Beware the ‘Critical State’ Mr Powell

Financial market gyrations and a recent family visit to the beach prompted me to return to Mark Buchanan’s excellent debut novel ‘’Ubiquity, Why Catastrophes Happen’’, a book I had the good fortune2 to stumble across in April 2006, just as the subprime housing crisis was about to trigger a financial catastrophe for the ages.

Applying scientific rigour and an easy writing style, Buchanan focuses his lens on a historical catalogue of real-life natural and human disasters, covering the sudden mass extinction of species, the outbreak of World War I, apocalyptic earthquakes, forest fire infernos and even stock market crashes.

In researching clues about the root causes of tumultuous events in our complex world, Buchanan uncovers a natural structure of instability connecting, underpinning, and potentially explaining, each of these random and seemingly unrelated events: the notion of the critical state.

At the beach, my two boys competed to build the biggest sandpile, successively emptying bucket upon bucket of sand until a large avalanche triggered a spectacular collapse. Back in 1987, three physicists, Per Bak, Chao Tang and Kurt Weisenfeld began playing the very same game in an office in New York State, only using a computer programme to rapidly speed up the game and outcomes.

Their objective: to try and make sense of why avalanches occur, and, more specifically, what causes them. Applying slightly more technical parlance, Bak and his colleagues were seeking to unearth insights regarding the general workings of nonequilibrium systems.

Instructing the computer to drop imaginary ‘grains’ onto an imaginary ‘table’ and applying some simple rules governing how grains would topple downhill as the pile grew steeper, the three physicists set the computer to work. In a short time, they became transfixed to the screen, running huge numbers of tests and observing the results with fascination.

In seeking to solve the mystery of the typical size of an avalanche, Bak and his colleagues ran into trouble. After counting the grains in millions of avalanches in thousands of sandpiles, a disappointing but interesting conclusion emerged: there is no ‘typical’ avalanche size. Outcomes ranged from tiny landslides involving a few grains to cataclysmic, pile-wide avalanches. To quote: ‘at any time, literally anything, it seemed, might be just about to happen’.

To explore why this heightened level of unpredictability should manifest in the game, Bak and colleagues next judiciously applied the ‘researcher’s prerogative’, tricking the computer by colouring each grain in the pile according to its relative steepness; green grains where the terrain was flat and stable, red grains where the terrain was steep and potentially on the cusp of a major trigger event.

The team observed that early in the game, the pile assumed a mostly green appearance, but as more and more grains were dropped, patterns of red began to infiltrate the growing pile. With more grains added, the frequency and magnitude of red danger spots grew ‘until a dense skeleton of instability ran through the pile’. For Bak and co. this was an important clue in explaining the behaviour exhibited by the sandpile game.

A grain falling on red terrain, could, via the domino effect, trigger sliding at nearby red danger spots. A sparse red network, where all trouble spots are relatively well isolated from each other, meant that that a single grain would likely cause only minimal damage. ‘But when the red spots come to riddle the pile, the consequences of the next grain became fiendishly unpredictable’. The reaction could involve anything from a few grains tumbling harmlessly down the pile to a cataclysmic event involving millions of grains.

It transpires that what makes one avalanche much larger than another has nothing to do with its original cause, nor does it arise from a unique situation inherent in the pile just before it starts. Rather, it is the perpetually unstable organisation of the critical state that makes the sandpile vulnerable to a trigger event of any size.

Buchanan discovers the presence of the critical state in many other aspects of life, from the upheavals previously mentioned to the spreading of epidemics, the flaring of traffic jams and even the way students organise and evolve themselves into human trail systems on a university campus.

For investors, today’s intricately interconnected web of capital markets is the scene for our own real-life version of the sandpile game, with Chairman Powell and US Federal Reserve members currently assuming the roles of physicists Bak, Tang and Weisenfeld in sprinkling grains (rhetoric and policy action) onto our steadily steepening sandpile (the financial system).

The first order effects have been a rapid tightening of financial conditions via a sharp contraction of liquidity to a system that has, for the best part of twelve years, become addicted to asset price inflation, fed by increasing levels of public and private sector debt. All made possible by a unique period in history, comprising ultra-low interest rates and structurally low inflation, with central banks ably supporting risk-taking and excessive speculation through an effective market ‘put’.

Against this backdrop, it is not difficult to imagine a dense skeleton of instability running through our global capital markets system today. Thus far, the damage, whilst painful across many asset classes, has been reasonably orderly, moving from more speculative areas of growth (SPAC’s, profitless technology and consumer securities, crypto currencies) to ‘traditional’ haven assets including long-dated treasury and investment grade bonds. Idiosyncratic corporate blow-ups have, thus far, also been relatively contained. It certainly qualifies as a major landslide.

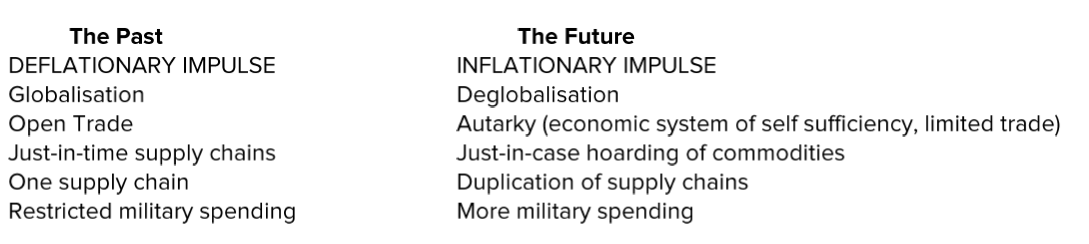

However, the issue going forward is that we now have the structural playbook for the past three decades being ripped up3, creating highly destabilizing forces:

In addition, the US Federal Reserve is on a mission to restore its own institutional credibility following the diabolical ‘transitory’ position it adopted on inflation through 2021 and the early part of 2022. The problem it faces is that it is aggressively pulling on the handbrake to restore price stability at the point that real-time data (economic, corporate and consumer) is deteriorating rapidly.

It is a precarious situation, and the odds of manufacturing a ‘soft landing’ for the economy appear increasingly unlikely. As market observers and investors, we have front-row seats to watch this sandpile game unfold. The more grains that are sprinkled, the greater the chances that a major avalanche is triggered via a true ‘break’ in the system. For central bankers, the key factor is where in the sandpile this break occurs and the proximity of other red danger spots to that break.

As the Fed continues its current path, we are very likely to find out. Be careful what you wish for Mr. Powell.

(Cover Image Source: Goh Rhy Yan)