Pressing Play on the Gaming Market

At TEAM, we want to invest in companies that are direct beneficiaries of at least one (but preferably more) of our six core megatrends. The video gaming sector straddles the borders of at least three of our trends, namely technology, urbanisation and demographics. With the world still enduring the effects of the COVID pandemic, we at TEAM believe that video gaming and viewing (streaming) have, and will continue to be, direct beneficiaries of the measures Governments have instigated to control the pandemic, and that these higher levels of engagement will continue post COVID. From an industry standpoint, the upside to the gaming sector is being driven by mobile gaming, game genre expansion, eSports, and powerful support from global demographic change.

Present estimates attribute a greater value to the gaming industry than to that of the music and film industries combined. Given Government “stay-at-home” orders, people have increasingly been playing video games as a form of entertainment to substitute for other pastimes which have been unavailable. In May, video game sales soared for the third month in a row, with sales totalling $977m, up 52% according NPD Group. This represents the best May performance for the industry since 2008, when there was a much greater reliance on physical, rather than online, delivery of game content. We have continued to see overall growth in the industry since May, albeit at a slower rate as lockdown conditions begin to ease. In June for example, sales rose 26%, whilst in July, there was 32% growth on a year over year basis. Subsequent to this period, of course, we have seen the emergence of a second wave of infections in various countries, the effects of which may have positively impacted August numbers which saw overall sales rise 37% year over year.

According to NDP Group, August sales totalled $3.33bn, bringing the year to date total to $29.379bn, up 23% over the comparable period in 2019. In the hardware sector, sales declined 2% to $166m in July, but rebounded strongly with sales rising 37% to $229m, with the Nintendo Switch being the best-selling platform. Hardware sector sales for the year total an increase of 23%, to $2bn. August accessories sales jumped 42% to $166m, an August record, driven by Sony’s PlayStation DualShock 4 Wireless Controller. Year to date, accessory sector sales are up 26% to an all-time high of $1.4bn. Content spending also rose in August, up 37% to $2.94bn, totalling year to date gains to 22%, past $25.9bn. According to Microsoft, there are more than two billion gamers around the world, a number which encompasses those playing free games on their phone, to those using a state-of-the-art computer fitted with the latest hardware. The Gaming market is continuing to expand, to transform pop culture, and to redefine the ways in which people consume entertainment.

(Source: Newzoo; Statista)

In 2017, The World Economic Forum published data that showed that the average US gamer is 35 years old, and that they have been playing video games on average for 14 years. This is suggestive of a lifestyle choice, rather than a transient phase. This also debunks the stereotype of the typical gamer, with 72% of US gamers being older than 18, and with women representing 31% of that figure. This equates to the total number of women over 18 playing video games being significantly greater than the total number of males under the age of 18 (31% vs 18%).

(Source: Entertainment Software Association)

A study by the Entertainment Software Association found that the average American gamer is more civically engaged, and that they exercise more, than non-gamers. The average adult gamer chooses to play casual games on a smartphone, and almost 80% believe that playing games provides mental stimulation, and that it is a good way to relax.

With the average gamer being aged 35, and game related purchases by income being relatively equally distributed across all income brackets, this signals that video gaming is not constrained from penetrating different demographic, social, or economic sectors.

(Source: Earnest)

Video games, through expansionary drivers such as enhanced technological capabilities, have catapulted the industry into the mainstream. Video gaming is now the largest and fastest growing form of media. NewZoo estimates that the global video game software market grew 7.2% to $148.8bn in 2019, with mobile leading the way with 9.7% growth, equating to $68.2bn. We see these trends continuing to grow, especially with the prospect of Government mandated stay-at-home orders as a result of further waves of the COVID virus. Video gaming as a primary entertainment source is also being noted by other companies in the entertainment industry. Netflix, in its Q4 2018 Shareholder Letter, stated “We compete with (and lose to) Fortnite more than HBO”. This signifies that the video game trend is growing, and is competing with, and taking share from, all other major entertainment industries.

(Source: Newzoo)

We like to identify companies which are uniquely positioned as key players across all of the above-mentioned expanding categories of mobile, genre expansion, and eSports, whilst also being able to capture an array of demographic segments.

Software developers have transformed how we play video games, with the ability to utilise the latest technology to enhance their gaming experience by providing realistic graphics and immersive experiences, online multiplayer capabilities and the opportunity to play games on multiple devices. We like companies that benefit from diverse revenue streams with high barriers to entry due the loyal fan base of their hit titles. There has been a clear shift from ‘one hit wonder’ games to a more predictable franchise business in the industry, where successful games can grow significantly with each iteration, while generating revenue between launches with additional content updates. Strong franchises across segments, with some of best IP in the industry, drive growth and provide value over time. The power of cash-cow franchises is evident comparing the release of video game sales versus movies. Disney’s Avengers: End Game, which was the top grossing film of 2019, took $850m during its opening weekend alone. It was beaten however by Take-Two Interactive’s Grand Theft Auto V, which when released in 2013, saw sales of over $1bn in its first 3 days after release. This signifies the true power of a company which has a library of ‘best in class’ franchises, and an established fan following. Grand Theft Auto V, the latest instalment of the Grand Theft Auto series, despite being launched 7 years ago, often remains in the top 10 chart, being the second most purchased game in May 2020. That level of durability is almost unmatched in any industry. We like gaming development stocks that utilise the recurring revenue models by launching continuous game updates, or benefit from its monthly subscription revenues. A ‘Game-as-a-Service’ model enables a company to scale down its costs significantly, whilst coupling with micro-transactions can form a key recurring revenue stream.

Mobile gaming has come an incredibly long way since Nokia first introduced the highly addictive game, Snake, which was first preinstalled on 400m Nokia phones in 1997. It now represents the largest segment of the gaming market, and we estimate that mobile gaming will account for 60% of the global market by 2022. The dramatic rise of mobile gaming stems from the advancement of smartphones and internet connectivity, making gaming much more accessible on a mobile device. TEAM’s primary area of concern with the companies that are purely exposed to the mobile gaming sector is that many have an over-reliance on one successful title. With mobile gaming being so fragmented and the barriers to entry in this segment being lower than console or PC, mobile gaming trends have the capability to change very quickly, and new games can fall down the popularity charts very quickly after an apparently successful release.

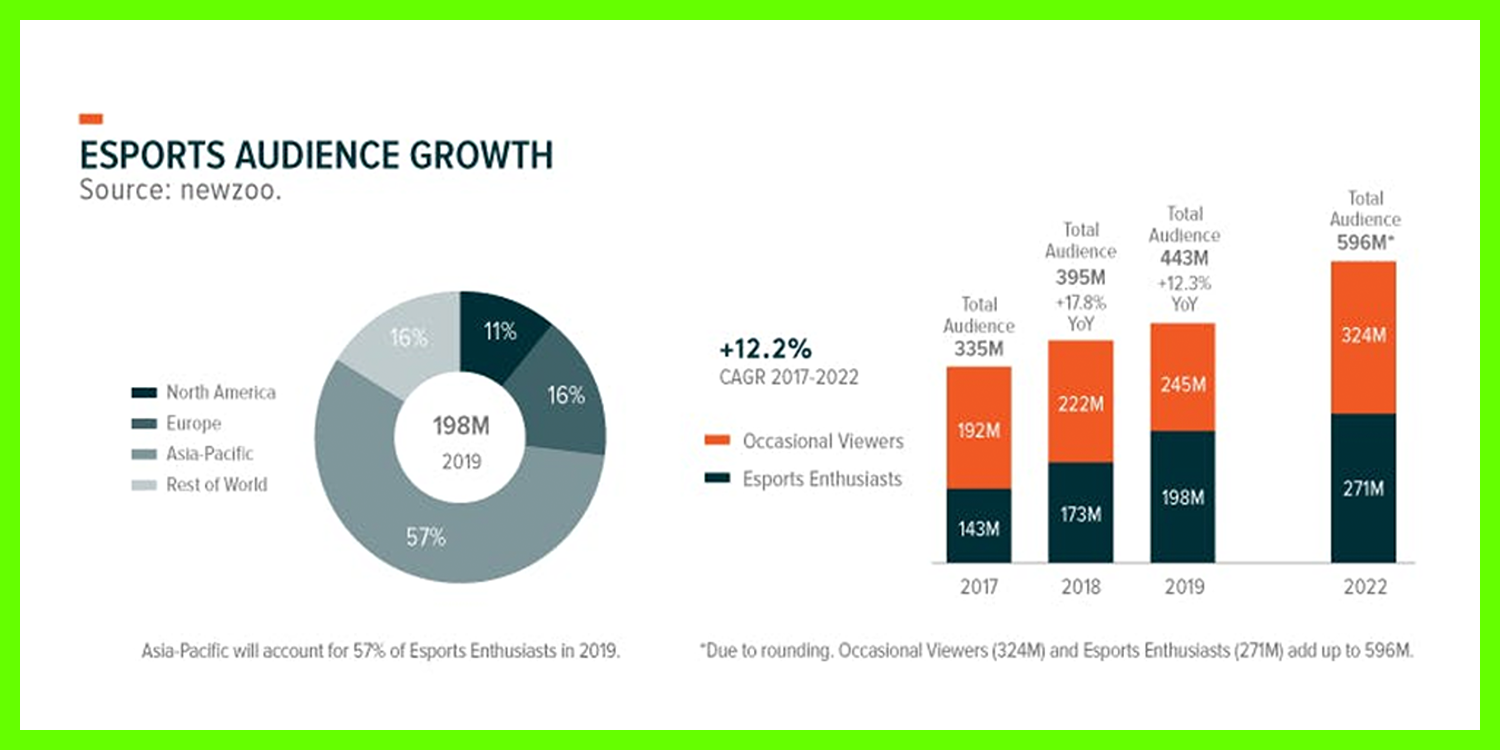

With an estimated current audience of 450m worldwide, which is estimated to grow by at least 12% per year for the foreseeable future, another of our favoured subsectors of the gaming market is eSports. eSports is a competitive league or championship that has taken a niche community and catapulted it into what is now a massive spectator sport. Demographic segmentation is very much apparent in viewership growth in eSports, with Millennials being more than twice as likely to watch an eSports event on a streaming site than any other demographic.

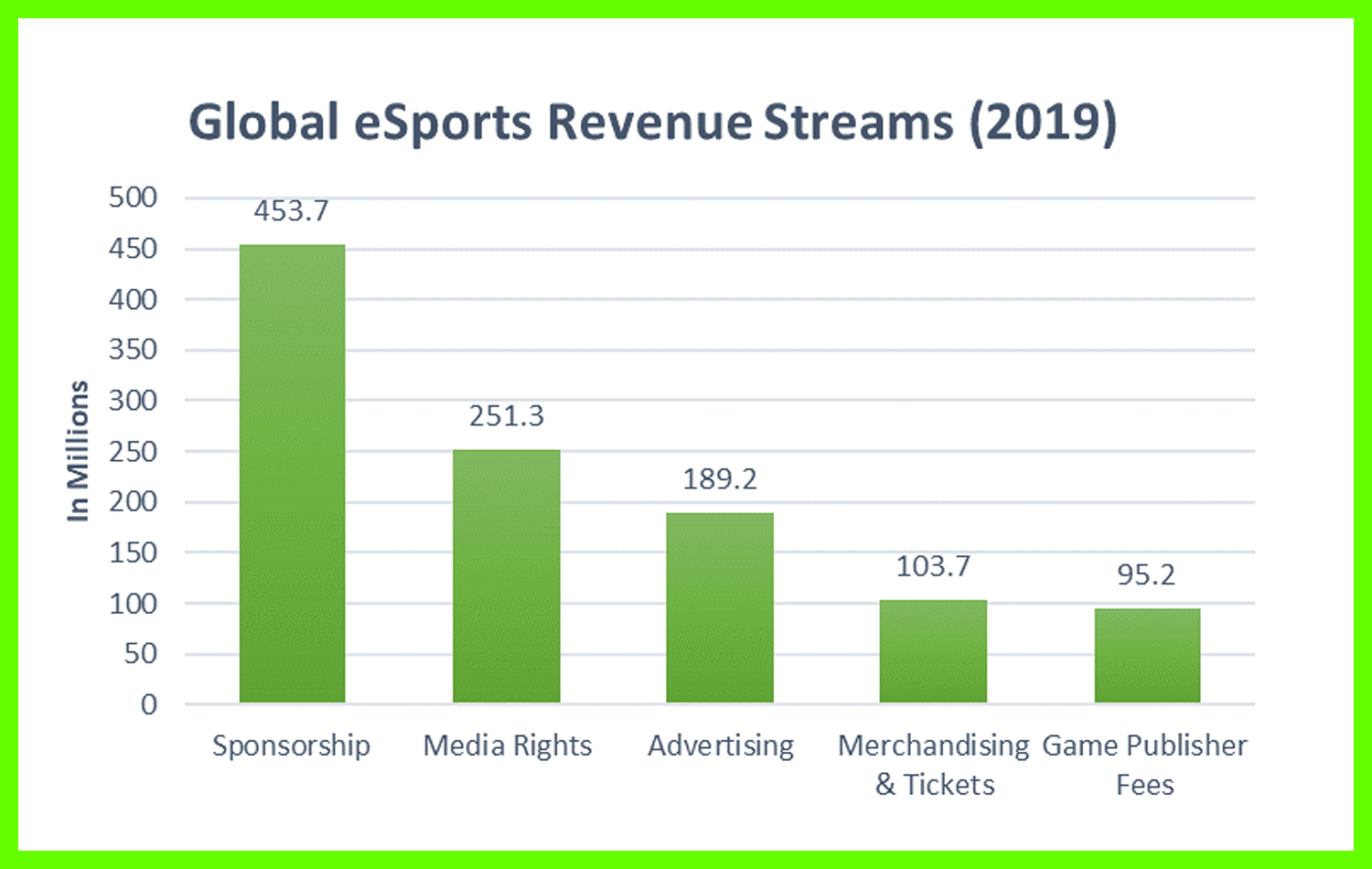

The growth of eSports has been exponential, and it is now a billion-dollar industry, whilst still remaining relatively underground, given only limited mass media coverage. The surge in eSports as a spectator sport has also begun to unleash a huge spike in revenues derived from sponsorships, advertising, and media rights.

(Source: Newzoo)

(Source: Newzoo)

Where traditional sports were halted for months during the initial COVID lockdown, eSports leagues such as the Call of Duty League were only postponed for a matter of weeks as a live spectator sport. Given the agile nature of the industry, Activision Blizzard managed to shift league games from arenas to ‘play-from-home’ competitions, whilst still managing to stream the tournaments online. The staging of major sporting events online, such as the 2020 24 Hour Le Mans race, has also contributed to growing acceptance of the format as a viable spectator sport, with the attendant revenue generation opportunities.

Live streaming online is another vastly popular avenue that links to eSports. With traditional sports, fans only get to view their teams/players once or twice per week on TV during an average season. Live streaming however has allowed players to interact with their fans whist playing the video games they compete in, which has created a closer relationship, and more intimate experience than traditional sports players and their fans. Putting this into perspective, as of March 2020, Twitch (the Amazon owned streaming platform) counted, on average, 1.44m concurrent viewers, and in Q1 this year, the company claimed a 65% share of 3.1 Billion total hours viewed.

We see the next generation of consoles, set to be released later this year, as a further catalyst for the gaming industry. Microsoft is set to release the Xbox Series X, whilst Sony are scheduled to begin deliveries of the PlayStation 5. Both consoles are claiming enhanced speed and performance, with both Companies highlighting reduced load times for games, allowing users to play games instantly, rather than enduring the longer load times associated with the current generation of consoles. Coupled with the introduction of 5G and cloud computing, we believe that the gaming experience will be enhanced further, with improved graphics, real time connectivity, superior download speeds and the ability to pick up any game, anywhere, and at any point. Some of the biggest players in this segment are Microsoft, Amazon, Alphabet and NVDIA, the latter, our favoured name in the sector, providing various products to the industry.

Internal hardware components are the final core area of the gaming industry. Performance and graphic enhancing components such as chips are becoming all important, especially in PC gaming, where these features can provide a substantial advantage to gamers competing against others with inferior hardware. In conclusion, it is clear to see that the video gaming industry has become a mainstream source of global entertainment. It is an increasingly attractive industry to invest, thanks to its positive outlook based upon technological advancement and demographic change. Games are becoming more accessible through multiple channels such as PC, console and mobile, with growth in mobile gaming being particularly strong. eSports are now competing for viewership against traditional sports, and its rate of growth is providing spin-off opportunities for a multitude of other industry sectors.

As readers will appreciate, because of the diverse nature of the sector, there are a multitude of investment opportunities. At TEAM, we hold exposure to select game development companies that have ‘best in class’ IP, solid growth potential, and several revenue generating assets. To ensure diversification amongst other sectors we also hold hardware component manufacturers whose products have multi-functional usage. In terms of individual companies, we hold chip maker NVIDA, whose chips are used for video gaming purposes, but are also used in other sectors such as 5G and cloud computing. Alphabet and Amazon are also core holdings with strong links to the gaming sector, as they provide exposure to the streaming side of the industry, in addition to their more traditional services. These companies provide diversification across many of the themes that we feel will, along with such things as the Gaming sector, drive us into tomorrow’s world.