The Domino Effect

Domino effect: a cumulative effect produced when one event initiates a succession of similar events (www.mirriam-webster.com)

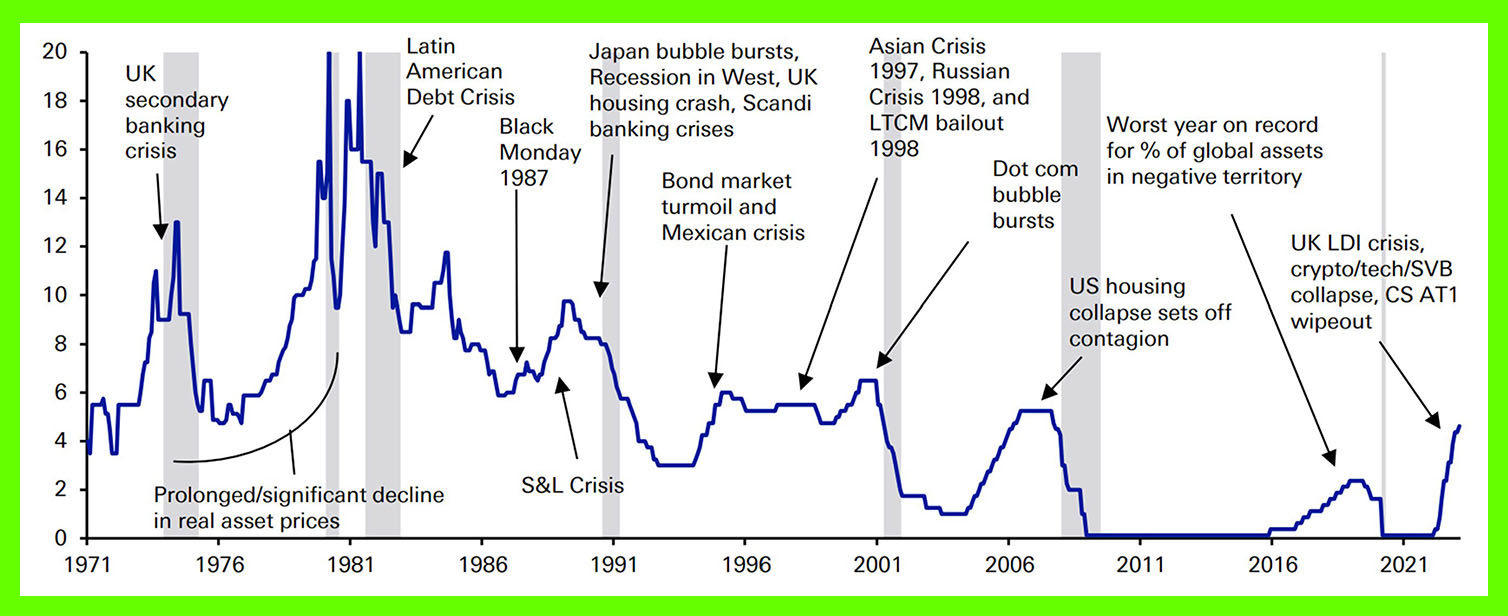

500 basis points of cumulative US interest rate hikes in a little over a year eclipses the speed and magnitude of any cycle since 1980, and, prior to that, 1973. We showed this chart back in March courtesy of Deutsche Bank to illustrate how effective Fed hiking cycles are in breaking things:

The US regional banking sector currently finds itself under significant strain, with smaller players facing several significant headwinds:

- Deposit beta is climbing as banks are forced to raise rates to compete with money market funds.

- Overall funding costs are rising.

- Net interest margins look to have peaked.

- Provisions for bad loans are growing, with some companies reporting sequential double-digit increases.

- Hyper competition has been introduced from disruptive technology firms offering attractive rates on cash.

- Sector regulation and oversight appears set to tighten.

All told, the profitability path looks set to trend down sharply.

Silicon Valley Bank, Signature Bank and First Republic Bank have been consigned to the history books, along with approximately $550 billion worth of assets. The lens of the market has now moved quickly to focus on PacWest Bancorp.

Chairman Powell accompanied the latest 25 basis point hike with comments that the ‘US banking system is sound and resilient’, and that the government seizure and sale of First Republic Bank to JP Morgan Chase & Co. was ‘an important step toward drawing a line under the period of severe stress’ for regional lenders.

If his remarks were intended to soothe investor concerns, Mr Market is not listening. The after-hours share price movements of PacWest (-52%), Western Alliance (-23%) Comerica (-9%), and Zions Bancorp (-10%) reflect renewed angst following a breaking story that PacWest Bancorp is considering strategic options including a sale.

A brief look at the US regional bank sector ETF below points to an impending retest of the March 2020 lows. To recap, this level was tagged briefly during the height of the COVID pandemic when the global economy was in the process of being shut down, an indication of the stress currently facing the sector:

With over 4,000 banks and more than 500 mutual banks in the US nationwide, the domino effect is playing out real-time as holders of deposits flee smaller regional banks in search of balance sheet strength and a trusted brand name.

Remember when sub-prime was ‘contained’?