Market Watch: New All-time Highs for the New Year

Three weeks into the new year and we have new all-time highs across the three major US indices. It was a familiar catalyst that we had seen all throughout 2023, AI, that was the driving force behind the rally. One of the key elements to AI is the role of semiconductors. The world’s largest semiconductor maker, Taiwan Semiconductor stated that it expects revenue growth this year to be at least 20%, more than doubling the rate of the industry. Industry rivals such as Broadcom and Qualcomm have also indicated that the market for high-end chip manufacturing is still strong. They anticipate a significant recovery in the smartphone and PC chip sectors towards the end of 2024 and into early 2025. Microsoft also made headlines this week as it overtook Apple as the world’s most valuable company. Whilst this is not the first time that Microsoft have etched ahead of the iPhone maker, but investors now believe it will maintain its top position, supported by its growing engagement in AI.

Microsoft holds a significant share in OpenAI, the creators of ChatGPT, and has been heavily investing in research and development, forming industry partnerships, and strategically acquiring companies like LinkedIn and GitHub. These moves are aimed at acquiring data and AI expertise.

On a macroeconomic front, it seemed it was the season to be shopping, in December, with retail spending in America increasing at its most robust rate in three months, as consumers shrugged off concerns about inflation and interest rates. US retail sales, seasonally adjusted but not inflation-adjusted, climbed by 0.6% compared to the previous month, a significant rise from the 0.3% growth in November and exceeding the 0.4% economists had anticipated. This surge marked a fitting conclusion to a year characterised by surprising economic resilience, largely driven by the sustained spending habits of American consumers. It also indicates that the US consumer is starting 2024 on a strong footing.

Closer to home, UK inflation unexpectedly accelerated in December, whilst wage growth sharply slowed toward the end of the year, leading traders to reconsider their expectations for lower interest rates. Consumer prices rose by 4% compared to a year earlier, contrary to the anticipated dip to 3.8%. Services inflation, a key indicator for the central bank, also edged up to 6.4% from 6.3%. Meanwhile, core inflation, which omits fluctuating food and energy costs, remained at 5.1%, defying predictions of a decrease. Despite these inflationary pressures, there was a noticeable slowdown in UK wage growth towards the end of the year. Total pay growth decelerated to 6.5%, after reaching a record 8.5% in July. However, there is a silver lining: with consumer price increases slowing down more rapidly, real (inflation-adjusted) earnings continued to rise, providing some relief from the intense financial strain experienced by Britons over the past two years.

Turning our gaze to the East, China has continued to attract attention, albeit for undesirable reasons. Its biggest challenges are falling home prices and a declining population. In 2023, the Chinese economy saw a rebound, growing by 5.2% matching the government's conservative target of "around 5%", a notable recovery from the 3% growth in 2022 amidst stringent zero-Covid policies. A declining population poses a long-term challenge for China, but it faces an immediate concern in the form of deflation. The "GDP deflator", which provides a more comprehensive view of inflation by comparing the economy's size in nominal and real (inflation-adjusted) terms, shows concerning trends.

In the fourth quarter, China's GDP deflator contracted by 1.5%, marking its most prolonged decline since 1999. Prolonged deflation, driven by weak domestic demand, a persistent property crisis, a sluggish job market, and diminishing exports, poses a significant risk of an economic downturn.

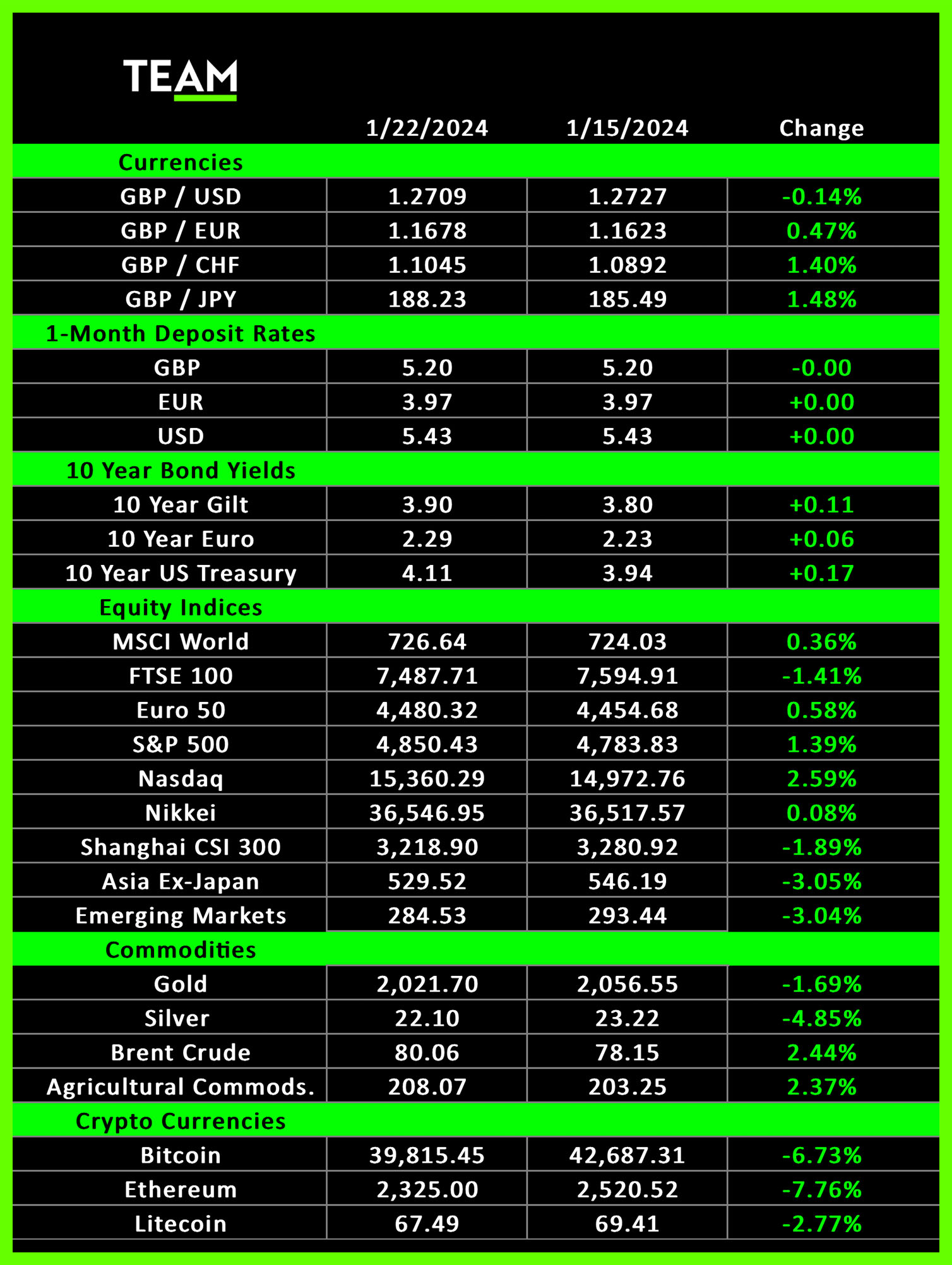

The crypto markets started the week strong after the landmark approval of Bitcoin ETFs the week prior. However, it seemed like it was a ‘buy the rumour, sell the news’ event as Bitcoin and most of the broader crypto had outperformed traditional markets throughout 2023. Despite the pullback in Bitcoin price, issuers of the Bitcoin ETFs have seen inflows of assets suggesting strong investor interest. There is a flurry of data for investors to watch out for in the week ahead. With earnings from the likes of Tesla, Netflix, Visa and Johnson & Johnson, consumer sentiment will be in the forefront of investors’ minds. From an economic perspective, Thursday will see the US economic growth for Q4 and the European Central Bank interest rate announcement.