Immunisation Time?

(Photo source: Markus Spiske)

The run-up in equity markets in recent weeks on the announcement of imminent COVID vaccination availability has caught many investors by surprise. No sooner were we congratulating ourselves on having largely avoided the vast swathes of sectors which the virus had doomed to obscurity (or as it is also known, Government subsidy), than the likes of airlines, retailers and, whisper it quietly, even oil companies, suddenly surged on the basis that everything was actually going to turn out fine and dandy after all. Rolls Royce, that doughty old British manufacturer of aero, marine and industrial turbines, was, at one point on the 9th November, up 93% ON THE DAY of Pfizer’s announcement. Chocks away and tally ho indeed.

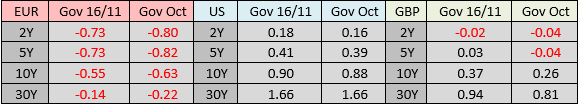

Government bond markets on the other hand, that bellwether ‘safe-haven’ (and nowadays largely return-free risk) asset class that few people outside of national Treasuries seem to admit to actually owning, have suddenly started to look a little exposed, give the level of bad news already baked into yields. One of the few asset classes to emerge from the travails of the Q1 2020 with any sort of gain might suddenly, if we’re genuinely close to the trough economically, look less than appealing. The changes in yields from 31st October to 16th November are shown below:

Ok, so yields have widened a tad, but let’s put things into perspective. That’s 10 Year Gilts at 0.37% (with September CPI running at 1.1%). Does that look like good value in relation to the risks facing the UK financial system at present? I guess that you can thank your lucky stars you’re not a Continental investor, with a decidedly Lutheran -0.55% on offer for 10 years for your hard-earned Euros.

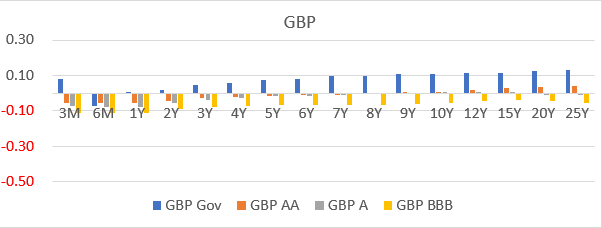

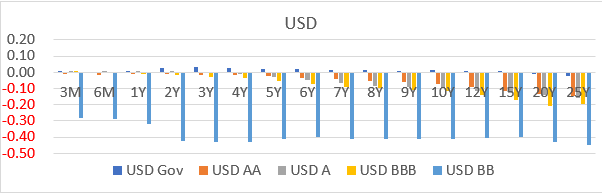

Yet just when you think this is all looking a bit too easy, and that it might finally be all over for the 30 Year Bond bull market, credit seems to be dancing to a different tune. Despite reference Government bonds widening, credit has continued to tighten all over the curves, as the ‘risk-on’ party in equities has spread to corporate bonds.

The following charts show changes in yields for the range of maturities in GBP, EUR and USD$ since the end of October.

As can be seen, (except in the UK where no satisfactory Benchmark BB credit curve exists), the further down the risk curve one looks, the greater the decline in yields seen. Whilst Invetsment grade (AA down to BBB rated) bonds have all seen a further yield compression, high yield has signfiicantly out-performed.

So it’e either genuninely risk on, or 10 Year BBB Sterling bonds at 1.5% ? It’s difficult to see how both can be right.