors, once again, with a likely capital loss in nominal terms.

Sticking to only shorter dated bonds offers some protection against broad market falls, as their maturity proceeds will be received in a short period of time and are thus less impacted by future inflation. Except almost all Western Government bonds, and most developed market investment grade corporate debt, presently trades with negative yields, which also serves to provide investors with a guaranteed capital loss on all bonds they hold to maturity.

In other words, it’s difficult to find a bond that doesn’t, at the present time, have a high chance of losing our clients’ money in the future.

Now, as we identified at the outset, conventional wisdom dictates that bonds represent the low-risk element of portfolios, balancing the volatility associated with equities and other riskier assets. Balanced and Cautious benchmarks, against which we (but more importantly others) measure the risks we take and returns we generate also contain substantial fixed interest components. A typical Balanced / Moderate risk benchmark will have anything up to 50% allocated to bonds on an ongoing basis, Cautious mandates even more. But is it accurate to still consider bonds, which offer little if any return, and lots of potential for loss in the event of a rise in inflation, low risk assets?

Which eventually leads us to the question posed by this piece. Do we choose the low risk (for ourselves) approach of continuing to hold a significant exposure to bonds, knowing with a fair degree of certainty that they will fall in value, but certain that we will perform broadly in line with our benchmarks? Or do we take the riskier approach of reducing (or avoiding) a major asset class we are confident will fall in value, and if we do so, will those who look over our shoulders accept a divergence against our benchmarks in terms of risk and return, even if they know that doing so is means we are acting in the clients’ best interests?

At TEAM we understand who pays our wages.