TEAM Investment Review & Outlook 2nd Quarter 2023

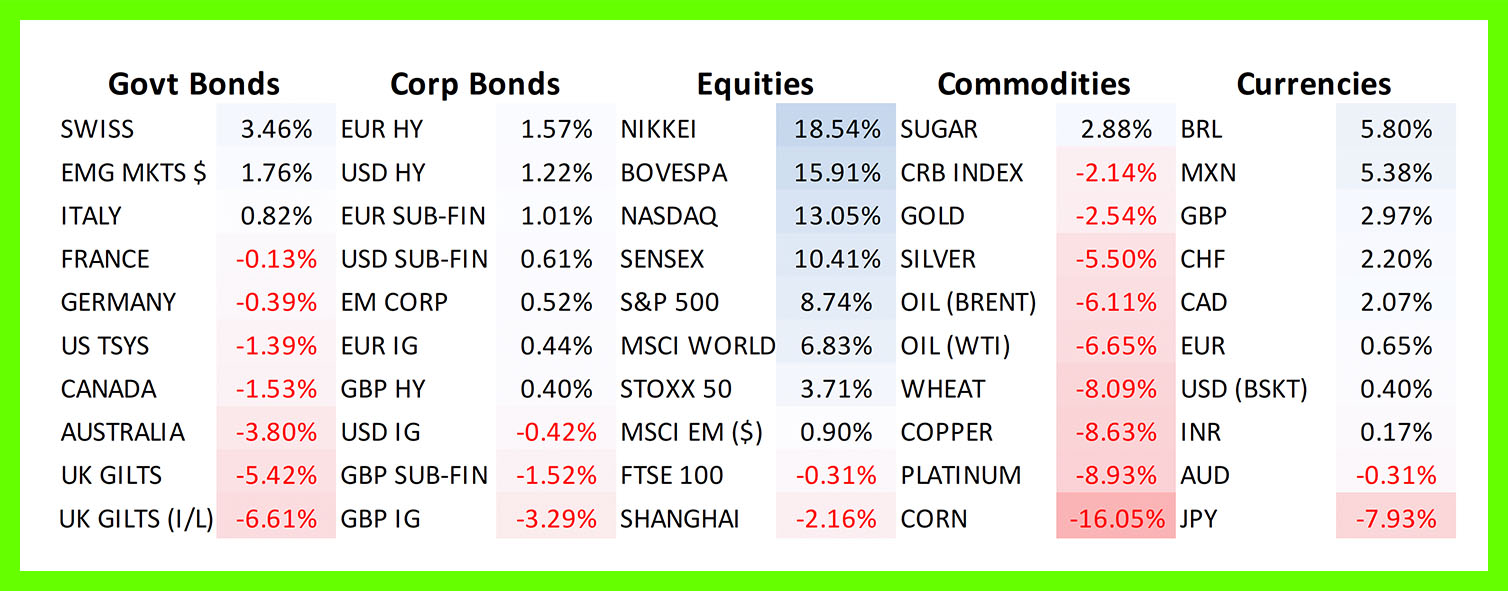

Major Asset Class Returns for 2nd Quarter 2023, local currency terms.

(Source: Bloomberg, TEAM)

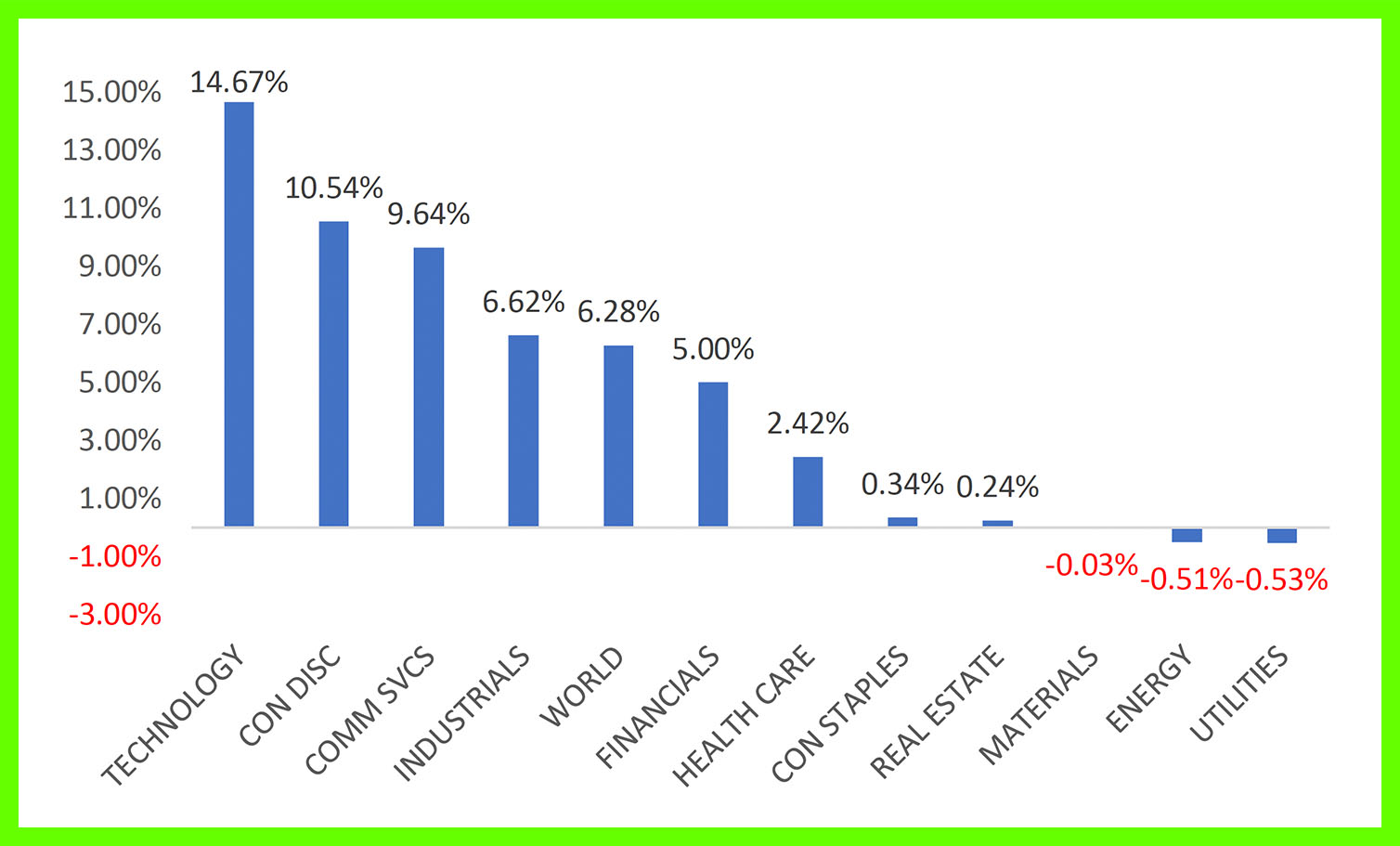

Global Equity Sector Returns for 2nd Quarter 2023, local currency terms.

(Source: Bloomberg, TEAM)

Investment Review 2nd Quarter 2023

Resilience

The ‘R’ word, namely a global recession led by the US, and when, and if it arrives, continues to dominate the market narrative. Against the backdrop of the fastest and most dramatic rise in US interest rates of any cycle since 1980, many had forecasted another annus horribilis for risk assets in 2023. Yet major headline equity indices continued to melt up in the second quarter, whilst credit markets remain remarkably well behaved thus far. What gives?

Sentiment was lifted by a (convoluted) resolution to the US debt ceiling debacle and subsiding fears regarding the health and outlook for the US regional banking sector following the Silicon Valley Bank (SVB) implosion in March, but the remarkable resilience displayed by the economy and a strong dose of Artificial Intelligence (AI) hype were the chief protagonists in powering equities higher over the period.

Bulging wallets

Simply put, consumer wallets, still bulging from the extraordinary monetary and fiscal policies introduced in response to the COVID enforced lockdown, have had the effect of elongating the current economic cycle, with a slew of recent economic data releases forcing analysts to push out ‘imminent’ recessionary forecasts to the second half of 2023, sometime in 2024, or beyond.

Growth in personal consumption expenditures registered 20-year highs (excluding the post-COVID rebound), new home sales advanced in May to the fastest pace in over a year (staggering given the magnitude of the rise in headline mortgages rates), weekly new claims for jobless insurance showed the largest drop since September 2021 and consumer confidence rose to 18-month highs. Finally, a sharp upward revision was made to the 1st quarter GDP figure to +2% annualised growth.

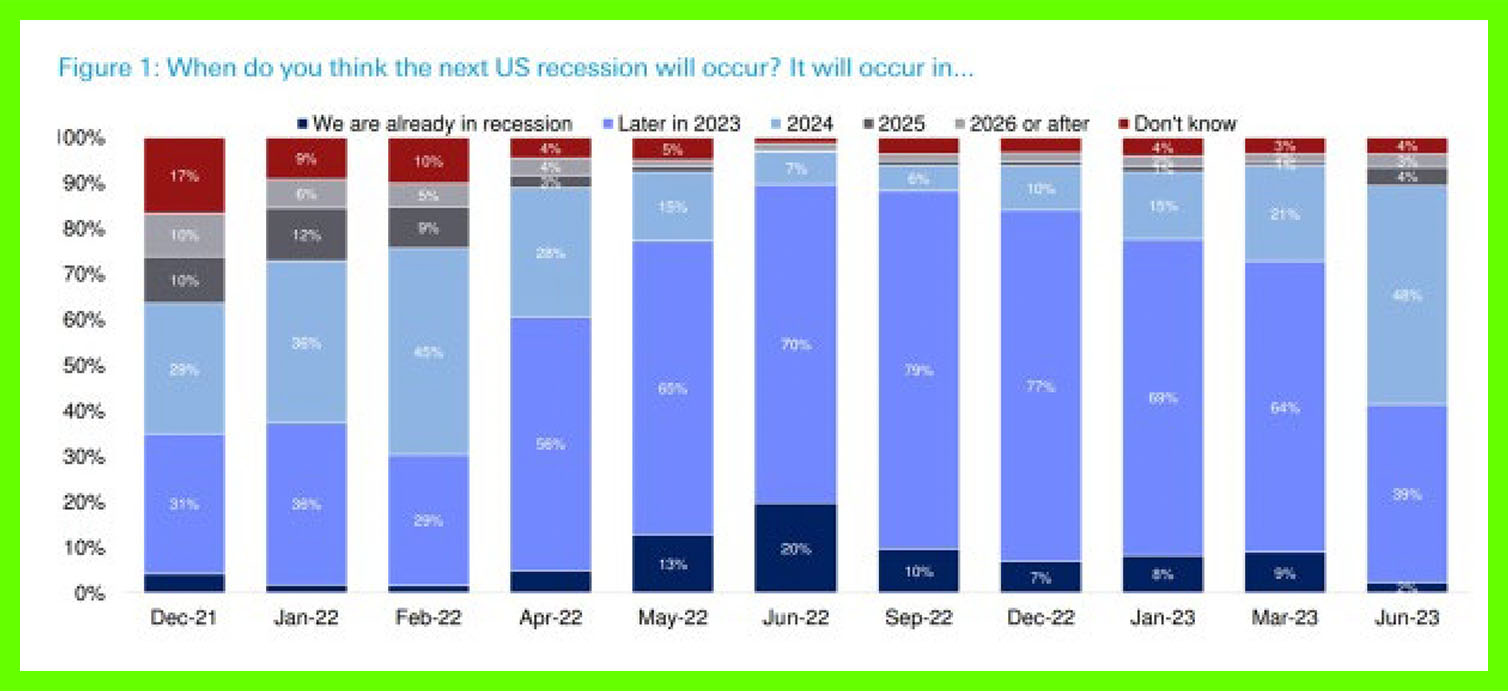

The consequent shift in views over an ‘impending recession’ can be illustrated using summer survey results from 400 fund managers recently conducted by Jim Reid and the team at Deutsche Bank Research. Those projecting a 2024 recession ‘arrival’ have more than doubled from the March 2023 survey responses to 48%:

Global Equities

The link from the economy to risk assets is via the impact on company earnings. Recessions are inevitably accompanied by a sharp deterioration in profits. Here too, a similar narrative has played out. Mirroring the call on the economy, many investors have been expecting profits to fall significantly this year, yet have been surprised by a durable corporate America, particularly within consumer and technology sectors. That has shaken confidence in the bearish narrative as asset allocators have been forced to reassess outlooks.

AI hype

Mega cap stocks have once again dominated the headline performance of the U.S. equity markets. This quarter it has been fuelled in part by vastly superior earnings results relative to consensus expectations, mostly by frenzied excitement around generative artificial intelligence (AI) technologies such as Chat GPT.

Chat GPT’s almost low-key release late last year triggered a wave of predictions about how disruptive, and transformative, the new generative artificial intelligence technology will be. Goldman Sachs believes AI could supercharge U.S labour productivity growth by 1.5% per annum over the next decade, whilst boosting corporate profit margins by 400 basis points.

Identifying companies that will eventually emerge victorious from AI is not altogether clear. However, as Mark Twain is alluded to have famously uttered, ‘during the gold rush it’s a good time to be in the pick and shovel business’. AI runs on computer processing power and data, so investors en masse have aligned themselves with themes most likely to benefit including specialist chipmakers, as well as companies that have access to large amounts of computing power, cloud storage, and data.

The outcome has been significant divergence in share price performance between winners and losers as the big continue to get bigger, ostensibly on the basis that any new generation AI companies will be bought by existing players with balance sheet firepower. Outside of technology and consumer related sectors, companies found the going tough. Real estate, utilities, consumer staples, materials, and energy sectors were all flat-to-down, led by broad rotation from defensive, value orientated stocks into growth.

Global Bonds

With developed market inflation readings, particularly core inflation (ex-food and energy prices) still uncomfortably high from a central bank perspective, government bonds yields drifted higher (pushing prices lower) on expectations that further rises in this cycle will be necessary:

(Source: FT.com, Refinitiv)

Except for the Bank of Japan, all major central banks lifted rates over the quarter. However, the Fed was the first to enact a ‘hawkish pause’ in June, leaving rates at 5% to 5.25%. The inference is that whilst Jerome Powell has decided to pause raising interest rates, no one should mistake this for signalling the end of the cycle.

The European Central Bank (ECB) continues to battle competing concerns over stubborn inflation and the deteriorating economic outlook for the Eurozone. Front-end bonds yields rose as central banks signalled more interest rate hikes are needed to tame inflation but the pressure on longer dated bond yields was more subdued as leading indicators pointed to a weakening Eurozone economy.

Whilst Eurozone headline inflation has slowed significantly from its peak of +10.7% in October, the core rate (+5.4%) has been much more stubborn and continues to give the ECB reason to be concerned that the tight labour market and rising wages could lead to more persistent inflation. Money market futures are now pricing in the ECB to hike interest rates two more times before the end of the year.

Closer to home, the UK’s Bank of England finds itself in a proverbial straitjacket, presiding over a slowing economy still facing the highest inflation rates in the developed world. Core inflation unexpectedly accelerated from +6.8% to +7.1% YoY in May, the highest level since March 1992. Wages are still rising, and the labour market remains incredibly tight due to falling participation rates and worker skills shortages resulting from Brexit, suggesting inflation will be a more persistent problem.

Optically, the UK economy is beginning to resemble an emerging market, with long-term government borrowing rates re-approaching 15-year highs, the same levels touched during the fallout from the Liz Truss mini-budget. Incredibly, it is now notably cheaper for Greece to borrow over 10 years than Britain. This does not reflect solvency concerns, but the market’s lack of confidence in the Bank of England’s ability to quell inflation.

Commodities

The broad commodity complex continued to struggle as markets normalise in the wake of initial supply chain upheavals emanating from sanctions against Russia. Persistent inflationary pressures, higher interest rates, dollar strength and China’s disappointing post-COVID rebound, particularly the poor outlook for infrastructure and construction activity, are pressuring prices.

Oil prices are seemingly taking their cue from macro considerations, evidenced by a failure to rise despite successive announcements of supply side cuts by petroleum exporting countries, threats of further cuts by Saudi, and an aborted Russian mutiny in June by mercenary group Wagner. Gold spent most of the second quarter consolidating after briefly reaching a fresh record high. Sentiment is currently challenged by the prospect for additional US rate hikes, thereby delaying the timing of a gold-supportive peak in rates.

TEAM Positioning & 3rd Quarter Outlook

TEAM enters the 3rd quarter of 2023 more positively positioned from a risk perspective. Our data driven investment framework began this year advocating a defensive posture, but we have steadily increased equity exposure in recent months.

Currently, our expectation is for equities to deliver a strong second half on balance, although we acknowledge that the extent of the first half move in prices, and seasonality, may lead to ‘summer doldrums’.

The primary reasons for the shift in our exposure are:

- A significant improvement in price trends across risk assets (global equities, led by the US, EM-ex China, Japan), combined with:

- Historical batting averages. Second half performance of the year is expected to be strong. For example, double digit returns are expected for the S&P based on first half of the year gains, and the VIX (demand for S&P 500 Index put options to protect portfolios) has subsided to cycle low levels. Whilst some view this as the ‘calm before the storm’, the historical evidence points to robust equity market returns, six, nine and twelve months forward.

- According to multiple credible surveys from research houses, optimism among fund managers in aggregate is improving, but not yet at extreme levels that would indicate FOMO (Fear of Missing Out) and the lack of a marginal buyer of securities at current prices.

- Additionally, many remain sceptical from a positioning perspective (overweight bonds and defensive sectors, underweight the US, the Eurozone, energy, and industrials sectors). There is still plenty of cash waiting to enter equity markets on a more positive reassessment of the outlook.

- Market breadth is improving, meaning that a greater degree of participation amongst stocks has been taking place in recent weeks. Cyclical sectors including airlines, homebuilders, cruise liners, and industrials stocks are taking the baton from technology in propelling the market higher. This is a healthy development.

- Seasonality is historically favourable. July to September is usually positive for equity market returns, whilst October to December is usually strong.

In terms of batting averages and looking ahead to the election year 2024, we are reminded of the power an incumbent president running for re-election has in terms of market returns, +12.8% on average for the S&P in election years since 19491. This compares to an average loss of -1.5% when there is no sitting president running and an open field. Whilst we insert the caveat that there are no guarantees in investing at this point, 2024 has the tailwinds of incumbency behind it. To summarise:

Equities: overweight

Global equity positions are an overweight exposure across our core range of multi asset strategies.

The US continues to be favoured via large cap growth and technology shares. We acknowledge that the underlying tension across financial markets remains acute, with bond markets singing a very different tune to equity and credit. In a nutshell, bonds see a very clear recession and a round of Fed cuts commencing in the next 12 months, stocks and credit currently do not.

Our working assumption is to watch what the Federal Reserve does, not what it says. In that regard, the reaction to March’s Silicon Valley Bank debacle and the fallout for the US regional banking sector indicates a low threshold for pain. We expect a severe break to be avoided, as central banks step in with emergency liquidity and whatever contingency measures are required to prevent a financial accident.

Japan has been pared back following a substantial rally, although we anticipate adding to this position again in due course. The corporate governance revolution is real, and, whilst we do not expect the line to be a straight one from A to B, investors can look forward to the prospect of enhanced returns driven by rising dividends, share buybacks and improved return on equity as companies look to improve balance sheet efficiency.

India remains one of the world’s most exciting domestic demand driven investment stories. The property sector is in its third year of an upturn, whilst there is accumulating evidence of a new capex cycle.

The UK exposure is international rather than domestic focussed given the economy’s malaise. Energy, commodities, and financials stocks offer style diversification in addition to an attractive, and sustainable yield.

Fixed interest: underweight

We are not yet sharpening the pencils in the fixed interest space, particularly with regards to GILTS and inflation-linkers for sterling investors. Our preference at this juncture is for emerging market sovereign bonds based on peak policy rates, attractive real yields and valuations, and also investment grade corporate bonds.

Corporate bond yields in aggregate are at their highest levels since the 2008/9 Global Financial Crisis, offering decent compensation even in a period of elevated inflation. The higher yields also enable investors to be more disciplined over credit selection and still pick up attractive returns.

Alternatives: underweight

Despite the miserable second quarter for commodities in general, we are actively looking for triggers to increase our exposure. These include renewed dollar weakness as interest rate gaps narrow, OPEC’s active management of oil production and prices, the Chinese government actively stepping up its support for the economy and, the risk of higher food prices into the autumn, as several key growing regions battle with hot and dry weather conditions.

Gold and gold miners were mainstays of TEAM’s real asset sleeve in 2022 and remain essential portfolio insurance. The positive long-term case for gold remains that the Fed, and by extension G7 central banks, will not be able to effectively normalise monetary policy. Headwinds this quarter have included dollar strength, making the yellow metal more costly to own for ex-dollar investors, and the fact that short-term real rates have turned positive.

Final Point

The overweight global equity position is modest rather than aggressive. We are cognizant that many forward-looking indicators including inverted yield curves, an acute tightening in bank lending standards to small-and-medium sized businesses, weak manufacturing activity, the level of corporate bankruptcies and the general ‘cost of money’ are all flashing warning signs.

This is reflected in both the allocation of equity risk across geographies and styles, and the retention of selective fixed income and alternatives assets to deliver appropriate portfolio ballast.

TEAM’s flexible investment framework, underpinned by a diverse asset allocation universe and the ability to tactically allocate with conviction, will remain critical as risks - and opportunities - present themselves in the months ahead.