US Recession Expectations

Insightful summer survey results recently conducted by Jim Reid and the team at Deutsche (400 FM responses).

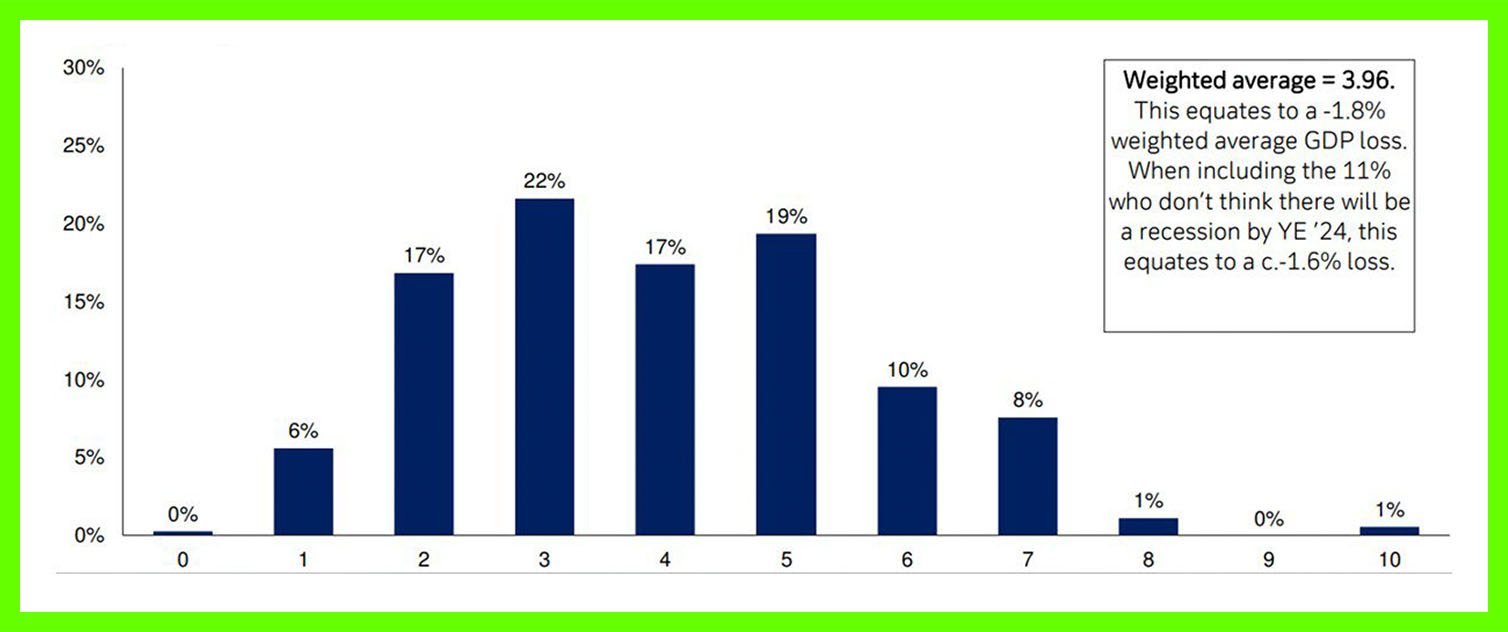

Shown in the first chart below, expectations over an impending US recession have been pushed back sharply during the quarter, with those now projecting a 2024 ‘arrival’ more than doubling from March’s survey to 48%. This certainly chimes with the move up in selective risk assets in 1H.

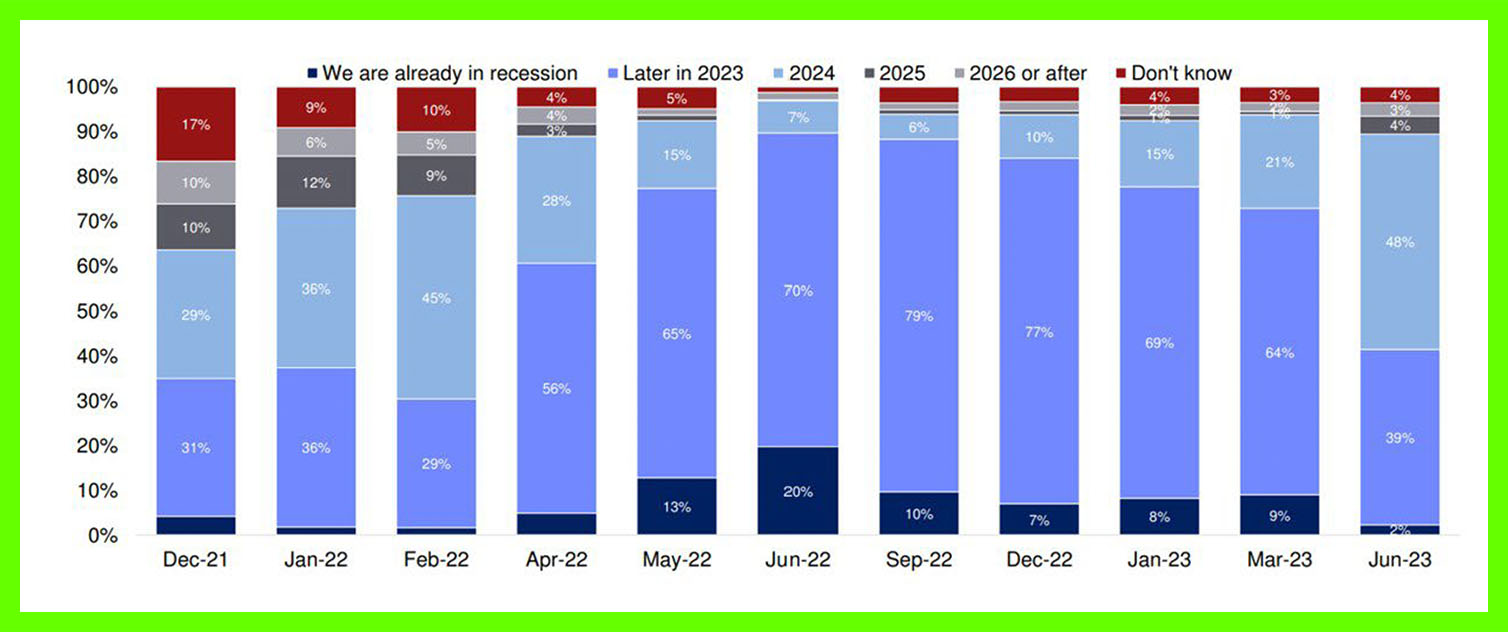

In terms of magnitude, as the second chart illustrates, the weighted average (Deutsche methodology) is for a peak-to-trough GDP loss of approximately -1.8%, adjusted upwards to -1.6% to account for the 11% not expecting a recession.

This is more pessimistic than the average of the consensus of economists polled on Bloomberg, where a small technical recession is expected in H2.

The second chart is almost a perfect bell curve, with very little representation in the tails. Suggests that potential might exist for a big surprise either way.

Figure 1: When do you think the next rescession will occur? It will occur in...

Figure 2: Youn said there will be a near-term US recession. Using a scale of 0 to 10 where 0 means "There would be the smallest technical recession (e.g.a 0.0-0.2% peak-to-through GDP fall) with limited or no market repercussions", 5 would be the median hsitorical drop (2-3%), and 10 'There would be GFC levels of activity drop (-4% peak-to-through(', what magnitude do you think this US recession will have?'