Quarterly Investment Review & Outlook

Investment Review & Outlook 1st Quarter 2022

Major Asset Class Returns for 1st Quarter 2022 in GBP Terms

Global Equity Sector Returns for 1st Quarter 2022 in GBP Terms.

(Source: Bloomberg)

Market Review: Dislocation

Vladimir Ilyich Ulyanov (1870 - 1924), the Russian revolutionary, politician, and political theorist better known by his alias ‘Lenin’, was reputed to have remarked that ‘there are decades when nothing happens, and there are weeks when decades happen’. His observation seems to aptly characterise the first quarter of 2022, as a defiant Vladimir Putin plunged Europe into the largest conflict, and resulting humanitarian crisis, since World War II. Our thoughts and prayers are with the brave people of Ukraine and all those affected by this ongoing tragedy. Price returns for the first quarter of 2022 reveal some striking numbers, but also conceal the vastly different journey for asset classes over the period, as investors attempt to navigate a rapidly shifting financial market landscape. The war has coincided with a period of rampaging global inflation, a reescalation of pandemic concerns following further strict lockdowns in China and a resurgence in global COVID cases, and a far more hawkish tone from both the US Federal Reserve (‘Fed’) and the European Central Bank (‘ECB’).

Western intelligence sources long suspected an imminent, and major, escalation of the Russo-Ukrainian war, a position the Russian authorities repeatedly denied as late as 23 February. In the run-up to the invasion, haven assets, including long-duration sovereign bonds and gold, attracted capital flows as investors shunned riskier pockets of the credit and equity markets. On 24 February, Putin announced a ‘special military operation’ to ‘demilitarise and de-nazify’ Ukraine. Missiles and airstrikes followed, alongside a coordinated, large ground invasion from multiple directions.

Incredibly, 24 February would mark the intra-quarter low for major US equity market indices including the large-cap S&P 500 Index (‘S&P’) and the technology-laden Nasdaq Composite Index. From a rather precarious position, risk assets, notably high-growth stocks, powered higher through March into quarter-end, propelling the S&P to a modest -1.74% loss for the quarter for sterling-based investors, leaving the index within a few percentage points of its all-time high.

With both governments and investors grappling with a vast range of potential outcomes to the current geopolitical situation and second-order effects of the war, specifically the lasting impact on commodity prices and what this might mean for energy security policy across the G7 (Group of Seven), major divergences in regional equity performance were seen over the period.

Latin American markets, boasting resource-rich producers that look to set to gain handsomely from a world seeking out new suppliers of minerals and materials, recorded their best quarter ever in absolute and relative terms, with Brazil the standout performer (+38%). The UK’s FTSE 100 also delivered a positive return, although one that was far less spectacular, of just under +3%, principally on account of a heavy index composition to resource, miners, and heavy industrial companies.

Unsurprisingly, regional European markets fared less well, with the flagship Euro Stoxx 50 Index down almost -9%. Proximity to developments on the ground, a disproportionately negative impact from commodity price spikes including natural gas and agriculture (particularly for the likes of Germany and Italy), and a European Central Bank that is arguably further behind the inflation curve than the US Federal Reserve, all seem sensible arguments to account for the relative degree of underperformance. Bond markets recorded their worst quarterly performance since 1980. For a date throwback, try the Jam’s ‘Going Underground’, which was the UK number 1 single at the time of writing. Every major sovereign bond, investment grade and high yield index delivered negative returns, with most government 10-year indices (including French, German, and Swiss issuers) down between -4% and 7%. This is clearly a major headache for conventional ‘balanced’ portfolios that have been able to rely on the fixed income space as an effective hedge during prior equity market dislocations.

The inference from bond prices (and the opposite direction of yields) is clear: the Fed (and potentially the ECB) tightening cycle, not Russia’s invasion of Ukraine, remains the key headline risk for credit markets. The Fed finally turned more hawkish to restore policy credibility, and “lift-off” from zero-bound interest rates came, as expected, in March, via a 25-basis point rate hike. Money markets are now pricing in 200 basis points of further hikes, at a swift pace, in 2022. Bond market action suggests this path, if followed, will have severe implications for the global economy.

The European Central Bank (ECB) also pivoted to a more hawkish stance in February, as Euroland inflation continued to rip higher. Comments from President Lagarde indicated rate rises were no longer ruled out for 2022 and the ECB also confirmed a faster reduction in asset purchases. Talk about late to the party.

Closer to home, consumer prices in the United Kingdom were 6.2% higher in February than a year earlier, reflecting the fastest annual inflation rate since 1992, the year that marked Britain’s painful withdrawal from the European Exchange Rate Mechanism (ERM) following a collapse in the pound. The Bank of England (BoE) raised rates for a second time in succession February, despite concerns about the UK economic outlook and cost of living pressures on households that are surging uncomfortably higher. Commodities soared, with the Commodity Research Bureau (CRB) Index, a broad basket comprising 19 separate commodities across energy, agriculture, and industrial and precious metals, surging 31%. Rising oil and gas prices have captured much of the world's attention, and for good reason. The ubiquity of oil has spill over effects throughout the global economy. Russia produced about 11% of the world's oil supply and 37% of Europe's natural gas supply last year. Disruptions to the global energy market, plus any additional uncertainty, are likely to be felt in the form of higher energy prices and heightened stock market volatility.

Gold and silver are usually the most widely watched metals by investors, but it's been industrial metals that are making the most waves in the wake of the war in Ukraine. Russia accounts for roughly 9% of the world's total nickel production (a key input for a wide variety of products including stainless-steel appliances and electric vehicles), and 40% of the world’s supply of palladium (used by automakers around the world). The decision by Russia to ban commodity exports in response to sanctions from the US and its allies, on top of existing supply chain disruptions and mounting trade tensions, has led to hyper-volatile trading and rising prices which may persist for some time.

Investment Outlook

We entered 2022 with a more cautious stance in terms of outlook and positioning than 12 months prior. From our 4th quarter 2021 commentary: ‘The crystal ball has certainly become murkier: can this bull market continue for another year? Will there be a major policy misstep? Does geo-political risk flare into something sinister?’ The latter has, sadly, become a stark reality, the former looks to be on shaky ground, whilst a policy misstep remains a major risk event as the Fed begins its pursuit of monetary policy normalisation.

Bonds

Bond markets are pointing to trouble ahead, that much is clear. Fed Chairman Powell finally raised a white flag in response to sustained, multi-decade high inflation readings throughout 2021 and 2022, abandoned his ludicrous ‘transitory’ position, and is now desperately attempting to restore policy credibility. His tone and rhetoric at the 16 March policy meeting, almost 4 weeks into the Ukrainian invasion by Russia, has now turned unmistakably hawkish. The message is clear: interest rates are heading higher, and quickly.

The reaction from bond markets is that a Fed tightening cycle of the speed and magnitude now being discussed will slam the brakes on the American economy. Historic episodes have not been kind in this regard, with previous tightening cycles over the past 70 years invariably triggering recessions. Shown in the chart below is the Fed Funds Rate, and subsequent recessionary periods (shaded light blue areas):

(Source: Federal Reserve, Jefferies Global Research, National Bureau of Economic Research (NBER)

It is not just rates hikes that markets are digesting. The release of Federal Reserve meeting minutes on 5 January also alluded to quantitative tightening (‘QT’) happening much sooner than markets were anticipating. In this regard, the Fed is talking about simultaneously raising interest rates and shrinking the size of its balance sheet which has more than doubled to US$8.94tn since the start of the pandemic (see chart below). For markets that have become accustomed to, if not dependent on, abundant global liquidity and ultra-easy monetary policy, this represents a sharp wake-up call.

(Source: Federal Reserve, Statista)

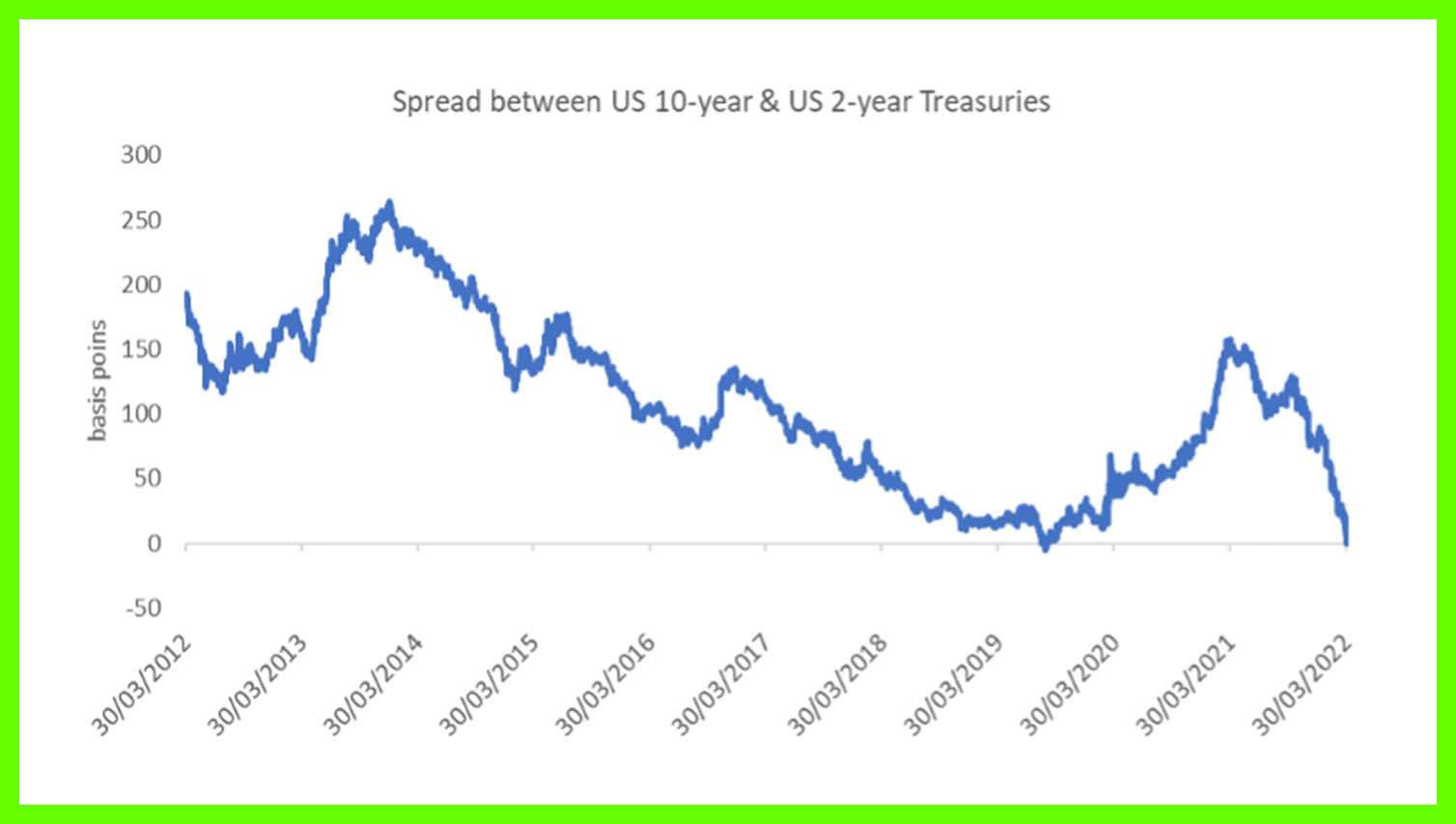

Perhaps the most obvious ‘tell’ of the bond market’s discontent is via the action of the yield curve itself, which represents the relationship between short-term and long-term interest rates. Alongside a sharp rise in absolute yields across the Treasury curve, the spread (or difference) between 10-year and 2-year Treasury bond yields shrank rapidly and ‘inverted’ on the last trading day of March. This is an important development, implying that investors can earn more interest lending money to the government for a 2-year period than over a 10-year period. Yield curve inversion boasts an excellent track record as a recession forecaster, pointing to deeper worries over America’s longer term growth prospects:

(Source: Bloomberg)

Equities

Turning to equity markets, many headline indexes have recovered large parts of the losses from the double-impact of the sell-off in the first half of the quarter and Russia’s invasion of Ukraine. Stocks are largely brushing off bond market concerns of stagflation (high inflation, a slow or stagnant economic growth rate, and a relatively high unemployment rate) for the global economy on the back of another round of supply disruptions, higher commodity prices that cannot solved with monetary policy and, starting in Europe, an erosion in business and consumer confidence.

Part of the answer may lie in the resilience of the American economy. Job creation has been solid and unemployment low, whilst over 11 million current job vacancies point to a robust labour market. Wage growth is at multi-year highs, and we might expect labour participation rates to steadily improve over time from current levels. Taken together, this should place the US in reasonable shape and able to better withstand a cost-of-living crisis, which is hitting European counterparts very hard given sensitivities to Russian energy prices. Consensus US real GDP growth forecasts remain reasonably robust at 3.5% for 2022, although whether they will stay at this level is another matter.

Another part of the answer may arise from the limited choices facing investors currently, giving rise to the ‘TINA’ (There Is No Alternative) acronym, or what market commentator Mohamed El-Erian has described as the ‘cleanest dirty shirt’ effect. Stocks are not exactly cheap in absolute terms, but they seem less dirty than the guaranteed negative real return on cash due to high inflation. Commodities can act as an effective hedge during inflationary periods but are highly volatile, and there are limits on how much capital can be channelled into this asset class. Finally, bonds remain vulnerable to further price drops as the Fed potentially engages in a hiking cycle and QT.

Conclusion

So, with bond and equity markets sending very different signals, where does this leave us?

The current financial market environment illustrates the ongoing dilemma facing allocators of capital and risk. We tend to shy away from predictions and forecasts for the most part, preferring to channel our resources to delivering resilient investment portfolios for our clients. What we are prepared to venture is that the sharp dislocation between equity and bond markets in recent times is suggestive of a more ominous, tectonic shift in the underlying financial market regime.

Globalisation, open trade, just-in-time supply chains and dependence on one supplier, combined with China’s entry to the WTO and major technological advances, created hugely disinflationary forces over the past thirty years. This was fantastic for bonds, and even better for equities. It is plausible that the COVID pandemic has bookended this unique period in financial market history, with Putin’s recent act of aggression acting as an accelerant.

De-globalisation (or localisation), autocracy, the sourcing and hoarding of commodities, duplication of supply chains, and a surge in military spending are sure to gather pace in the coming months and years ahead. The consequence is likely to be a more unstable, volatile world, with inflation moving up to a higher plateau. Consequence: bad news for bonds, and a more difficult environment for equities.

Asset Allocation & Positioning Summary

TEAM enters the 2nd quarter of 2022 with much the same message as three months prior: advocating a relatively conservative posture in terms of equity risk, with a focus on playing ‘good defence’ rather than blindly chasing riskier pockets of the market.

Our key positioning calls heading into April:

Strong underweight to fixed interest. We retain a zero (0%) position in conventional bonds, a stance we have held for 18 months on the premise that such investments represent ‘return-free risk’. Our preference is to re-allocate this capital to two other risk buckets:

- Absolute-return strategies that offer uncorrelated return streams, have an established market edge, and act as an effective equity hedge/bond proxy during downdrafts for risk assets.

- Alternative income streams, securities that exhibit conventional bond characteristics, namely an attractive and sustainable yield and less-than-equity market volatility. Examples include renewables infrastructure assets and music royalty streams.

Underweight equity risk. Global large-cap, global technology, and global small cap equities are our preferred areas of exposure, principally as medium-term price trends have improved.

Strong overweight to real assets. We continue to lean in hard to this risk bucket, bolstered by TEAM’s extensive asset allocation menu in this area. Significant positions in physical gold, commodities (ex-gold), US infrastructure equity, global property and logistics, volatility and a modest crypto allocation are preferred.

TEAM’s flexible investment framework, underpinned by a diverse asset allocation menu and the ability to tactically allocate, continues to serve our clients well. Our approach has delivered very respectable risk-adjusted returns during what can be described as a ‘robust’ stress-test of our portfolios so far in 2022. We anticipate taking advantage of further opportunities over the coming quarters.

Craig Farley

Head of Multi Asset Investments