Quarterly Investment Review & Outlook

Investment Review & Outlook – Third Quarter 2021

Major Asset Class Returns for Third Quarter 2021 in GBP Terms.

Global Equity Sector Returns for Third quarter 2021 in GBP Terms.

(Source: Bloomberg)

Global equity markets struggled through September to leave most major developed market bourses registering flat-to-low single digit returns for the quarter. The S&P, FTSE and Eurostoxx indices returned +3.25%, +1.96% and +0.08% respectively in the third quarter in sterling terms. While the post-lockdown recovery continues in earnest, markets are struggling to digest a slower pace of growth, the uncertain direction of the COVID-19 Delta variant, inflation angst and the prospect of quicker-than-expected US central bank tapering. At the time of writing, concern has supplanted complacency as the defining term of the investment landscape.

The highly contagious COVID-19 delta variant remains the key variable in determining the path towards full re-opening for many major economies. Evidence suggests that the Delta wave has peaked globally. The global 7-day average daily new Covid case count has declined by 32% from a recent high of 661,827 in late August to 447,899 at the end of last quarter and is now 46% below the peak of 826,439 reached in late April, according to data from Johns Hopkins University (chart 1):

Furthermore, whilst the Delta wave caused cases to exceed previous peaks globally, hospitalisations and deaths have been significantly lower, most particularly in countries where vaccination programmes are well advanced. The number of hospitalised Covid patients in Britain, for example, rose from a low of 872 in late May to 6,733 at the end of last quarter, though it remains 83% below the peak of 39,254 in mid-January. The 7-day average daily Covid death count in Britain also remains 90% below the January peak.

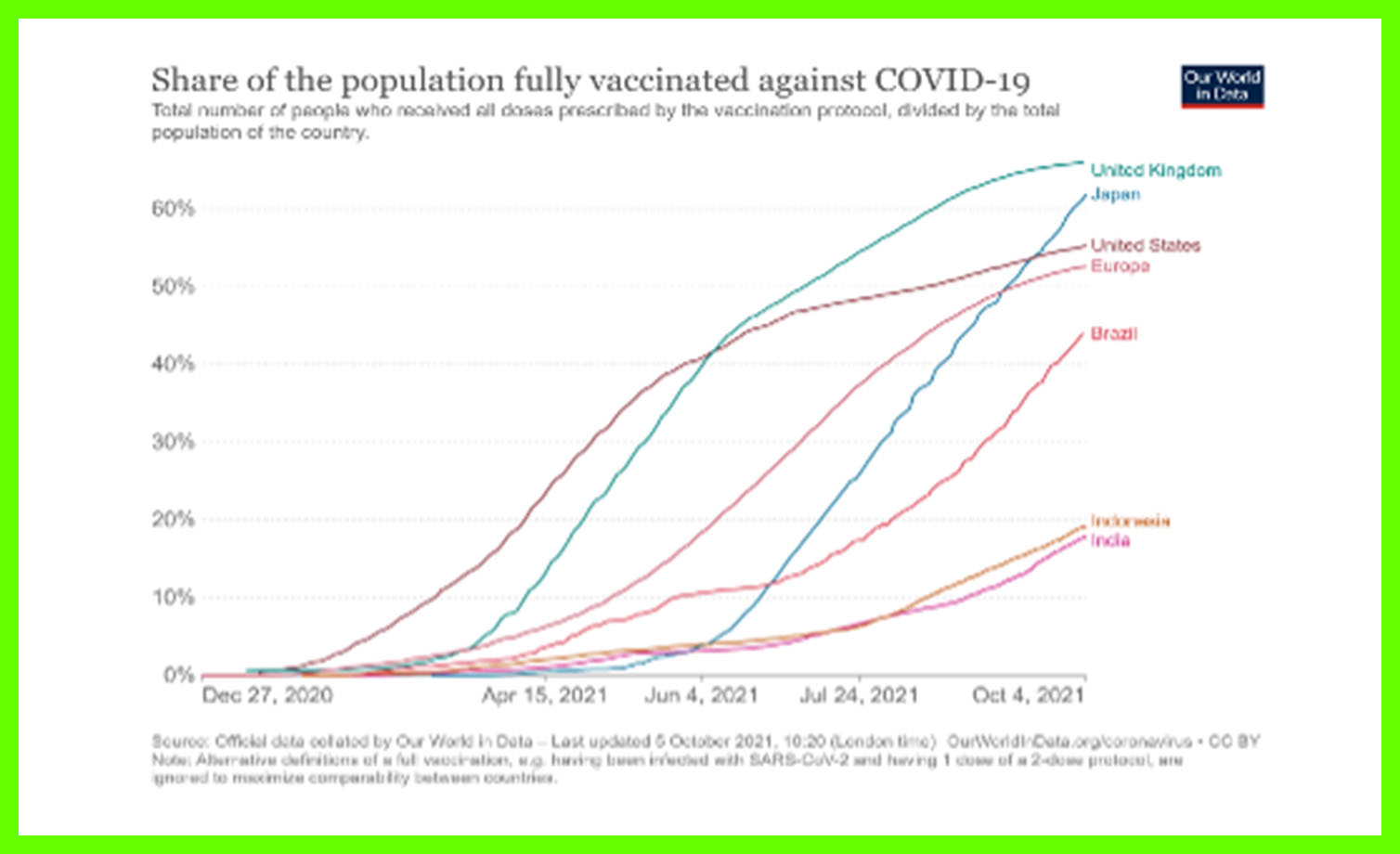

Vaccination rates are accelerating globally (see chart 2), and emerging economies are catching up with developed markets, implying that the structured reopening of economies should continue over the remainder of 2021. The onset of winter in the northern hemisphere is expected to provide a robust test of this view, but with Israel and China to the fore, some countries are already doubling efforts to ensure that a rollout of booster vaccination shots should help avoid widescale renewed lockdowns.

(Source: Johns Hopkins University)

Inflation

Inflation continues to feature near the top of the list of investor concerns, specifically whether the pickup in inflation witnessed in the Western world this year is ‘transitory’ or ‘structural’. It is mightily important. The eventual outcome will have far-reaching consequences for the direction and path of global asset prices over the coming quarters, if not years.

Investors have been accustomed to hearing the party line from central bankers across the G7 economies, namely that the inflation spike we are witnessing is driven by temporary factors and ‘transitory’ phenomena that will dissipate as we move into 2022. Nevertheless, a raft of steadily accumulating inflation evidence finally provoked a response, with US Federal Reserve Chairman Jerome Powell and European Central Bank (ECB) president Christine Lagarde conceding in late September that inflation may not be as transitory as believed at first.

For market watchers, this will not have come as a surprise. Both the Fed and the ECB have had to raise their inflation forecasts significantly since the start of this year. The Fed has raised this year’s US headline PCE inflation forecast from 1.8% in December to 4.2% in September, while the ECB has raised its 2021 inflation forecast for the Eurozone from 1.0% to 2.2% over the same period (chart 3):

(Source: ECB, US Federal Reserve)

In the US, the Fed’s preferred inflation gauge, the core personal consumption expenditures (PCE) price index, rose 3.6% over the 12 months to August. German inflation reached a 29-year high of 4.1%, whilst core Eurozone consumer prices jumped 3.4% in August, the highest level since 2008.

Though dispersion among the sector was high during the quarter, the Commodity Research Bureau (CRB) Index, a basket of 19 commodities with approximately 40% exposure to both energy and agricultural commodities, finished the quarter +10.1% higher. Fragile supply chains, shortages of workers in some industries and layoffs in others, massive pandemic-related state spending programmes and a potentially significant marginal buyer in the form of China is severely disrupting the demand and supply dynamic.

The result has been parabolic moves higher in a range of commodities from sugar to shipping prices. The situation has been mirrored at the corporate level from companies operating all over the globe. Research by Goldman Sachs has suggested that no less than 169 industries have been negatively impacted by delivery time disruptions. US retailer Dollar Tree stores best outlined the upward creep of prices with the announcement that the company will no longer be able to offer every item in the store for one dollar or less.

We are keeping a close eye on a range of indicators to assess the US Federal Reserve’s appetite and willingness to raise interest rates. Among them is the central bank’s preferred longer term inflation metric, the 5-year, 5-year forward inflation expectations rate, which measures the expected inflation rate over the five-year period that begins five years from now. (chart 4) The measure currently sits at 2.23%, which, for now, is comfortably below the threshold of what we would consider the Fed’s ‘worry point’:

(Source: Factset)

Wage pressures are also becoming a secondary issue. Average hourly earnings growth in the US is rising at an accelerating rate, up +4.3% YoY in August from +4.1% year on year (YoY) in July and +0.3% YoY in April. Average hourly earnings growth is now running at an annualised rate of 6.2% over the past five months. With the US Federal Reserve committed to an ‘inclusive’ employment mandate, the key question is whether underlying inflation is allowed to run hot while pursuit of this objective. The fixed income markets are most likely to reveal the answer. Thus far, bonds are trading in a remarkably relaxed fashion (chart 5):

(Source: Factset)

Evergrande

Elsewhere, the most high-profile development amongst other major economies has been the ongoing regulatory storm in China, led by a central government directive to squeeze the residential property sector, the biggest sector in the Chinese economy (accounting for 30% of GDP by some credible estimates) via a variety of measures including forcing developers to keep within specified leveraged ratios.

The so-called “three red lines” policy was first announced in August 2020 and is the reason why Evergrande, China’s most leveraged developer with debts of USD300bn, faced a growing liquidity crisis last quarter. For a brief period, financial market commentators were heralding a Chinese “Lehman moment”, plainly ignoring the fact that this “crisis” has been induced by the authorities. Expect state-owned property developers to take over many or all of Evergrande’s nearly 800 half completed projects in what would amount to a managed liquidation.

Dollar gains

Against the above backdrop, it was not surprising to see flows gravitate to perceived safe havens including the US dollar, the Japanese yen and the Swiss franc. The US dollar Index (DXY), a measure of the value of the US dollar relative to the value of a basket of currencies of six of the US’ most significant trading partners, touched 94.50 on the final trading day of the quarter, the highest level in over 12 months. Sterling suffered, weakening to close September at USD1.35 as the UK government grappled with a resurgent Delta variant and a mini energy crisis leading to extensive petrol pump queues and failing energy retailers. Brent crude closed up +7.3% on the week.

Re-opening

Absent new resilience demonstrated by the Delta variant and/or the emergence of a new and lethal strain of the coronavirus, the reopening trade should resume over the coming months. Cyclically geared companies that offer attractive valuations are reporting stronger earnings upgrades. Financial stocks comprise the largest sector in the MSCI World Value Index, and should benefit from further yield-curve steepening, which will boost profitability (banks borrow ‘short’ duration deposits and lend ‘long’ in the form of loans and mortgages).

The rotation in economic growth leadership away from the United States should also bolster the reopening trade. Emerging market equities have been poor performers since the vaccine announcement, but there are some tentatively encouraging signs. The vaccine rollout has accelerated in the region and policy easing in China should begin to feed through to an improved growth outlook. The path of Chinese regulation is harder to predict, but the underperformance of Chinese internet and technology companies suggests much is priced in. Much will depend on the direction of the US dollar. We are watching developments closely.

Regional Round Up

The US economy is likely to sustain above-trend growth into 2022. However, the easy yards have been made. Early evidence that the Delta variant wave may have peaked and the potential for greater vaccine access for children along with recent booster trial news are positives for a move to genuine full reopening in the quarters ahead. Wage inflation is a key risk to this view, as is the US Federal Reserve’s tolerance to run inflation hot in the pursuit of ‘full and inclusive employment’.

Fiscal stimulus brinkmanship continues to play out in Washington D.C. The tax provisions in these bills are likely to be most impactful for financial markets. Credible research estimates suggest that higher corporate taxes could subtract about four percentage points from S&P earnings growth in 2022.

Eurozone growth slowed through the third quarter but looks to be on course for a return to above-trend growth over the fourth quarter and into 2022. Vaccination rates are high, whilst the region is being supported by tremendous fiscal firepower as the European Union pandemic recovery fund begins to disburse stimulus. Europe’s exposure to financials and cyclically sensitive sectors such as industrials, materials and energy, and its relatively small exposure to technology, gives it the fuel to outperform as Delta variant fears subside, economic activity picks up and yield curves in Europe steepen.

In the UK, supply bottlenecks and labour shortages have triggered a sharp rise in underlying inflation and raised fears that the Bank of England (BoE) may begin lifting rates as early as the end of this year. The FTSE 100 Index is the cheapest of the major developed equity markets, and this should attract capital as borders fully reopen and activity normalises.

Finally, Japan is beginning to look interesting. The main protagonist for the market’s weakness in the first half of 2021 was an unfeasibly slow vaccine rollout. Just weeks before the lighting of the Tokyo Olympics ceremonial torch, Japan’s fully vaccinated rate was running at an alarmingly low 8% of the population. This problem has now been addressed, with the percentage of the Japanese population now double-jabbed standing at 60%. Corporate Japan is also exhibiting improving return on equity ratios and enjoys abundant cash on balance sheets that, sensibly spent, has the ability to boost profitability.

Asset Allocation & Positioning Summary

- TEAM enters the 4th quarter of 2021 advocating a healthy allocation to:

- Equities including global large-cap, global and UK small-cap and Japan.

- Real assets including commodities (oil, grains and precious metals), crypto currency (Bitcoin) and global property.

- Bonds, namely emerging market sovereign bonds, inflation protected government bonds and selective high yield corporate credits. We view conventional bond exposure at this juncture as return-free risk and maintain zero percent exposure.

- More deeply entrenched inflationary pressures will test the resolve of the Fed. Cognitive dissonance is in play. Watch wage growth, inflation breakeven rates, the US employment picture and bond markets for early warning signs of destabilisation and de-risking.

- The big macro risk is that the tide is turning in global monetary policy, with emerging market economies leading the tightening cycle. Other risks we are monitoring include Big Tech regulatory risk, virus mutation and efficacy issues and potential policy missteps from government at a critical point in the recovery cycle.