Quarterly Investment Review & Outlook

Tariff Torpedo’s

Investment Review 1st Quarter 2025

(Source: Grok 3, TEAM)

Animal spirits crushed

Sentiment and confidence are fragile human characteristics. Fresh from stellar back-to-back years for risk assets, and a colossal Republican presidential victory on 5 November 2024 by Donald Trump, investors entered 2025 in an ebullient mood, buoyed by increasing belief in the notion of ‘American exceptionalism’.

January appeared to confirm the prevailing narrative. Insatiable investor appetite for American stocks, led by a frenzied retail investor community, powered US indices higher, leaving seasoned market observer’s purring over prospects for the ‘January Barometer’ to play out over the remainder of the year.

To recap, the January Barometer, first devised by Yale Hirsch of Stock Trader’s Almanac fame, holds that a positive close for the S&P 500 Index in January portends better than average returns for US stocks for the full year.

However, two months is an awfully long time in markets. By the end of March, investor jitters had swiftly replaced euphoria as the collective lens of the market moved to focus squarely on other, potentially damaging, policies of the administration, namely tariffs and immigration controls.

Any lingering hope of a watered-down version of reciprocal tariffs set to be unleashed on America’s trading partners on April 2, labelled ‘Liberation Day’ by the Make America Great Again (MAGA) team, were dashed late in the quarter by a howitzer from the President, courtesy of Truth Social:

‘For decades the U.S has been ripped off and abused by every nation in the world, both friends, and foe. Now it is the time for the good old USA to get some of the money, and respect back. God bless America.’

Markets took fright, ignoring any potential revenue benefits of tariff policies and focussing their attention on probable negative impacts to domestic growth (lower) and inflation (higher, as ultimately these costs will need to be borne by the retailer and/or the consumer), as well as speculating what a retaliatory response from those countries affected might look like. Time to dust off the Game Theory textbooks.

Ultimately, the initiative is being widely interpreted as throwing sand into the gearbox of an already slowing US economy, whilst adding considerable uncertainty to the global macroeconomic picture.

China’s ‘Sputnik’ Moment and the ‘Lagnificent 7’

In classic contrarian investment fashion, when the news can’t get any better, by definition, it can only get worse.

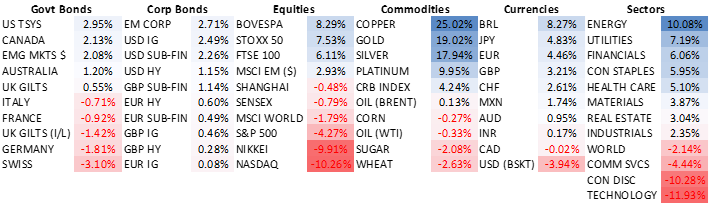

No sooner did ‘US exceptionalism’, epitomised by the unparalleled domination of the Magnificent 7 companies (Apple, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla) in global indexes (see chart below), become mainstream, cue a stunning development in the AI space from China, namely the unveiling of a Chinese AI chatbot, Deep Seek R1, in January.

(Source: FactSet, MSCI, Jeffries Global Research)

Developers of Deep Seek, a free open-source language model that quickly became the App Store’s most downloaded app, claim that it only took two months and less than $6 million to build using less advanced Nvidia chips. Arguably, the event represents the most significant development in global stock markets since the January 2023 announcement of Microsoft’s investment in ChatGPT maker Open AI, which served as the original catalyst for a new leg to the technology story.

The announcement showcases China’s often overlooked culture of entrepreneurship and burgeoning technological capabilities, whilst demonstrating that investing in AI may be nothing like as expensive as previously thought. This should accelerate the advancement of the technology while at the same time potentially commoditizing so-called large language models that do the heavy lifting processing the data.

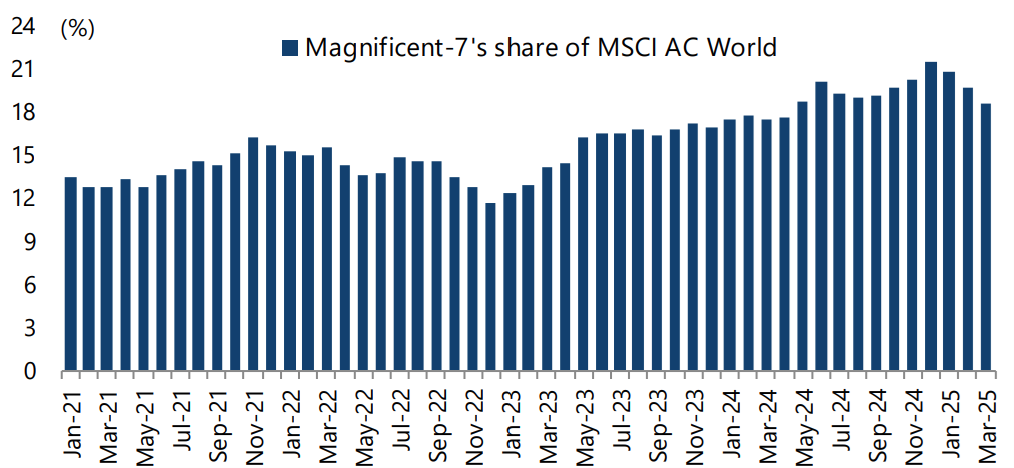

For investors, these implications led to a deeper questioning over, 1) whether the Big Tech incumbents will be able to maintain their dominant positions given the clearly disruptive potential of AI, and 2) whether the gargantuan amounts being spent on computing power in the AI capital expenditure arms race is justified. Against the backdrop of premium valuations and wildly optimistic over future cash flow conversion from AI capabilities, ‘Magnificent 7’ stocks were humbled in the first quarter:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

Germany’s fiscal revolution

Across the Atlantic in Europe, the German government delivered an excellent working example of the investment axiom, ‘it is darkest just before the dawn’. From the ashes of a long period of economic malaise and a succession of political fiascos culminating in the collapse of Germany’s coalition government late last year, came a resurrection triggered by the German federal election on 23 February.

Galvanised by a series of extraordinary speeches from Vice-President JD Vance and the Donald on the need for Europe to look after its own defences, Chancellor-to-be Friedrich Merz wasted no time in revising Germany’s self-imposed constitutional debt brake, or ‘Schuldenbremse’, which restricts borrowing to a maximum of 0.35% of GDP in a fiscal year.

The plan, which ‘could easily be a sustained fiscal stimulus unparalleled in Germany’s history’ (Jim Reid, Deutsche Bank), was passed on 21 March. The €1 trillion debt-funded package is centred around unlimited defence spending and a €500 billion extra-budgetary fund to upgrade the country’s creaking infrastructure over the next decade, including decarbonisation projects, expansion of its rail network, renovation of universities and new housing.

Moody’s forecasts the extra borrowing will increase Germany’s annual budget deficit up to 2.5% of GDP but will remain below the EU’s 3% limit and other members. In the longer-term, the boost to the economy should offset the costs. Over the next two years, Germany’s total debt-to-GDP ratio is expected to rise 5% from 63% to 68%. It has plenty of room for manoeuvre.

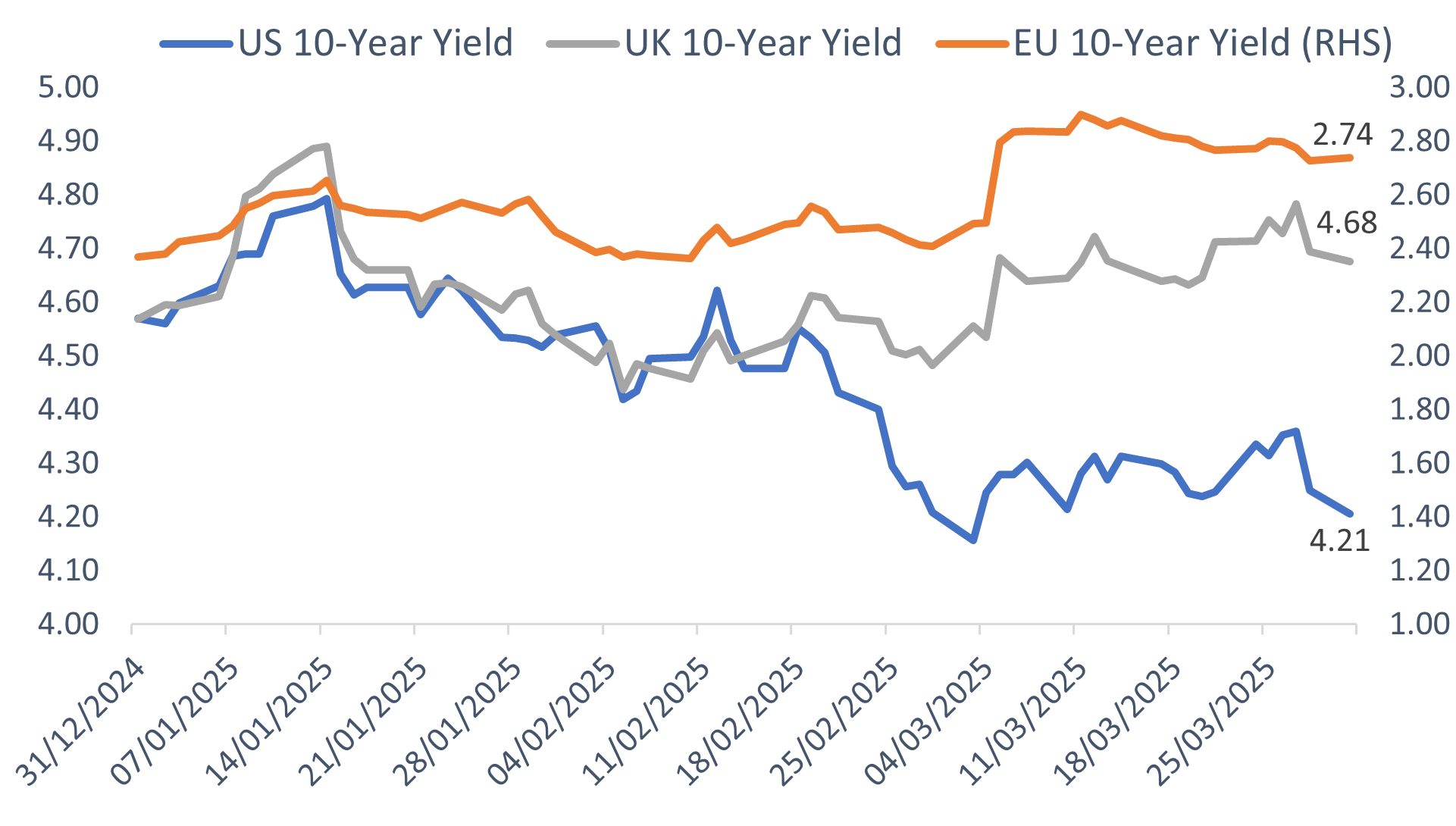

Equities: Scores on the Doors (all returns in sterling terms)

Developed market equities (represented by the MSCI World Equity Index) delivered a -1.8% total return over the 1st quarter, masking far more severe returns in other developed markets. The S&P 500 large cap index delivered a -4.3% total return, whilst the technology-laden Nasdaq Index returned -10.3%.

Japan’s Nikkei 225 Index returned -9.9% over the quarter.

European developed market equities ex-UK returned +6.9%, whilst the MSCI Emerging Markets Index returned +2.9% over the quarter.

China delivered a modest negative return of -0.5%.

India returned -0.8% on the quarter.

Fixed Interest

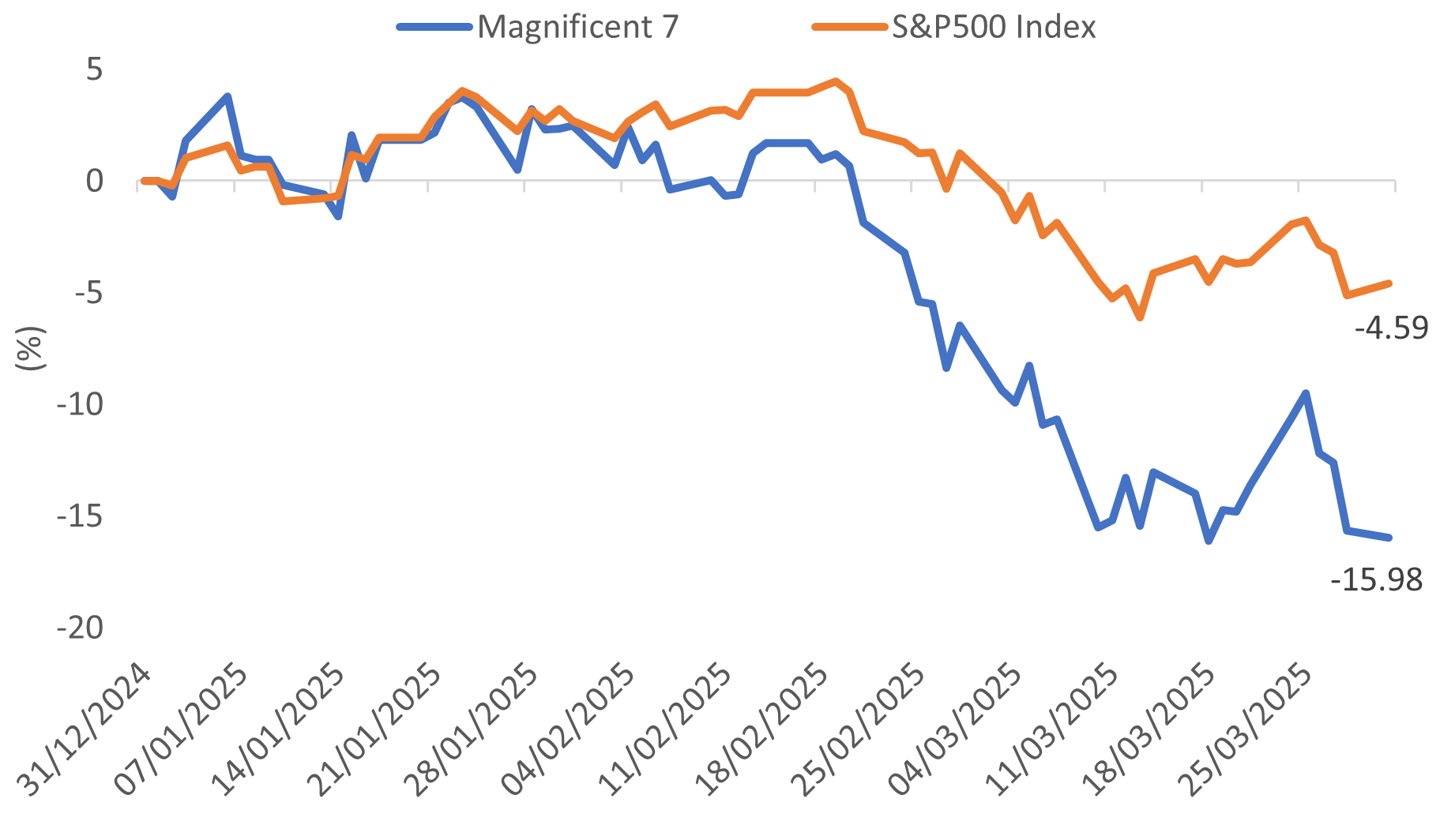

G7 government bond yields traded mixed throughout the first quarter across markets, gyrating on a combination of the German fiscal bazooka and Trump’s impending tariff torpedo’s:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

A more dovish Federal Reserve

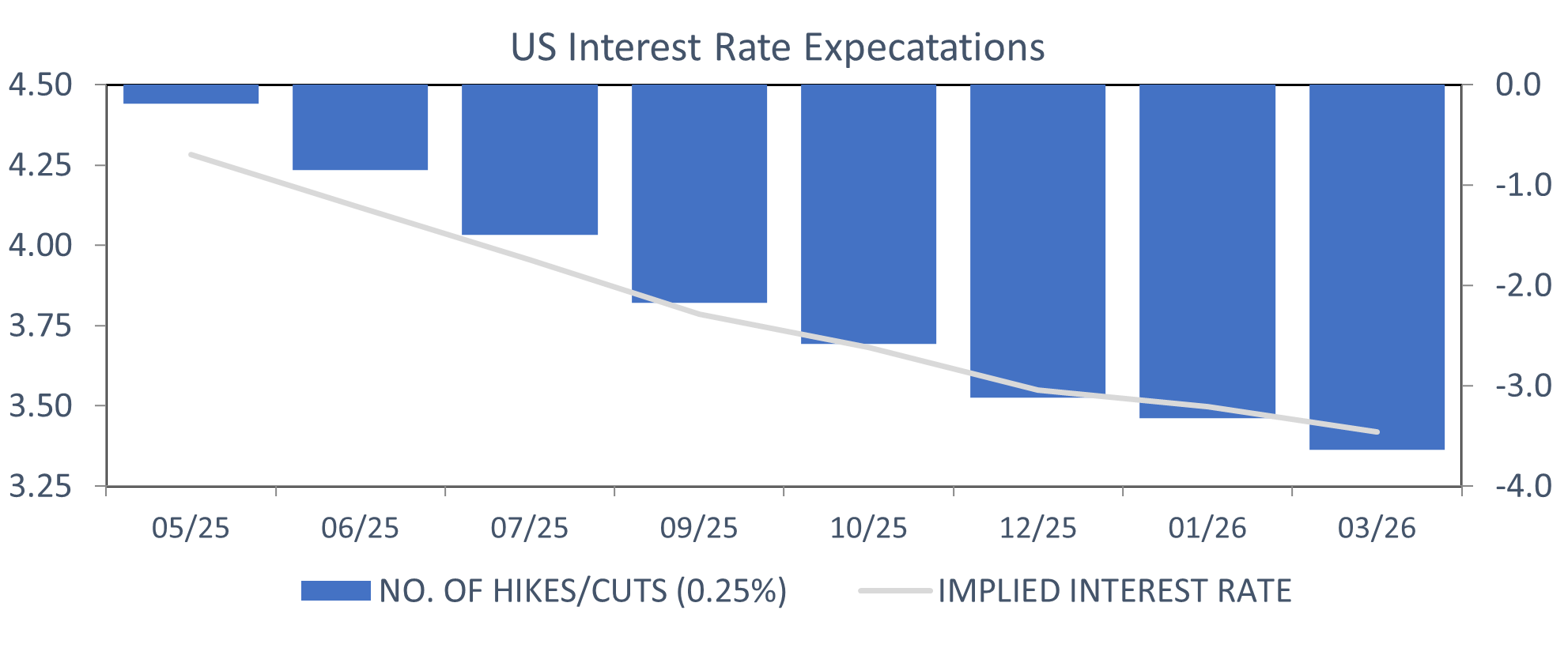

Although the Federal Reserve held its benchmark interest rate unchanged in March, a more dovish tone suggested it will cut rates at a faster pace than the ECB during the remainder of the year. This reflects a shift in expectations from worries that the Donald would turbo charge the economy with tax cuts and deregulation to concern that a focus on spending cuts (“DOGE”) and trade protectionist policies will have the opposite effect.

Consequently, the Fed lowered its forecast for the economy to grow at 1.7% this year, down from 2.7%, and announced it will slow the speed of its quantitative tightening programme, reducing the notional value of US Treasuries it allows to roll off its balance sheet each month from USD 25 billion to USD 5 billion from April.

The Fed is also struggling to grasp the impact of tariffs on inflation with Chair Jay Powell suggesting the base case is that the impact will be “transitory”, a term which tested the market’s patience, and policymakers’ credibility, in the aftermath of the Covid pandemic. He added that in this scenario, it would be appropriate to look through inflation, paving the way for rate cuts to try to head off downside risks to the economy. Money markets are now pricing in three more quarter point cuts this year:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

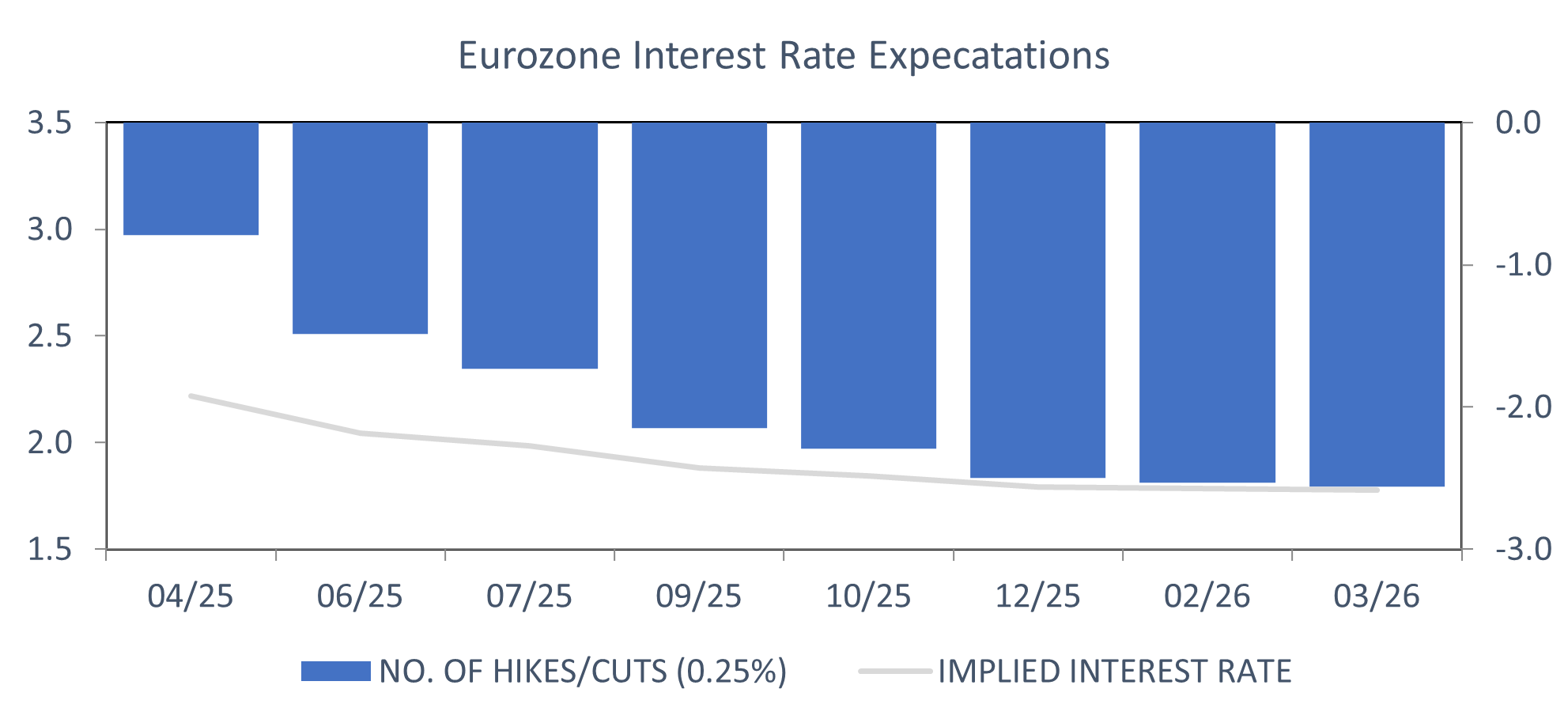

Lagarde U-turns

As expected, the European Central Bank cut its deposit rate by another 0.25% to 2.5% in March but with a surprisingly hawkish twist, adding that “monetary policy is becoming meaningfully less restrictive” in its statement. Although there was no opposition to the rate cut from voting members of the council, Austria’s central bank government Robert Holzmann abstained.

Money markets immediately reacted and eased expectations of the pace and magnitude of future policy easing, pricing in a little more than two additional quarter point rate cuts between now and the end of the year:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

The ECB lowered its economic growth forecast for the Eurozone for this year from 1.1% to 0.9% but it didn’t account for the fiscal bazooka fired by its largest economy. President Christine Lagarde cited the high uncertainty, at home and abroad, particularly around tariffs, is holding back investment and weighing on consumer confidence.

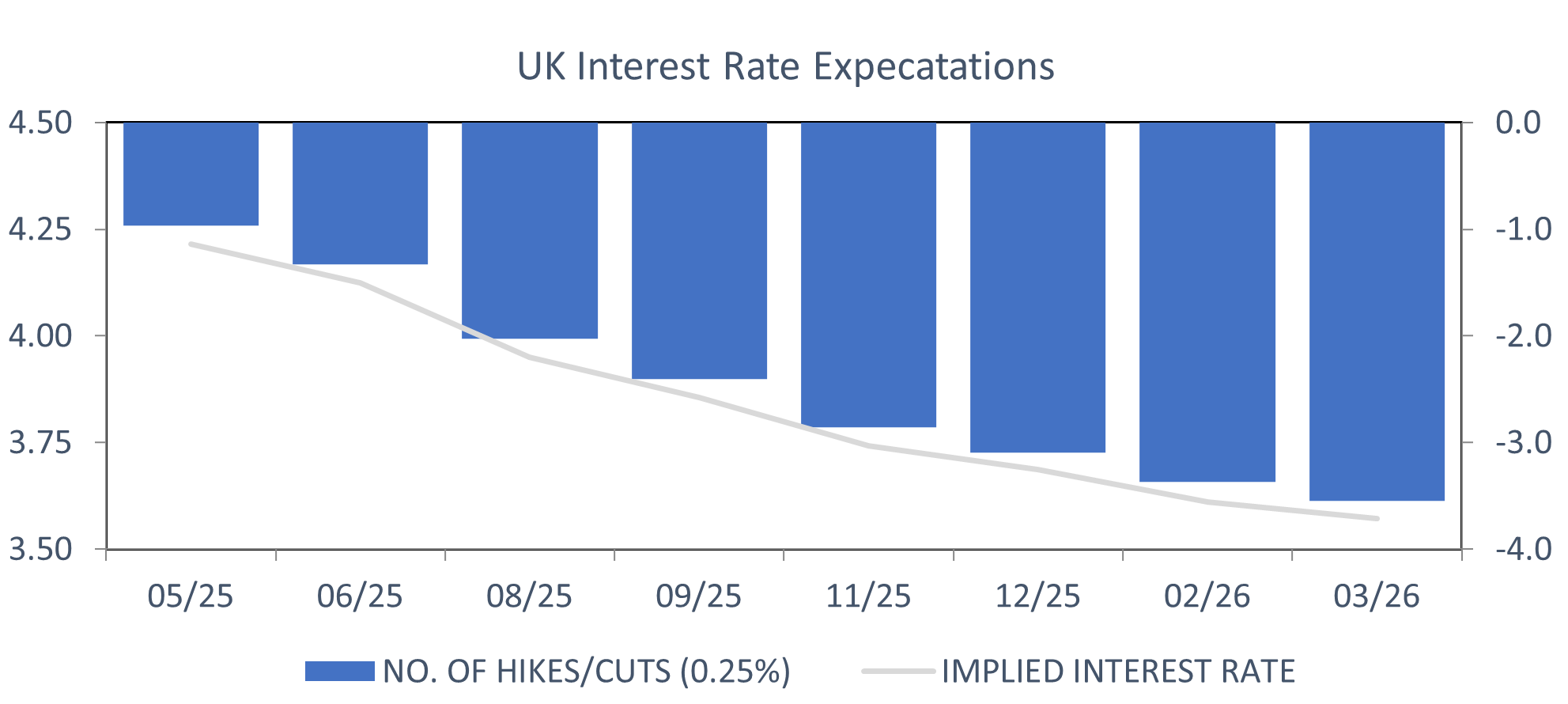

Stagnant UK

At the start of the year, money market futures were pricing in the Bank of England cutting interest rates just two times in 2025, bringing the base rate down to 4.25% by Christmas. However, the BoE is now expected cut rates three more times this year to head off risks to the economy from a trade war:

(Source: Bloomberg, TEAM)

(Source: Bloomberg, TEAM)

Inflation slowed more than expected to +2.8% in February, driven by a fall in clothing prices, yet services inflation, held steady at 5%. Prior to the announcement of tariffs, the BoE forecast inflation will rise to 3.7% in the third quarter, primarily due to higher energy prices, and slow to 2.5% next year and reach the target rate of 2% in 2027. This month’s increases to water, energy and telecoms bills will also stoke inflationary pressures going forward.

Commodities

Gold returned +19% on the quarter in US dollar terms, and the performance of the yellow metal remains respectable in the face of rising real yields in this post COVID cycle. We have witnessed record central bank gold buying since the third quarter of 2022, potentially triggered by America’s decision earlier that year to freeze Russia’s foreign exchange reserves.

As a result, global central banks bought a record net 1,082 tonnes of gold in 2022, a net 1,051 tonnes in 2023, and a net 1,045 tonnes was purchased in 2024 according to the World Gold Council. In addition, strong demand from Asia, and still simmering geopolitical risks continue to drive a flight to haven assets.

Silver, the ‘white metal’, delivered an impressive +18% gain in the first quarter. Robust industrial demand, particularly from the renewable energy sector, led by solar in China, has been driving a structural mismatch between supply and demand that is projected to sustain for some time.

Turning to oil, both Brent and WTI prices were broadly flat on the quarter. OPEC’s announcement that it would move forward with adding back supply next month has created a potential supply glut, whilst the Trump tariff regime threatens to create headwinds for growth. Dated Brent briefly crossed below $70 per barrel to trade traded with a “6-handle’’ for the first time since late 2021.

TEAM Positioning & 2nd Quarter 2025 Outlook

From our January 2025 monthly commentary, ‘As the saying goes, one swallow does not a summer make, but the slowing outperformance of mega-cap technology alongside a global rotation into cheaper equity markets has been acknowledged by our investment framework. Viewed through the prism of fundamental investment building blocks (valuation, sentiment, technical, positioning), America is flashing ‘red’ on all metrics.

We are not proclaiming imminent recession, but we do think the seeds have been sown for a potential growth scare in 2025. The US housing market remains an area of vulnerability, with unsold inventory amongst the big national developers creeping steadily higher. Separately, government employment has done the heavy lifting in terms of payroll growth this cycle but looks to be firmly in the crosshairs of the Department of Government Efficiency (DOGE) that is hellbent on showing quick and effective results.’

The American growth scare scenario is playing out more quickly that we had envisaged. In addition to a meaningful weakening in housing and labour markets, consumption is cooling, evidenced by ‘hard’ (reliable and methodologically sound statistics taken from official or organisational bodies) and ‘soft’ (survey, sentiment, and expectations, releases) data that points to lower US spending trends and dwindling confidence over the future. We now have the Trump tariff shock to add to this cocktail.

Action taken

Opportunistically, we meaningfully dialled down equity risk exposure for our more conservative and balanced strategies in January and February, whilst shifting some American equity exposure to more unloved regions for our growth and equity risk strategies. Within the US, the equal-weight large-cap S&P 500 index has materially outperformed the cap-weighted S&P 500 growth index and the technology-laden Nasdaq index, both of which are suffering a rapid repricing to the downside.

Within bonds, we have been strategically underweight long duration bonds against the backdrop of mounting government deficits and a wall of supply this year that could create refinancing problems for weaker companies. Germany’s recently announced mammoth fiscal spending plan will have to be paid for somehow, and the absence of economic growth engines in the UK remains a worry. Our preference in the space remains high quality investment grade corporate credits and financial hybrid bonds issued by well capitalised European banks and insurance companies.

Gold continues to shine, breaking through the psychologically important three thousand dollars per ounce level for the first time in its history. The barbarous relic, as it is known by investors unconvinced by its allure, has now outperformed the S&P index by 2.5 times since the year 2000. Go figure.

Saints and sinners

What worked: Physical gold and precious metal miners, energy sector equities, International (ex-US) equities including Asia, Europe, and UK, high yield corporate bonds.

What did not work: US technology and MCG (mega cap growth) companies, US infrastructure equities, small cap equities, India equities.

Our asset allocation for the core TEAM MPS multi asset range and equity strategy is shown relative to neutral weightings in the table below:

Equities

Having retained a ‘barbell’ approach to our equity exposure, with US mega cap and technology as ‘core’, and ex-US equities as ‘satellite’, we enter the second quarter of 2025 with a far more international look. Our framework seeks to stay in harmony with strong primary trends and it is detecting a shift in market leadership both within America and in a global context.

In Europe, the devil will of course be in the detail with regards to successful execution of Germany’s fiscal plan. The hope is that rather than expending energy on how to deal with Trump’s posturing, politicians maintain current momentum by focusing firmly on domestic issues, namely reflating their economies and driving growth via productive investment towards critical infrastructure and defence. The next few years could prove to be a case of last chance saloon for European economic and fiscal integration considering the election success of nationalist parties across Europe over the past year.

On China, important developments are taking place, with the goal of unshackling a Chinese consumer that remains extremely nervous following stop-start COVID lockdowns and the subsequent property market crash. The net result has been a huge increase in aggregate household savings, a money mountain that Beijing is actively seeking to tap via encouraging public announcements including one in March that included a “special action plan to boost consumption’’.

Our preferred method of exposure remains the Chinese internet space that, despite the recent Nasdaq technology unwind, still trades at a substantial discount (approximately 60% to the Magnificent 7) to American counterparts, whilst corporate earnings in China are inflecting upwards, a promising signal.

Deep Seek news aside, what is underappreciated by the market in our humble view is China’s growing competitiveness in high-tech sectors. This is not just EVs or batteries but also robots and automation. China accounted for 51% of global industrial robot installations in 2023, with 276,288 new units installed, according to the International Federation of Robotics.

India remains one of the world’s most exciting domestic demand driven investment stories, particularly against the backdrop of ongoing global market turbulence. A new capital expenditure boom is underway and anticipated to drive 7% real GDP growth and approximately 12-15% aggregate corporate earnings growth over the next 5 years or more. Given India still miniscule representation in the MSCI World All Country Index of 1.8%, room still exists for a significant re-rating.

We noted last quarter, ‘In the short-term, further underperformance would not come as a surprise, as the market unwinds some of the froth that has built up during this cycle, particularly in the small and mid-cap space.’ That has continued, led by aggressive foreign selling of Indian stocks to the tune of a net US$12.8bn last quarter after selling a net US$12.3bn in 4Q24.

However, more populist government budget from third-term Prime Minister Modi combined with recent personal income tax cuts should provide tailwinds for consumption.

Fixed interest

We continue to remain sceptical about the pricing of longer-term interest rates in the UK, Europe, and the US. Do 10-year Bund (2.7%), Treasury and Gilt (4-5%) yields offer investors adequate compensation for the risks that inflation becomes more structural due to competition for scarcer resources, political risk, and/or for the supply of bonds needed to fund budget deficits? We don’t think so.

Although we are mindful that credit spreads have tightened significantly over the past couple of years, the easy money has clearly been made and there is less juice to squeeze from the trade, credit valuations compared to their longer-term averages do not look too expensive. Furthermore, credit spreads are historically positively correlated to lower interest rates at the start of the easing cycle with companies benefitting from easier re-financing conditions.

Key risks to the constructive outlook include inflationary fiscal (tax cuts) and trade policies in the US which could restrict the Federal Reserve from cutting interest rates further and slow the pace of monetary easing elsewhere. Fed chair Jerome Powell admitted that some members of the FOMC had incorporated these proposed policies into their inflation forecasts at December’s meeting – fifteen of the 19 members see a higher risk inflation will exceed their expectations rather than undershoot them.

Higher government bond yields could also impact returns. Medium-to-long term yields have risen in 2024 despite policy support from the ECB, lower inflation and a weaker economic growth outlook, implying that markets have become more sensitive to high budget deficits and the impact of higher borrowing costs on national debt levels. Governments have given bond vigilantes the whip hand, and it is possible that there will be a greater focus on debt and political stability next year leading to steeper yield curves.

To offset this risk, we will continue to focus our investments on intermediate dated bonds, or the ‘belly’ of the curve, which we think offer the most attractive risk-reward profile and credit spreads can provide a buffer against volatility in government bonds.

Alternatives and Cash

Physical gold and global miners remain essential portfolio insurance in the context of long-term dollar debasement (the loss of purchasing power). The simple case for ownership is that gold has outlasted every stock market in history, and 10kg of the yellow metal will still buy an average family size home, just as it did nearly 100 years ago.

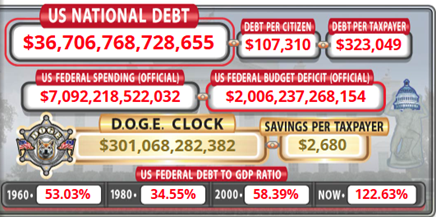

Despite the headline grabbing efforts of Musk and DOGE, the brutal reality is that 96% of existing US interest payments are directed to Medicare, Medicaid, and Social Security, which are essentially ‘untouchable’. Elon has his work cut out as shown below by the enormous, and growing, US debt mountain, which currently stands at 36.3 trillion dollars, excluding unfunded liabilities:

(Source: USdebtclock.org)

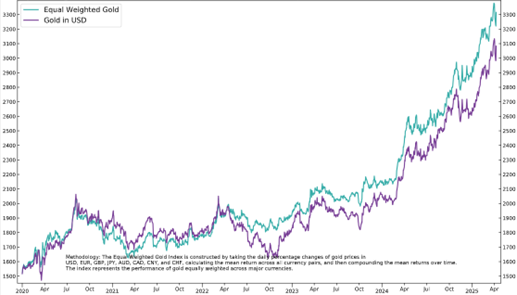

Gold continues to shine, with the price touching new all-time highs during the quarter across many major currencies. Shown below, gold in dollars (purple line) being led by an equal-weighted basket (teal line) which prices gold across eight major currencies including the Swiss Franc, Japanese Yen, Euro and Pounds Sterling:

(Source: 3Fourteen Research, TEAM)

We also anticipate strong returns in this cycle from established, well-managed, precious metals mining companies that are cheap in absolute and relative terms, generating formidable cash flows, and delivering solid operational performance given current spot prices. It would not take much in the way of global capital flows to put a bid under the sector.

As always, rather than attempt to look around corners and predict outcomes, we rely steadfastly on our systematic investment process, which has successfully navigated an array of market conditions during this post-pandemic cycle and delivered respectable risk-adjusted returns for our investors.

Thank you for your continued support and interest in TEAM.

(Cover Image Source: Mathieu Stern)