Rate Expectations

(Cover Image Source: Philip Veater)

As we approach the end of the third quarter of 2021, an early autumnal storm of COVID, BREXIT, Chinese Authoritarianism, and (probably) the re-emergence of Strictly Come Baking, are coalescing to blow in something of an inflationary wind.

The latest CPI data from the UK, Europe and the US has shown that prices in the West are rising at their fastest rate in years, driven by both cost push (higher wage and raw material costs) and demand pull (supply shortage) factors. The following chart shows the lowest, highest, and most recent monthly CPI numbers for each region for 2021 to date:

As can be seen, whilst inflation has been rising for the entire year, the most recent data (Green dots) are also the highest numbers seen thus far in 2021.

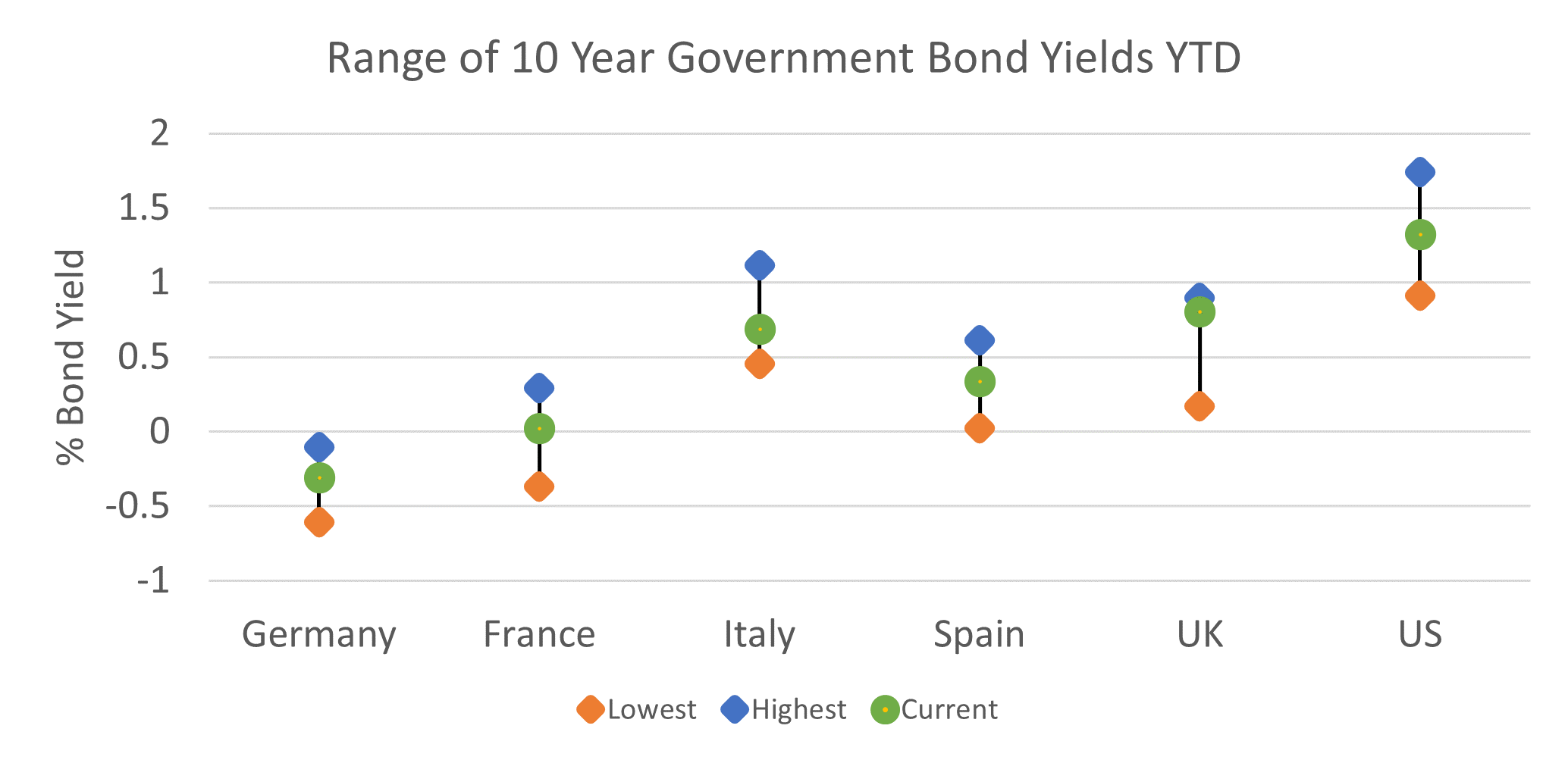

The implications of this inflationary spike would normally be felt quite rapidly in bond markets, where concerns over interest rates being raised (to dampen the demand causing the rise in prices) would cause yields to rise. If we look at a similar chart for lowest, highest and current 10 Year Government Bond yields during 2021, one would expect the candlestick points to look similar to the inflation chart above, with recent yields trading near year highs:

Surprisingly, the only market where this relationship holds remotely true is the UK, where 10 Year Gilt yields have recently approached 0.9%, having been as low as 0.17% in January. US Treasury yields are at 1.3% against a current US inflation rate of 5.3%, whilst 10 Year Bunds yield -0.31% versus an EU inflation rate of 3%. (Italian BTP’s, at 0.69% are closer to their year lows of 0.46% than their year highs of 1.2%).

With ‘real’ returns (i.e. nominal bond yields less inflation) in such deeply negative territory, one has to constantly question why bond investors remain so willing to keep losing money in real terms.

Are fears that COVID’s effects upon the global economy will be so prolonged that the recent surge in prices represents something of a false dawn? Is the expectation that price rises will quickly return to their long-term trend?

Or are we finally approaching the peak in the post-epidemic economic recovery? The most recent GDP figures for each region would suggest otherwise. (Even China, where concerns over slowing are most extreme, grew at a ‘paltry’ 7.9% during the second quarter of the year).

Or have investors finally caught on to the fact that with Debt to GDP ratios for most major countries now decisively through 100% after a debt-financed 18-month relief spending splurge, that Central Banks have finally got what they have wanted for the best part of 15 years. Sufficient inflation to begin reducing the future value of their debt mountains they have created. And why would they spoil that party by doing something as irresponsible as raising interest rates?