99 Red Balloons (well, 6 actually)

99 red balloons floating in the summer sky

Panic bells, it's red alert

There's something here from somewhere else” by Goldfinger, 1983

The US market has sold off by approximately 6% since its October highs sparked by rising Covid cases in Europe (some countries are reinstating lockdown protocols), and concerns over the outcome and consequences of the US election result.

Data however continues to show a sharp V-shaped recovery in the US. Durable goods orders, retail sales, ISM manufacturing and service sector reports, productivity and import/export data are all showing positive data. Unemployment claims continue to fall, and this week’s Q3 GDP numbers rose by 33% over the 2nd quarter.

Other data has been equally positive, with the Case-Shiller House Price Index rising an adjusted 0.5% month on month, and 1.1% (unadjusted). On a y/y basis the unadjusted increase was 5.2%, easily beating the consensus for a 4.1%. rise.

The Richmond Fed Manufacturing Index jumped to 29 vs. last month's 21, beating estimates for 18. This is the 5th month in a row of manufacturing growth.

At the same time, Federal Reserve Chairman Jerome Powell recently signaled that the Fed will keep key interest rates near zero through 2023, which is a year longer than previous guidance.

The Fed also wants to push inflation above 2% to stimulate economic growth (and, dare we say it, to attempt to deflate the growing debt bubble). Consumers are spending, and in our view, there is a huge level of pent up demand.

Near term stock price action might be a little disturbing, but the market, and our favourite TEAM stocks, will bounce back. We have a strong third-quarter earnings season, and growing evidence of a V-shaped economic recovery, on our side.

So, let’s burst some red balloons.

1. The US stock market is crazy!

“Today’s US stock market has gone mad; investors have lost their minds; just look how bad the US economy is?”

Wrong. The stock market is NOT the economy.

Stock markets are forward looking. Today is irrelevant. You are not buying yesterday’s performance. Historically, stock markets bottom approximately four months before an economic recession officially ends. Share prices do not wait for good news.

The stock market being disconnected from the real economy is the NORM. It is NOT an anomaly.

Our assessment is that the US stock market today is looking ahead 12 months, much as investors look at 12-month forward price earnings ratios. Today’s market is taking into account the pent-up demand, the fading effects of Covid, and the huge amount of cash sitting in banks.

The U.S. Federal Reserve recently reported over $3.4 trillion being held in savings/deposit accounts, up from $2.25 trillion at the start of 2020. This is oney earning virtually no interest, and which is waiting to be employed in some form of longer-term investment. If (or when) this cash is deployed in a discerning manner, it will be in those companies with the highest potential future earnings, and those that are perceived as secure long term bets. Currently, we are seeing wave after wave of positive earnings from most S&P 500 companies. About 10% of the companies in the S&P 500 have reported to date (24/10/20), with 86% beating estimates; higher than the five-year average of 73% (Source: FactSet).

2. This US election outcome will be damaging!

Wrong. It really doesn’t matter who wins.

Since 1933, the average annual return from the S&P500 has been between 4.9% and 13.6%. the highest average being when there has been a Democrat Senate and Republican House. (Source, Strategas Research).

3. US stock market valuations are too high!

Wrong.

Valuations are relatively high with the S&P 500 trading on 12-month forward price earnings (p/e) of 20 to 22 times depending on the earnings forecast. It has however historically been a lot higher, and we believe forecasts are still cautious based upon the potential for recovery into the second half of next year.

But the most important reason these valuations can be justified is US interest rates.

We keep writing about the importance of the Equity Risk Premium (ERP) and make no apologies for returning to this important measure.

A 10-year US Treasury bond currently earns an annual yield of 0.83% for a period 10 years. Equities are not risk free, so investors want more reward for taking risk. How much reward? Let’s assume they need 4 times more. So, around 4%.

4% annual return is equivalent to a p/e of 25 times.

If investors think rates will stay low for longer, they might be encouraged to accept a lower equity return. A 3.5% return for example would equate to a p/e of 28.5 times.

Bear in mind that cash presently earns close to zero.

Based upon these numbers, we believe the US stock market could rise by a further 13% to 29.5% over the next 12 months.

4. Total US stock market capitalisation to US GDP shows we are in a bubble!

Wrong.

This is apparently Warren Buffett’s favorite valuation indicator. It is, however, hugely flawed.

A. Foreign Earnings. 43% of the US S&P company sales are from overseas earnings (2018), not domestic US.

B. Interest rates and opportunity cost. The market-cap to GDP ratio is low when government rates are high. Conversely, when rates are low as they are today, and are expected to be for some time, the ratio increases. The ratio needs to be seen in the context of prevailing interest rates, and the opportunity cost of capital.

C. Corporate tax. From the 1950s to the early 1980s, US corporate taxes were around 50% Currently they are 21%. That means higher margins and better returns on capital. A stock market capitalisation to GDP to comparison doesn’t take this into account.

D. GDP has changed. The largest US companies today are the likes of Apple, Microsoft, Amazon, Alphabet and Facebook. These types of companies are not reliant on commodity prices or cyclical demand, nor do they face any significant competition from foreign rivals. All have above-average profit margins. All are global. However, Market Cap to GDP comparisons imply that they should be worth the same as an oil company or car manufacturers. That makes no sense.

E. Public / Private. This measure only takes into account publicly traded companies and therefore ignores the true distribution of economic activity and profits. There are about 4,000 publicly listed companies making up the US stock market but there are over 5 million privately owned companies.

F. John Kenneth Galbraith. Our favourite quote from the proponent of American liberalism:

“We have two classes of forecasters: those who don’t know, and those who don’t know they don’t know.”

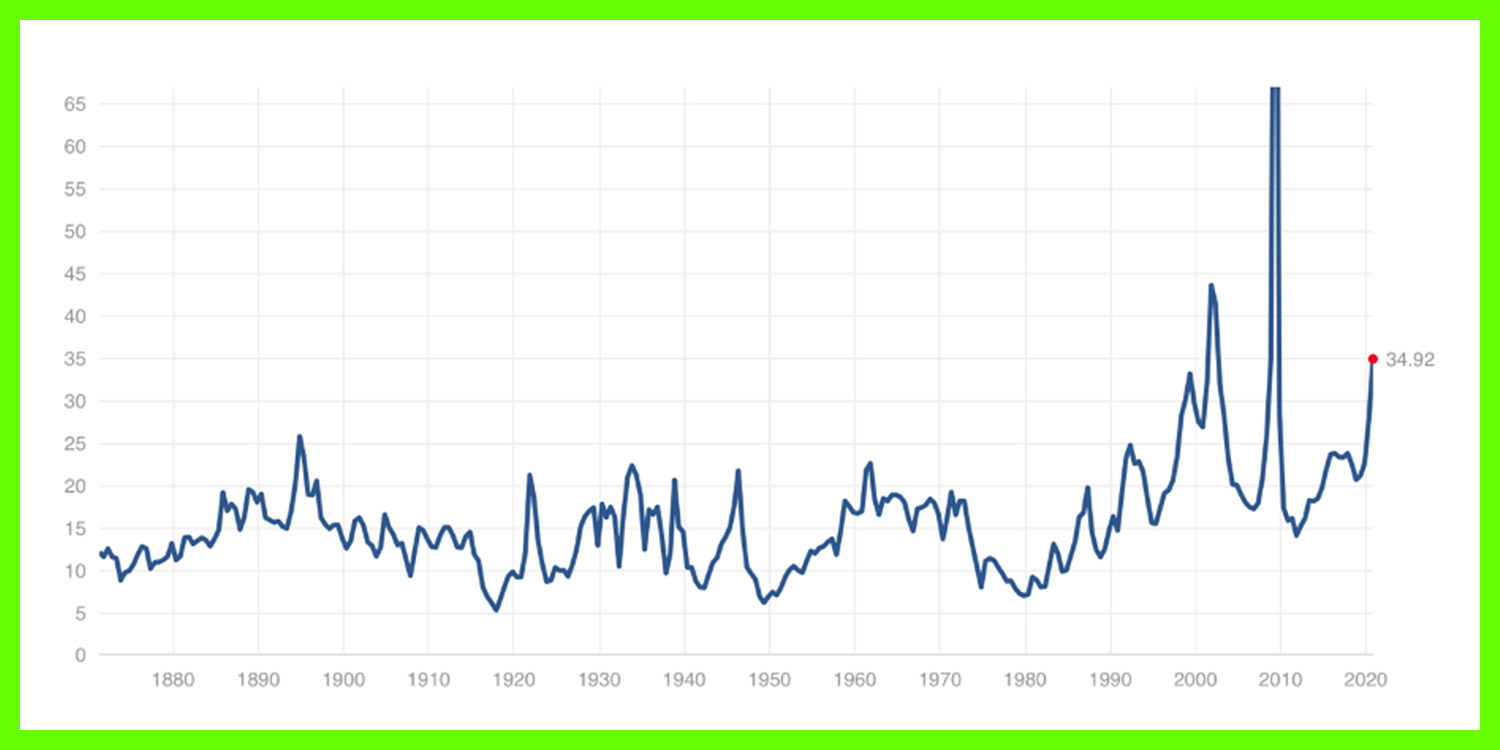

5. The stock market has been driven by tech stocks (FAANG) and we are heading for another “dot com” crash! It’s like 1999!

Wrong.

Late 90’s valuations were significantly more extreme for large-cap technology stocks than at present. By most measures, the valuations of today's majortechnology shares fall well short of the dot-com era. Many of the companies have substantial revenue and most generate revenues (and in most cases) profits.

Looking at the S&P 500 Information Technology Index as of October 23rd, the aggregate forward price earnings ratio for the sector was 27 times. That is half the level in 2000 and compares with 20 to 22 times for the broad market.

However, for the Technology sector, we now have Q3 results from 61.1% of the sector companies in the S&P 500 index. Please note that the 61.1% of the index’s Tech sector that have reported account for 79.9% of the sector’s total market capitalization in the index. In other words, the sample size is large and representative.

Total earnings for these Tech companies are up +9.8% from the same period last year on +5.7% higher revenues, with 95.5% beating EPS estimates and 90.9% beating revenue estimates.

It is hard to see the Covid-19 impact in the sector’s recent results, at least not in the way that we see with all the other sectors in the S&P 500 index. This reemphasizes the point that Tech sector profitability dances to a different tune than businesses in most other sectors.

It is this resilience of the sector’s profitability that you should keep in mind as you look at the relative stock market performance of the different sectors in the S&P 500 index.

In addition, we believe that we are currently witnessing the convergence of a number of significant innovations that will drive future growth within the technology sector.

5G, artificial intelligence, precision medicine, the ‘Internet of Things’, virtual and augmented reality, biotech, and blockchain are all relatively new technologies which are in only the early stages of their growth.

Which is not to say that there are no over-valued individual companies (or indeed sectors), however, there remain a significant number of companies where we believe the numbers support the valuations.

The FAANG five have combined balance sheet cash of over USD$ 500 Billion.

These companies reinvest a large percentage of operating cash flow into their businesses, driving further competitive advantages, extending their reach, and providing funding for new ventures. Profitable cash flow, rather than earnings per share, is a better indicator of the fundamental value of a company’s shares, and on cashflow multiples, most of these shares still look to offer good value.

6. There’s no inflation you idiot. We have deflation, stupid!

In June, the US consumer price index jumped 0.6%, the biggest increase since 2012. Grocery prices have surged during the pandemic. The cost of “food at home” has risen at a 5.6% yearly pace — the highest since 2011.

We wrote about inflation in our article “Pointing in the Right Direction”.

The Fed has handled Covid differently to the Financial Crisis of 08/09. The 08/09 QE stimulus largely benefitted financial institutions, as they failed to lend the newly created liquidity out into the wider economy, so whilst the money supply expanded, that additional money never found its way into consumers’ pockets.

This time around, the stimulus is going directly to companies as Covid loans etc. With the economy remaining partially shut, these companies have little or no revenue. The Covid loans are financing payroll, so whilst not quite helicopter money, it has definitely found its way into peoples’ pockets.

How do we know this? The increase in bank deposits, and the US savings rate. In April, this hit an historic high of 33%. For the same month spending declined 13.6%. People have 30% plus more in the bank today than at the beginning of the year.

Whilst savings have dropped off a little recently (coincident with the pick-up in August US economic activity), August savings were still high at over 14%.

In our view, the stimulus is still largely sitting in people’s bank accounts and will eventually be spent. This could lead to inflationary pressure in the future.

This fear of inflation might also partially account for the recent market sell-off, and this has extended to bonds, with US 10 Year Treasury Note yields starting to rise.

Equities should provide the best hedge against inflation, because a company’s revenues and profits should grow at similar rate to inflation. We would do well to remember that investing in the stock market is not a sprint, but that historically, shares have risen on average every three years out of four.

With central banks around the world telling us that interest rates will remain close to zero for the foreseeable future, we continue to believe that being fully invested is the only option for those who want to protect and grow their real wealth over the long term.