Quarterly Investment Review & Outlook

Investment Review 1st Quarter 2024

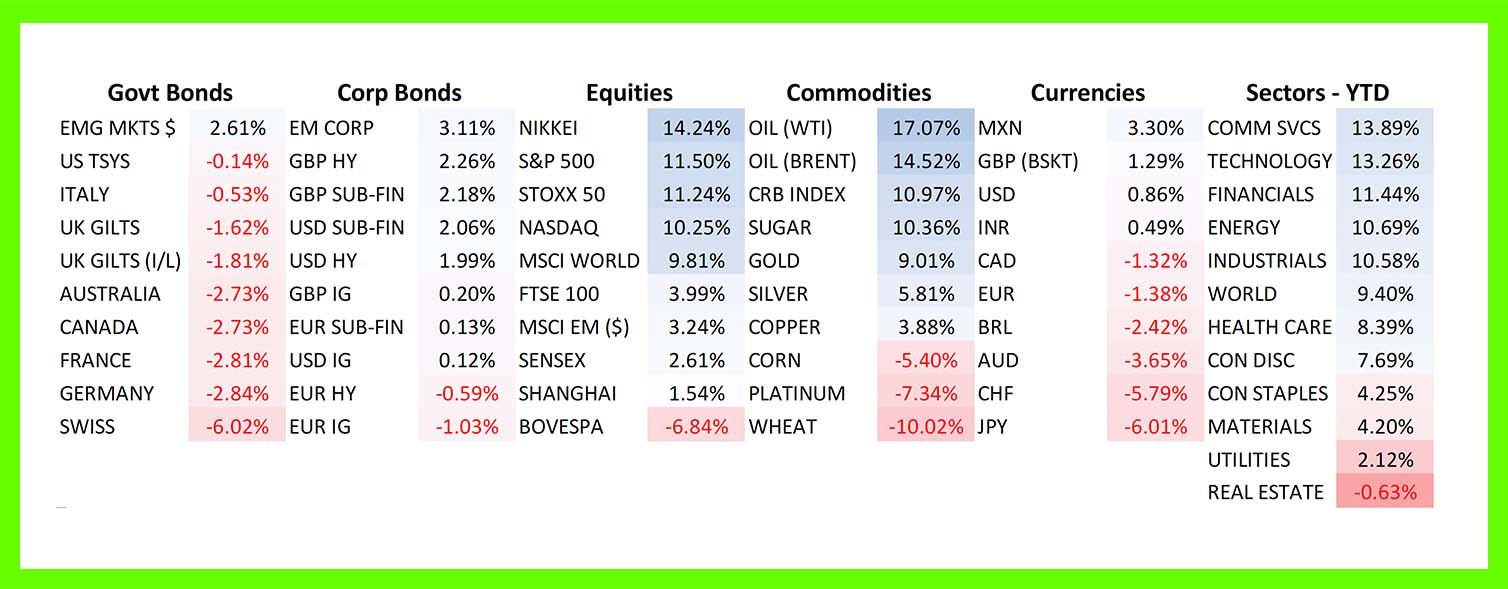

Major Asset Class Returns for 1st Quarter 2024, GBP (£) terms.

SuperJay to the Rescue!

Global equity markets soar

Risk assets enjoyed a blistering start to 2024, as a combination of an accelerating arms race to invest in the unfolding Artificial Intelligence (‘AI’) technology theme and dovish central bank activity provided the communition to propel many major equity markets to new all-time price highs.

The US Federal Reserve (‘Fed’), chaired by Jerome Powell, remains centre stage as investors eagerly await the first of what is hoped to be a series of interest rate cuts in 2024. Any cut, should it materialise, would close the chapter on the fastest monetary tightening cycle seen in several decades.

March’s US Federal Reserve policy meeting was significant, in that various economic (personal spending, housing), employment, and inflation (including the Fed’s own preferred aggregate measures) reports released during the quarter had been hotter than expected, creating nervousness amongst investors that multiple interest cuts this year are not a fait accompli.

Powell’s poker ‘tell’?

Powell & colleagues acknowledged as much, raising the Fed’s own 2024 US economic growth forecast to +2.1% and increasing the terminal federal funds rate, the ultimate interest rate level that the Fed sets as its target for a cycle of hikes or cuts, from 2.5% to 2.6%. Yet the committee stood firm on the outlook for rates, signalling that it still expects to cut three times this year.

More interestingly, in the press conference following the meeting, Powell stated several times that the Fed’s plan was to bring inflation down to the 2% target ‘over time’. This could, and possibly is, being interpreted by markets as a soft removal of the 2% target, or at least, a subtle attempt at providing wiggle room to get there.

In a nutshell, the Fed has, in poker terms, signalled its position. Its dual mandate of 1) achieving long-term price stability, and 2) full employment has reached a point of tension in this cycle. Powell and Co. seem to be slowly shifting its policy priority away from fighting inflation and more towards maximum employment.

Swiftly thereafter, the Swiss National Bank (SNB) surprised with a 25-basis point cut (versus no change expected), taking its headline rate back to 1.5%, with SNB Chair Thomas Jordan revealing that policymakers expect inflation to remain below 2% for at least the next few years. The surprise move sent the Swiss franc tumbling to its lowest point versus the Euro since July 2023.

Closer to home, the Bank of England (BoE) announced that it would maintain interest rates at 16-year highs (5.25%), but also hinted that rate cuts are not far away, with BoE Governor Andrew Bailey encouraged by recent inflation data. Markets now expect the BoE to match the Fed with three cuts this year.

Whilst most central banks have set the stage for lower interest rates, the Bank of Japan moved in the opposite direction, raising borrowing costs for the first time since 2007 and pulling the curtain down on an extraordinary period of eight years of negative interest rates. Equity markets cheered the news, and major developed markets including the UK and Europe, delivered very strong performance over the quarter. As the rally has broadened out (meaning a greater number of sectors and securities are taking part in upside moves), this has more positively impacted markets outside of the US where index composition is dominated by pure technology and AI stocks.

Equities: Scores on the Doors (all returns in sterling terms)

Developed market equities (represented by the MSCI World Equity Index) delivered a +9.8% total return over the 1st quarter. The bellwether S&P 500 large cap index, arguably the key global barometer of investor risk appetite, delivered a +11.50% total return, this on top of the +6.4% return for the fourth quarter of 2023.

Japan’s Nikkei 225 Index pierced the 40,000-price level for the first time in its history, catapulting the market to ‘top of the pops’ via a return of +14.2%. Whilst Japan has become a dwindling component of global equity portfolios in recent years, the seeming end of nearly two decades of deflation, regulatory reforms, and a long-sought corporate refocus on shareholder value is attracting international investors back to the market.

European developed market equities ex-UK returned +11.2%, whilst the MSCI Emerging Markets Index returned +3.2% despite the heavy anchor of China, which still accounts for almost 25% of the index.

China continues to frustrate many, returning a meagre +1.5% on the quarter. For those hoping for a big bazooka stimulus of the type we have seen over the prior twenty years, there is seemingly nothing in the works. What prompted a relatively meaningful rally into quarter-end has been a raft of measures designed to support the stock market, from state-owned purchases of securities to restricting trading activity.

The key issue remains the continuing property downturn and its impact on confidence. Yet, there remains no sign of a central government-directed initiative on the uncompleted projects of developers that have been declared bankrupt or whose balance sheets are heavily distressed. The crux of the problem is that, contrary to many countries, people pay 100% of the total consideration up-front ahead of development.

Fixed Interest:

We surmised in our previous outlook piece that ‘the swift and significant repricing of expected interest rate cuts (into the turn of this year), and their potential impact on asset prices, has priced in a lot of good news in a very short space of time.’ Simply put, the prospect of a negative surprise(s) that might threaten the rate cut story had materially grown.

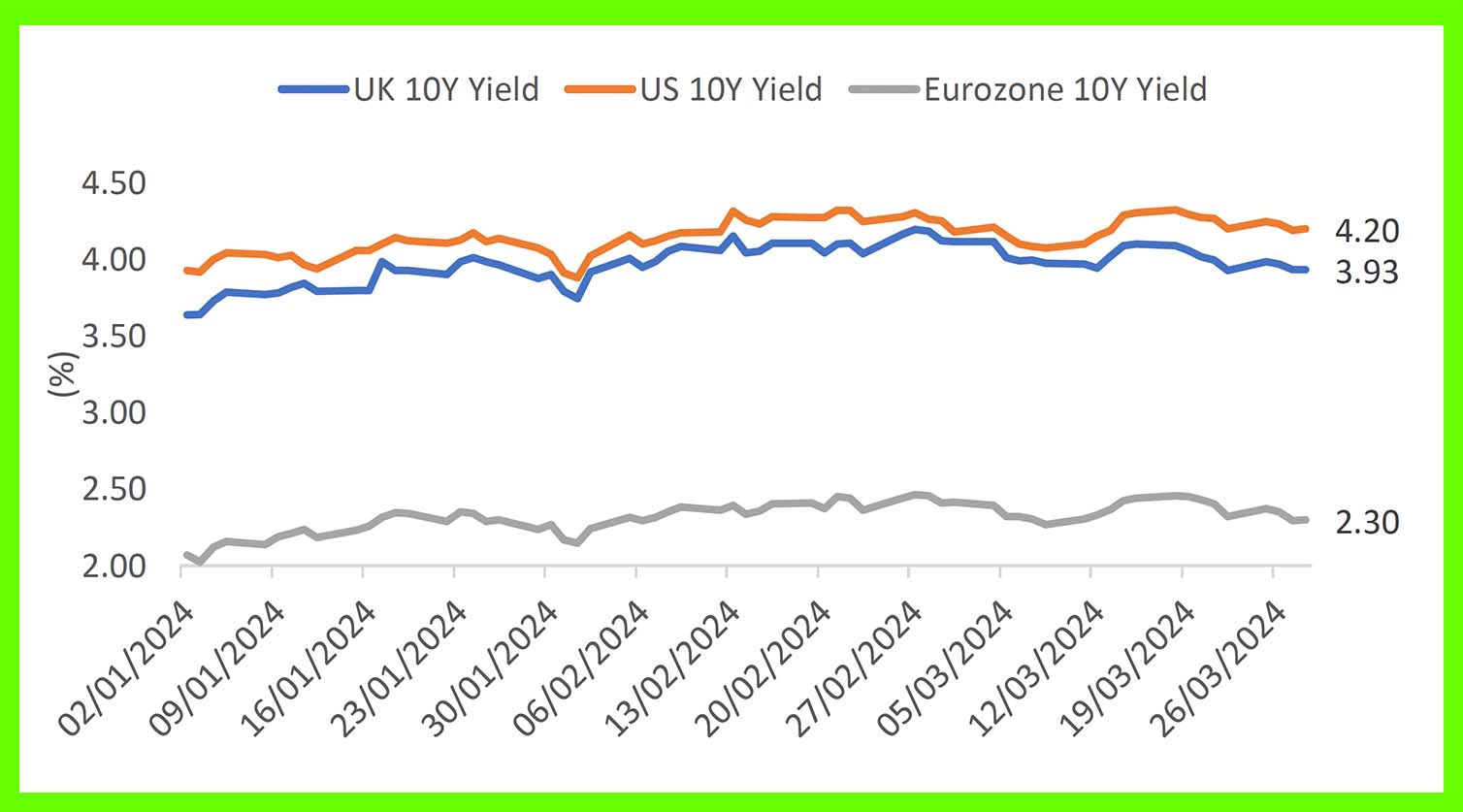

This has played out to some extent during the quarter, with hotter than expected data across the western world acting as the proverbial fly in the ointment. Shown below are the benchmark 10-year yields (bond prices move inversely to yields) for EU, UK, and US government bonds over the quarter:

(Source: Bloomberg, TEAM AM)

(Source: Bloomberg, TEAM AM)

Developed market government bonds sold off, with 10-year yields backing up (bond parlance for ‘moved higher’) by approximately 30 basis points during the period. Europe led declines where a longer duration (longer duration bond prices are more sensitive to a move in yields than shorter duration bonds) index composition weighed on French, German, and, in, particular Swiss bonds.

Meanwhile, investment grade corporate and high yield bonds continue to outperform in the face of the biggest tightening cycle in decades. This is in part because many mega-cap companies, particularly within the technology sector, are net cash and, therefore, positively geared to rising rates in terms of what companies can earn on their cash balances.

Separately, Chief Financial Officers (CFO’s) at investment-grade (‘IG’) corporate companies, led by the US, have earned their crust in the post-pandemic cycle by refinancing company debt at ultra-low levels. As a result, the bulk of IG corporate bonds outstanding do not mature until after 2029. Contrast this with the headache facing many individuals on what do about their mortgage this year if they are facing a refixing.

High yield bonds (HYBs) pay investors a credit spread over ‘risk free’ assets (such as US Treasuries) to compensate for expected losses stemming from defaults, plus an extra amount to reflect the greater volatility of the asset class. Investor appetite for HYBs tends to increase as their assessment of economic conditions improves, since a stable or growing economy reduces the risk of corporate defaults.

With inflation coming down steadily, and economic data seemingly holding firm, markets have become increasingly confident that interest rates have peaked, and the global economy will avoid the sort of ‘hard landing’ that would trigger a sharp rise in high yield default rates. Combined with a relatively short maturity profile (and therefore less sensitivity to rising rates), high yield remains well bid.

Commodities

Commodities have also been thrust back into the limelight, with oil and precious metals enjoying a stellar quarter. Within the oil complex, supply concerns abound, with Ukraine striking out at Russian refineries and oil facilities, whilst Russia separately announced that it would deepen its Q2 production cuts. Late in the quarter an Israeli airstrike on Iran’s embassy in Syria killed several military personnel.

Separately, the International Energy Agency (IEA), in a 14 March report, reduced its projected global oil supply growth forecast by over 50% from February’s projections of 1.7 million barrels per day to 800,000 barrels per day.

Turning to the demand side, in the same report, the IEA increased its demand growth forecast, revising 2024 demand growth up by +110,000 barrels per day from 1.2 million to 1.3 million. China is the chief protagonist, with the country’s estimated oil demand increasing by +6.1% year-on-year to 14.4 million barrels per day.

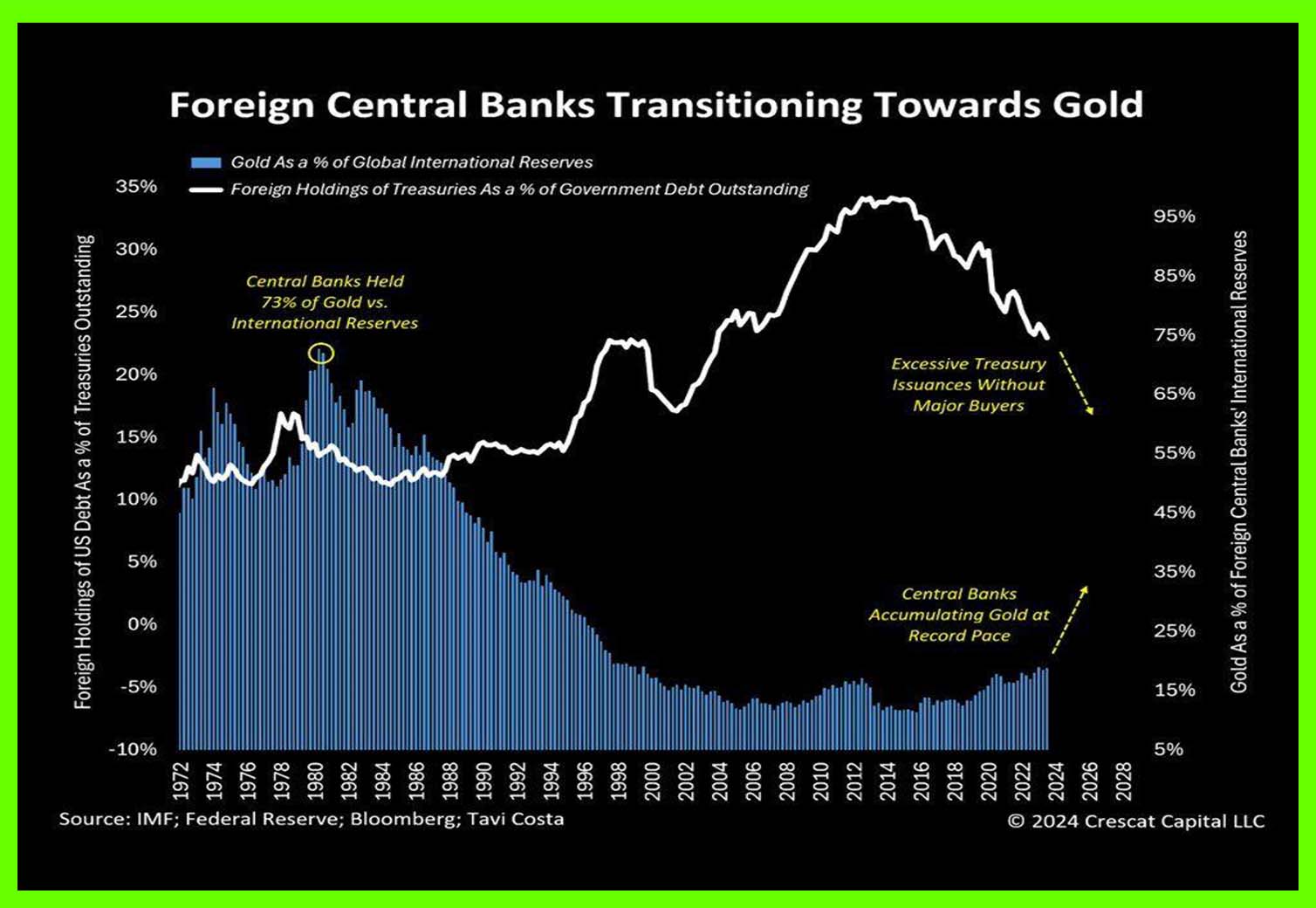

Gold’s ascent and break out to new all-time highs has many scratching their heads given the increase in real interest rates (interest rates adjusted for inflation, which is broadly declining). We have witnessed record central bank gold buying since the third quarter of 2022, potentially triggered by America’s decision earlier that year to freeze Russia’s foreign exchange reserves.

TEAM Positioning & 2nd Quarter 2024 Outlook

We highlighted the critical importance of sticking to one’s investment plan in our previous quarterly, using the working example of what might transpire for investors in 2024. There was a laundry list of reasons (economic, geopolitical, valuation-driven etc.) to be negative on the short-term outlook for markets and expect a nasty correction.

And herein lies the rub.

Imagine receiving a visit from the genie on New Years Eve, December 31, 2023, who grants you a wish. You ask her to reveal some facts about the state of the world and market prices in three months’ time. She replies with the following:

- Bond yields will be significantly higher,

- Geopolitical risks have ratcheted up, notably between Israel and Iran,

- The price of oil has rallied over $10 to a 5-month high,

- The price of gold is at new all-time highs,

- US inflation and employment data has come in hot, and

- The Fed has raised its economic growth and long-term interest rate forecast.

Armed with that information, it is highly unlikely that your chips would be placed on a continued rip in risk assets, that high yield and investment grade credit spreads would narrow, not widen, and that cash would underperform almost all other assets.

In this regard, we are pleased to report that our systematic framework has continued to keep us in harmony with strong trends and prevent our cognitive and emotional biases from acting impulsively on short-term noise.

Additionally, the mainstays of our alternatives sleeve, such as physical gold, mining stocks, and energy equities, assets that have provided valuable diversification benefits during this cycle at the expense of spectacular returns, are finally enjoying their moment in the sun.

Saints and sinners

What worked: equity overweight, fixed income underweight, physical gold, US infrastructure equities, energy equities, gold, and a nice lift from mining stocks into quarter end.

What didn’t work: long duration bond exposure (although we have a very modest allocation) and cash, although we make no apology for being paid to be patient as we look to deploy into risk assets at more attractive levels.

There were no material positioning changes over the quarter, but worth noting that we used a short-term tactical rally during February to sell down our inflation-linked bonds to 0% across the MPS range, channelling the allocation to investment-grade corporate bonds.

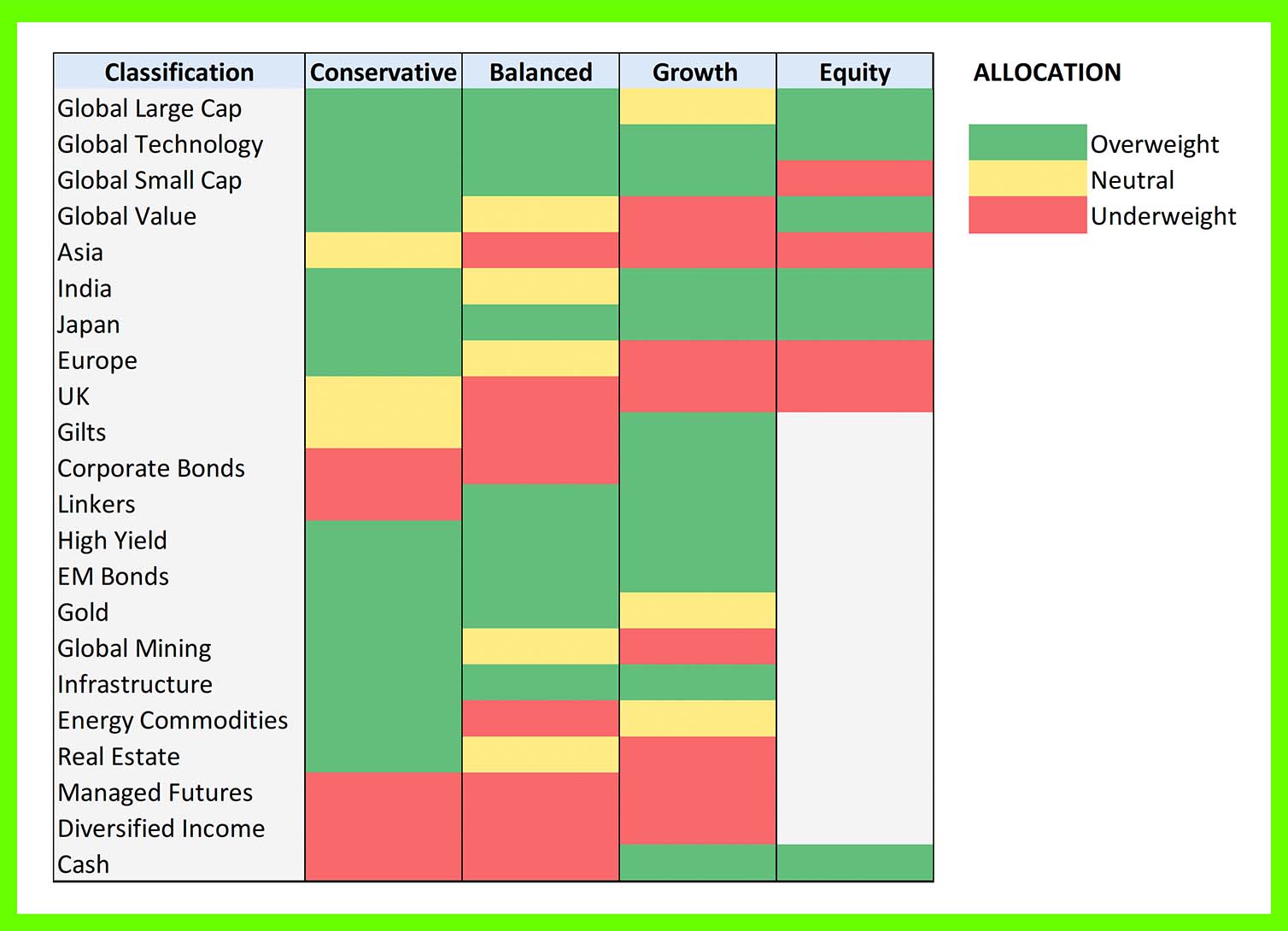

We enter the second quarter of 2024 positively positioned from a risk perspective, with overweight allocations to equities, funded from modest underweights to fixed income to alternatives.

Our asset allocation for the core TEAM MPS multi asset range is shown relative to neutral weightings in the table below:

TEAM MULTI ASSET MPS RANGE

Equities: overweight

We retain a healthy split between US and non-US equity securities, with a skew to large-cap companies.

In a world where the cost of financing is set to remain disproportionately high (read: ‘painful’) for smaller companies, bigger is better.

Large cash balances are earning meaningful interest income, which is finding its way to bottom line profits. Separately, regarding US technology trends, whilst we claim no edge in picking the eventual winners in the AI space, it is hard to argue against big tech companies winning via organic or inorganic (acquisition) means. We have a modest exposure to small cap and zero to micro-cap companies.

Japan’s corporate governance revolution, driven by the Tokyo Stock Exchange (TSE), is the real deal. The aim is to hold corporate management teams to account over governance and performance issues, with the TSE now maintaining a monthly name and shame list of companies that voluntarily disclose information regarding ‘actions to implement management that is conscious of cost of capital and stock price’.

Whilst we do not expect the line to be a straight one from A to B, investors can look forward to the prospect of enhanced returns driven by rising dividends, share buybacks and improved return on equity as companies look to improve balance sheet efficiency.

Separately, foreign arrivals to Japan, are surging on account of both a very cheap yen and the fact that Japanese prices have essentially flatlined since 1995. For US visitors, prices are the equivalent to where they were in 1969 (!). Unsurprisingly, this is supercharging spending in the country.

India remains one of the world’s most exciting domestic demand driven investment stories. A new capital expenditure boom is underway and anticipated to drive 7% real GDP growth and approximately 12-15% aggregate corporate earnings growth over the next 5 years or more. Given India still miniscule representation in the MSCI World All Country Index of 1.8%, room still exists for a significant re-rating.

India’s upcoming general election is set to deliver a landslide victory to incumbent Prime Minister Narendra Modi’s BJP Party, providing further runway to continue meaningful reform. We acknowledge that the biggest short-term risk to the market remains valuations given the extraordinary outperformance relative to emerging markets in this cycle.

Fixed interest: underweight

After markets travelled a long way in a short period of time at the backend of 2023, it was little surprise that returns were more subdued in the first quarter, despite the assurances from central banks that interest rate cuts are coming soon.

The inflation outlook is now more encouraging in the Eurozone, than elsewhere in the developed world, which should enable the ECB to move ahead of the Fed and others in early June, especially with the economy moving at a fraction of the speed of the US.

We think the tailwind of lower rates and headwind of stickier inflation will broadly offset, paving the way for relatively range bound bond markets in the months ahead. The tightening of credit spreads provided the heavy lifting of returns in the first quarter, but it is unlikely that they can deliver the same again.

In this scenario, we think being both boring and pragmatic will add the most value. Boring is to avoid leaning too hard over our skis and focussing on credits that offer attractive yields and balance sheet strength to withstand periods of market turbulence. Pragmatic is being flexible and nimble, adjusting positioning quickly if the facts change.

Alternatives and Cash: underweight

Physical gold and gold miners remain essential portfolio insurance. Gold’s performance through this cycle should still be viewed as resilient in the context of acute rate tightening.

This might be attributed to record central bank buying of gold in recent quarters, triggered seemingly by a reaction to America’s decision in late February 2022 to freeze Russia’s foreign exchange reserves. As a result, global central banks bought a record net 1,082 tonnes of gold in 2022 and 1,037 tonnes in 2023. It is worth noting that these institutions once held as much as 80% of their balance sheet in gold vs. 20% today.

Shown below is a 50-year chart demonstrating a narrowing of the chasm between international holdings of US Treasuries as a percentage of global government debt outstanding (top line, left hand axis) and gold as a percentage of global international reserves (bottom bar graph, right hand axis). Our expectation is for this trend to continue.

(Source: Tavi Costa, Crescat Capital LLC)

As for the energy commodities basket, and oil in particular, we noted during our prior commentary that ‘the outlook is less bullish, but with that said, exogenous shocks, particularly of a geopolitical nature, are not out of the question. Energy equities continue to offer genuine asset and sector diversification.’ Unpleasant as the catalyst may have been, this scenario has played out during the first quarter, catching many off-guard.

We maintain this view, as the prospect of further supply disruption remains a possibility. Indeed, a renewed rally in the oil price in the months ahead remains the key risk for Biden’s Administration, the Federal Reserve, and global markets, given the natural transmission mechanism from oil through to forward-looking inflation expectations. Continued hot economic and jobs data would be another troubling development.

As always, rather than attempt to look around corners and predict outcomes, we rely steadfastly on our systematic investment process, which has successfully navigated an array of market conditions over the prior three years and delivered respectable risk-adjusted returns for our investors.

Thank you for your continued support and interest in TEAM.