What’s Going On

Mother, mother

There's too many of you crying

You know we've got to find a way

To bring some lovin' here today, yeah

Oh, you know we've got to find a way

To bring some understanding here today

Come on talk to me

So you can see

What's going on (What's going on)

Yeah, what's going on (What's going on)

Tell me what's going on (What's going on)

I'll tell you, what's going on (What's going on)

The late, simply great, Marvin Gaye.

The market sold off hard earlier this week (a lot of crying), and the technical damage was real and substantial. In the eyes of the financial press, the out-of-the-blue cause was the omicron variant.

(Oh, you know we've got to find a way, To bring some understanding here today).

The narrative goes something like this: fears of a new coronavirus strain, particularly if current vaccines prove ineffective, force governments to initiate shutdowns” again, tipping the global economy back into recession. The result: violent market sell-off and ultimately a “Bear Market” of epic historical proportion.

This fear was further evidenced in the oil price where benchmark crude oil prices fell 15%-20% in a matter of days. The oil price is widely acknowledged as a barometer of economic activity.

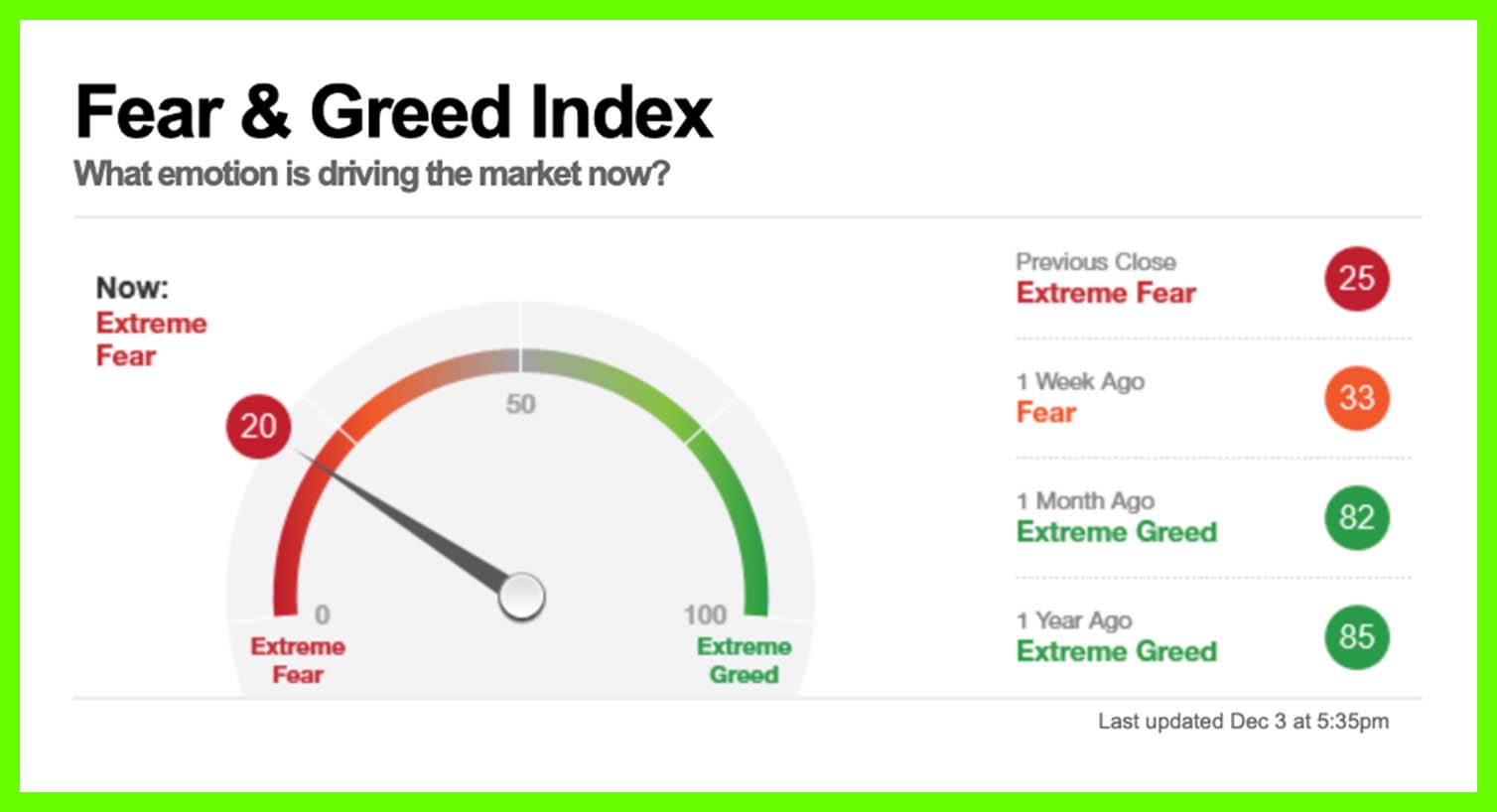

My favorite barometer, the CNN “Fear and Greed” Index, is back to “Extreme Fear” levels.

So, we have moved from 83, “Extreme Greed” only less than a month ago to “Extreme Fear” (20) at the end of last week.

See my last article

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” : Warren Buffett

I think Omicron was a sideshow.

Yes, current vaccines do not have the same efficacy regarding Omicron and yes, this will cause a relatively aggressive policy response from governments across the globe. It already has, with all of us responding most promptly versus when Covid first appeared.

We know the responses will, and do, include travel restrictions, quarantine periods, and potentially even moderate lockdowns. That will negatively impact economic activity over the next few months.

However, I don’t think these measures will last more than a few weeks, or months, and they will be met with notable consumer resistance in some countries. Therefore, this is not a return to March 2020, but rather, a temporary return to March 2021,

I think the real show is and was the Federal Reserve and its monetary policy regarding interest rate rises in 2022.

On this topic, there is an old stock market adage: “bull markets do not die of old age; they are killed off by central banks”.

The saying implies the standard run of events leading to a Bear Market go like this:

- Inflation starts to pick up as the business cycle runs hot causing labour shortages and wage rises.

- The central bank tightens monetary policy to fight inflation. Interest rates climb at an accelerating rate.

- “Easy money” disappears as credit conditions tighten. Cue, the end of cheap borrowing or low interest rates.

- Capital is withdrawn and risky projects stop getting financed. People and businesses stop investing.

- Profits turn down and inflated valuations start to fall away.

- Optimists become pessimists and a new bear market begins

Let’s start with inflation. To be clear, inflation in 2021 has not been the “transitory” outcome many Central Banks had forecast.

Last week, Federal Reserve Chairman Jerome Powell delivered a very clear message in his remarks to the Senate Banking Committee: It is time to go into inflation-fighting mode.

That means taking the policy tightening actions that, historically, have tended to kill off past bull markets. See above.

But how will it affect the market in 2022?

I would argue:

Consumer demand seems unlikely to abate significantly in the near future.

The jobs market has been improving, but wages have been ticking higher.

Entrepreneurs are starting new businesses at a rapid clip. According to the Census Bureau, applications for 4.54 million new businesses were submitted in the first three quarters of 2021, the most on record. That leaves the supply side of the equation.

There are already signs supply chain problems are easing. Multiple CEOs have commented on easing supply chain bottlenecks.

In Asia, energy shortages and port capacity limits have eased, and ocean freight rates have fallen from record highs. China has resumed manufacturing largely at normal capacity since October.

In the United States specifically, major ports are still congested and ships are still waiting to offload goods, but things are moving more and more.

Oxford Economics surveyed “country experts” across 45 economies and found that nearly everyone believed supply chain disruptions had peaked.

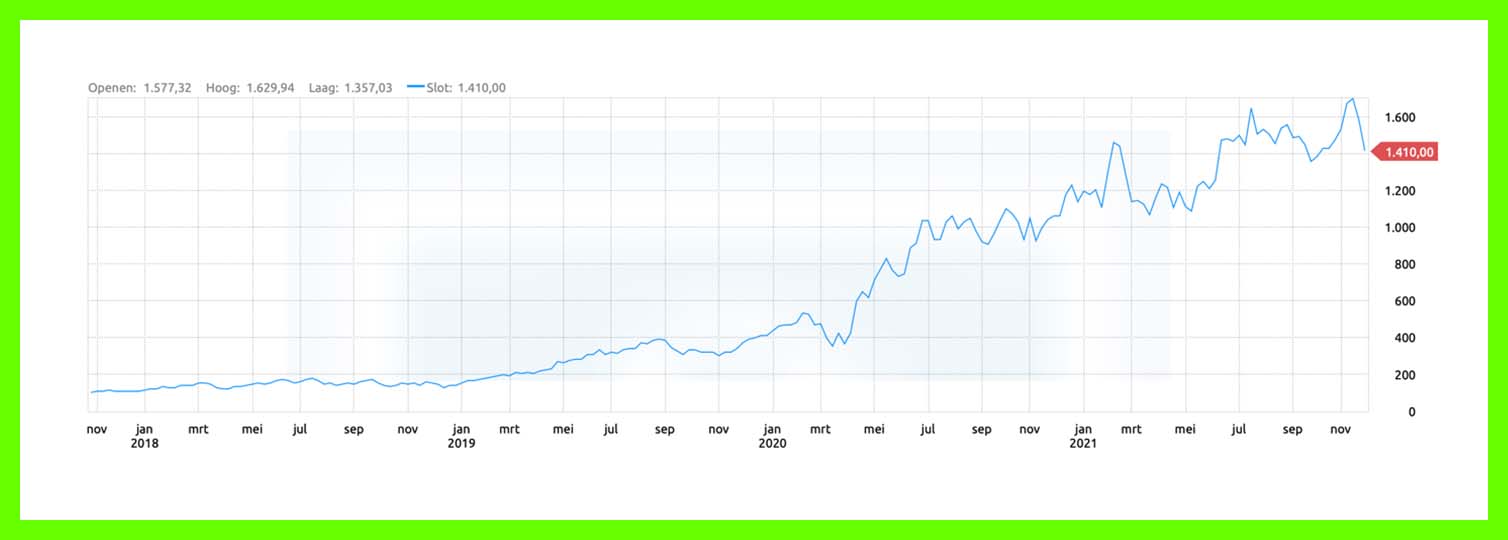

The Baltic Dry Index gives an overview of the average cost of transporting raw materials around the world.

The chart below tells the story.

There is also a distinct possibility that supply shortages could ultimately become supply gluts in the next couple of years.

A great example is in the auto industry, where there is a significant amount of partially built vehicles parked up just waiting for the delivery of semiconductors.

Once the chips are installed and the vehicles move into dealerships, supply could potentially outweigh consumer demand.

Similarly, the Bank for International Settlements recently noted that many companies are establishing ‘precautionary stockpiles’ of parts, which could be exacerbating shortages.

Supply could easily overshoot demand once it catches up.

Central Banks will be aware of this and will perhaps continue to moderate the risk of a snap interest rate decision.

Now to address Omicron. The reality is the Omicron strain is already spreading.

Despite Omicron’s potential for higher transmissibility rates, the current research suggests its symptoms are “mild.”

South African doctor (Coetzee) stated that relatively milder symptoms were observed in cases of Omicron.

"The biggest difference between the two is that Delta will give you loss of smell, loss of taste in most cases. They will come in for fever, have an elevated pulse rate, and lower than normal oxygen levels. In Omicron's case, oxygen stays normal, there is a very slight increase in pulse rate and no loss of smell. Only a scratchy throat and generally not feeling well for 1-2 days. They get well in a few days, even if you are vaccinated, it is still mild," she said.

My personal view on Omicron is it will spread rapidly over the next few months causing a spate of sporadic social distancing and travel restriction measures across the globe.

This will cause global economic activity to slow and consumer spending may be curtailed.

In the face of slowing economic activity and with bottlenecks improving, the global supply-demand picture will rebalance. Inflation pressures will subside. Inflation rates will return to the Fed's 2% target levels by mid-2022.

The Fed will continue to taper its asset purchasing program. They will re assess the economic outlook in March or April next year. I think by then they will see slowing growth and falling inflation, and perhaps decide to do nothing.

The result could be zero rate hikes in 2022 or certainly no major hikes. Yields could stay for lower-for-longer. That is very positive for equities.

Furthermore, if the Omicron variant becomes the dominant strain, and is less dangerous than Delta, then negative economic effects could be muted. This would potentially accelerate our world’s return to normalcy and a more predictable economic outlook.

Now to examine the recent sell off.

Let’s not forget that the S&P 500 was up roughly 28% year to date before Thanksgiving Day, the 25th November.

Investment Managers and individuals were and are sitting on substantial profits for the first 11 months of 2021. There is always the temptation to “book profits” and reduce risk heading into the year-end.

We need to also remember that since the financial crisis of 2007/9, the S&P has fallen more than 2% in a single trading day 107 times.

Or has experienced more than one pullback of 5% per year.

Or had a market correction every 2.62 years. Corrections refer to declines of 10% to 20%.

Or been in a Bear Market every 8.4 years.

Or Market crashes of 40% or more have occurred roughly every 25 years (but they happened in 1973, 2000, and 2008, so were not evenly spaced).

Of those 107 times, 75% of those have then seen the S&P500 move higher than its pre-drop level within 20 trading days.

That means there is a very good chance the S&P 500 will be trading above the index level of 4,675 by December 30.

As you can see, nothing about this latest volatility represents a truly material change in the primary drivers of today’s market. Earnings are still respectable, the economy continues to rebound, and we have a reasonable idea about upcoming Fed policy and timing.

Lastly, the carrion cry, “the market is ludicrously expensive!”

Well, is it?

According to research company, FactSet, the forward 12-month PE ratio for the S&P 500 is 21.4. For context, this is higher than the 5-year average of 18.4 as well as the 10-year average of 16.5.

However, it’s not outrageously higher.

Further, this market average is skewed by certain, super-popular mega-stocks that are expensive.

If you look at mid- and small-cap stocks, they’re trading at roughly average valuations since 1999.

I believe the majority of bear markets and major corrections typically coincide with economic recessions.

I think Omicron will blow over, the Fed won’t do anything rash, and the market will return upwards after working through this volatility.

But maybe I am missing something or there is a something far worse out there. Maybe Omicron is worse. Maybe inflation keeps rising accompanied by interest rate rise pushing the global economy into recession and a worldwide deep Bear market and Crash. Maybe.

However, I go to the words of the great George Soros, “The worse a situation becomes, the less it takes to turn it around, and the bigger the upside.”

Or Think think of the Baron Rothschild quote, “Buy when there’s blood in the street, even if the blood is your own.”

For now, we recommend sticking with the trend of the underlying fundamentals (positive) and the historical data that are both pointing towards higher prices by the end of the year.

Remember the cast iron rule that earnings and sales growth are the major drivers of share prices. The more a company grows its earnings, the more its shares will be worth.

At TEAM, we will continue to adhere to the investment principles that have guided successful risk-adjusted returns for our clients for many years. The typical company in our equity portfolio garners strong brand value amongst consumers of its product or service, boasts an exceptional track record of execution, is innovative, embraces technology and is able to maintain pricing power through cycles.

These characteristics place our international equity fund on a firm footing as we enter 2022 and the potential range of challenges that lie ahead.