Quarterly Investment Review & Outlook

Investment Review 3rd Quarter 2024

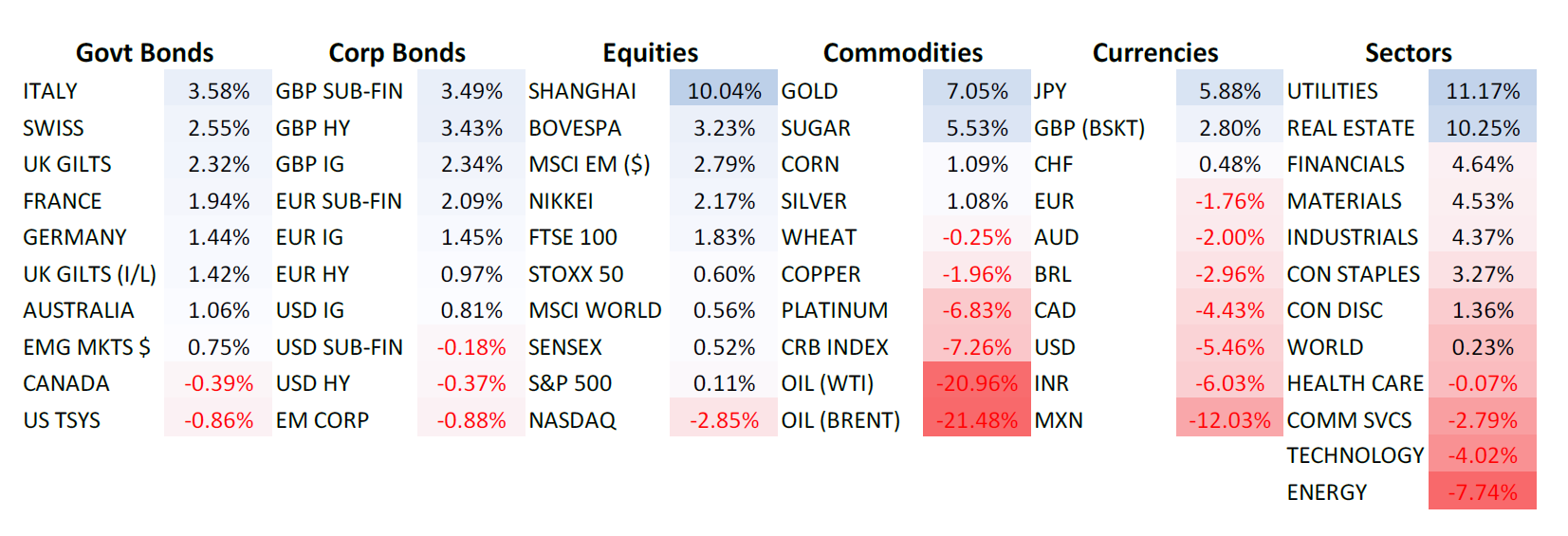

Major Asset Class Returns for 3rd Quarter 2024, GBP (£) terms

The ‘Powell Put’

The ‘Fed Put’: a term used by financial market participants to describe the belief that the US Federal Reserve will step in to support the economy and asset prices during times of stress or uncertainty.

A fascinating period for global financial markets that resembled anything but the ‘summer doldrums’, a traditionally quieter time for investors on account of the European summer holiday season and thinner trading volumes. The path from A (end of June) to B (end of September) was anything but gradual, which is broadly what is suggested by headline global equity and bond market returns for the third quarter.

Asset prices gyrated wildly at times, digesting news of the biggest IT outage in history, two assassination attempts on Presidential candidate Donald Trump, incumbent President Joe Biden’s decision to withdraw from the election race and the subsequent nomination of Vice-President Kamala Harris as Democratic Presidential candidate, a global volatility shock triggered by the Bank of Japan, a ‘big bazooka’ in the form of stimulus from China, and a rapid escalation of conflict and tension in the Middle East.

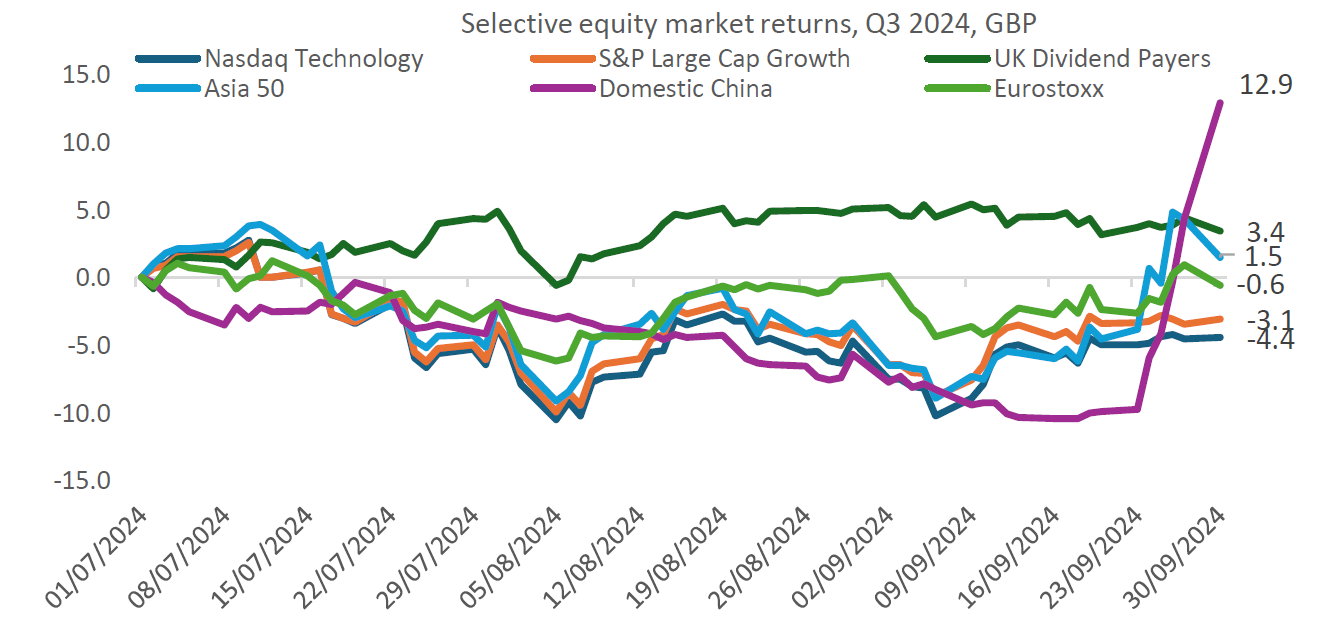

From an equity market standpoint, the key feature of Q3 has been leadership rotation away from the pandemic winners of this cycle (Artificial Intelligence (A.I.)-related technology shares led by the Magnificent 7 of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla) and towards other more cyclical, value-orientated, sectors and regions listed outside of the United States:

Identifying a protagonist for the rotation is usually a fool’s errand, for the true reason will only be known in hindsight. Nevertheless, several factors appear to have contributed at the margin.

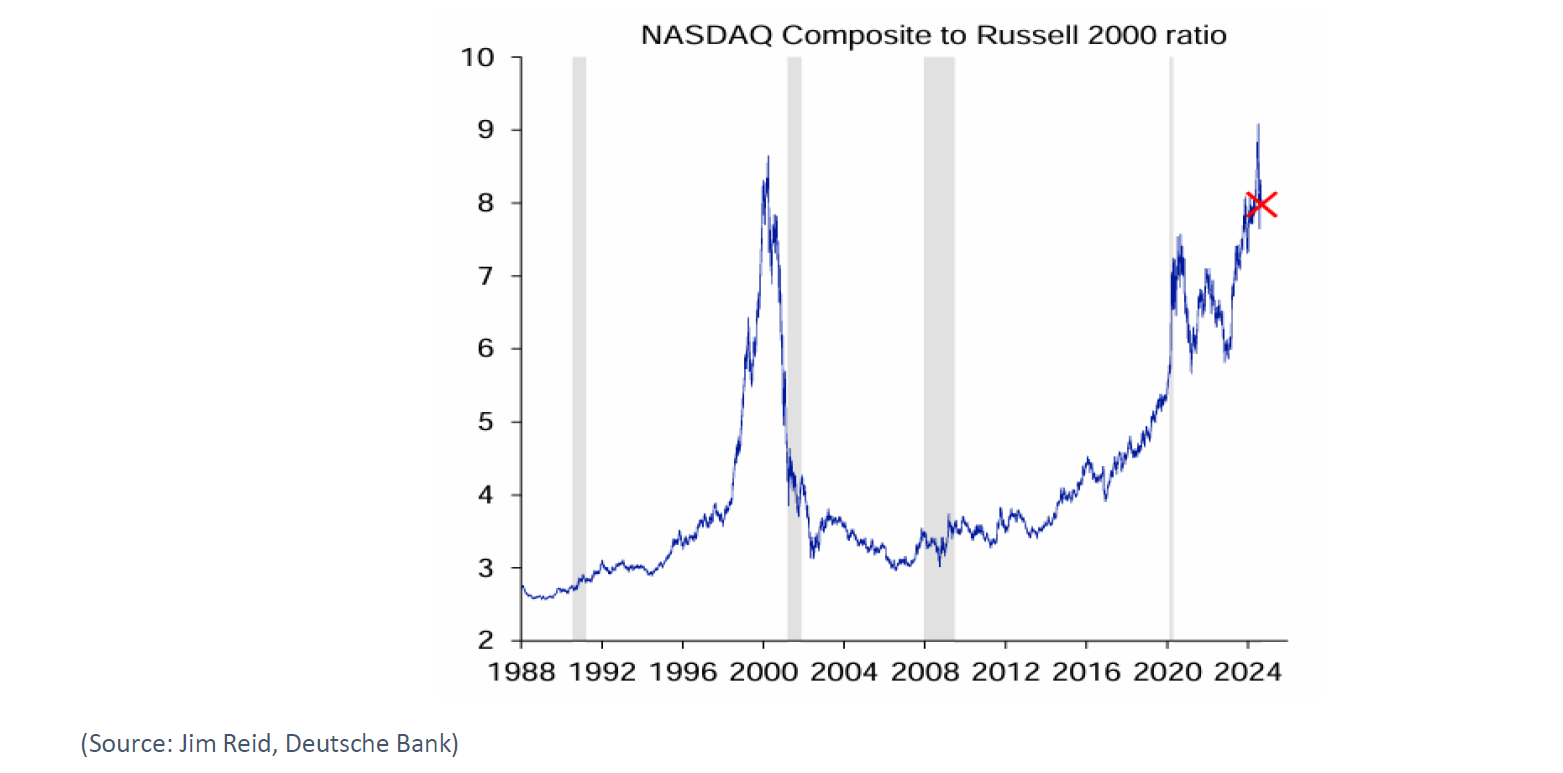

The remarkable outperformance of mega-cap technology shares, deeply concentrated positioning in the technology sector by global fund managers, and euphoric sentiment regarding the prospects of these companies, all indicated that a pause for breath, or something more acute, was likely over the summer months. Shown in the chart below is the relative performance of the Nasdaq technology index versus the Russell 2000 index, a proxy for small capitalisation stocks in America:

Is this the early innings of a substantial correction, or merely a small setback? That is the question vexing investors who, en masse, have finally began asking whether businesses are likely to reap sufficient returns on what, by some estimates, could be over 1 trillion dollars in A.I. spending in the coming years.

Soothing comments from CEO Jensen Huang of Nvidia, the posterchild of the A.I. revolution, regarding insatiable demand for A.I. semiconductor chips, and solid earnings results from key industry players that provide goods and services to A.I. companies, provided a degree of reassurance, at least for now.

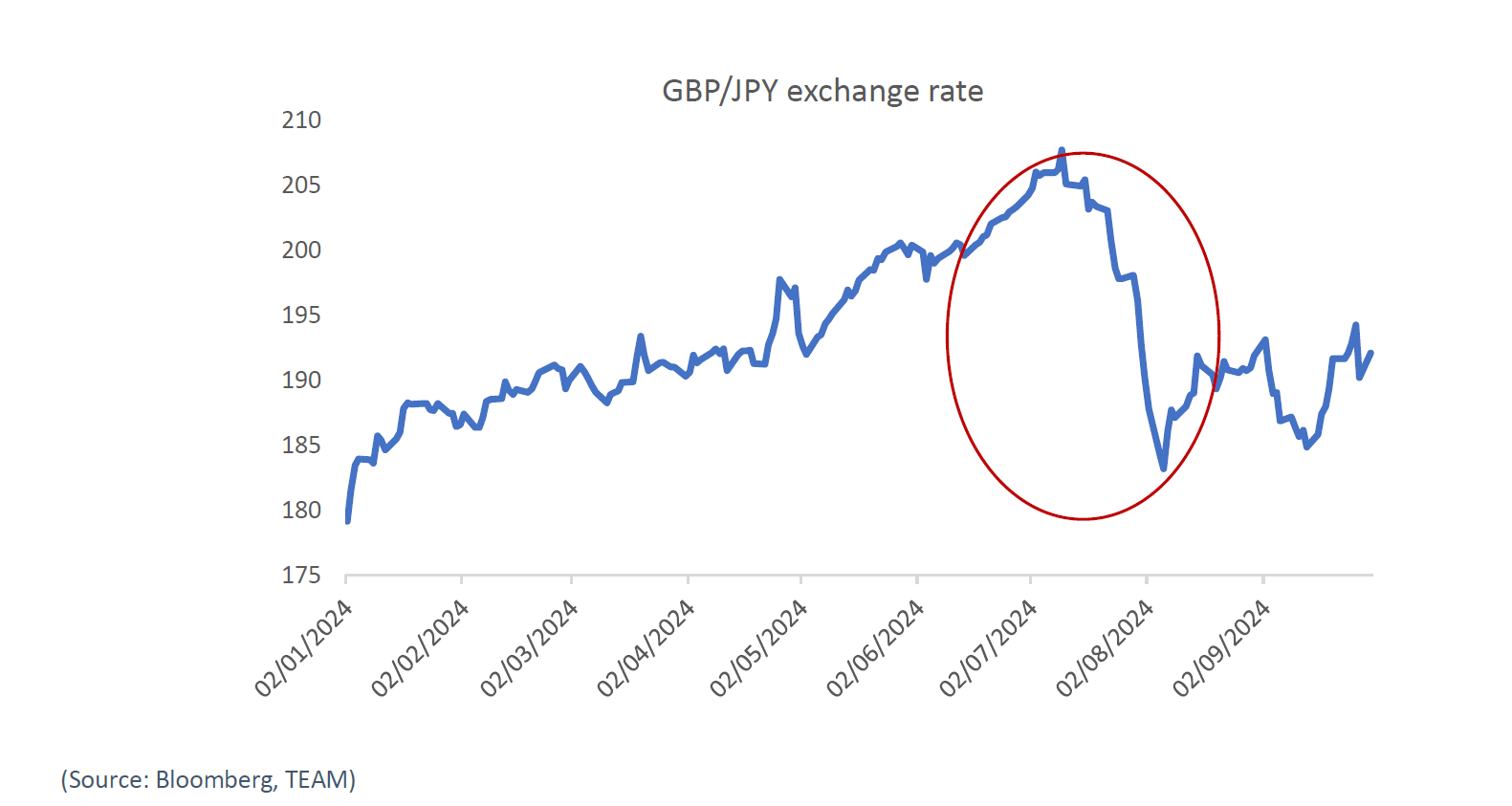

August was characterised by the re-emergence of volatility, hidden in the shadows for much of 2024. The VIX index, a measure of investor’s appetite for S&P index put contracts to hedge portfolios and referred to as the ‘fear index’, spiked to 65, a level only previously matched during the depths of the 2008 global financial crisis, and the more recent 2020 global pandemic.

Just three trading days into August, the blue-chip S&P 500 index had fallen more than 6%, whilst Japan’s Nikkei 225 Index collapsed 20% lower for its biggest drop in percentage terms since 1959. The rout was triggered by a perfect storm of unrelated, technical events, and price movements were magnified in thinner summer markets.

Chief amongst these were the Bank of Japan’s second rate rise in 17 years which prompted a sharp unwind of the ‘carry trade’, borrowing in yen to buy higher yielding assets. An old investment adage states that financial markets ‘take the stairs up (bull market), and the elevator down’ (bear market), and that was certainly the case with the dramatic move seen in the strengthening of the Japanese yen in early August (year-to-date chart shown below in sterling terms):

At one point, money markets were pricing in a 60% chance of an emergency interest rate cut by the US Federal Reserve. Funds flowed into haven assets, such as gold and government bonds.

However, subsequent economic data releases gave some reassurance that the US economy is not on the brink of recession and provided a platform for markets to showcase their bouncebackability, a characteristic that has come to define risk assets in this post pandemic cycle. Retail investors piled into equities in late August, with inflows into US stocks at their highest level in over a year.

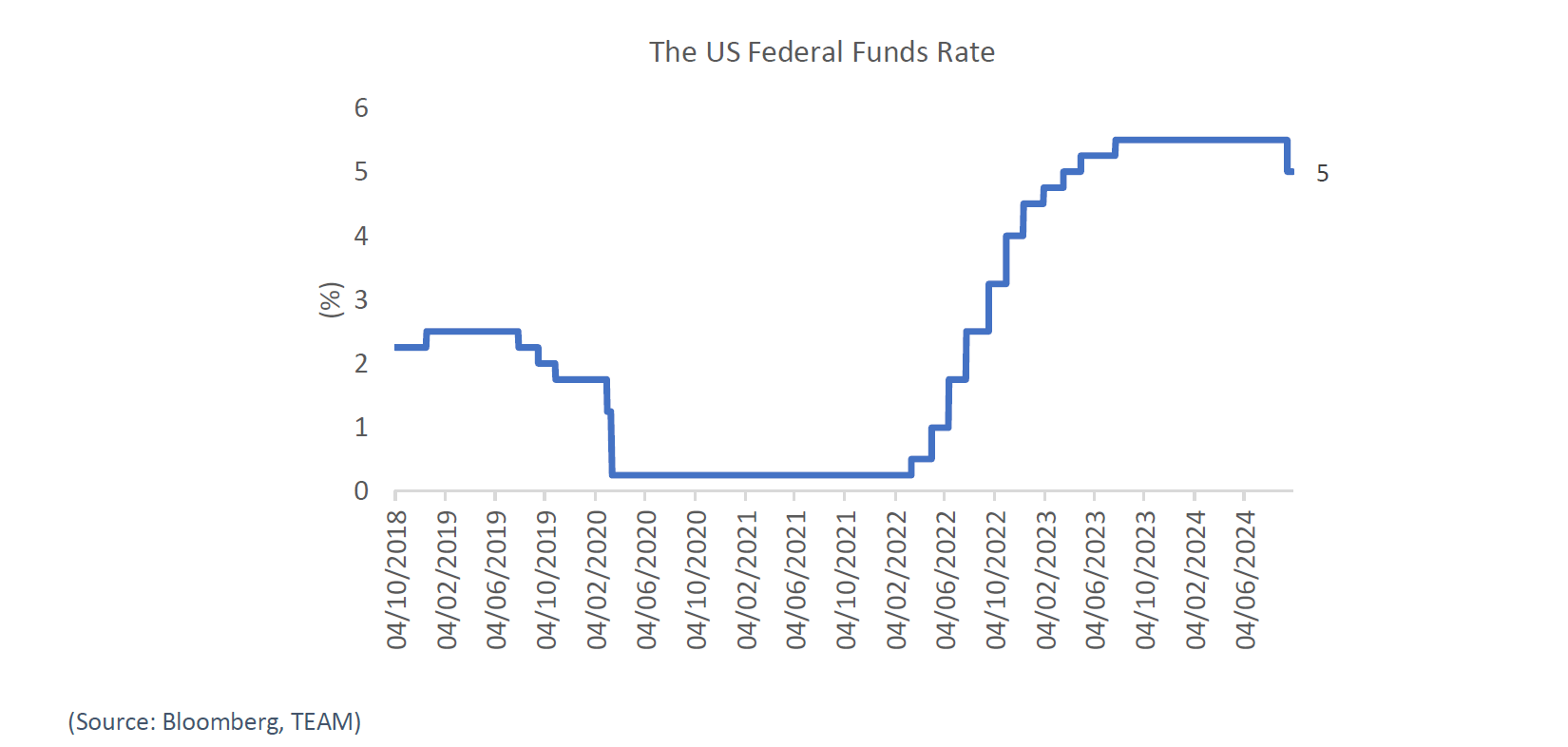

Investors were further galvanised later in the quarter following one of the most widely anticipated interest rate decision meetings in history. Federal Reserve Chairman Jerome Powell delivered a jumbo 50 basis point rate cut, the first of its kind outside of recessionary episodes in the modern era:

The accompanying statement and comments indicated the lens of the committee has now shifted from inflation and towards growth. Employment stability is now the number one policy priority.

History tells us that when a rate cutting cycle begins, equity markets move strongly higher over the next year or two. However, during the 2000 and 2007 rate cutting cycles there were noticeable negative equity returns over the following two years. The determining factor between these two binary outcomes is whether the US enters a recession. For now, the weight of evidence suggests not.

Following a lull mid-month as investors digested mixed macro data from America and more alarming economic paralysis in Germany, the 2024 bull stampede was reignited by China, as Beijing officials declared their own version of Mario Draghi’s famous ‘whatever it takes’ moment, unleashing a wide-ranging series of monetary and fiscal stimulus measures in a bid to shore up confidence amongst the populace.

The People's Bank of China (PBOC) announced significant cuts to bank reserve requirements and a key lending rate, a slew of property-related measures designed to stimulate activity, and liquidity support for China Inc. The coordinated policy moves aim to stimulate growth amid significant economic challenges, providing a short-term boost to investor sentiment.

Mr Market’s ability to confound and surprise is one of the few constants in the investing world. Having registered 52-week price lows less than a fortnight ago amidst a widespread sense that China has become ‘un-investable’, the domestic Shanghai and Shenzhen indexes soared to touch new 52-week price highs on the final day of the quarter that included the best week for equities since 2008.

China’s news acted like a steroid injection for risk assets, with sectors and companies that have been hurt by the country’s economic slowdown this year now benefitting from the pivot towards improving domestic consumption and industrial activity.

The pan-European Stoxx 600 index rose, with most sectors in positive territory. Mining stocks led the gains, benefiting from what is likely to be significantly increased demand for commodities. Major miners like Antofagasta, Anglo-American, Glencore, and Rio Tinto saw strong increases.

Closer to home, the UK's economic challenges have dominated recent headlines, with the recently installed Labour government grappling high debt, sluggish growth, and limited options for public investment. The national debt now exceeds 100% of GDP, and borrowing reached £64.1 billion by August. Labour kicked off their annual conference amid a political row involving donations, back-tracking on the non-domicile rules, and PM Starmer’s calamitous ‘bring back the sausages’ moment.

Equities: Scores on the Doors (all returns in sterling terms)

Developed market equities (represented by the MSCI World Equity Index) delivered a +0.24% total return over the 3rd quarter. The S&P 500 large cap index delivered a -0.45% total return following a blistering first half for American large caps.

Japan’s Nikkei 225 Index returned +1.56%, although this masks tremendous volatility. The carry trade unwind was followed in September by a shock win for Shigeru Ishiba in securing the leadership of Japan's ruling Liberal Democratic Party, a move that was widely interpreted as market unfriendly from a reform perspective.

European developed market equities ex-UK returned -0.23%, whilst the MSCI Emerging Markets Index returned a respectable +1.68%, driven by companies in Taiwan and South Korea benefiting from the arms race to build AI infrastructure.

China also outperformed global market averages handily, with MSCI China returning +15.01% on the quarter. Its big bazooka moment caught many investors offside, forcing them to scramble and buy shares back to cover loss-making positions, or to reintroduce exposure on a swift turn in sentiment.

India returned -0.83% on the quarter, underperforming global and emerging market benchmarks for the first time in several quarters. As one of the best performing emerging market performers in this post pandemic cycle, a combination of elevated valuations in the short-term, particularly in the midcap space, may be capping further price gains, whilst the sudden rush to invest in China has likely led to investors using India as a switching candidate.

Fixed Interest

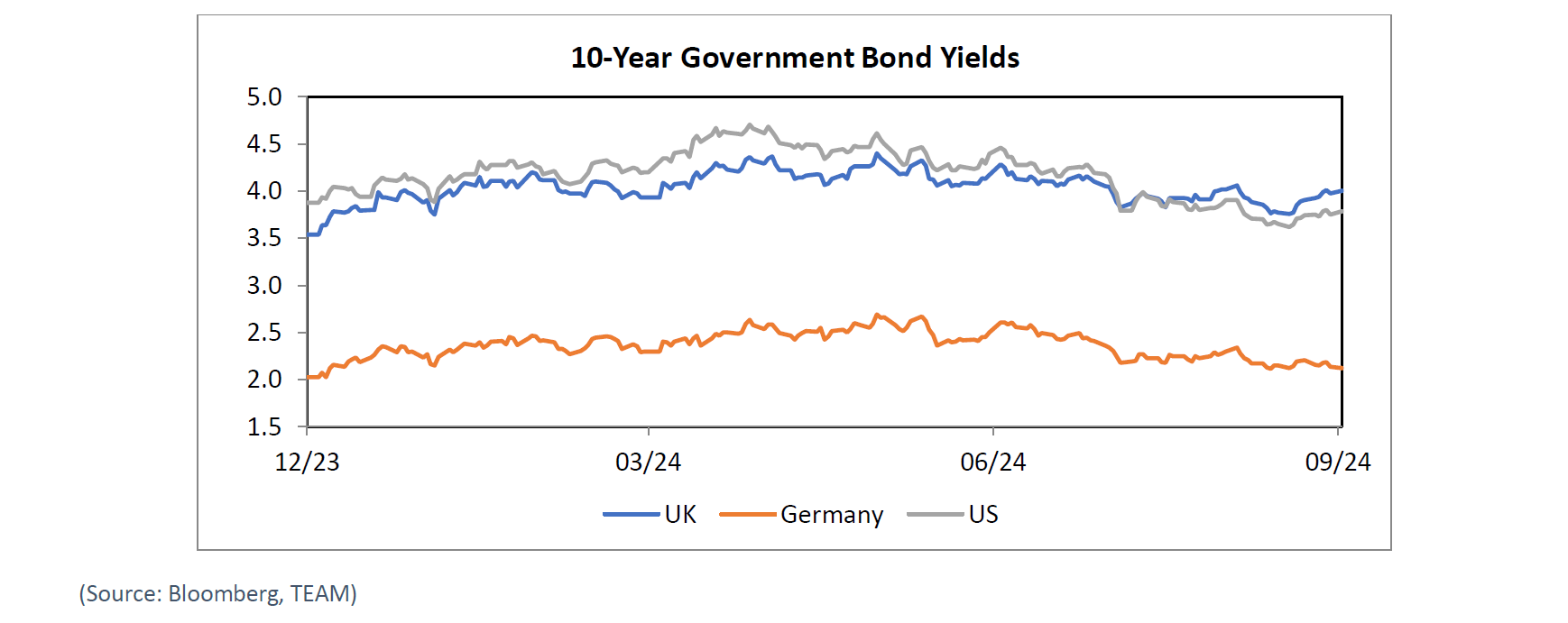

Government bond yields trended lower, almost uninterrupted, throughout the third quarter, supported by the prospect of coordinated monetary easing by global central banks and heightened geopolitical risks from the Middle East to Ukraine.

Offering positive real yields, high grade bonds have also once again become an effective tool for hedging, and diversifying, risk in multi-asset portfolios and have attracted strong demand at times of broader market turbulence during the quarter, not least when the high-flying technology stocks have experience bouts of volatility.

The ECB began cutting interest rates in June, and following a pause over the summer, it cut its deposit rate by another 25 basis points in September, as was widely expected, and pointed to identical moves at each of the remaining two meetings before the end of the year.

In a knife edge 5-4 vote, the Bank of England’s Monetary Policy Committee opted to cut its base rate for the first time since 2020 in July. Although the BoE forecasts headline inflation will climb back up to 2.7% this year, the majority on the committee, including Governor Andrew Bailey, were encouraged by the longer-term outlook which projects inflation to fall below the 2% target rate within two years. However, the MPC opted to pause in September, preferring to wait and assess the content of the Chancellor’s autumn budget at the end of October.

The Federal Reserve, which delivered a larger 0.5% interest rate cut in September, the largest of its kind outside of a recession or crisis, has also provided cover for other central banks to ease more assertively. Back-to back much weaker than expected payrolls reports released in early August and September put a jumbo-sized rate cut firmly on the table, but Fed Chair Jerome Powell managed to deliver it without spooking markets into worrying that the US economy is hurtling towards a hard landing. Instead, Powell emphasised the progress made on inflation and asserted that “the US economy is in a good place.” Markets expect the Fed to move broadly in lockstep with the ECB over the next 12 months.

Commodities

Gold returned +13.2% on the quarter in US dollar terms, and the performance of the yellow metal remains respectable as we enter what is set to be the beginning of an extended global interest rate cutting cycle. We have witnessed record central bank gold buying since the third quarter of 2022, potentially triggered by America’s decision earlier that year to freeze Russia’s foreign exchange reserves.

As a result, global central banks bought a record net 1,082 tones of gold in 2022 and a net 1,037 tonnes in 2023, whilst a net 483 tonnes was purchased in the first half of 2024 according to the World Gold Council.

Turning to oil, geopolitical events aside, the major sector news came from global marginal player Saudi Arabia, who announced a notable shift in strategy. For much of this current cycle, the world’s largest exporter has been hoping to keep the price close to the $100/barrel mark it needs to balance its books. Going forward, it has abandoned the price target in pursuit of regaining the market share that has been lost in recent years. Markets have taken this as a sign that a supply glut in the short to medium term is a real possibility.

TEAM Positioning & 4th Quarter 2024 Outlook

To recap, the genesis of our investment framework is stay in harmony with primary (medium to long-term) trends across our asset allocation menu, whilst seeking out genuine diversification through cycles.

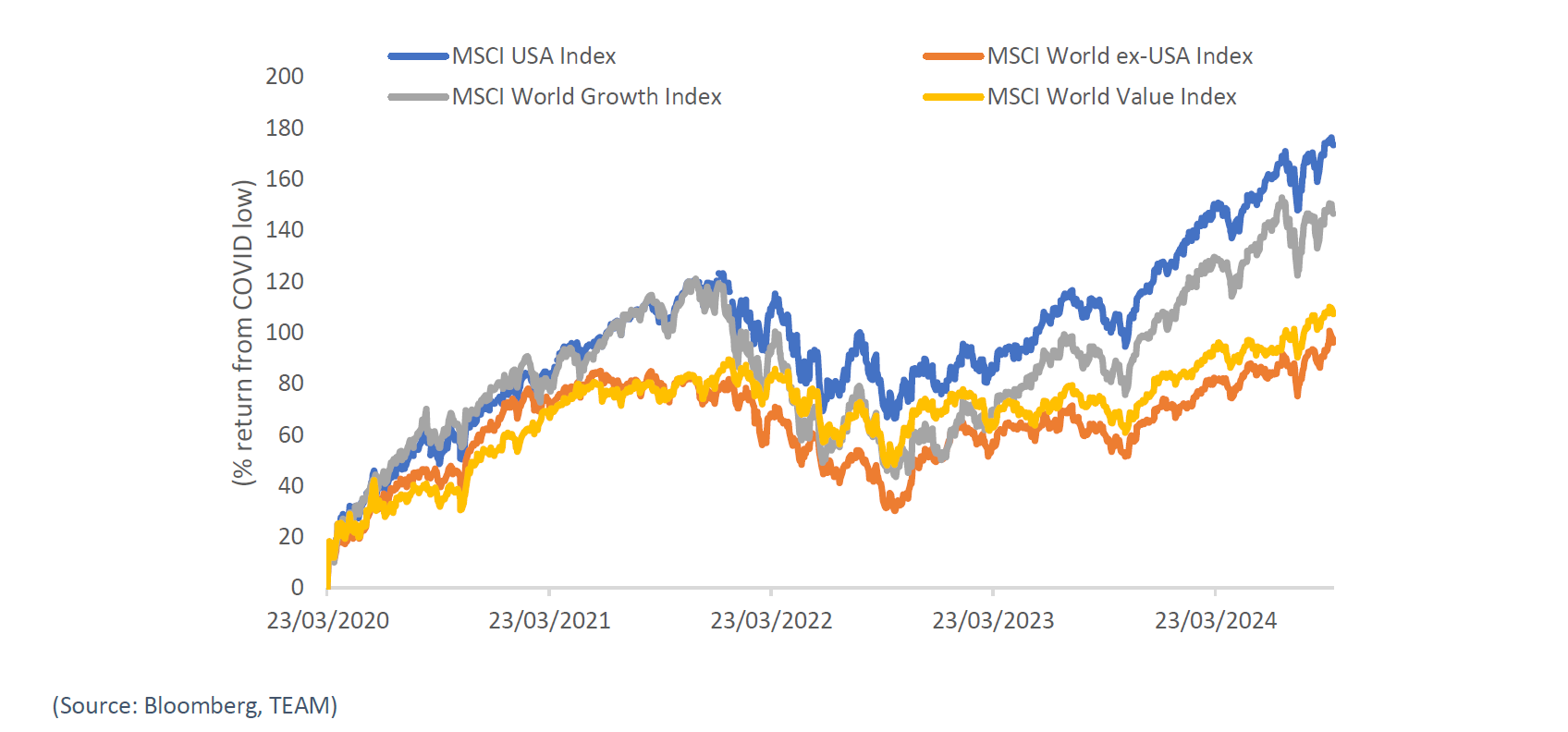

For much of this post-pandemic cycle, the strongest trends have been seen in equity markets, notably consistent outperformance by the US relative to the rest of the world, and a clear preference for growth assets over value:

TEAM’s exposure has remained ‘in gear’ with these trends, with US mega-cap growth and technology stocks comprising the lion’s share of equity exposure across our strategy range. With that said, one of the pitfalls of a trend-following process is that you never know when a new primary trend will begin or finish. We accept that, as part of our process, we are very unlikely to catch the top or bottom of a trend.

This quarter was a good working example of an aggressive rotation in market leadership, out of mega-cap growth stocks in America and into more cyclical, value-orientated markets including north and south Asia and the UK, as well as stodgier sectors such as healthcare, consumer staples, and utilities.

Pleasingly, the diversification aspect of our framework worked well during the quarter, mitigating a large part of the underperformance of pockets of our equity menu.

We introduced a domestic China equity position back in May as part of our Asia equity exposure, sensing that things only needed to go from awful to slightly-less-awful to deliver a positive surprise. Coming into September, ‘short China’ was a hedge fund favourite, and ‘underweight China’ the go-to playbook for Asia and emerging market managers for the past two years. Valuations (cheap in absolute and relative terms), and robust earnings growth (double-digit for the aggregate market) meant all we were lacking was a catalyst.

Patience with China has been rewarded with the best return on the quarter, and our liquid alternatives sleeve (physical gold and mining stocks, improving sentiment towards the global property sector, US infrastructure equites) also did some heavy lifting. Bonds also continue to (re)offer effective portfolio ballast in the prevailing environment.

The ‘sinners list’ of detractors includes long-term equity winners of this post pandemic cycle, notably India and Japan, where we have scaled back portfolio exposure in recent months.

Importantly, the currency factor also played a key role with the dollar depreciating over 2% versus sterling on the month. All TEAM MPS portfolios hold a meaningful amount of dollar-denominated assets. We are not currency traders, and exposure to the world’s reserve currency seems to us to be a pragmatic approach in the context of portfolio construction.

Saints and sinners

What worked: domestic China equities, physical gold and mining stocks, global property, and US infrastructure equites. Bonds also continue to (re)offer effective portfolio ballast in the prevailing environment with government bonds, investment grade corporates, and high yield corporates, all delivering low single digit returns with incredibly low volatility.

What did not work: Energy equities, S&P large cap growth equities, Nasdaq technology equities, India equities, Japan equities.

We enter the fourth quarter of 2024 positively positioned from a risk perspective, with overweight allocations to equities, funded from fixed income, liquid alternatives, and cash.

Our asset allocation for the core TEAM MPS multi asset range is shown relative to neutral weightings in the table below:

Equities

We retain a healthy split between US and non-US equity securities, with a skew to large-cap companies, although within the US we note that we have diversified away from a focus on mega-cap growth and towards other sectors in recent months as market breadth (stock participation) steadily improves.

Large cash balances are earning meaningful interest income, which is finding its way to bottom line profits. Separately, regarding US technology trends, whilst we claim no edge in picking the eventual winners in the AI space, it is hard to argue against big tech companies winning via organic or inorganic (acquisition) means. We have a modest exposure to small cap and zero to micro-cap companies.

Japan’s corporate governance revolution, driven by the Tokyo Stock Exchange (TSE), is the real deal. The aim is to hold corporate management teams to account over governance and performance issues, with the TSE now maintaining a monthly name and shame list of companies that voluntarily disclose information regarding ‘actions to implement management that is conscious of cost of capital and stock price’.

Whilst we do not expect the line to be a straight one from A to B, investors can look forward to the prospect of enhanced returns driven by rising dividends, share buybacks and improved return on equity as companies look to improve balance sheet efficiency.

Recently appointed Japanese Prime Minister Ishiba is already reversing course on several key policies, just days into his tenure. We watch with interest and expect a walk-back on his beliefs of wanting lower consumer spending and higher taxes (bad for re-election and stock markets).

The explosive move higher in China’s stock markets has been triggered by short-covering and managers being wrong-footed by the announcement.

India remains one of the world’s most exciting domestic demand driven investment stories. A new capital expenditure boom is underway and anticipated to drive 7% real GDP growth and approximately 12-15% aggregate corporate earnings growth over the next 5 years or more. Given India still miniscule representation in the MSCI World All Country Index of 1.8%, room still exists for a significant re-rating.

In the short-term, further underperformance would not come as a surprise, with India becoming a natural source of funds for renewed interest in China.

Fixed interest

It’s difficult to challenge the path of short-term interest rates that markets are pricing in. It feels about right, especially when central banks have set their stall out and committed to easing rates away from “restrictive” territory, rather than wait for core inflation to move meaningfully closer to targets. Central banks have also made it clear that they will look past any near-term re-acceleration of inflation, or second round effects.

However, we remain more sceptical about the pricing of longer-term interest rates in both Europe and the US. Do 10-year Bund (2.1%) and Treasury (3.8%) yields offer investors adequate compensation for the risks that inflation becomes more structural due to competition for scarcer resources, political risk or for the supply of bonds needed to fund budget deficits? We don’t think so.

Instead, we continue to see more value in intermediate dated bonds, the ‘belly’ of the curve. In contrast to inverted government bond yield curves, credits curves are upwards sloping, enabling us to extend duration without giving up yield.

Although we are mindful that credit spreads have tightened significantly over the past couple of years, the easy money has clearly been made and there is less juice to squeeze from the trade, credit valuations compared to their longer-term averages do not look too expensive. Furthermore, credit spreads are historically positively correlated to lower interest rates at the start of the easing cycle with companies benefitting from easier re-financing conditions and the likelihood that a hard landing can be avoided.

Alternatives and Cash

Physical gold and gold miners remain essential portfolio insurance in the context of long-term dollar debasement (the loss of purchasing power). The simple case for ownership is that gold has outlasted every stock market in history, and 10kg of the yellow metal will still buy an average family size home, just as it did nearly 100 years ago:

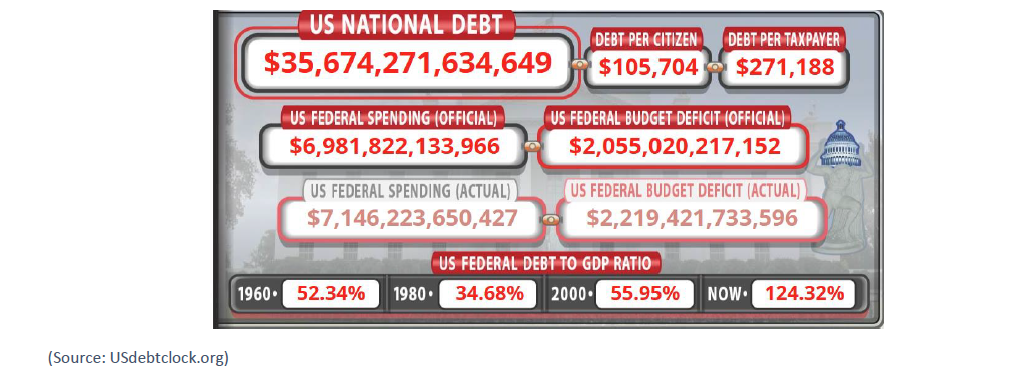

Peering into what the next presidential cycle might hold in terms of monetary policy, neither candidate for has demonstrated a willingness to credibly address the elephant in the room, the enormous, and growing, US debt mountain, which currently stands at 35.7 trillion dollars, excluding unfunded liabilities. That is equivalent to $271,188 per US taxpayer at the time of writing:

Gold continues to shine, with the price touching new all-time highs in many major currencies. Indeed, this is gold’s best 10 month start to a year this century. News that Saudi Arabia has joined the list of central banks quietly accumulating significant holdings of the yellow metal underpinned sentiment, as did the tragic events unfolding in the Middle East, which are, naturally, creating a flight to haven assets.

As for the energy commodities basket, and oil in particular, we noted during our prior commentary that ‘the outlook is less bullish, but with that said, exogenous shocks, particularly of a geopolitical nature, are not out of the question. Energy equities continue to offer genuine asset and sector diversification.’ Unpleasant as the catalysts may have been, this scenario is playing out real-time, catching many off-guard given the recent Saudi Arabia announcement. We anticipate adding back exposure during the fourth quarter.

As always, rather than attempt to look around corners and predict outcomes, we rely steadfastly on our systematic investment process, which has successfully navigated an array of market conditions during this post-pandemic cycle and delivered respectable risk-adjusted returns for our investors.

Thank you for your continued support and interest in TEAM.

(Cover Image Source: charlesdeluvio)