Quarterly Investment Review & Outlook

Investment Review 4th Quarter 2023

Major Asset Class Returns for 4th Quarter 2024, GBP (£) terms.

Volte-Face

Volte-Face: A reversal in policy: ABOUT-FACE (Source: Merriam-Webster). Volte-face came to English by way of French from Italian voltafaccia, a combination of voltare, meaning ‘to turn’, and faccia, ‘face’.

Much like the mountaineer crushing a steady climb, major developed equity markets, led by the US, continued their ascent during the 4th quarter, recording strong gains. Embracing FOMO (fear-of-missing-out) and celebrating an early Christmas present from the Federal Reserve (‘Fed’) in the form of expected interest rate cuts early next year, investors purchased $263 billion of US equity ETFs in the fourth quarter1, propelling the S&P index to its highest closing level since March 2022, and the Dow Industrials index to a new all-time high in nominal price terms.

The key catalyst driving optimism amongst investors continues to be the extraordinary volte-face by Chairman Powell and colleagues at the Fed. To recap, during the first half of 2023, markets had been constantly pushed and pulled by ongoing concerns over elevated inflation and the need for tight(er) monetary policy to subdue price pressures.

Additional factors creating headaches for central bankers included the remarkable resilience of economies, particularly America, to the sharpest 2-year interest rate hiking cycle in decades2, tight labour markets, and the collective bargaining power of workers to demand higher wages. In sum, central bankers were encouraged by falling headline inflation numbers, but fearful of the dangers posed by loosening policy too early and risking a second inflationary wave.

However, in recent months, coincident readings pointing to a weakening inflation backdrop and a softening in the American jobs market, whilst not alarming on the surface, appear to have given the Federal Reserve adequate ‘cover’ for a path towards rate cuts next year. The collective evidence was enough to prompt Powell into stating during the 13 December Fed meeting that a rate cut ‘is clearly a topic of discussion out in the world and also a discussion for us at our meeting today’.

In addition, the Fed committee’s ‘dot-plot’ (each dot represents the view of one of the twelve Fed policy makers for the federal funds rate target range for each of the next 3 years) suggested a consensus view of three potential interest rate cuts over the course of 2024. Finally, Chair Powell did not rebuff the prospect of early 2024 cuts during his press conference Q&A, a significant shift from prior messaging.

Financial markets had already begun pricing in a significant increase in monetary easing expectations heading into the December meeting, but Powell’s actions were a triumph for the optimists. Cue a rocket-fuelled Santa Claus ‘almost everything’ rally, led by technology and consumer discretionary in the equity space, with bonds and property also well- bid as investors have become increasingly confident that interest rates will need to be cut at an even faster pace than the Fed, Bank of England, and the European Central Bank are indicating.

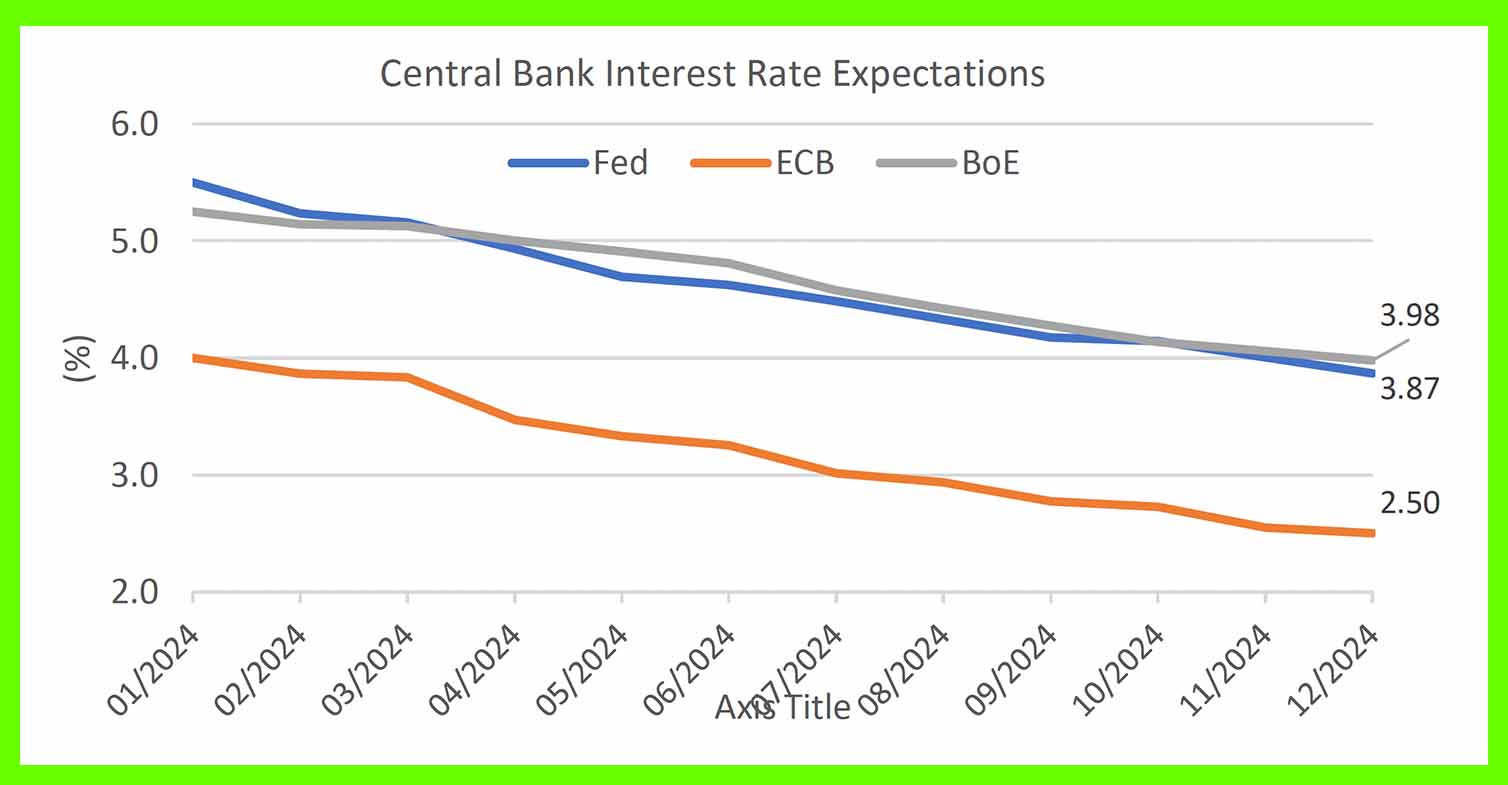

Money market futures (arguably the most accurate real-time barometer of the likely path of interest rates) are now pricing in the equivalent of five cuts by the Bank of England, six cuts by the Federal Reserve, and more than six cuts by the European Central Bank, taking implied core base rates back down to 4%, 3.9%, and 2.5% respectively:

(source: Bloomberg, TEAM, pricing at 31/12/2023)

Equities: Scores on the Doors (all returns in sterling terms)

Developed market equities (represented by the MSCI World Equity Index) delivered a +6.7% total return over the fourth quarter. The bellwether S&P 500 large cap index, arguably the key global barometer of investor risk appetite, delivered a +6.4% total return, for its best quarterly performance since Q4 2021.

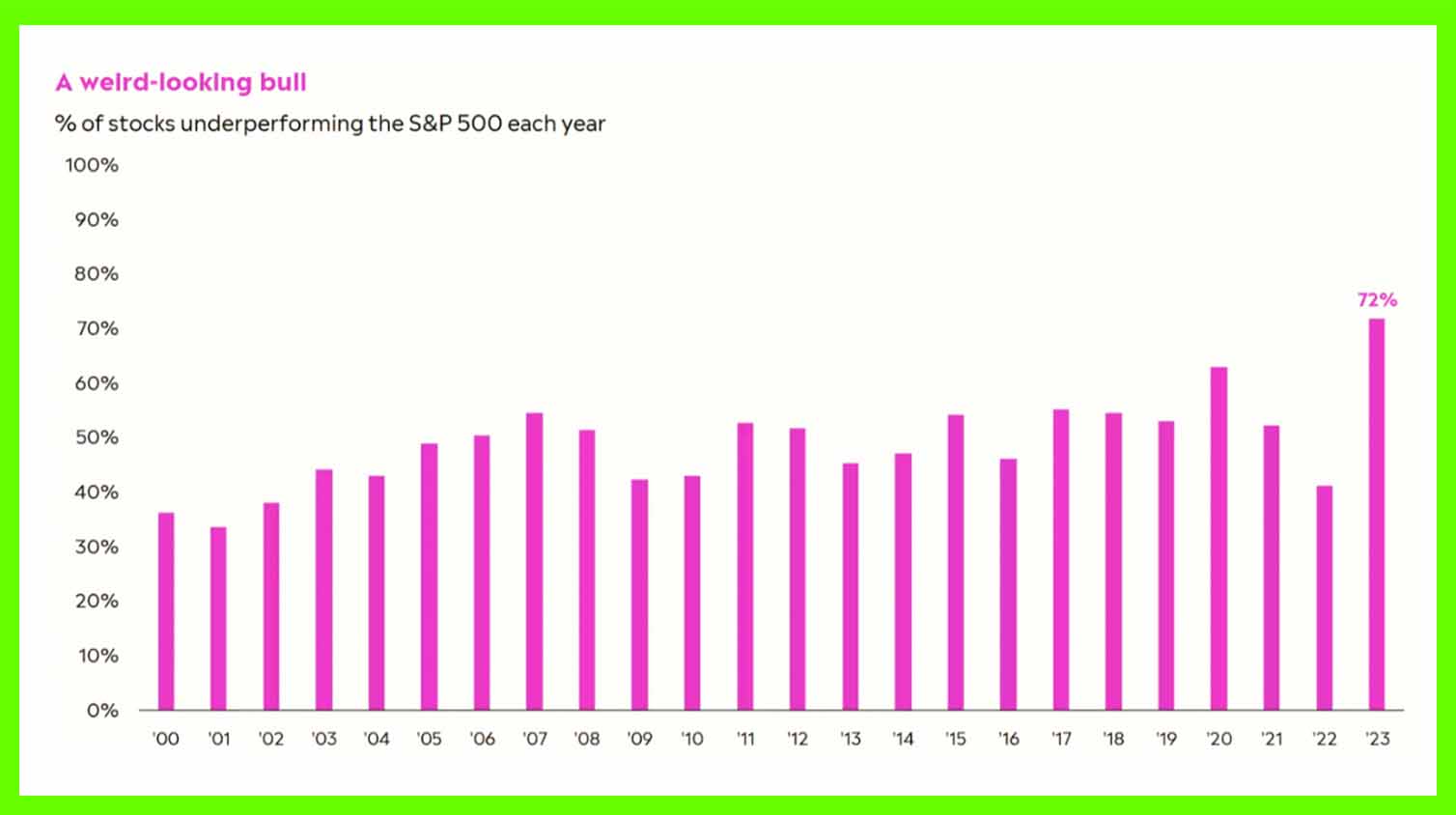

Peeling back the onion, 2023 returns within the S&P index were largely powered by the ‘magnificent 7’ (Google’s parent Alphabet, Amazon, Apple, Facebook’s parent Meta, Microsoft, Nvidia and Tesla) as investors scrambled to get exposure to perceived winners from the AI-related story. As a result, this basket of stocks alone contributed fully two-thirds of the S&P’s 2023 return, and now account for almost one third of the entire market capitalisation of the S&P index.

Put another way, a staggering 72% of the constituents of the S&P index underperformed the benchmark in 2023:

(Source: Callie Cox at eToro, FT.com)

From a technical perspective, the most encouraging aspect of the rally has been a significant broadening out in the participation of markets, sectors, and securities beyond technology and consumer discretionary. Value stocks delivered a respectable +4% on the quarter, whilst real estate investment trusts (REITS) and global small caps, both sectors that had struggled in the face of generationally high interest rates, bounced back sharply, posting +13.1% and +7.2% respectively.

European developed market equities ex-UK returned +8.3%, whilst Japan, represented by the Nikkei 225 Index, returned +6.6%. The MSCI Emerging Markets Index returned +2.8% despite the heavy anchor of China, which still accounts for almost 25% of the index.

The Chinese stock market must be a contender for most disappointing investment in 2023. The much-hyped COVID economic rebound has proved for the most part to be a damp squib, with ongoing issues in the property sector casting a large shadow over investor sentiment. Property remains a core growth engine, as it still accounts for fully one quarter of economic activity. The domestic stock market index is now at a 5-year low, whilst a measure of the property sector index has, incredibly, returned to Global Financial Crisis (2008-2009) levels.

This has done little to bolster investor confidence, particularly among overseas investors, who have chosen to access the ‘China story’ through alternative channels including Japanese automakers and European luxury goods companies.

Fixed Income: Rapid Repricing

Coming into 2023 off their worst calendar year performance in history3, bonds defied doomsday predictions for a repeat, closing the year with a strong fourth quarter on a more dovish anticipated path for rates. Expectations of early central banks cuts and tightening spreads (note: a credit spread reflects the difference in yield between a government bond and a corporate bond of the same maturity. Bond spreads are often seen as an important gauge of economic health, where widening spreads are considered ‘bad’, narrowing spreads considered ‘good') underpinned positive returns.

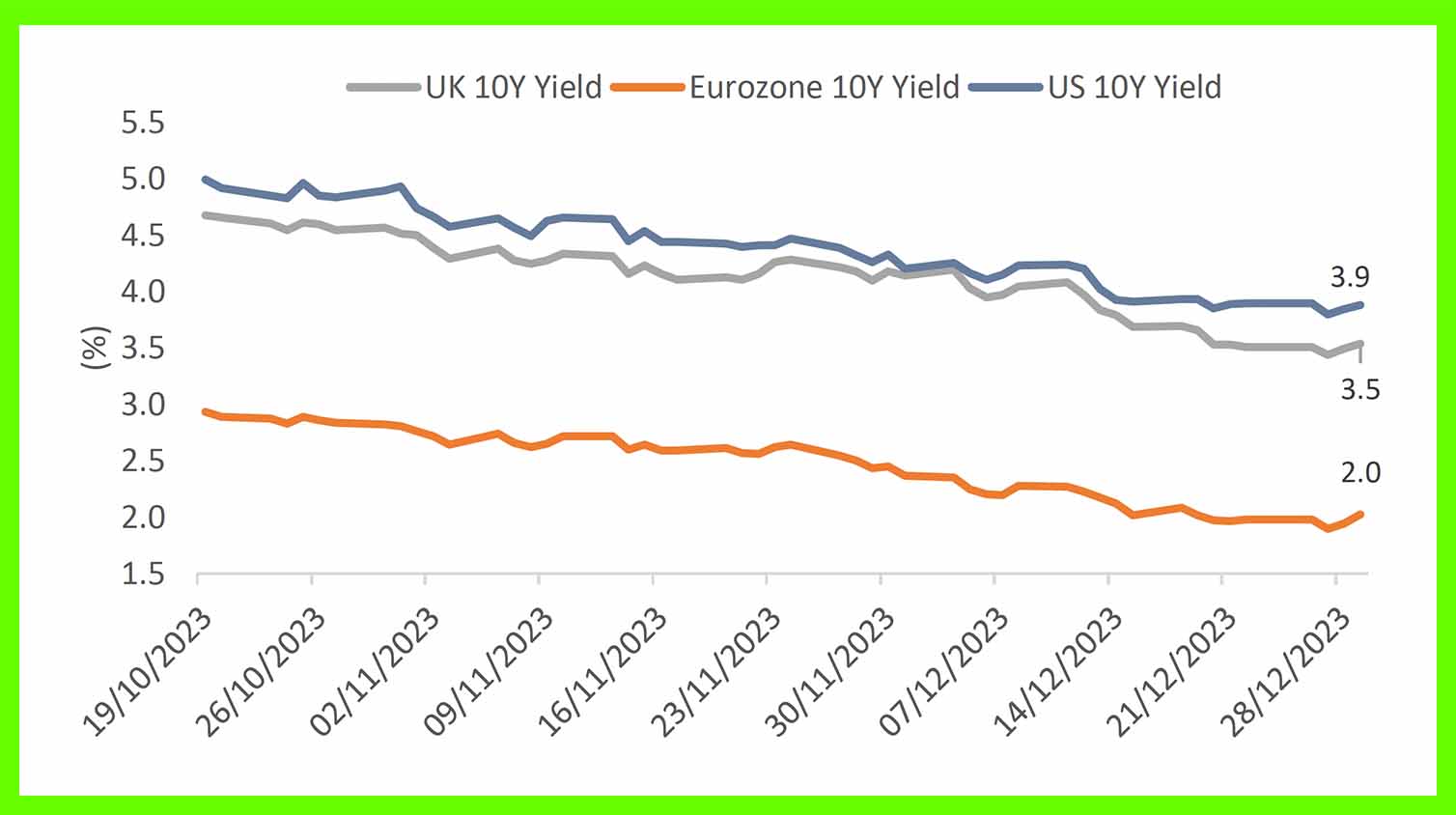

To give a sense of the magnitude of the repricing in rate expectations, shown below are the US, Eurozone, and UK 10-year government bond yields from their 19 October 2023 ‘peak’ for the cycle to year-end. All told, both the US and UK yields dropped by a dramatic 110 basis points (-1.1%), whilst Eurozone yields fell by 90 basis points (-0.9%):

(source: Bloomberg, TEAM, pricing at 31/12/2023)

Commodities

Turning to the commodity sector, oil has almost fully round tripped its second half rally this year, with WTI crude closing out 2024 at c.$71 on abundant short term supply concerns. Elsewhere in the space, gold regained its allure, with the price settling at just under new all-time highs of $2,100 in nominal terms. Central banks are on pace to buy over 1,000 tonnes of the yellow metal this year.

TEAM Positioning & 1st Quarter 2024 Outlook

‘Currently, our expectation is for equities to deliver a strong second half on balance, although we acknowledge that the extent of the first half move in prices, and seasonality, may lead to ‘summer doldrums’. At the end of the third quarter, the S&P large cap index and the Nasdaq currently find themselves approximately -5.5% and -7% below their peak July 2023 levels.

As the saying goes, investing is simple but its never easy. Periods of acute market dislocation and stress can feel uncomfortable on the senses, increasing the desire to check one’s portfolio valuation, and elicit a gnawing temptation ‘do something’ to alleviate any short-term pain. Oftentimes, knee-jerk decisions that are made in this scenario materially impede long-term investment outcomes.’

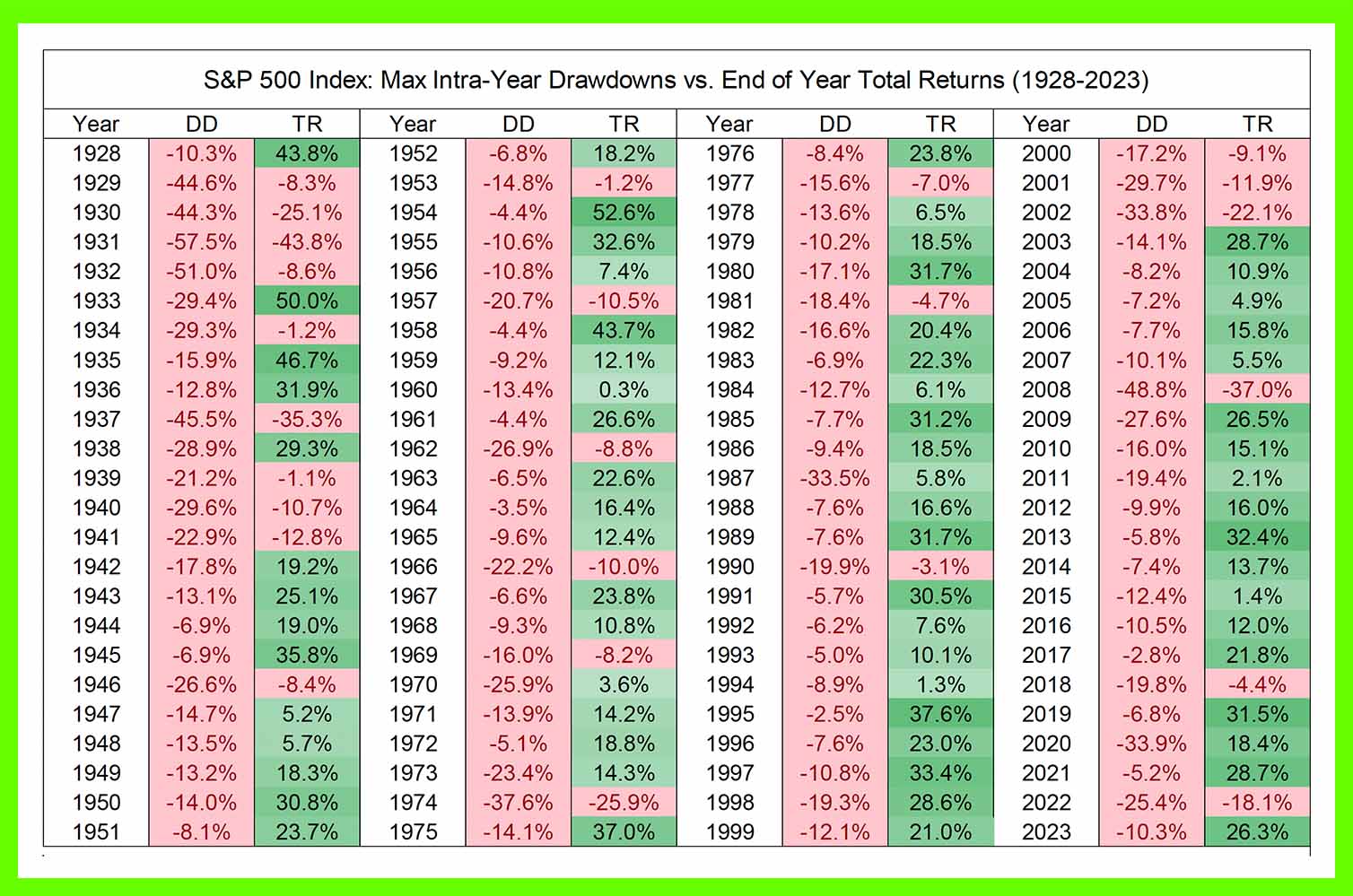

With the year now behind us, we can update the table below showing almost 100 years of returns for the US S&P 500 large cap index (TR column indicating the total return of the index including dividends received), with the maximum intra-year drawdown (DD column indicating drawdown, or the largest peak-to-trough index price decline recorded during the year):

(source: TEAM)

We are pleased to report that on account of TEAM’s robust investment framework and process, we steadily increased our exposure to risk assets across the MPS range through the second half of the year, notably in October. Consequently, we have participated meaningfully in the rally, all the while staying true to our principles of riding strong price trends across assets, whilst seeking out genuine diversification through cycles. Simply put, aggregate equity exposure across the MPS range is above cycle average, but we do not have our foot to the floor.

Capital has primarily been deployed into US equities via 1) selective US large-cap and technology shares that continue to offer the defensive characteristics exhibited by consumer staples and healthcare sectors in previous cycles, and 2) a basket of US infrastructure equities, where the premise for investment is simple: a deep, wide-ranging upgrade to the country’s physical infrastructure, following a chastening review by The American Society of Civil Engineers , who assigned a letter grade of C- to the state of U.S. infrastructure in 2021.

Our basket of stocks reflects companies that stand to benefit from a potential increase in infrastructure activity in the United States, including those involved in the production of raw materials, heavy equipment, engineering, and construction.

Outside of equities, we became increasingly more positive on the outlook for fixed income given the back-up (bond market jargon for an increase) in yields that took place during October. We added meaningful exposure to long dated government bonds, but our strong preference was to put money to work in investment grade corporate bonds that offered attractive absolute and relative yields, without needing to reach down into riskier areas of the credit spectrum. This paid off, with corporate bonds delivering solid returns over the fourth quarter (+8.6%).

Looking Ahead

Looking ahead to 2024, the swift and significant repricing of expected interest rate cuts, and their potential impact on asset prices, has priced in a lot of good news in a very short space of time.

The contrast in consensus expectations to this time last year could not be greater. Then, a global recession led by the US, was all but ‘guaranteed’. Now, investors are convinced a US soft landing is equally ‘certain’. A so-called Goldilocks scenario (using the porridge analogy: not too hot, not too cold, but just right), it implies inflation falling towards the Fed’s 2% neutral target without materially impacting the labour market. A look back at history suggests the odds of this outcome occurring are poor.

We are reminded of the Ned Davis quote ‘beware of the crowd at extremes’, which is to say, anytime everyone leans hard to one side of the proverbial markets boat, it is not a bad time to look over the other side for what could sink you. The list of potential catalysts for corrections in the coming year is daunting. It includes contagion from ongoing hot wars and conflicts around the world, unexpected setbacks related to technology, and the prospect of real election shocks across much of the democratically elected western world, not least America. With that said, human psychology causes many of us to fear that something bad (a nasty market correction) must naturally follow something good (the 2023 rally). We will typically read or hear words to the effect that ‘the gains cannot last’, or ‘stocks are priced for perfection’, or ‘the easy money has been made’ etc.

It is possible, of course, that investors are already leaning hard over their skis given the prevailing assumptions over multiple rate cuts and a soft landing. Wall Street is expecting S&P 500 companies to grow total operating earnings by a hefty 11% this year. This would be no small feat. As risk managers, we constantly consider downside risk potential for our clients.

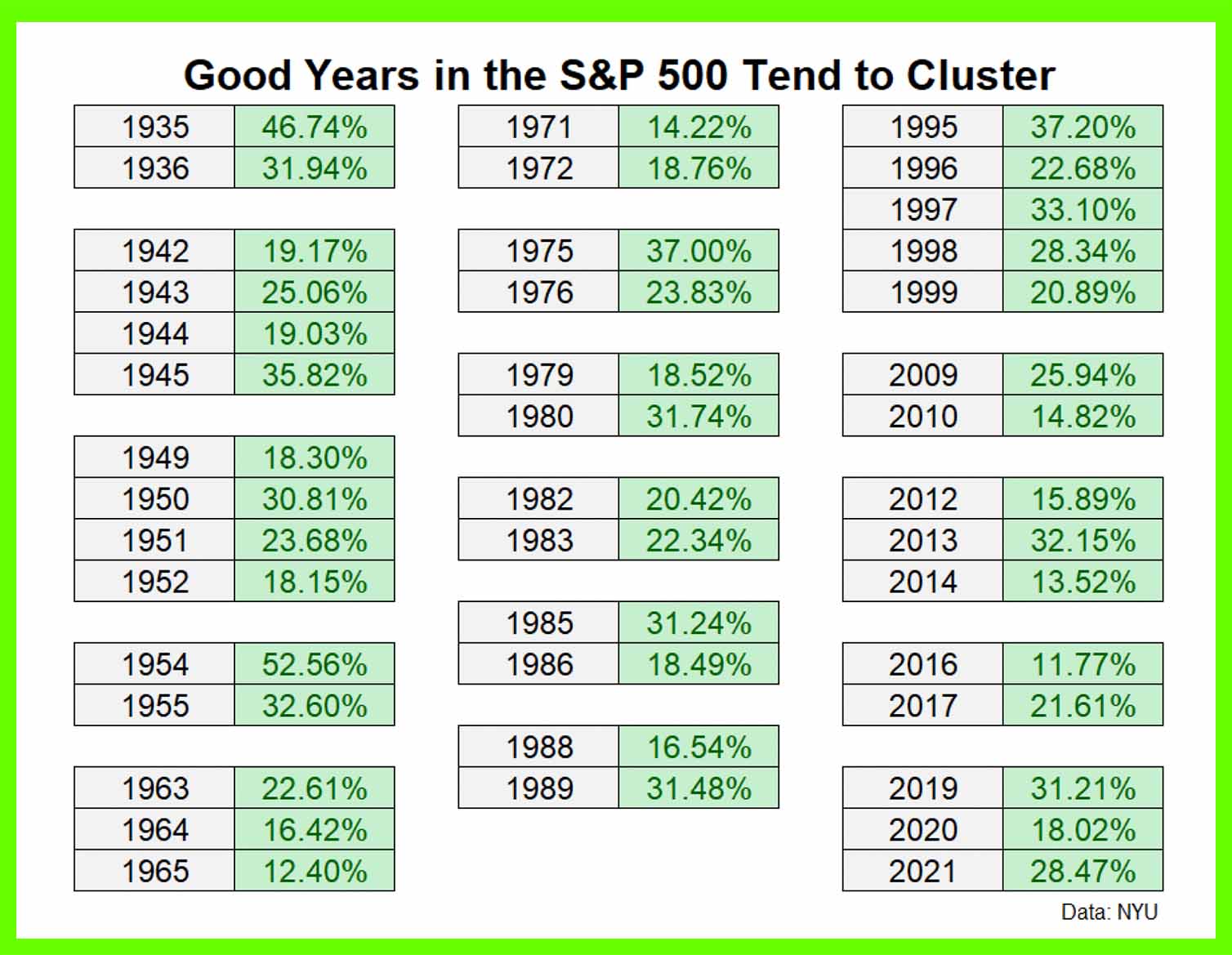

But it is also important to remember that bull markets can positively surprise. In this regard, we are advocates of batting averages. The good news: solid annual stock market returns tend to cluster. Shown below is a look-back of S&P index returns to 1928 that identifies when large index returns were followed by further large returns. Surprisingly, it happens more frequently than one would expect, with 16 separate clusters representing 40% of all annual returns over the period:

(Source: Ben Carlson, a Wealth of Common Sense)

Second, looking ahead to the election year 2024, we are reminded of the power an incumbent president running for re-election has in terms of market returns, +13% on average for the S&P in election years since 19494. This compares to an average loss of -2% when there is no sitting president running and an open field. The caveat is that incumbent President Biden is currently lamenting his worst approval rating (approximately 34% from credible surveys) since taking office, despite the rude health of the stock market, the economy, and labour markets.

We enter 2024 positively positioned from a risk perspective, with overweight allocations to both equities and bonds, and a modest underweight to alternatives. Our asset allocation for the core TEAM MPS multi asset range is shown relative to neutral weightings in the table below:

Equities: overweight

We retain a healthy split between US and non-US equity securities, with a skew to large-cap companies.

In a world where the cost of financing remains disproportionately high (read: ‘painful’) for smaller companies, bigger is better. Large cash balances are earning meaningful interest income, which is finding its way to bottom line profits. Separately, regarding US technology trends, whilst we claim no edge in picking the eventual winners in the AI space, it is hard to argue against big tech companies winning via organic or inorganic (acquisition) means. We have a modest exposure to small cap and zero to micro-cap companies.

Regarding Japan, the corporate governance revolution is real, receiving official sponsorship in 2023 with the Tokyo Stock Exchange’s “name and shame” campaign to threaten corporates with delisting if they do not meet certain “return” criteria by March 2026. Whilst we do not expect the line to be a straight one from A to B, investors can look forward to the prospect of enhanced returns driven by rising dividends, share buybacks and improved return on equity as companies look to improve balance sheet efficiency.

India remains one of the world’s most exciting domestic demand driven investment stories. The latest quarterly GDP growth data (+7.6% last calendar quarter) has confirmed that the Indian economy is now being driven by investment rather than consumption, thereby reversing the pattern of the past decade. Real private consumption rose by +3.1% YoY while real gross fixed capital formation (GFCF) was up +11% YoY. Real GDP from the construction and manufacturing sectors was also up +13.3% and +13.9% YoY respectively.

With an Indian general election due to be held in April-May this year, the other positive for a buoyant stock market were the results of the recent state elections which came in better than expected for Prime Minister Modi’s ruling BJP. The party won three important state elections held in November, while Congress won only one. Indeed, the BJP gained votes share in all four states.

Fixed interest: overweight

Our preference at this juncture within TEAM’s fixed income sleeve is for:

- investment grade corporate bonds that continue to offer decent compensation even in a period of still-elevated inflation. The higher yields also enable investors to be more disciplined over credit selection and still pick up attractive returns.

- emerging market sovereign bonds based on peak policy rates, attractive real yields, and valuations.

Our sense is that longer dated government bond prices have moved a long way of late, and potential negative inflation surprises are still possible, particularly in the UK.

Alternatives and Cash: underweight

Physical gold and gold miners were mainstays of TEAM’s alternatives sleeve in 2023 and remain essential portfolio insurance. Gold’s performance last year should still be viewed as resilient in the context of the US monetary tightening cycle.

This can largely be attributed to record central bank buying of gold in recent quarters, triggered seemingly by a reaction to America’s decision in late February 2022 to freeze Russia’s foreign exchange reserves. As a result, global central banks bought a record net 1,082 tonnes of gold in 2022 and a net 800 tonnes5 in the first three quarters of 2023. It is worth noting that these institutions once held 80% of their balance sheet in gold vs. 20% today.

As for the energy commodities basket, and oil in particular, we noted during our fourth quarter commentary that a range of technical factors would likely create tough resistance for WTI crude oil at $100, which came to pass. Coming into 2024, the Saudi’s have almost single-handedly held the market up, whilst OPEC is sitting on approximately two million barrels of spare capacity, weighing on the market. In a nutshell, the outlook is less bullish, but with that said, exogenous shocks, particularly of a geopolitical nature, are not out of the question. Energy equities continue to offer genuine asset and sector diversification.

Rather than attempt to look around corners and predict outcomes, we rely steadfastly on our systematic investment process, which has successfully navigated an array of market conditions over the prior three years and delivered respectable risk-adjusted returns for our investors.

What is certain is that 2024 is sure to be another fascinating year for markets.