Batting Averages: Stocks and Bonds

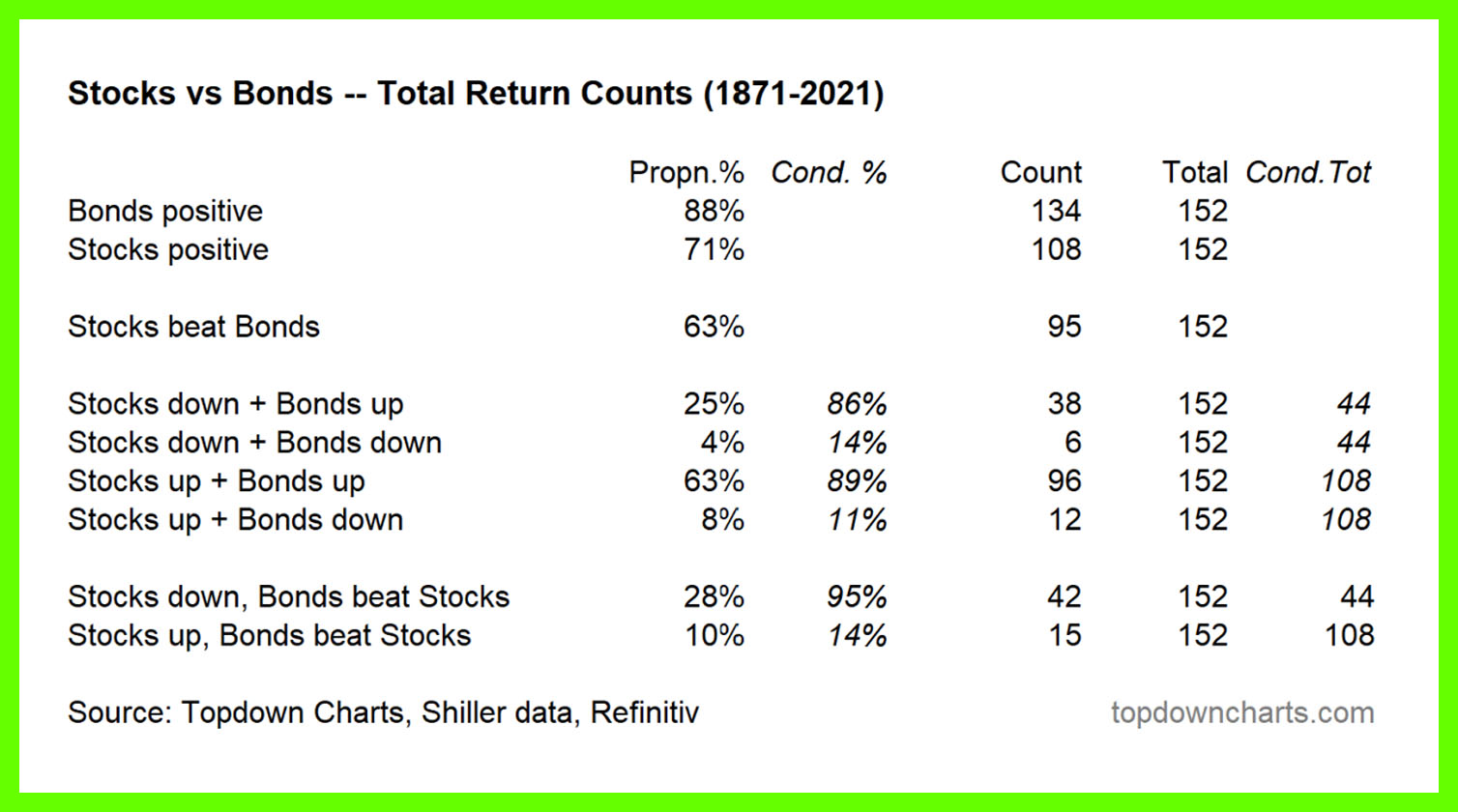

Summary snapshot below of the absolute performance of Stocks vs Bonds over the past 152 years (1871 – 2021), courtesy of the excellent www.topdowncharts.com

On an annual basis:

- Bonds beat stocks approximately 37% of the time,

- Bonds beat stocks 95% of the time when stocks were down, BUT

- Bonds only beat stocks 14% of the time when stocks were up.

- Bond returns were positive 89% of the time when stocks were also positive.

Key takeaway: one can be right on bonds, and wrong on stocks vs bonds, but the most reliable way to be right on bonds beating stocks is to ‘pick stocks going down rather than bonds going up’.

Caveat: timing the stock market is a notoriously difficult, and often costly, pursuit. 2023 to date is providing another classic real-time example of the ability of Mr. Market to confound the prevailing narrative, namely a guaranteed global recession, led by the United States.

Whilst bonds remain cheap in absolute terms, and relative to stocks as measured by headline US indices, the S&P 500 has recently broken out to new AT relative highs vs US Treasuries. From a purely technical perspective, the path of least resistance is higher prices for stocks.

It is why price structure and trend are, in our view, essential components in allocating capital and managing risk in a multi asset context.